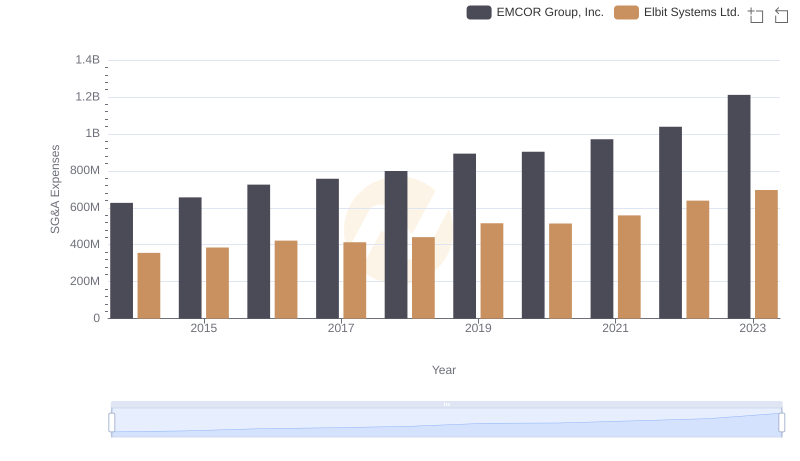

| __timestamp | EMCOR Group, Inc. | Elbit Systems Ltd. |

|---|---|---|

| Wednesday, January 1, 2014 | 355858000 | 358274000 |

| Thursday, January 1, 2015 | 362095000 | 390932000 |

| Friday, January 1, 2016 | 395913000 | 424003291 |

| Sunday, January 1, 2017 | 478459000 | 438616108 |

| Monday, January 1, 2018 | 489954000 | 374866620 |

| Tuesday, January 1, 2019 | 556055000 | 502866000 |

| Wednesday, January 1, 2020 | 601449000 | 484464000 |

| Friday, January 1, 2021 | 646861000 | 576645646 |

| Saturday, January 1, 2022 | 682399000 | 505269000 |

| Sunday, January 1, 2023 | 1009017000 | 544811000 |

Igniting the spark of knowledge

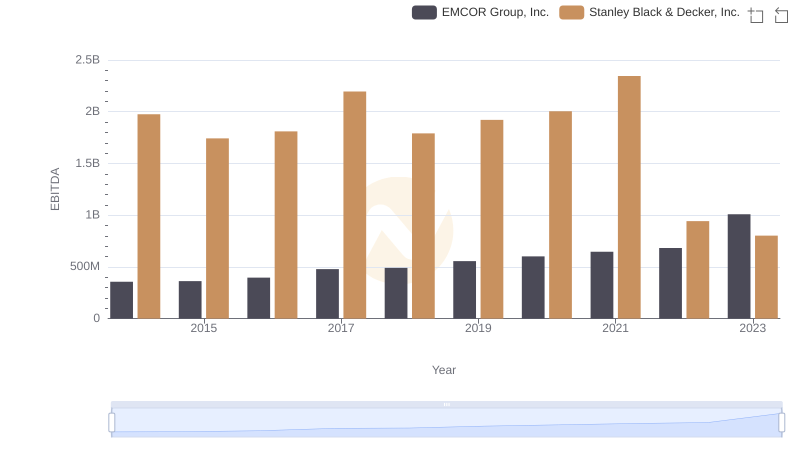

In the competitive landscape of global engineering and defense, EMCOR Group, Inc. and Elbit Systems Ltd. stand as titans. Over the past decade, EMCOR has demonstrated a robust growth trajectory, with its EBITDA surging by approximately 183% from 2014 to 2023. This impressive growth reflects EMCOR's strategic expansions and operational efficiencies. In contrast, Elbit Systems Ltd. has shown a steady, albeit more modest, increase of around 52% in the same period, underscoring its stable position in the defense sector.

From 2014 to 2023, EMCOR's EBITDA consistently outpaced Elbit's, peaking in 2023 with a remarkable 1.009 billion USD. Meanwhile, Elbit's EBITDA reached its zenith in 2021, highlighting its resilience amidst global uncertainties. This financial narrative not only showcases the dynamic nature of these industries but also offers valuable insights for investors and stakeholders alike.

