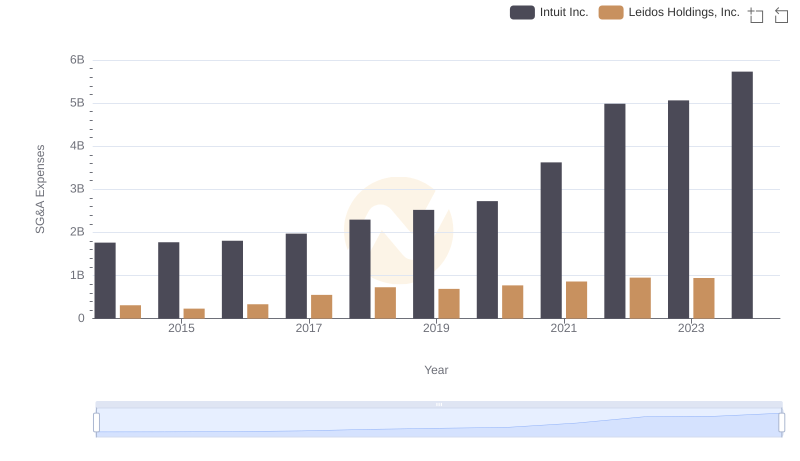

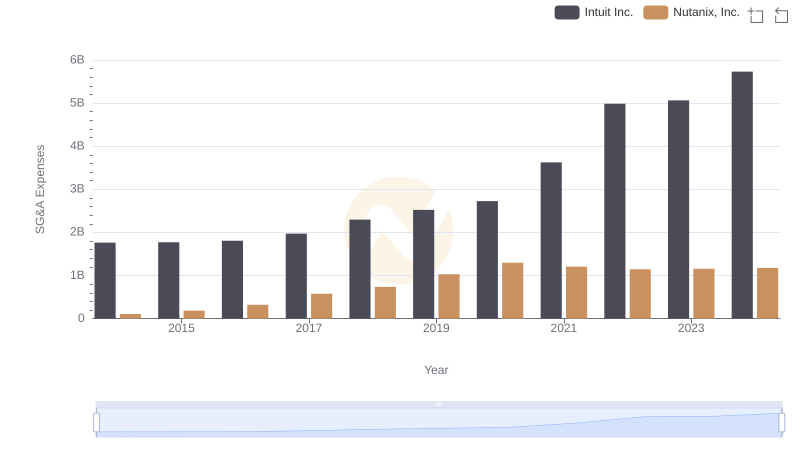

| __timestamp | Intuit Inc. | Trimble Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 634689000 |

| Thursday, January 1, 2015 | 1771000000 | 629900000 |

| Friday, January 1, 2016 | 1807000000 | 633600000 |

| Sunday, January 1, 2017 | 1973000000 | 706500000 |

| Monday, January 1, 2018 | 2298000000 | 829600000 |

| Tuesday, January 1, 2019 | 2524000000 | 834800000 |

| Wednesday, January 1, 2020 | 2727000000 | 767900000 |

| Friday, January 1, 2021 | 3626000000 | 875900000 |

| Saturday, January 1, 2022 | 4986000000 | 975800000 |

| Sunday, January 1, 2023 | 5062000000 | 1070500000 |

| Monday, January 1, 2024 | 5730000000 |

Unleashing the power of data

In the competitive landscape of financial management, Intuit Inc. and Trimble Inc. have showcased distinct strategies in handling Selling, General, and Administrative (SG&A) expenses over the past decade. From 2014 to 2023, Intuit's SG&A expenses surged by approximately 225%, reflecting a strategic expansion and investment in growth. In contrast, Trimble Inc. maintained a more conservative approach, with a 69% increase in the same period, indicating a focus on cost efficiency.

Intuit's expenses peaked in 2024, while Trimble's data for that year remains unavailable, suggesting potential reporting delays or strategic shifts. This comparison highlights Intuit's aggressive growth strategy, leveraging higher SG&A costs to fuel innovation and market expansion. Meanwhile, Trimble's steady expense management underscores its commitment to operational efficiency. As these companies navigate the evolving market, their SG&A strategies will continue to play a pivotal role in their financial narratives.

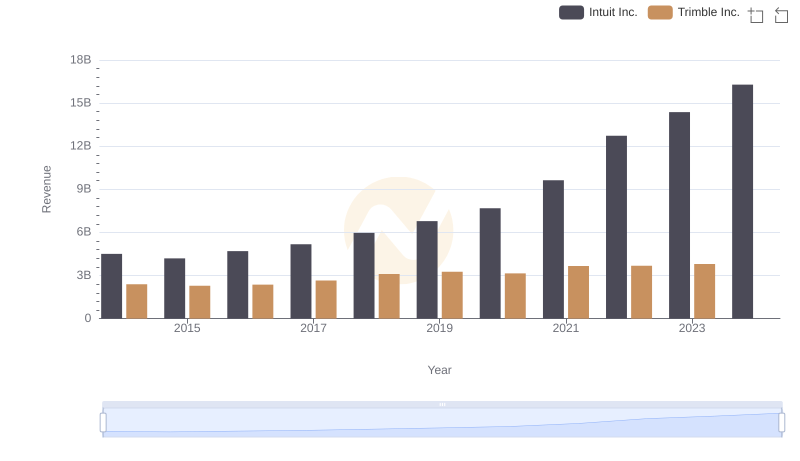

Breaking Down Revenue Trends: Intuit Inc. vs Trimble Inc.

