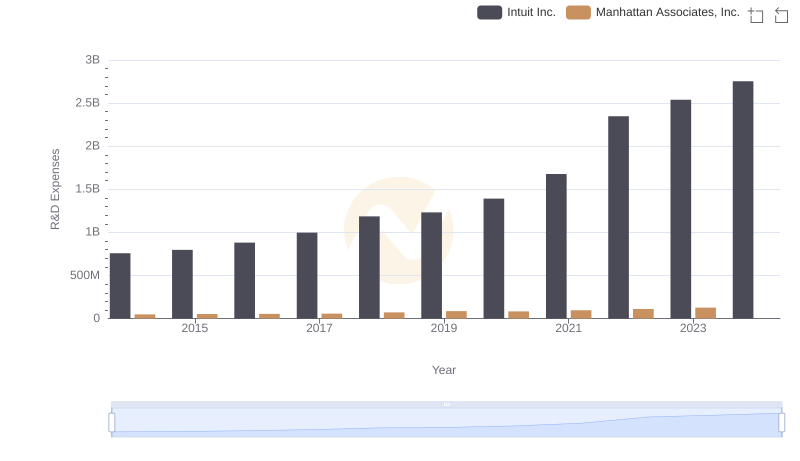

| __timestamp | Guidewire Software, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 76178000 | 758000000 |

| Thursday, January 1, 2015 | 93440000 | 798000000 |

| Friday, January 1, 2016 | 112496000 | 881000000 |

| Sunday, January 1, 2017 | 130323000 | 998000000 |

| Monday, January 1, 2018 | 171657000 | 1186000000 |

| Tuesday, January 1, 2019 | 188541000 | 1233000000 |

| Wednesday, January 1, 2020 | 200575000 | 1392000000 |

| Friday, January 1, 2021 | 219494000 | 1678000000 |

| Saturday, January 1, 2022 | 249665000 | 2347000000 |

| Sunday, January 1, 2023 | 249746000 | 2539000000 |

| Monday, January 1, 2024 | 269381000 | 2754000000 |

Unleashing the power of data

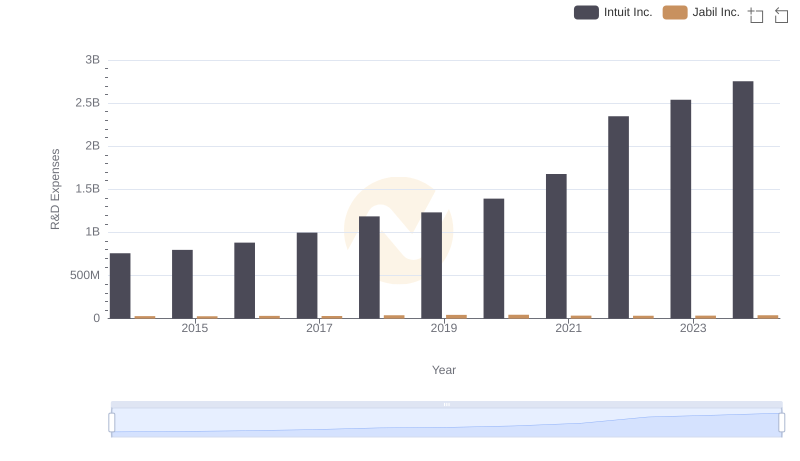

In the ever-evolving tech landscape, research and development (R&D) are the lifeblood of innovation. Over the past decade, Intuit Inc. and Guidewire Software, Inc. have demonstrated their commitment to innovation through substantial R&D investments. From 2014 to 2024, Intuit's R&D expenses surged by over 260%, reflecting its strategic focus on enhancing financial software solutions. In contrast, Guidewire's R&D spending increased by approximately 250%, underscoring its dedication to advancing insurance technology.

By 2024, Intuit's R&D expenses reached nearly 2.75 billion, dwarfing Guidewire's 270 million. This stark contrast highlights Intuit's aggressive investment strategy, which is nearly ten times that of Guidewire. As these companies continue to innovate, their R&D investments will play a pivotal role in shaping the future of their respective industries. Stay tuned as we delve deeper into how these investments translate into groundbreaking products and services.

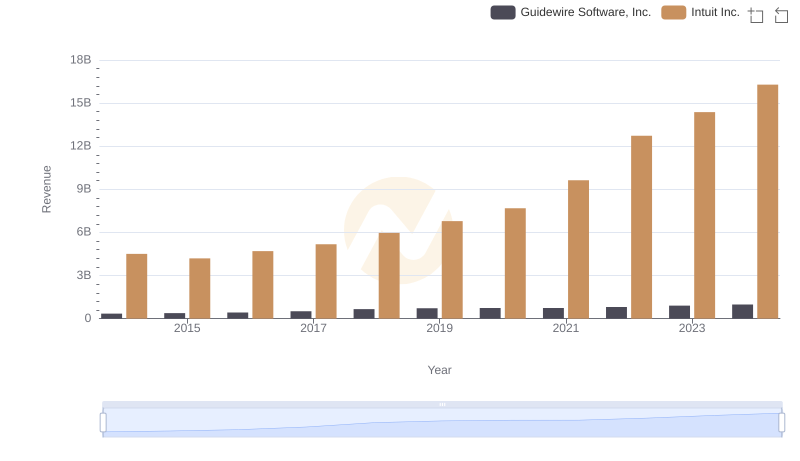

Intuit Inc. vs Guidewire Software, Inc.: Annual Revenue Growth Compared

Research and Development Expenses Breakdown: Intuit Inc. vs Teradyne, Inc.