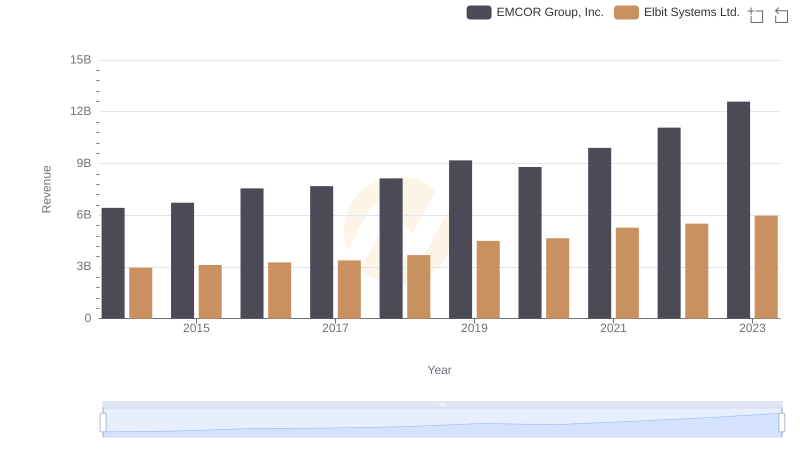

Comparing Revenue Performance: EMCOR Group, Inc. or Elbit Systems Ltd.?

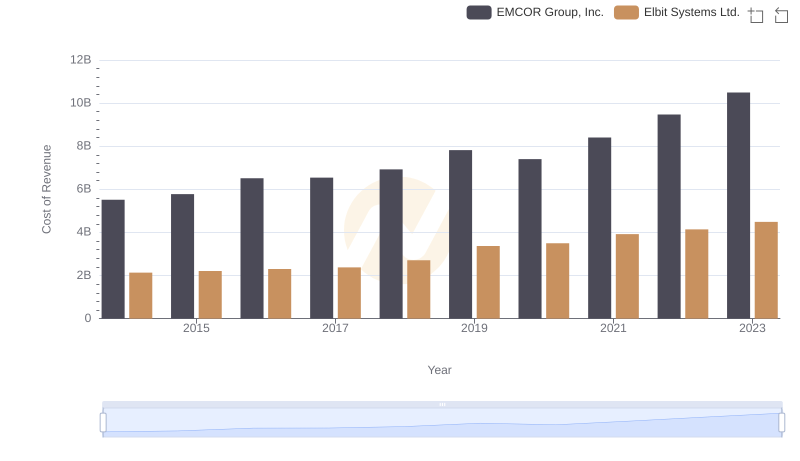

Cost of Revenue Trends: EMCOR Group, Inc. vs Elbit Systems Ltd.

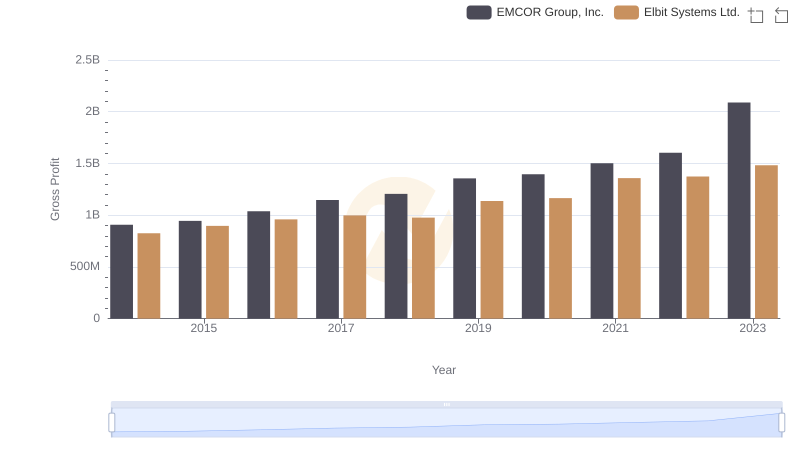

EMCOR Group, Inc. vs Elbit Systems Ltd.: A Gross Profit Performance Breakdown

EMCOR Group, Inc. and Stanley Black & Decker, Inc.: A Detailed Examination of EBITDA Performance

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs Elbit Systems Ltd.

