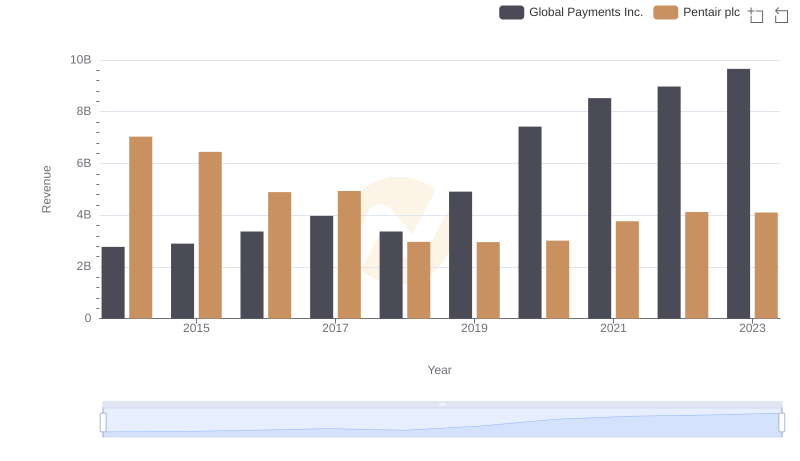

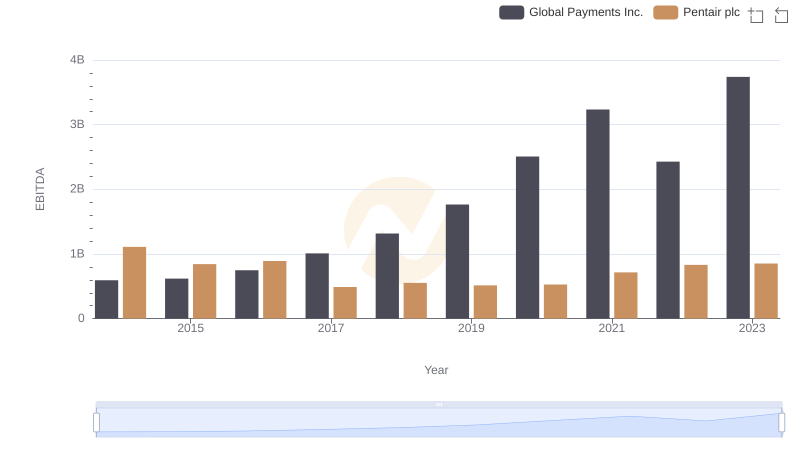

| __timestamp | Global Payments Inc. | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1295014000 | 1493800000 |

