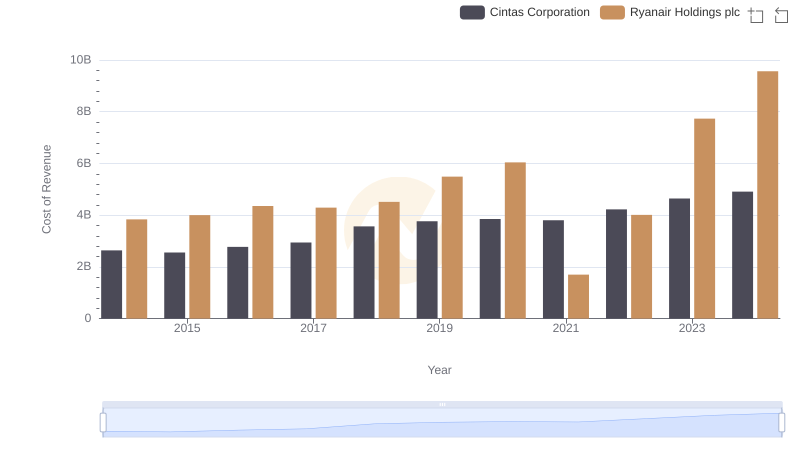

| __timestamp | Cintas Corporation | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 192800000 |

| Thursday, January 1, 2015 | 1224930000 | 233900000 |

| Friday, January 1, 2016 | 1348122000 | 292700000 |

| Sunday, January 1, 2017 | 1527380000 | 322300000 |

| Monday, January 1, 2018 | 1916792000 | 410400000 |

| Tuesday, January 1, 2019 | 1980644000 | 547300000 |

| Wednesday, January 1, 2020 | 2071052000 | 578800000 |

| Friday, January 1, 2021 | 1929159000 | 201500000 |

| Saturday, January 1, 2022 | 2044876000 | 411300000 |

| Sunday, January 1, 2023 | 2370704000 | 674400000 |

| Monday, January 1, 2024 | 2617783000 | 757200000 |

Igniting the spark of knowledge

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a crucial indicator of a company's operational efficiency. This analysis delves into the SG&A trends of Cintas Corporation and Ryanair Holdings plc from 2014 to 2024.

Cintas Corporation, a leader in corporate identity uniforms, has seen its SG&A expenses grow by approximately 101% over the decade. Starting at around $1.3 billion in 2014, the expenses have surged to over $2.6 billion by 2024, reflecting the company's expansion and increased operational activities.

Ryanair, Europe's largest low-cost airline, presents a contrasting picture. Its SG&A expenses have increased by nearly 293%, from $192 million in 2014 to $757 million in 2024. This growth highlights Ryanair's strategic investments in customer service and operational efficiency.

Both companies showcase distinct strategies in managing their SG&A expenses, offering valuable insights into their business models and market positioning.

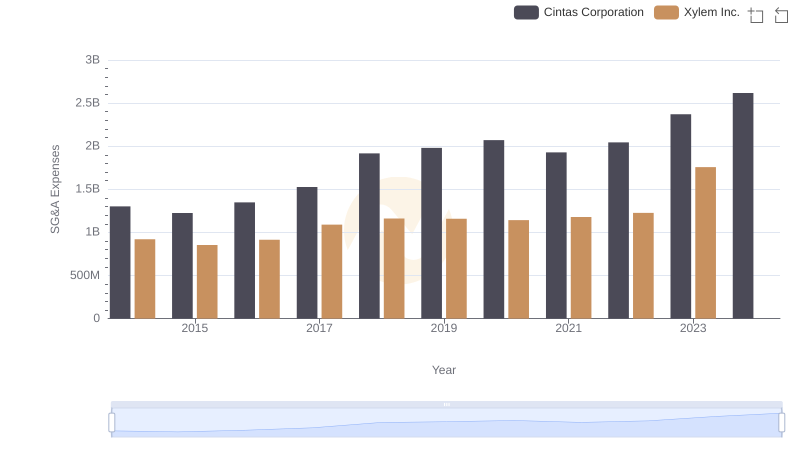

Cintas Corporation or Xylem Inc.: Who Manages SG&A Costs Better?

Cost Insights: Breaking Down Cintas Corporation and Ryanair Holdings plc's Expenses

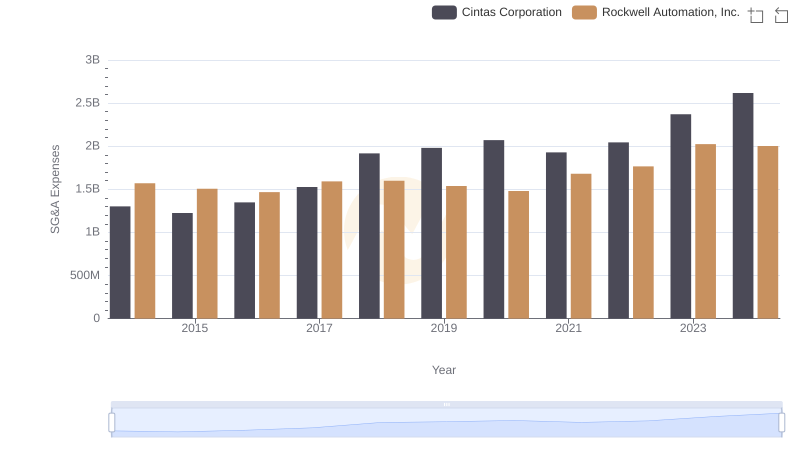

Comparing SG&A Expenses: Cintas Corporation vs Rockwell Automation, Inc. Trends and Insights