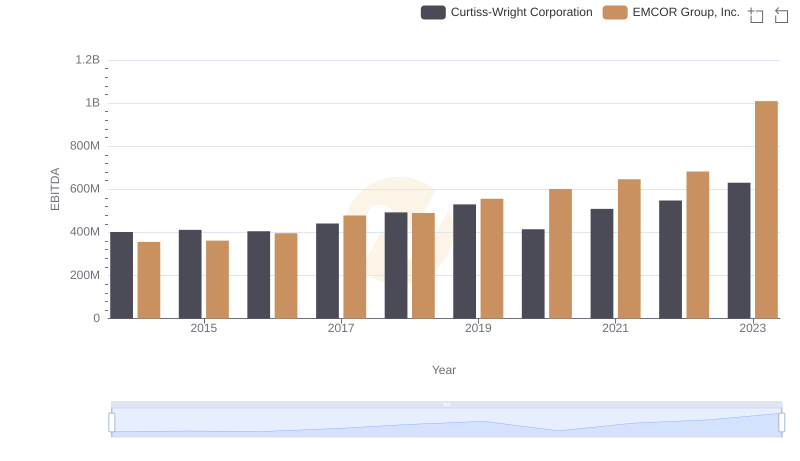

EBITDA Metrics Evaluated: EMCOR Group, Inc. vs Curtiss-Wright Corporation

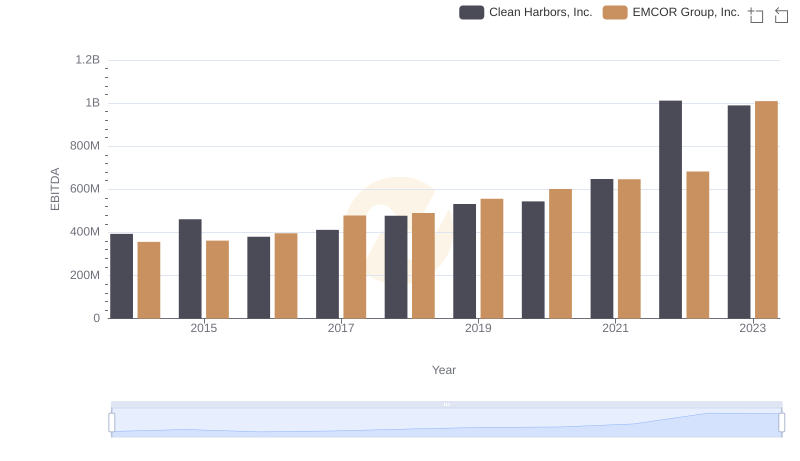

EBITDA Metrics Evaluated: EMCOR Group, Inc. vs Clean Harbors, Inc.

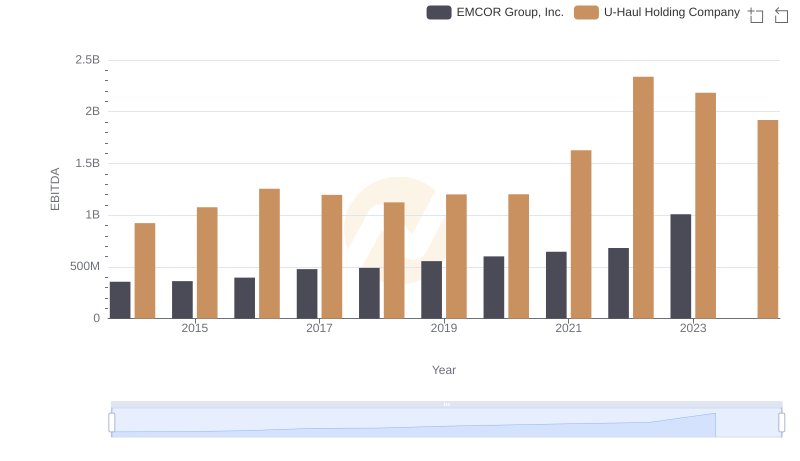

Professional EBITDA Benchmarking: EMCOR Group, Inc. vs U-Haul Holding Company

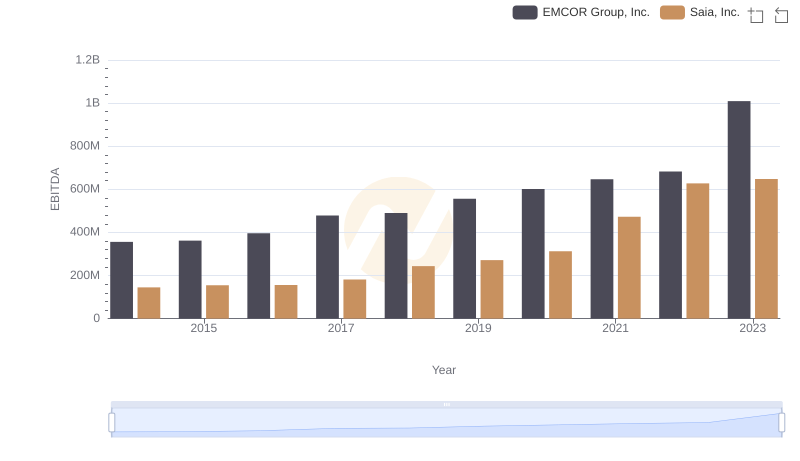

A Side-by-Side Analysis of EBITDA: EMCOR Group, Inc. and Saia, Inc.