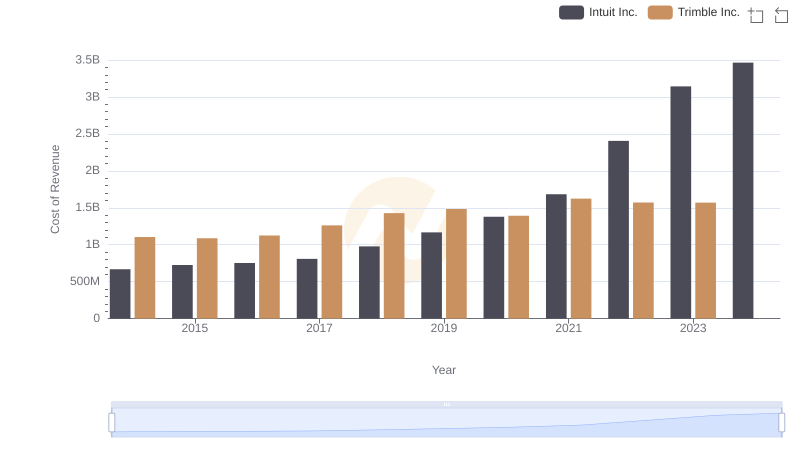

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Trimble Inc.

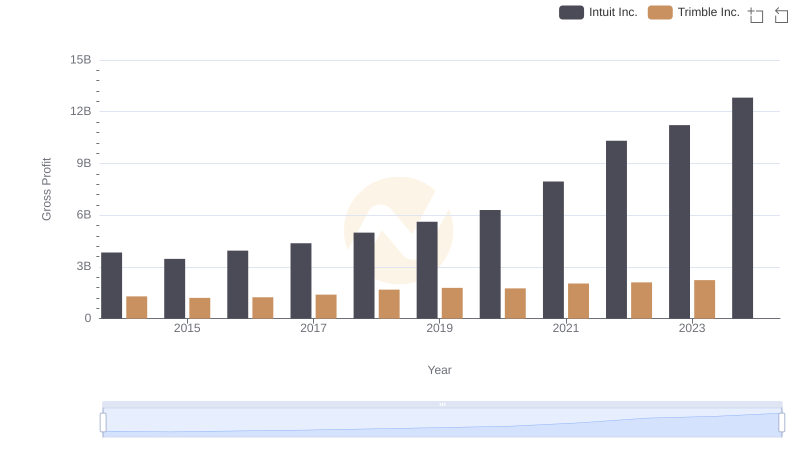

Key Insights on Gross Profit: Intuit Inc. vs Trimble Inc.

R&D Insights: How Intuit Inc. and Trimble Inc. Allocate Funds

Intuit Inc. and Teradyne, Inc.: SG&A Spending Patterns Compared

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Leidos Holdings, Inc.