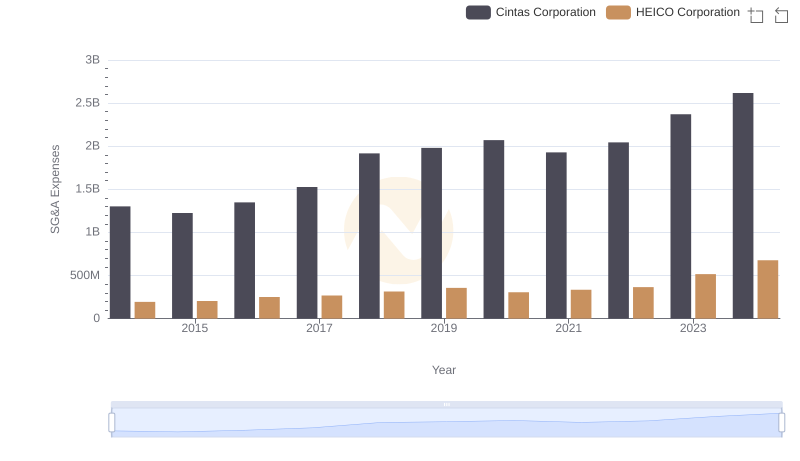

Cintas Corporation vs HEICO Corporation: SG&A Expense Trends

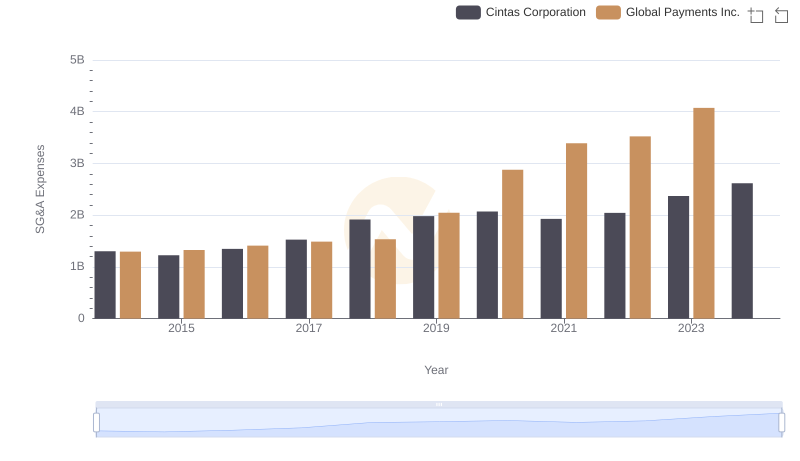

Cintas Corporation and Global Payments Inc.: SG&A Spending Patterns Compared

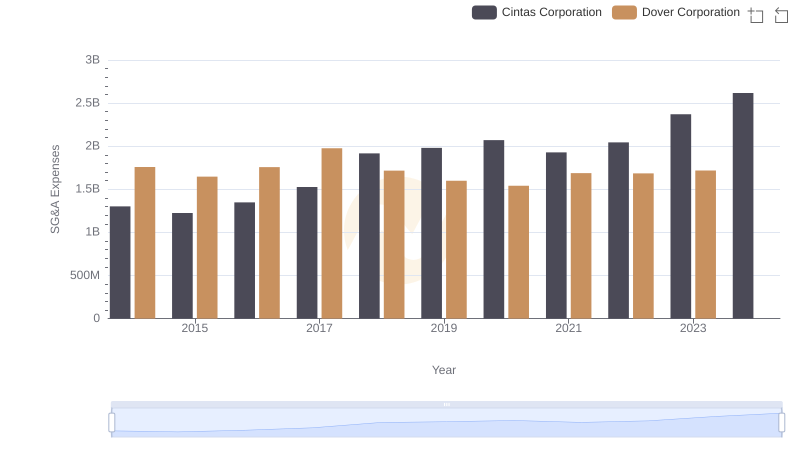

Cintas Corporation and Dover Corporation: SG&A Spending Patterns Compared

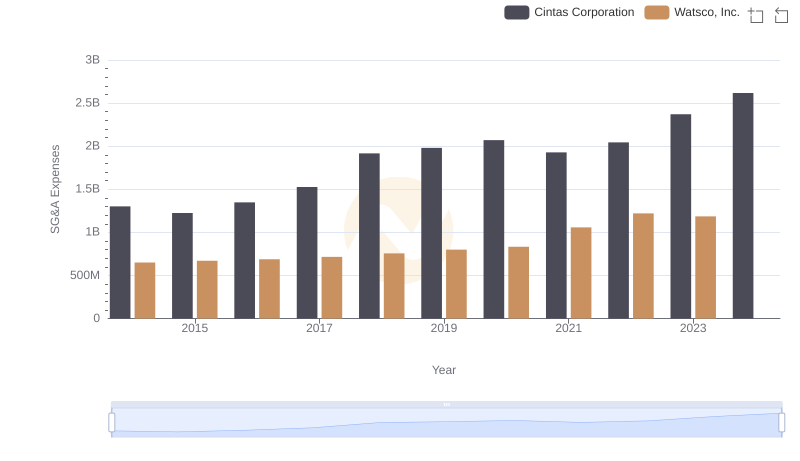

