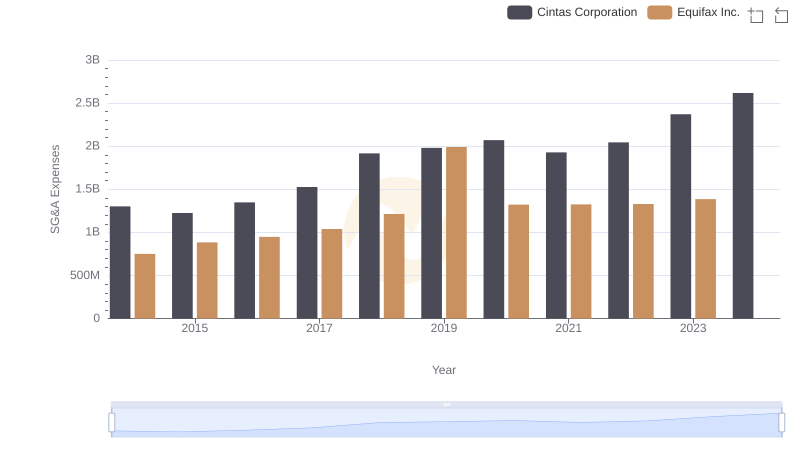

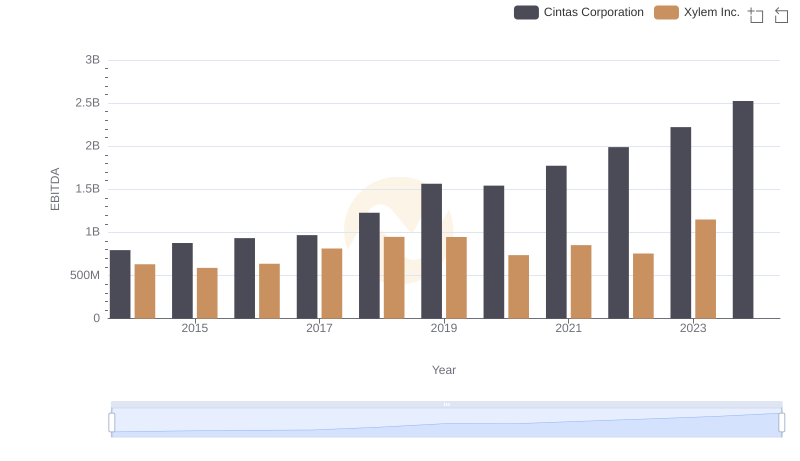

| __timestamp | Cintas Corporation | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 920000000 |

| Thursday, January 1, 2015 | 1224930000 | 854000000 |

| Friday, January 1, 2016 | 1348122000 | 915000000 |

| Sunday, January 1, 2017 | 1527380000 | 1090000000 |

| Monday, January 1, 2018 | 1916792000 | 1161000000 |

| Tuesday, January 1, 2019 | 1980644000 | 1158000000 |

| Wednesday, January 1, 2020 | 2071052000 | 1143000000 |

| Friday, January 1, 2021 | 1929159000 | 1179000000 |

| Saturday, January 1, 2022 | 2044876000 | 1227000000 |

| Sunday, January 1, 2023 | 2370704000 | 1757000000 |

| Monday, January 1, 2024 | 2617783000 |

Infusing magic into the data realm

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Cintas Corporation and Xylem Inc. have demonstrated contrasting approaches to SG&A management. From 2014 to 2023, Cintas consistently increased its SG&A expenses, peaking at approximately $2.37 billion in 2023, a 95% rise from 2014. In contrast, Xylem Inc. showed a more conservative increase, with SG&A expenses growing by about 91% over the same period, reaching $1.76 billion in 2023.

While Cintas's aggressive expansion strategy is evident, Xylem's steady growth reflects a more controlled approach. Notably, data for 2024 is missing for Xylem, leaving room for speculation on future trends. This analysis provides a fascinating glimpse into how these industry giants navigate financial management, offering valuable insights for investors and business strategists alike.