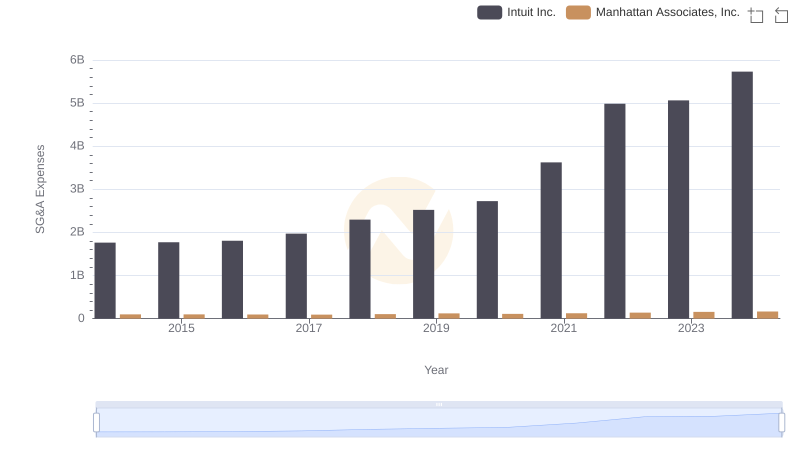

Intuit Inc. vs Manhattan Associates, Inc.: SG&A Expense Trends

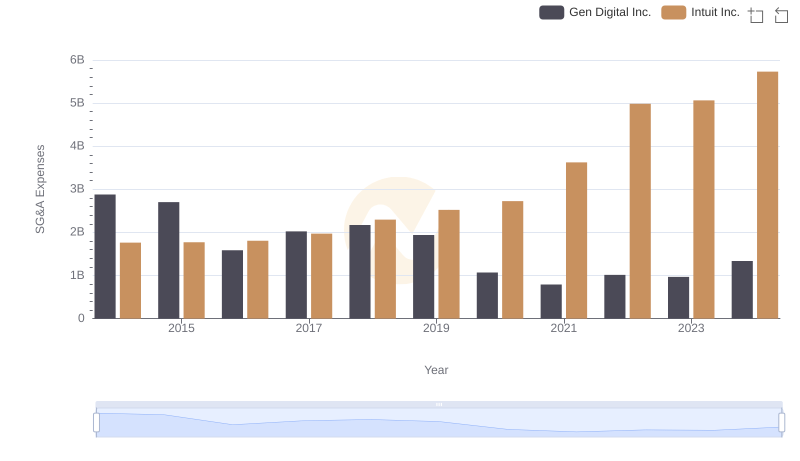

Breaking Down SG&A Expenses: Intuit Inc. vs Gen Digital Inc.

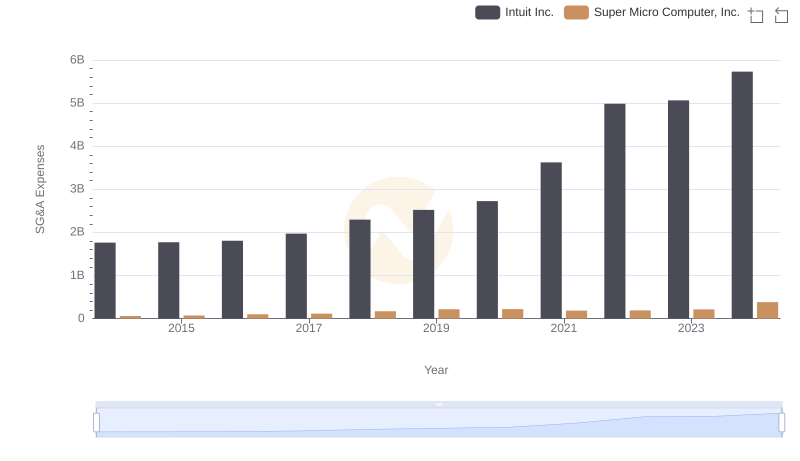

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Super Micro Computer, Inc.

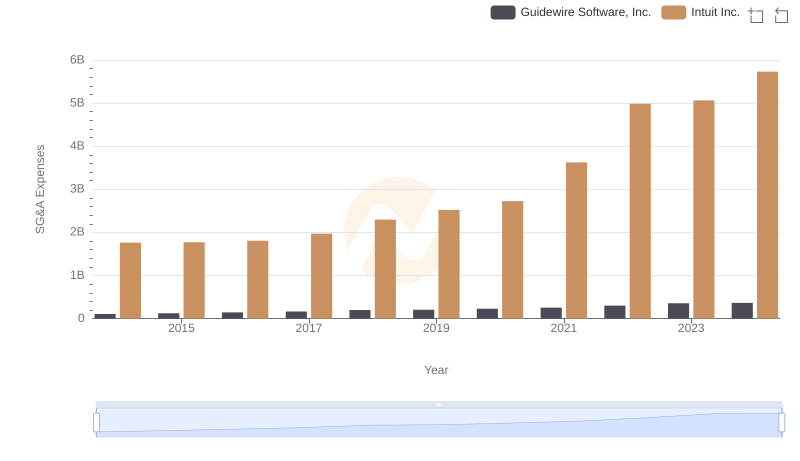

Selling, General, and Administrative Costs: Intuit Inc. vs Guidewire Software, Inc.

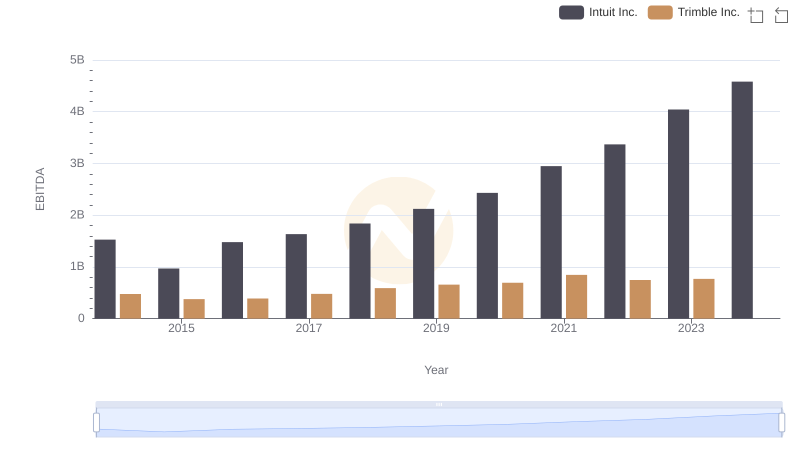

Comparative EBITDA Analysis: Intuit Inc. vs Trimble Inc.

Who Optimizes SG&A Costs Better? Intuit Inc. or Nutanix, Inc.