| __timestamp | EMCOR Group, Inc. | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 355858000 | 923383000 |

| Thursday, January 1, 2015 | 362095000 | 1076520000 |

| Friday, January 1, 2016 | 395913000 | 1255474000 |

| Sunday, January 1, 2017 | 478459000 | 1195593000 |

| Monday, January 1, 2018 | 489954000 | 1123974000 |

| Tuesday, January 1, 2019 | 556055000 | 1200955000 |

| Wednesday, January 1, 2020 | 601449000 | 1202436000 |

| Friday, January 1, 2021 | 646861000 | 1627442000 |

| Saturday, January 1, 2022 | 682399000 | 2337788000 |

| Sunday, January 1, 2023 | 1009017000 | 2183839000 |

| Monday, January 1, 2024 | 1919656000 |

Infusing magic into the data realm

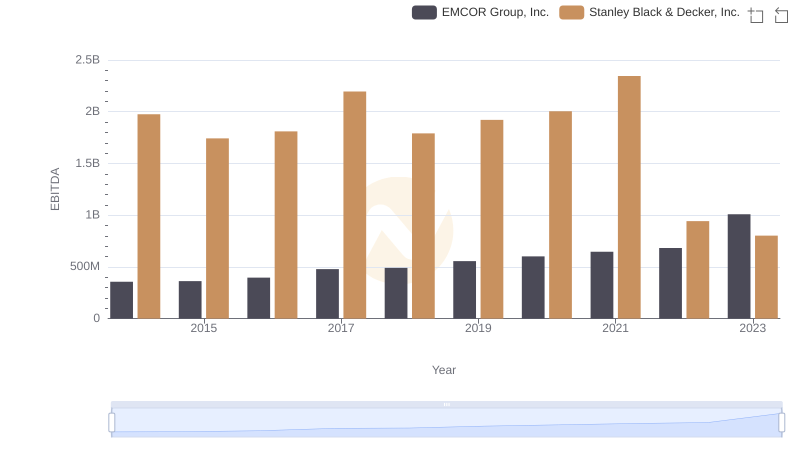

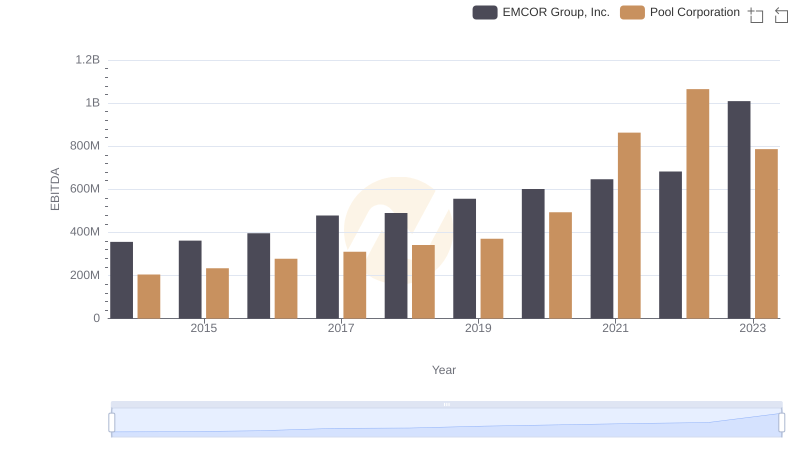

In the competitive landscape of the U.S. stock market, EMCOR Group, Inc. and U-Haul Holding Company stand as titans in their respective industries. Over the past decade, from 2014 to 2023, these companies have showcased remarkable growth in their EBITDA, a key indicator of financial health and operational efficiency.

EMCOR Group, Inc., a leader in mechanical and electrical construction services, has seen its EBITDA grow by approximately 183% from 2014 to 2023. Meanwhile, U-Haul Holding Company, a household name in moving and storage, experienced a 137% increase in the same period. Notably, U-Haul's EBITDA peaked in 2022, reaching a staggering 2.34 billion, while EMCOR's highest was in 2023 at 1.01 billion.

This data highlights the resilience and strategic prowess of these companies, even amidst economic fluctuations. However, the absence of EMCOR's 2024 data suggests potential challenges or strategic shifts on the horizon.