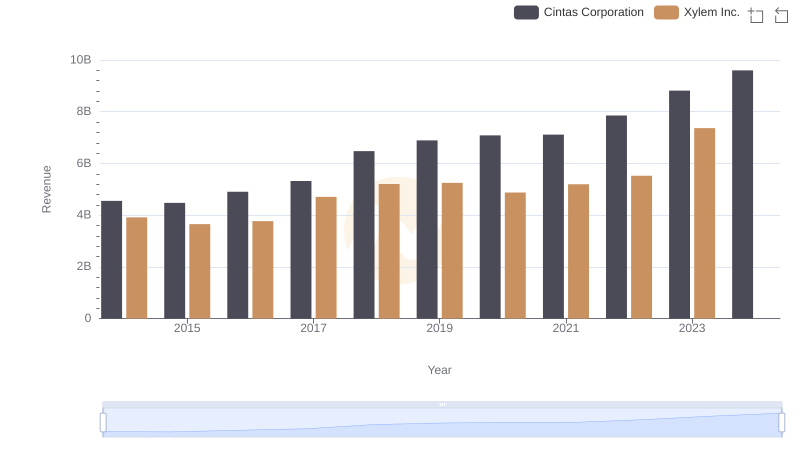

Breaking Down Revenue Trends: Cintas Corporation vs Xylem Inc.

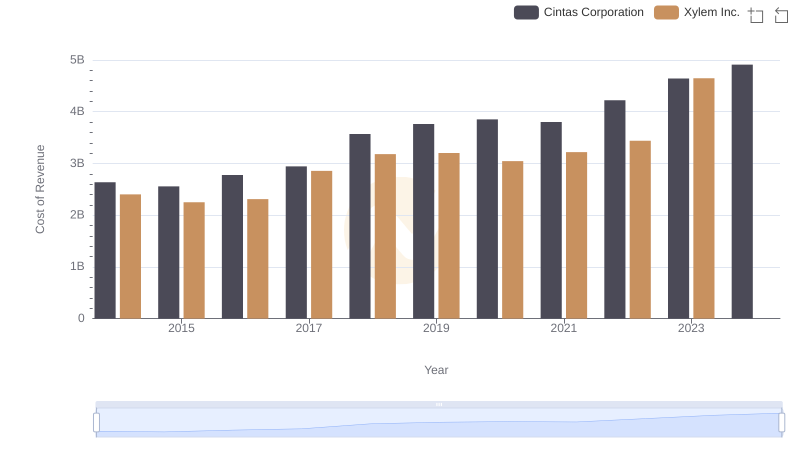

Cost Insights: Breaking Down Cintas Corporation and Xylem Inc.'s Expenses

Breaking Down SG&A Expenses: Cintas Corporation vs Equifax Inc.

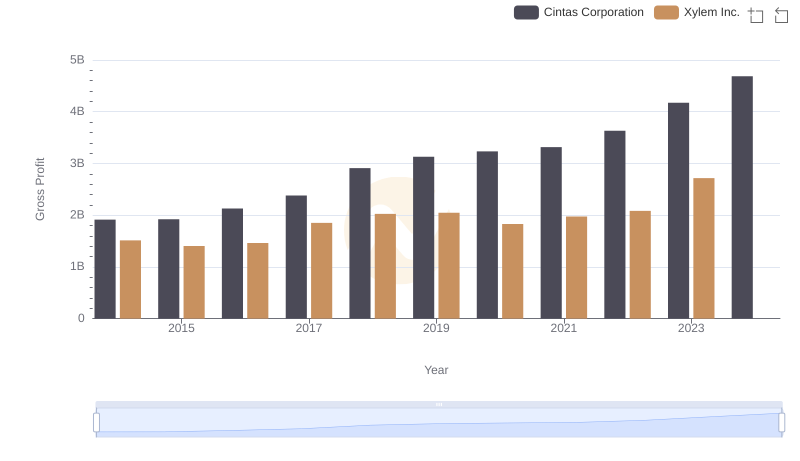

Gross Profit Analysis: Comparing Cintas Corporation and Xylem Inc.