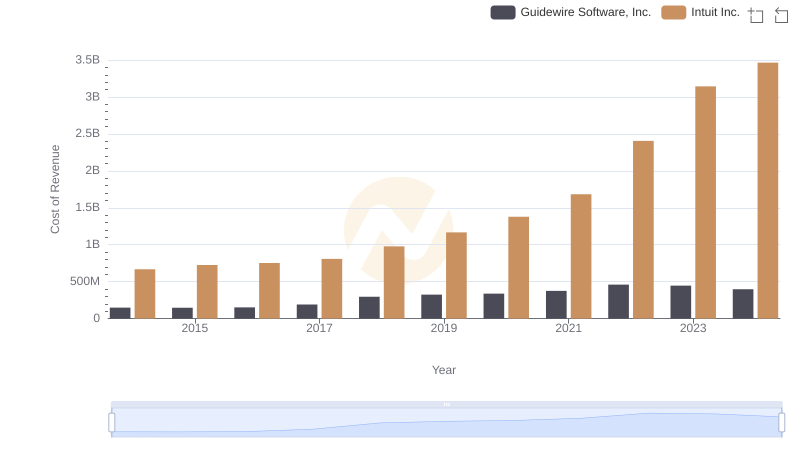

Analyzing Cost of Revenue: Intuit Inc. and Guidewire Software, Inc.

R&D Insights: How Intuit Inc. and Trimble Inc. Allocate Funds

R&D Spending Showdown: Intuit Inc. vs Manhattan Associates, Inc.

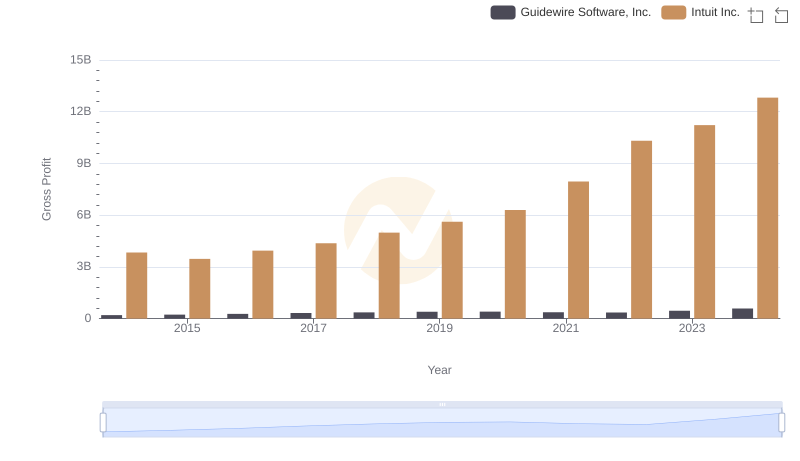

Gross Profit Analysis: Comparing Intuit Inc. and Guidewire Software, Inc.

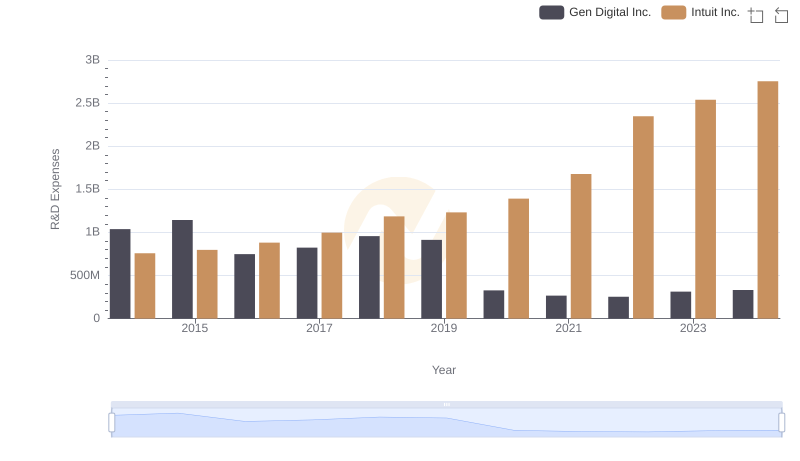

Research and Development Investment: Intuit Inc. vs Gen Digital Inc.

