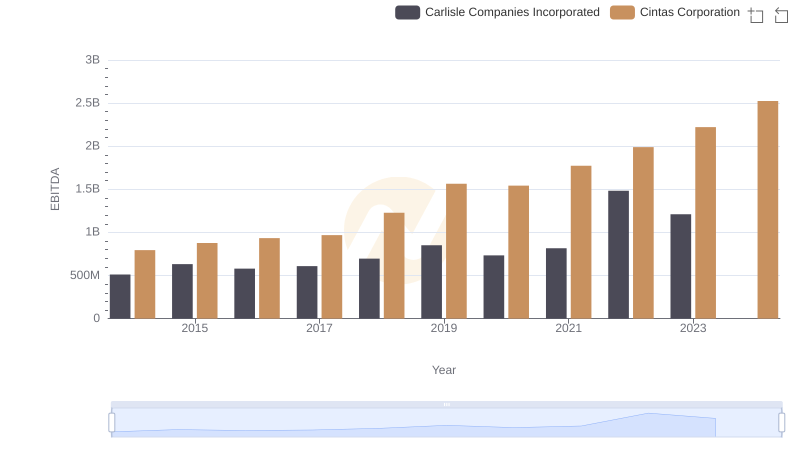

| __timestamp | Cintas Corporation | Expeditors International of Washington, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 793811000 | 643940000 |

| Thursday, January 1, 2015 | 877761000 | 767496000 |

| Friday, January 1, 2016 | 933728000 | 716959000 |

| Sunday, January 1, 2017 | 968293000 | 749570000 |

| Monday, January 1, 2018 | 1227852000 | 850582000 |

| Tuesday, January 1, 2019 | 1564228000 | 817642000 |

| Wednesday, January 1, 2020 | 1542737000 | 1013523000 |

| Friday, January 1, 2021 | 1773591000 | 1975928000 |

| Saturday, January 1, 2022 | 1990046000 | 1916506000 |

| Sunday, January 1, 2023 | 2221676000 | 1087588000 |

| Monday, January 1, 2024 | 2523857000 | 1154330000 |

Unlocking the unknown

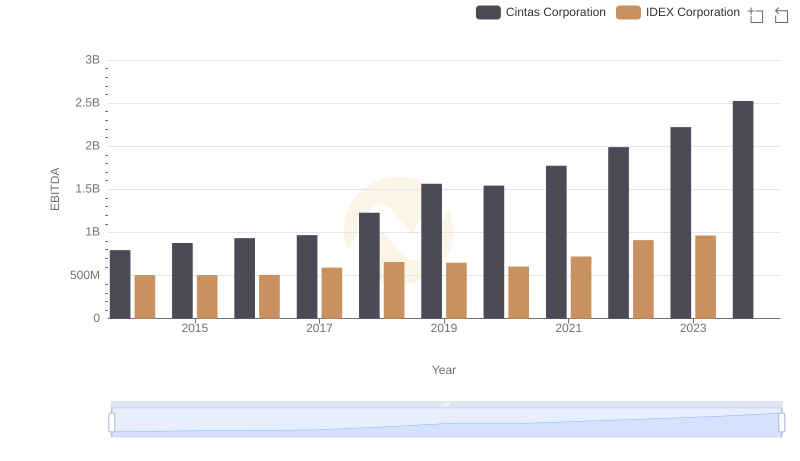

In the competitive landscape of corporate finance, EBITDA serves as a crucial indicator of a company's operational efficiency. Over the past decade, Cintas Corporation and Expeditors International of Washington, Inc. have showcased intriguing trends in their EBITDA performance. From 2014 to 2023, Cintas Corporation has demonstrated a robust growth trajectory, with its EBITDA increasing by approximately 218%, from $794 million to $2.22 billion. This growth reflects Cintas's strategic expansions and operational efficiencies.

Conversely, Expeditors International experienced a more volatile EBITDA trend, peaking in 2021 with a 197% increase from its 2014 figures, before declining in 2023. This fluctuation highlights the challenges faced by logistics companies in adapting to global market dynamics. Notably, data for 2024 is missing for Expeditors, indicating potential reporting delays or strategic shifts. These insights underscore the importance of EBITDA as a measure of financial health and strategic direction.