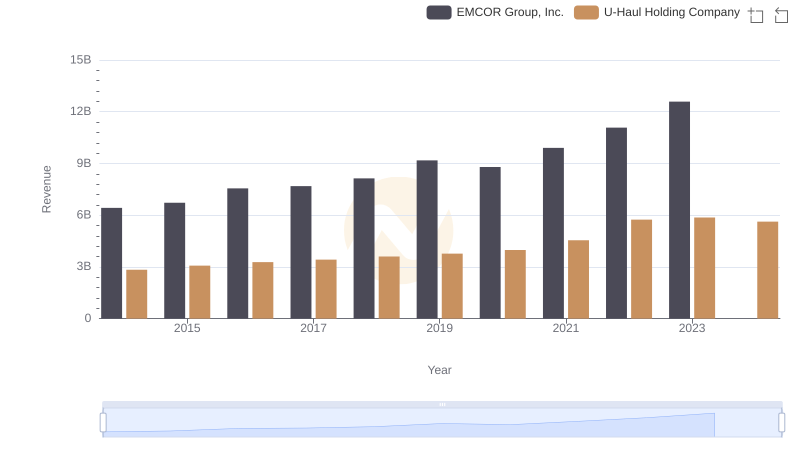

Comparing Revenue Performance: EMCOR Group, Inc. or U-Haul Holding Company?

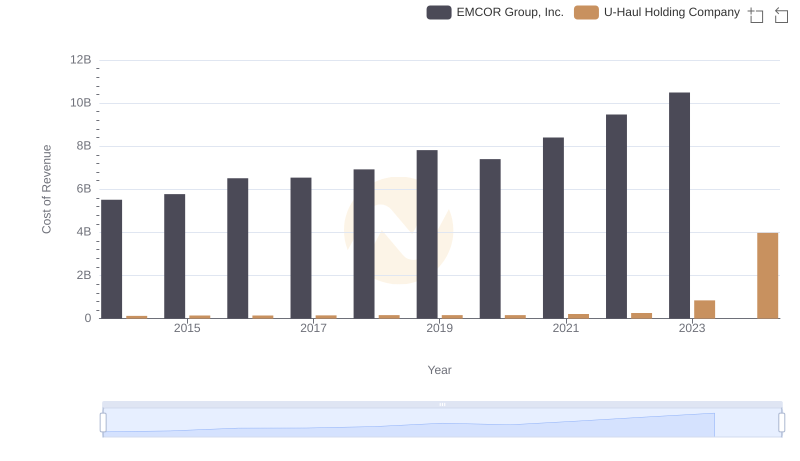

EMCOR Group, Inc. vs U-Haul Holding Company: Efficiency in Cost of Revenue Explored

Gross Profit Analysis: Comparing EMCOR Group, Inc. and U-Haul Holding Company

EMCOR Group, Inc. and Stanley Black & Decker, Inc.: A Detailed Examination of EBITDA Performance

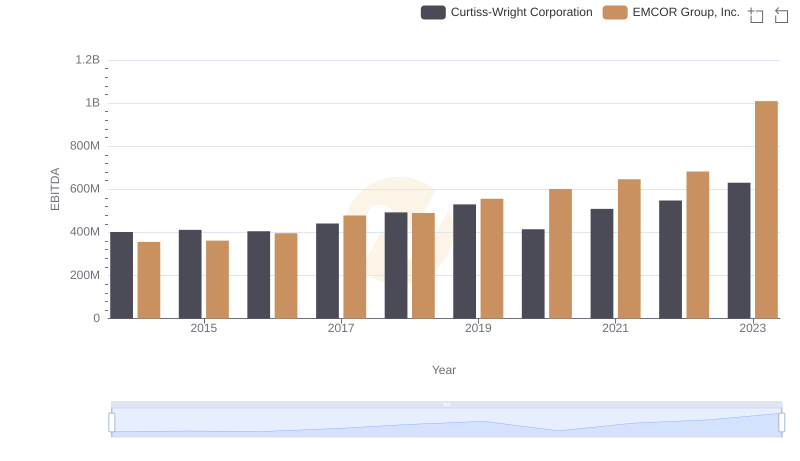

EBITDA Metrics Evaluated: EMCOR Group, Inc. vs Curtiss-Wright Corporation

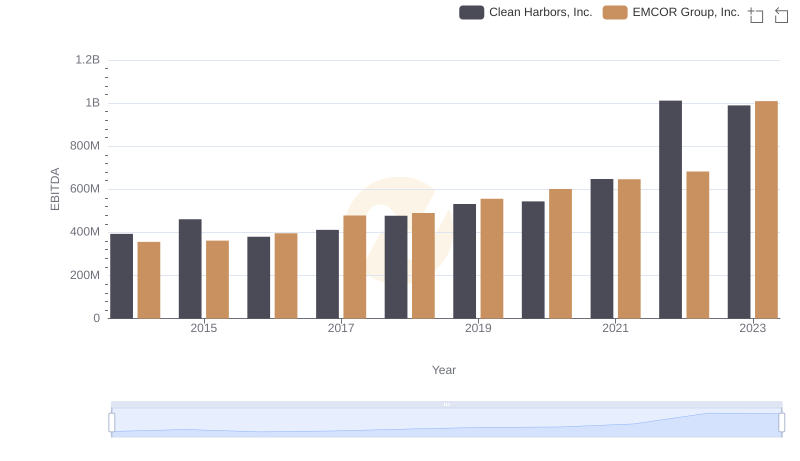

EBITDA Metrics Evaluated: EMCOR Group, Inc. vs Clean Harbors, Inc.