| Thursday, January 1, 2015 | 1325567000 | 1334300000 |

| Friday, January 1, 2016 | 1411096000 | 979300000 |

| Sunday, January 1, 2017 | 1488258000 | 1032500000 |

| Monday, January 1, 2018 | 1534297000 | 534300000 |

| Tuesday, January 1, 2019 | 2046672000 | 540100000 |

| Wednesday, January 1, 2020 | 2878878000 | 520500000 |

| Friday, January 1, 2021 | 3391161000 | 596400000 |

| Saturday, January 1, 2022 | 3524578000 | 677100000 |

| Sunday, January 1, 2023 | 4073768000 | 680200000 |

| Monday, January 1, 2024 | 4285307000 | 701400000 |

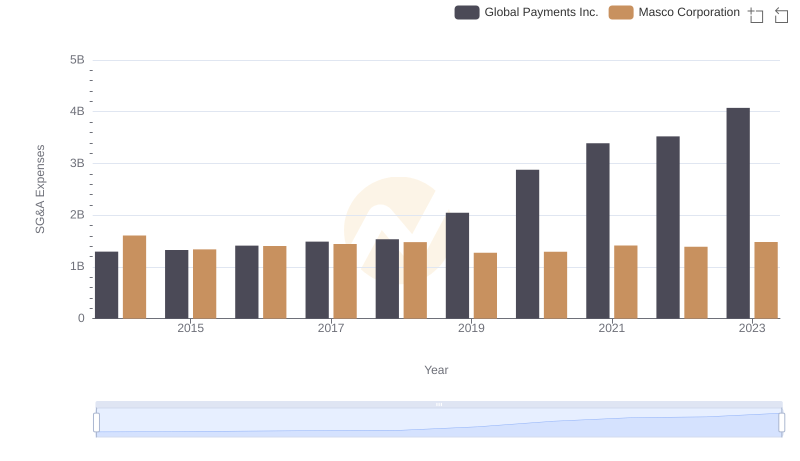

Unleashing insights

In the ever-evolving landscape of corporate finance, Selling, General, and Administrative (SG&A) expenses serve as a critical indicator of a company's operational efficiency. This analysis juxtaposes the SG&A expenses of Global Payments Inc. and Pentair plc from 2014 to 2023.

Global Payments Inc. has seen a remarkable upward trajectory in its SG&A expenses, growing by over 200% from 2014 to 2023. This increase reflects the company's aggressive expansion and investment in operational capabilities. By 2023, their SG&A expenses reached a peak, indicating a strategic focus on scaling operations.

Conversely, Pentair plc experienced a 54% decline in SG&A expenses over the same period. This reduction suggests a strategic shift towards cost optimization and efficiency. Despite fluctuations, Pentair's expenses stabilized in recent years, highlighting a commitment to lean operations.

This comparative analysis underscores the diverse strategies companies employ to navigate financial landscapes.

Global Payments Inc. vs Pentair plc: Examining Key Revenue Metrics

Breaking Down SG&A Expenses: Global Payments Inc. vs Masco Corporation

Global Payments Inc. vs J.B. Hunt Transport Services, Inc.: SG&A Expense Trends

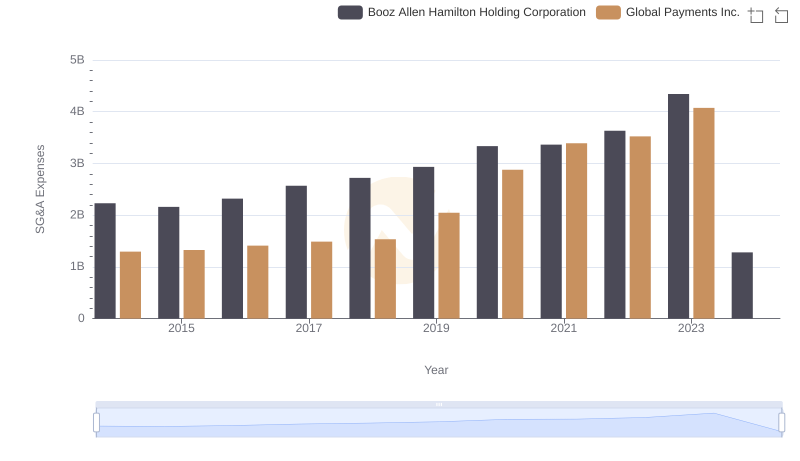

Who Optimizes SG&A Costs Better? Global Payments Inc. or Booz Allen Hamilton Holding Corporation

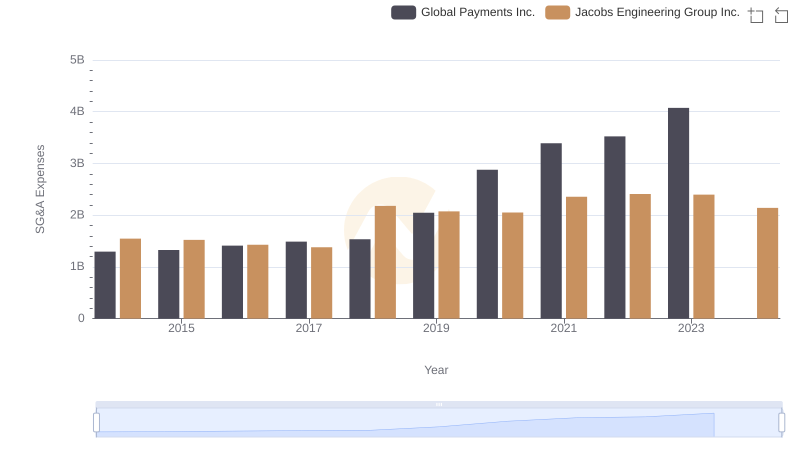

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Jacobs Engineering Group Inc.