Cintas Corporation vs Watsco, Inc.: SG&A Expense Trends

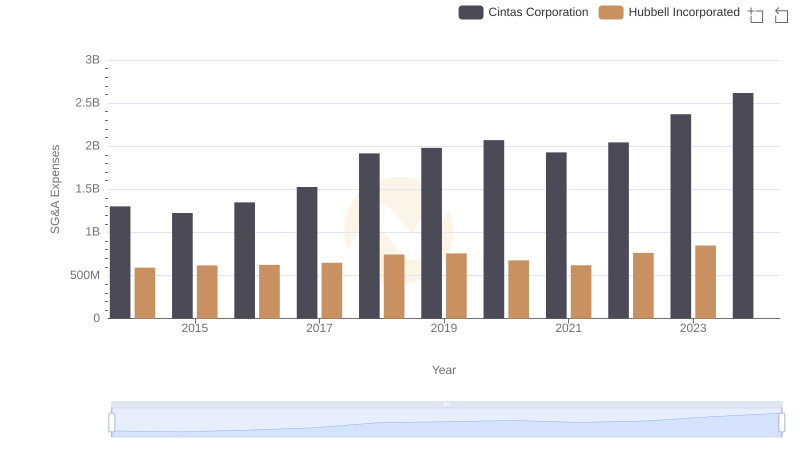

SG&A Efficiency Analysis: Comparing Cintas Corporation and Hubbell Incorporated

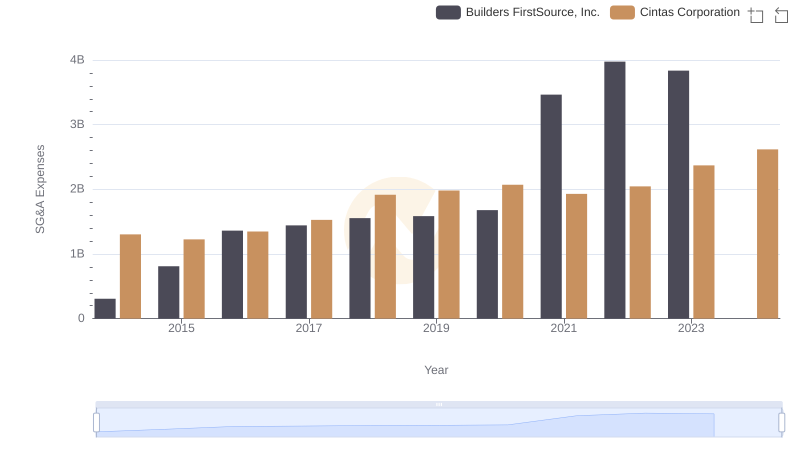

Breaking Down SG&A Expenses: Cintas Corporation vs Builders FirstSource, Inc.

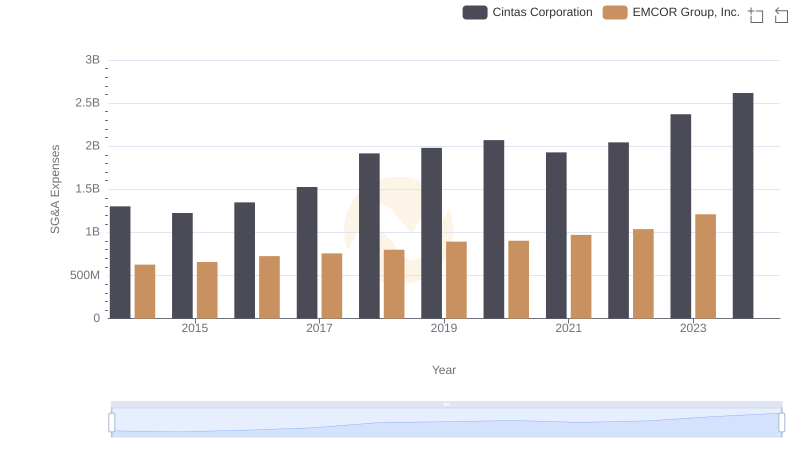

Comparing SG&A Expenses: Cintas Corporation vs EMCOR Group, Inc. Trends and Insights