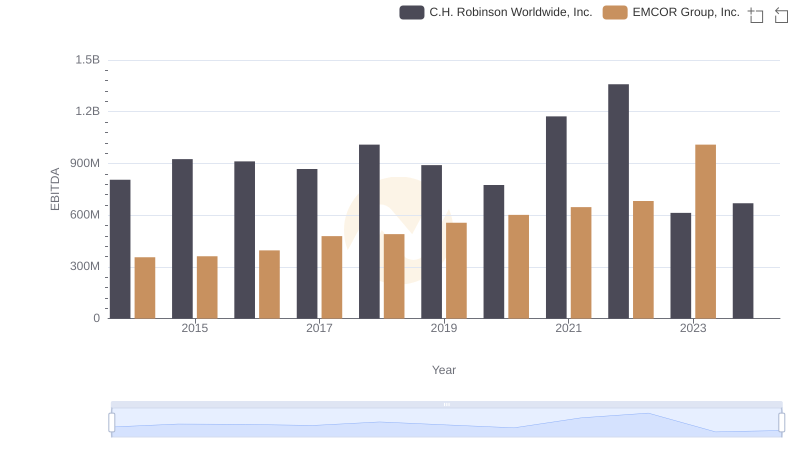

Comparative EBITDA Analysis: EMCOR Group, Inc. vs C.H. Robinson Worldwide, Inc.

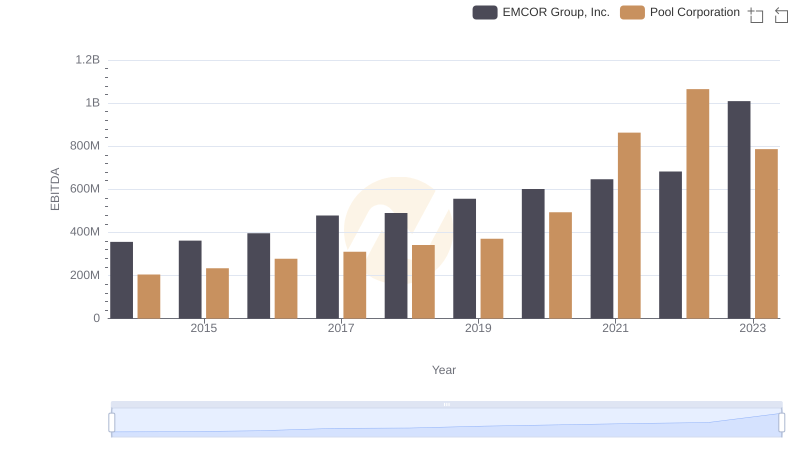

Professional EBITDA Benchmarking: EMCOR Group, Inc. vs Pool Corporation

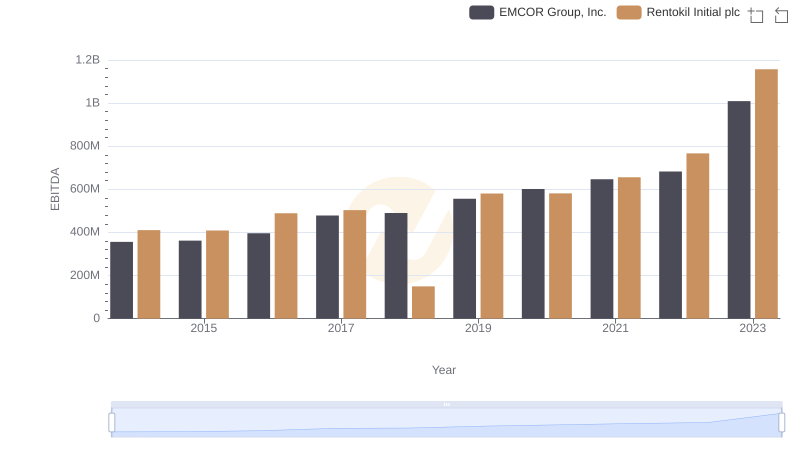

EBITDA Performance Review: EMCOR Group, Inc. vs Rentokil Initial plc