Professional EBITDA Benchmarking: Global Payments Inc. vs Pentair plc

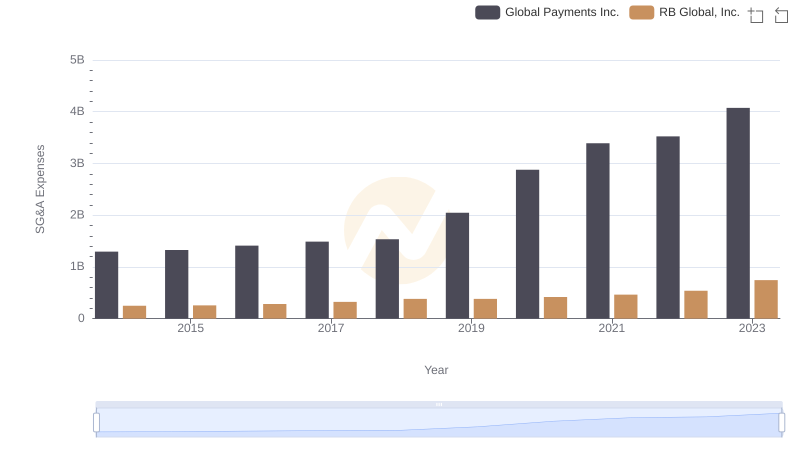

Cost Management Insights: SG&A Expenses for Global Payments Inc. and RB Global, Inc.

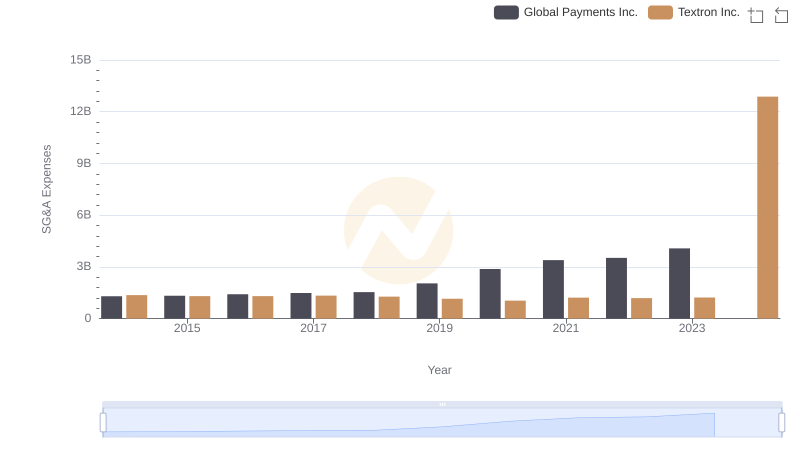

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Textron Inc.

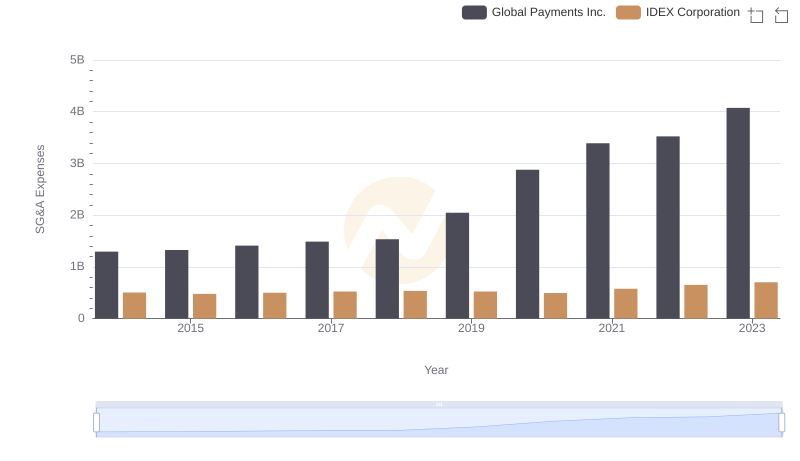

Who Optimizes SG&A Costs Better? Global Payments Inc. or IDEX Corporation