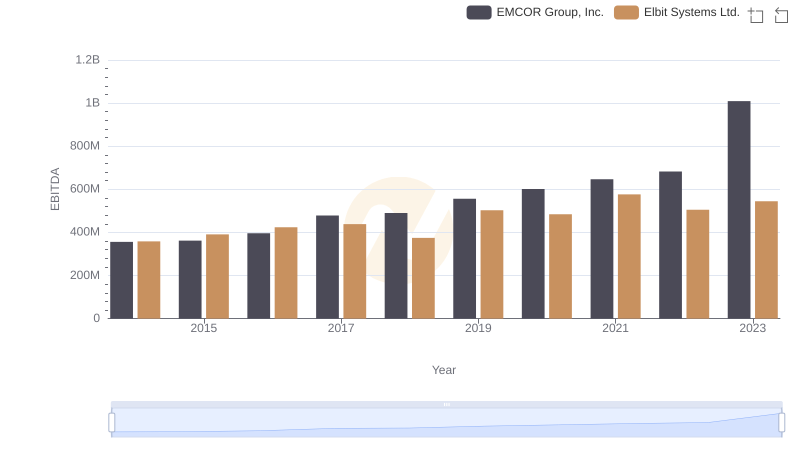

| __timestamp | EMCOR Group, Inc. | Elbit Systems Ltd. |

|---|---|---|

| Wednesday, January 1, 2014 | 626478000 | 356171000 |

| Thursday, January 1, 2015 | 656573000 | 385059000 |

| Friday, January 1, 2016 | 725538000 | 422390000 |

| Sunday, January 1, 2017 | 757062000 | 413560000 |

| Monday, January 1, 2018 | 799157000 | 441362000 |

| Tuesday, January 1, 2019 | 893453000 | 516149000 |

| Wednesday, January 1, 2020 | 903584000 | 514638000 |

| Friday, January 1, 2021 | 970937000 | 559113000 |

| Saturday, January 1, 2022 | 1038717000 | 639067000 |

| Sunday, January 1, 2023 | 1211233000 | 696022000 |

Infusing magic into the data realm

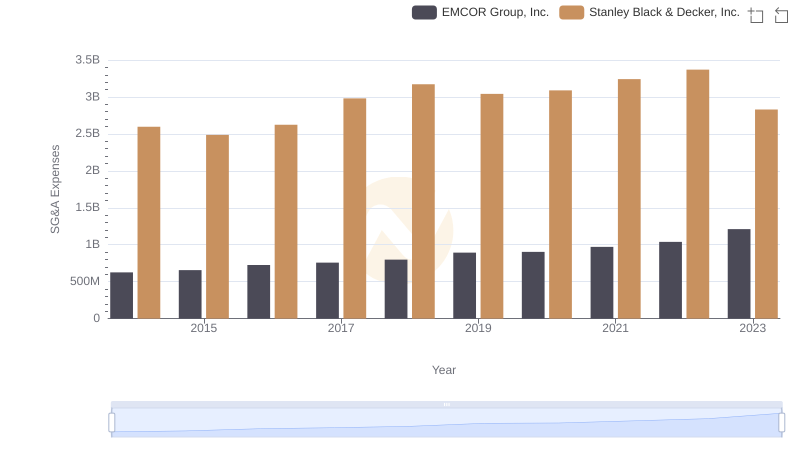

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, EMCOR Group, Inc. and Elbit Systems Ltd. have demonstrated distinct trajectories in their SG&A expenditures. From 2014 to 2023, EMCOR Group, Inc. saw a remarkable 93% increase in SG&A expenses, reflecting its strategic expansion and operational scaling. In contrast, Elbit Systems Ltd. experienced a 95% rise, indicating its robust growth in the defense sector.

These trends highlight the dynamic nature of SG&A expenses and their impact on corporate strategy.