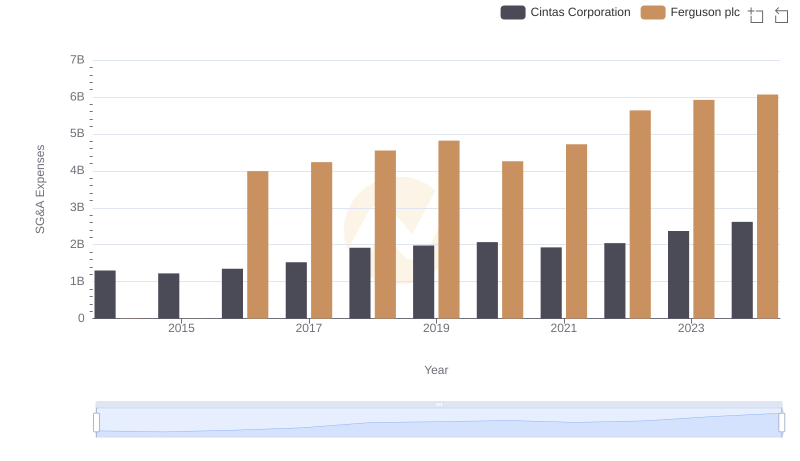

Selling, General, and Administrative Costs: Cintas Corporation vs Ferguson plc

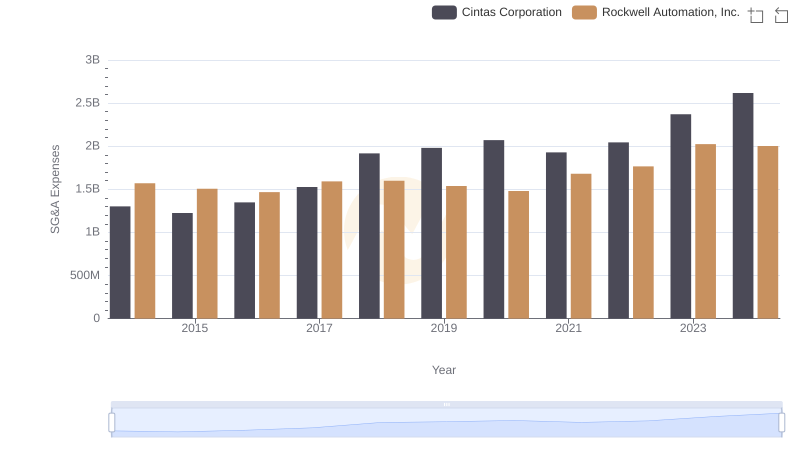

Comparing SG&A Expenses: Cintas Corporation vs Rockwell Automation, Inc. Trends and Insights

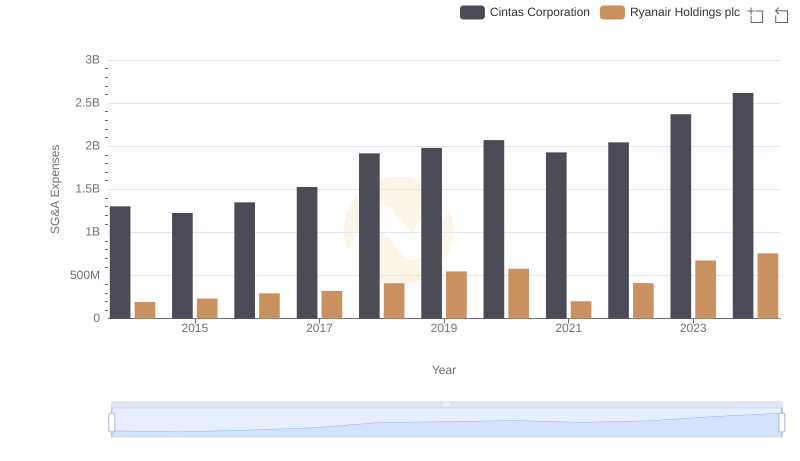

Comparing SG&A Expenses: Cintas Corporation vs Ryanair Holdings plc Trends and Insights

Professional EBITDA Benchmarking: Cintas Corporation vs Xylem Inc.

