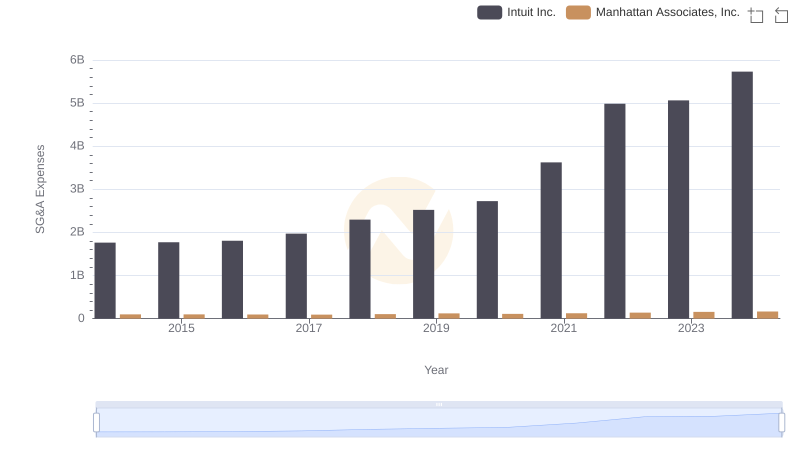

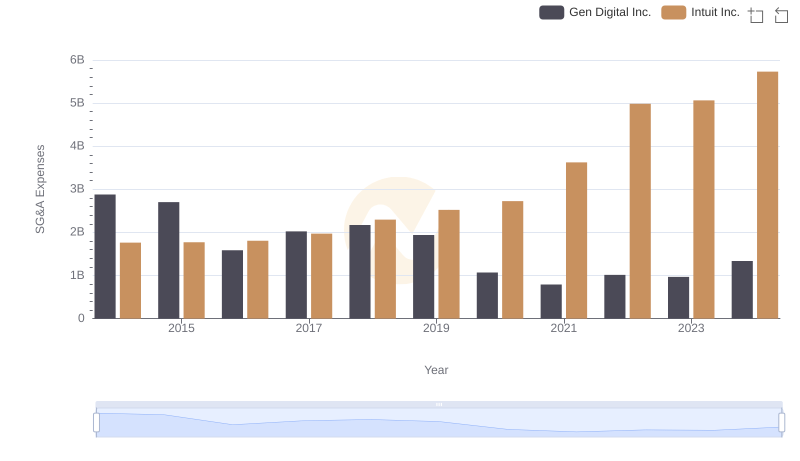

| __timestamp | Intuit Inc. | Nutanix, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 106497000 |

| Thursday, January 1, 2015 | 1771000000 | 185728000 |

| Friday, January 1, 2016 | 1807000000 | 322758000 |

| Sunday, January 1, 2017 | 1973000000 | 577870000 |

| Monday, January 1, 2018 | 2298000000 | 736058000 |

| Tuesday, January 1, 2019 | 2524000000 | 1029337000 |

| Wednesday, January 1, 2020 | 2727000000 | 1295936000 |

| Friday, January 1, 2021 | 3626000000 | 1206290000 |

| Saturday, January 1, 2022 | 4986000000 | 1145122000 |

| Sunday, January 1, 2023 | 5062000000 | 1156897000 |

| Monday, January 1, 2024 | 5730000000 | 1178149000 |

Unleashing the power of data

In the competitive world of tech, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Intuit Inc. and Nutanix, Inc. have taken different paths in optimizing these costs. From 2014 to 2024, Intuit's SG&A expenses have surged by over 225%, reflecting its aggressive growth strategy. In contrast, Nutanix has maintained a more stable trajectory, with a 100% increase over the same period.

Intuit's expenses peaked in 2024, reaching nearly 5.73 billion, while Nutanix's expenses remained under 1.2 billion. This stark difference highlights Intuit's expansive approach compared to Nutanix's more conservative strategy. As businesses navigate the post-pandemic landscape, these insights offer valuable lessons in balancing growth with cost efficiency. Which strategy will prove more sustainable in the long run? Only time will tell, but the data provides a fascinating glimpse into the financial strategies of these tech giants.