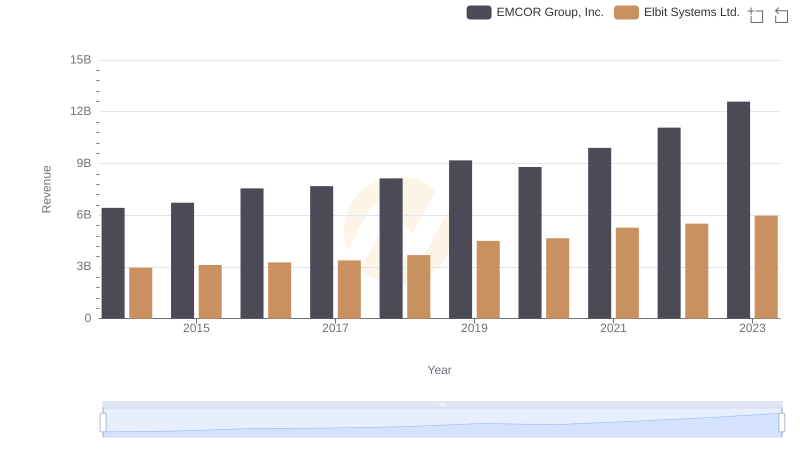

Comparing Revenue Performance: EMCOR Group, Inc. or Elbit Systems Ltd.?

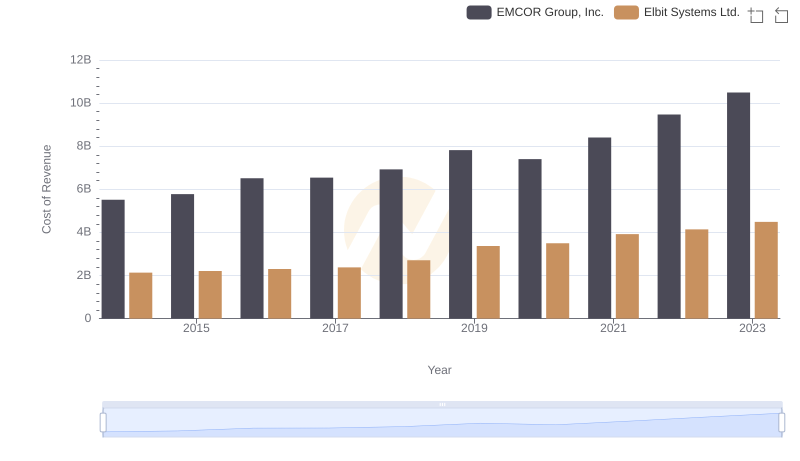

Cost of Revenue Trends: EMCOR Group, Inc. vs Elbit Systems Ltd.

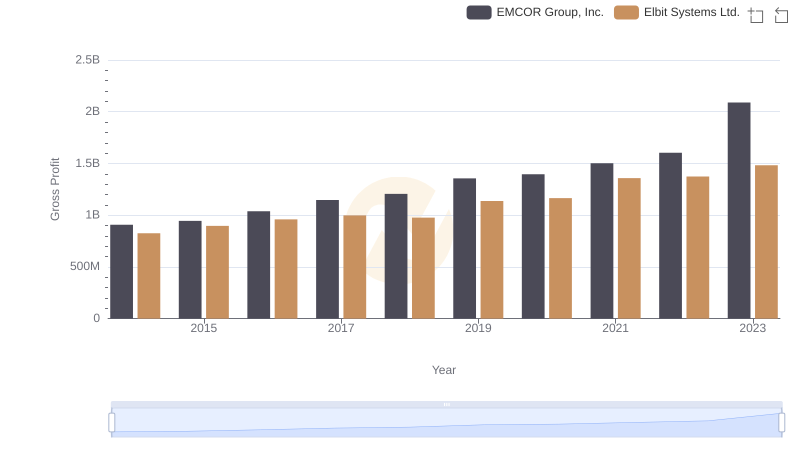

EMCOR Group, Inc. vs Elbit Systems Ltd.: A Gross Profit Performance Breakdown

Selling, General, and Administrative Costs: EMCOR Group, Inc. vs Stanley Black & Decker, Inc.