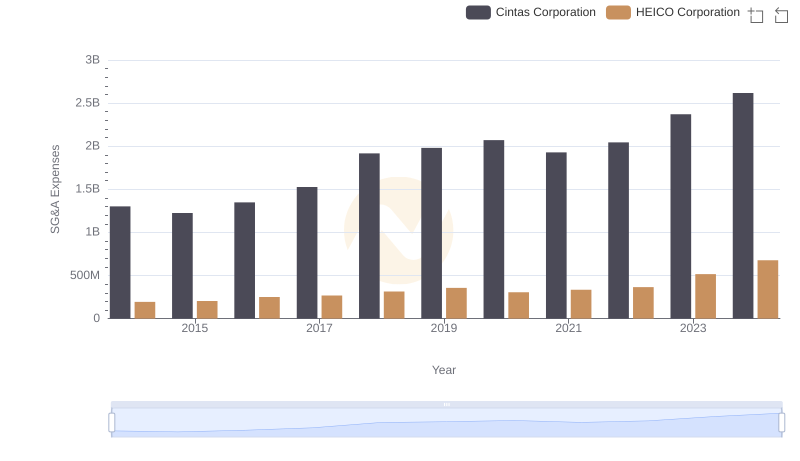

Cintas Corporation vs HEICO Corporation: SG&A Expense Trends

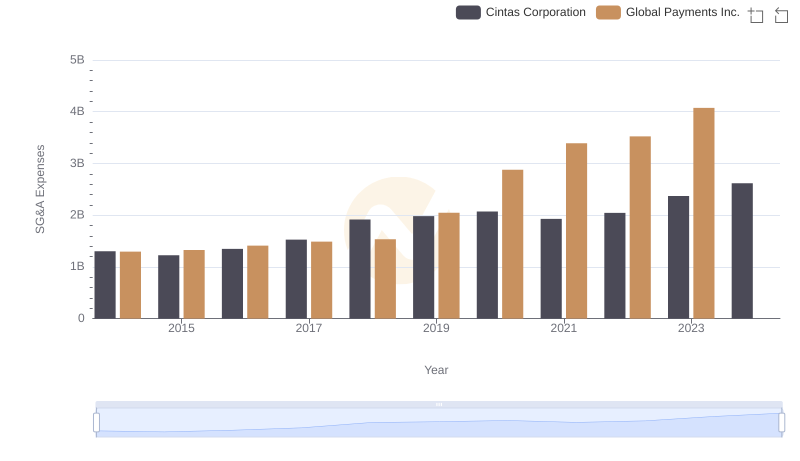

Cintas Corporation and Global Payments Inc.: SG&A Spending Patterns Compared

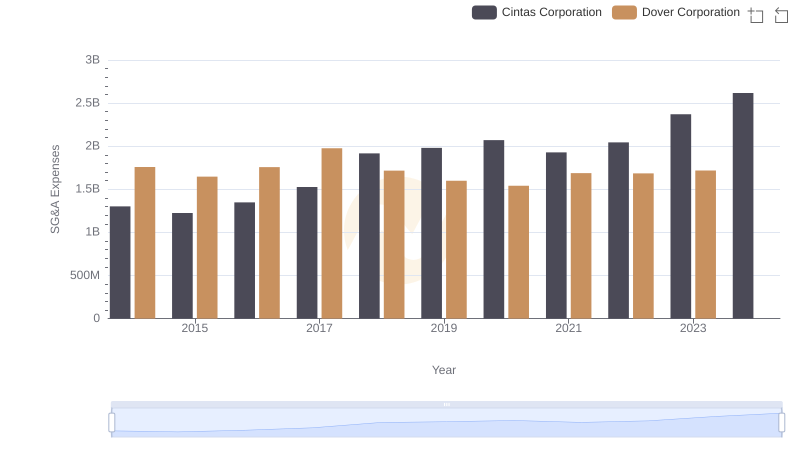

Cintas Corporation and Dover Corporation: SG&A Spending Patterns Compared