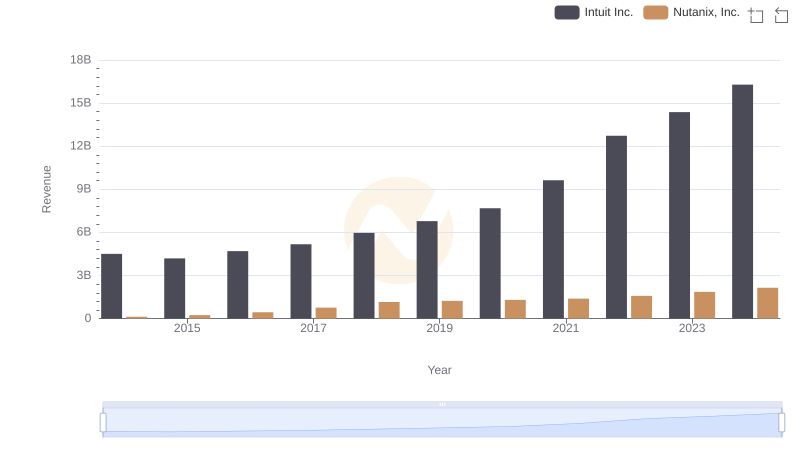

Breaking Down Revenue Trends: Intuit Inc. vs Nutanix, Inc.

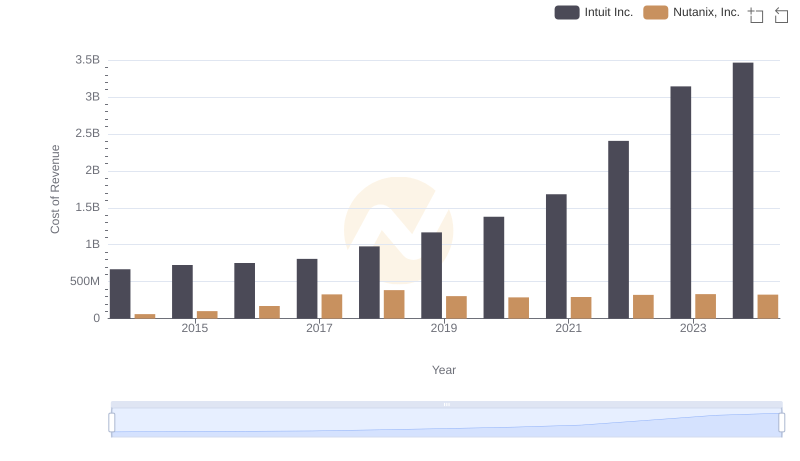

Intuit Inc. vs Nutanix, Inc.: Efficiency in Cost of Revenue Explored

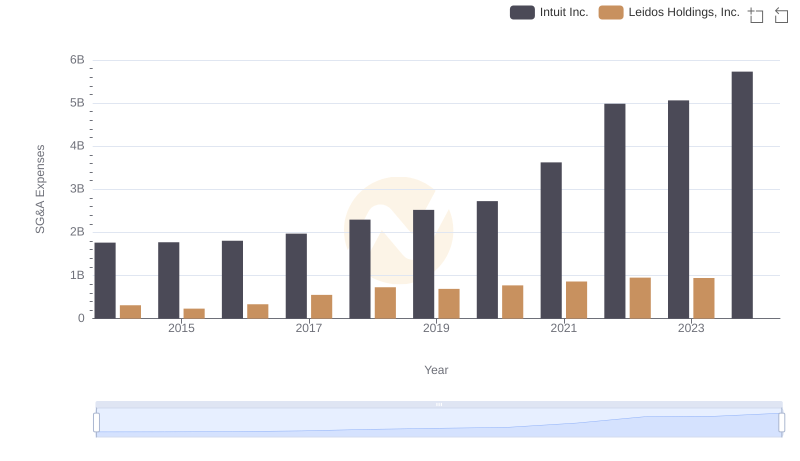

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Leidos Holdings, Inc.