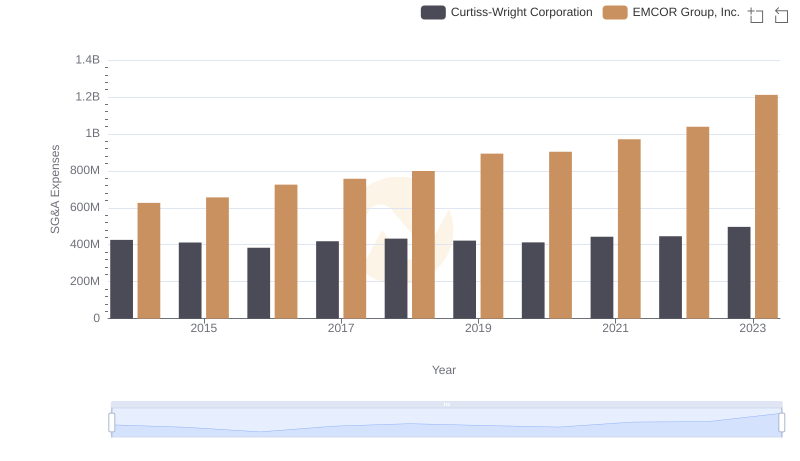

EMCOR Group, Inc. vs Curtiss-Wright Corporation: SG&A Expense Trends

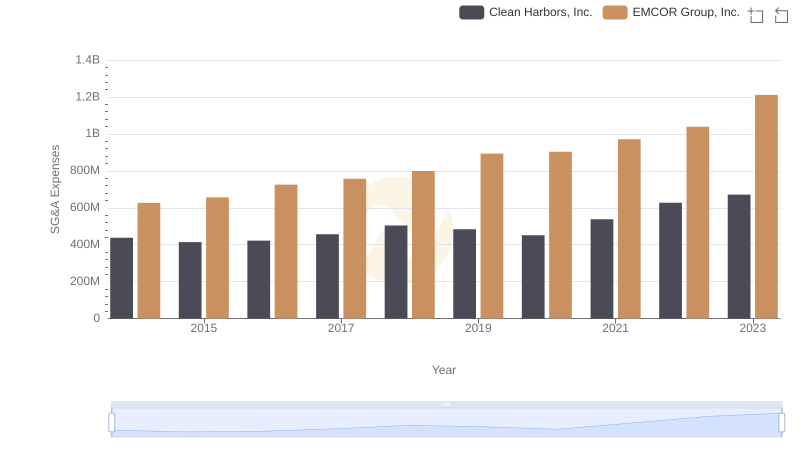

EMCOR Group, Inc. and Clean Harbors, Inc.: SG&A Spending Patterns Compared

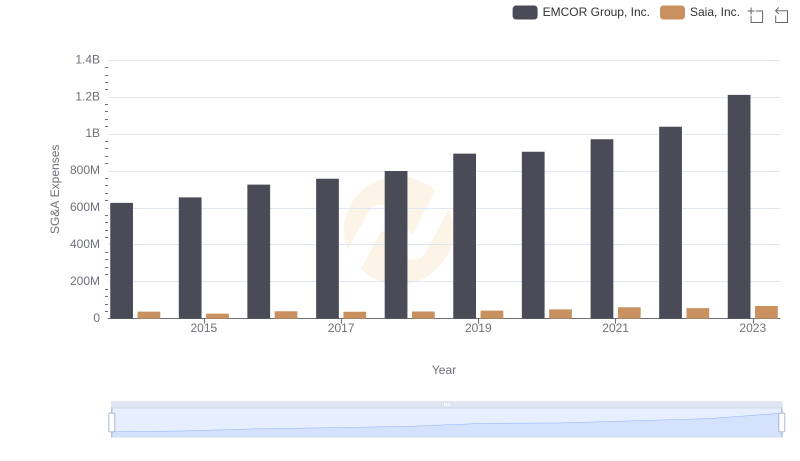

SG&A Efficiency Analysis: Comparing EMCOR Group, Inc. and Saia, Inc.