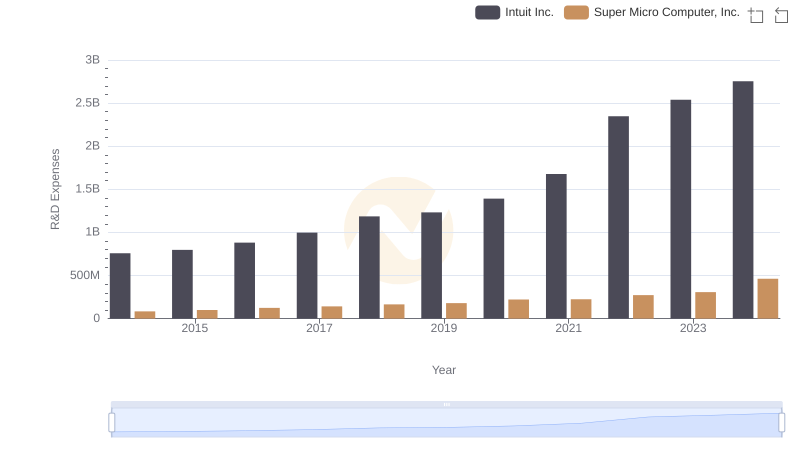

Intuit Inc. or Super Micro Computer, Inc.: Who Invests More in Innovation?

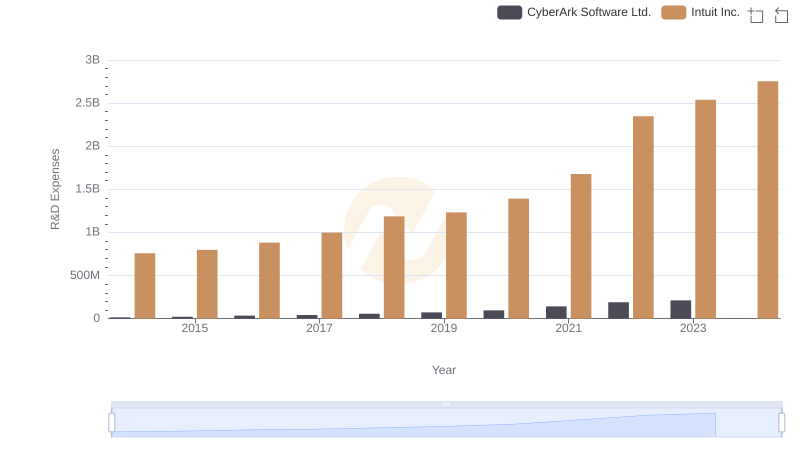

Research and Development Expenses Breakdown: Intuit Inc. vs CyberArk Software Ltd.

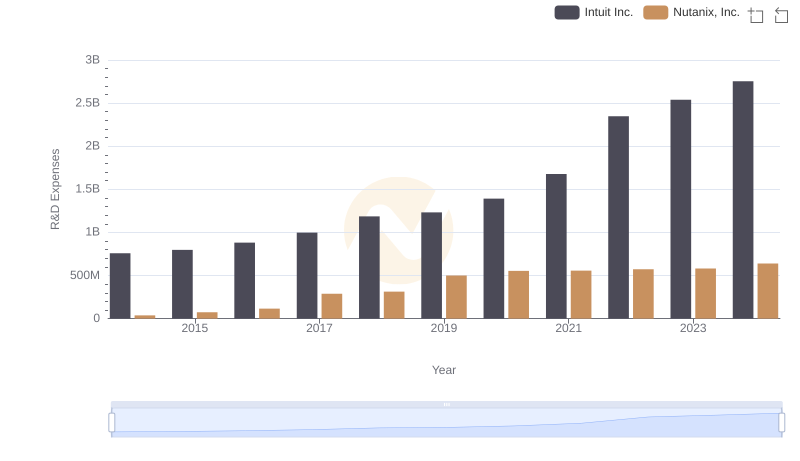

R&D Insights: How Intuit Inc. and Nutanix, Inc. Allocate Funds

Research and Development: Comparing Key Metrics for Intuit Inc. and Jabil Inc.

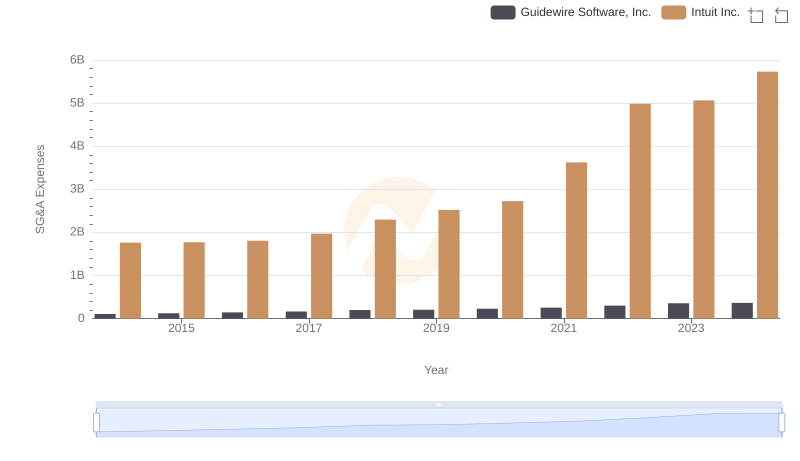

Selling, General, and Administrative Costs: Intuit Inc. vs Guidewire Software, Inc.