Intuit Inc. vs Manhattan Associates, Inc.: SG&A Expense Trends

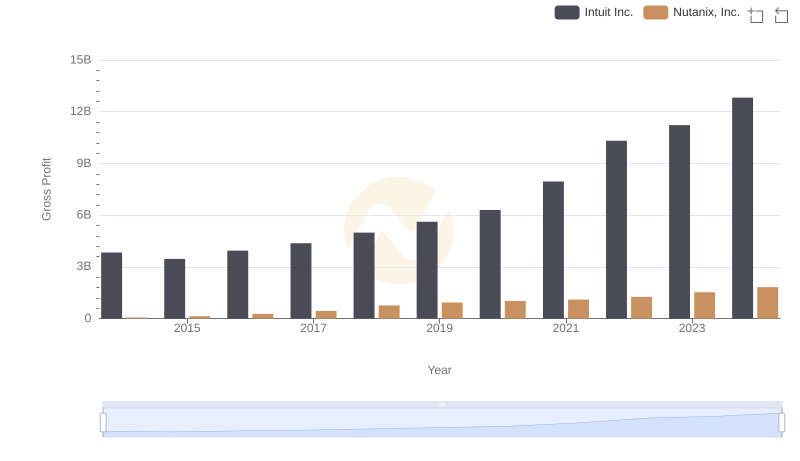

Key Insights on Gross Profit: Intuit Inc. vs Nutanix, Inc.

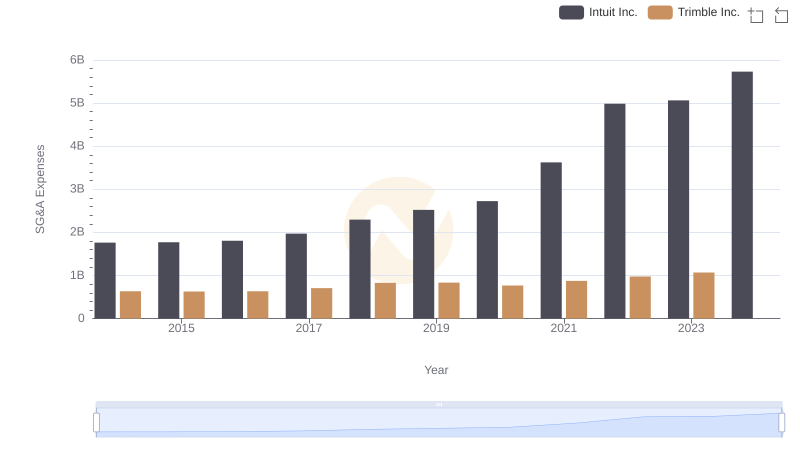

Intuit Inc. or Trimble Inc.: Who Manages SG&A Costs Better?

Breaking Down SG&A Expenses: Intuit Inc. vs Gen Digital Inc.

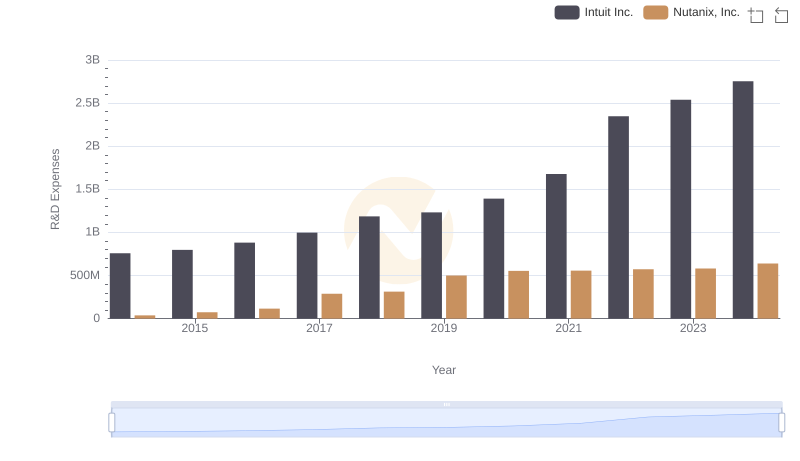

R&D Insights: How Intuit Inc. and Nutanix, Inc. Allocate Funds

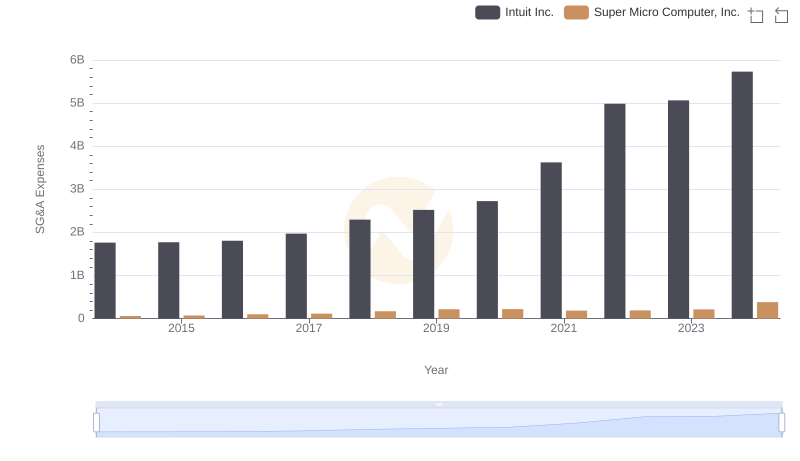

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Super Micro Computer, Inc.