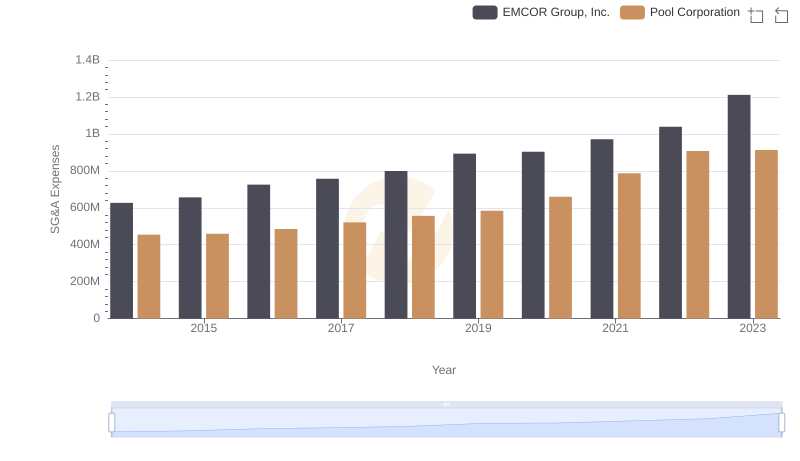

EMCOR Group, Inc. vs Pool Corporation: SG&A Expense Trends

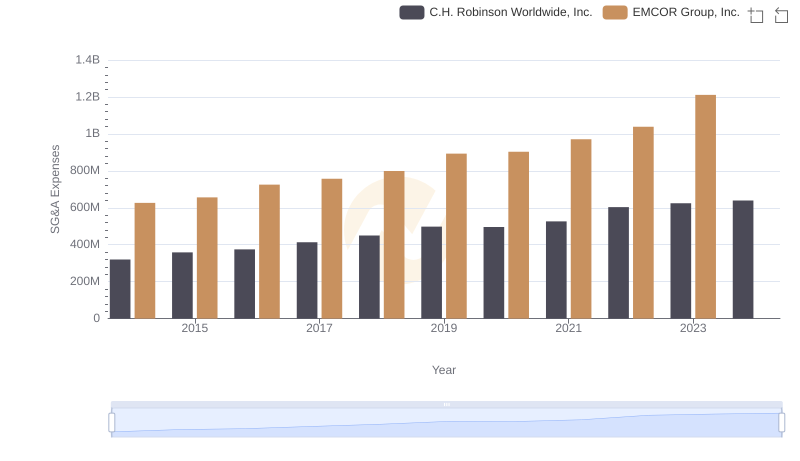

EMCOR Group, Inc. or C.H. Robinson Worldwide, Inc.: Who Manages SG&A Costs Better?

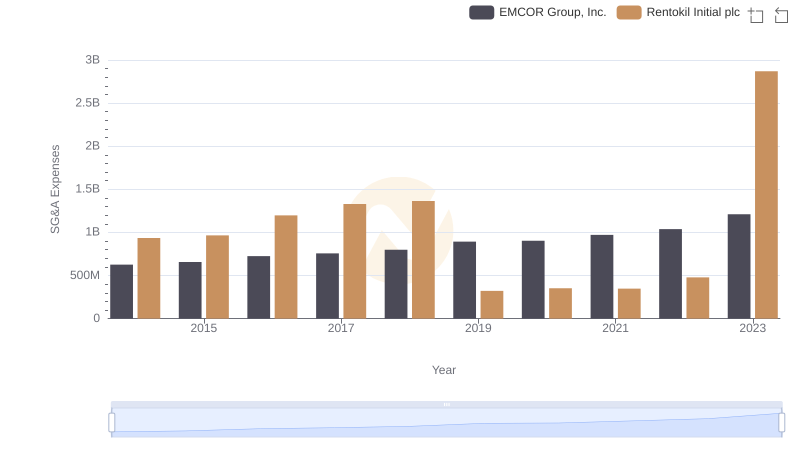

EMCOR Group, Inc. and Rentokil Initial plc: SG&A Spending Patterns Compared

Professional EBITDA Benchmarking: EMCOR Group, Inc. vs Elbit Systems Ltd.