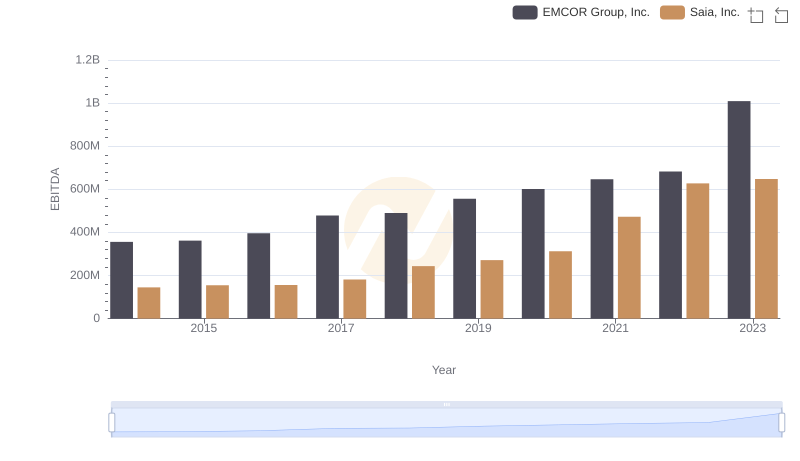

A Side-by-Side Analysis of EBITDA: EMCOR Group, Inc. and Saia, Inc.

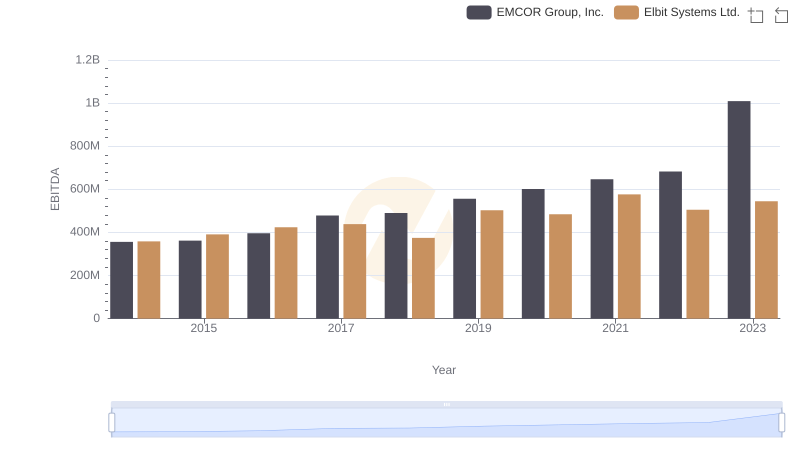

Professional EBITDA Benchmarking: EMCOR Group, Inc. vs Elbit Systems Ltd.

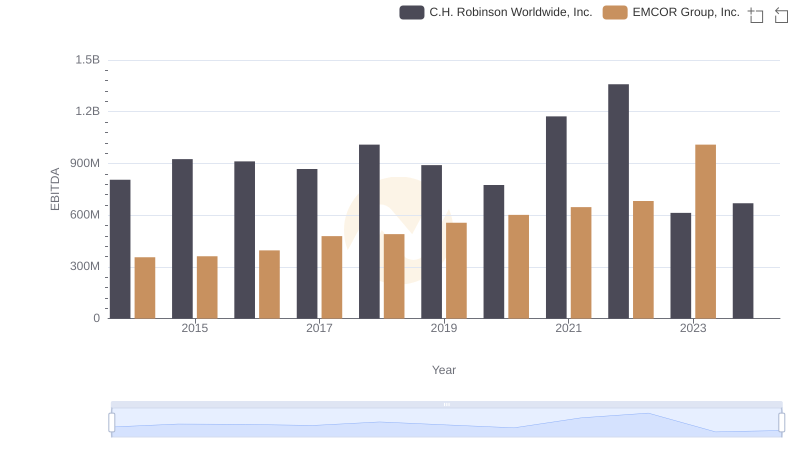

Comparative EBITDA Analysis: EMCOR Group, Inc. vs C.H. Robinson Worldwide, Inc.

Professional EBITDA Benchmarking: EMCOR Group, Inc. vs Pool Corporation