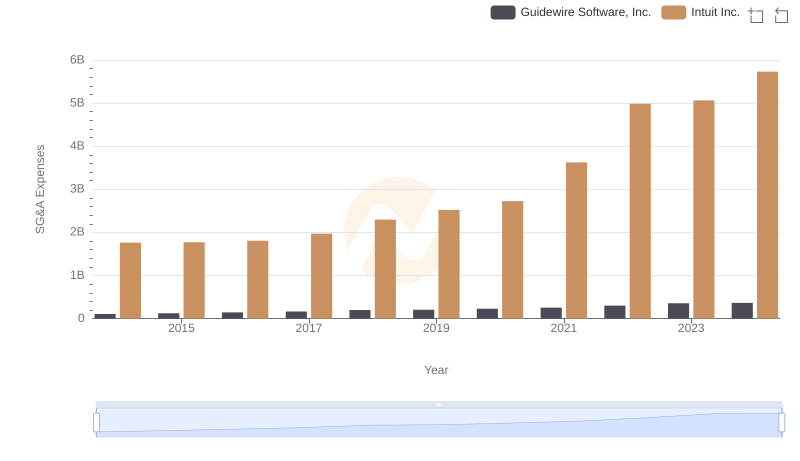

Selling, General, and Administrative Costs: Intuit Inc. vs Guidewire Software, Inc.

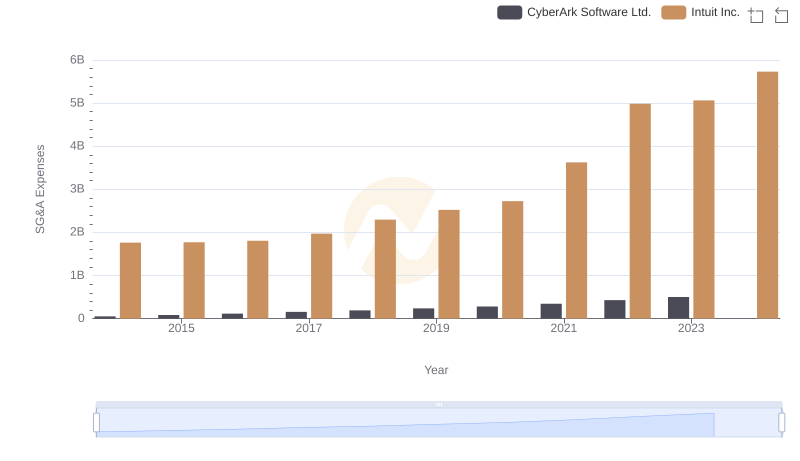

SG&A Efficiency Analysis: Comparing Intuit Inc. and CyberArk Software Ltd.

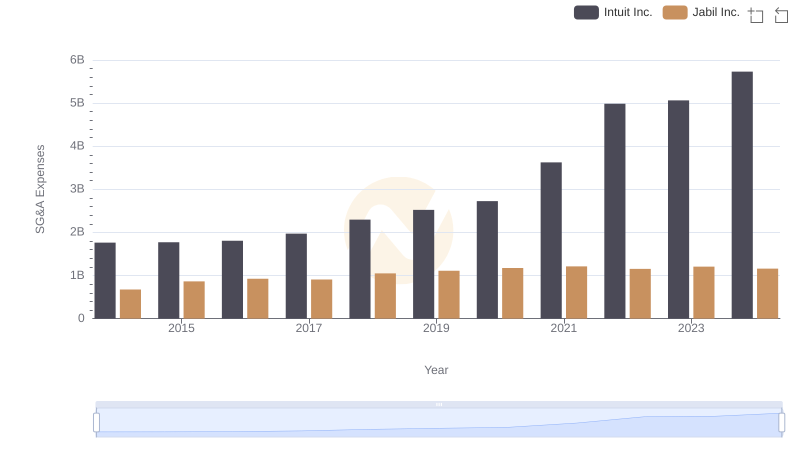

Intuit Inc. vs Jabil Inc.: SG&A Expense Trends