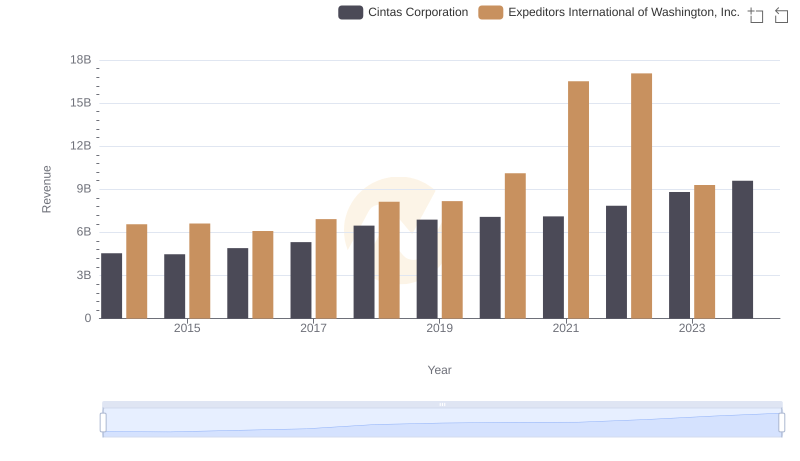

Cintas Corporation or Expeditors International of Washington, Inc.: Who Leads in Yearly Revenue?

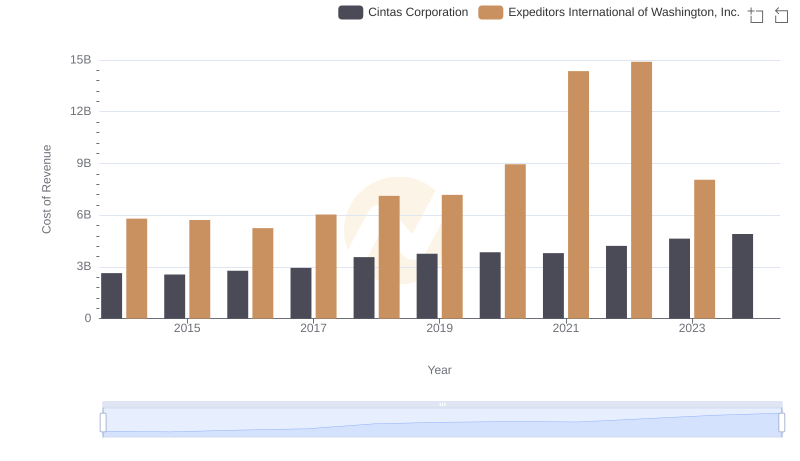

Cost Insights: Breaking Down Cintas Corporation and Expeditors International of Washington, Inc.'s Expenses

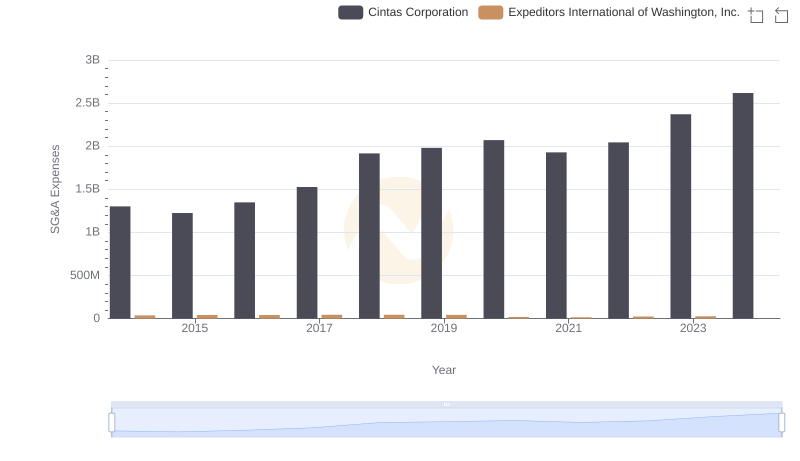

Operational Costs Compared: SG&A Analysis of Cintas Corporation and Expeditors International of Washington, Inc.

EBITDA Metrics Evaluated: Cintas Corporation vs Carlisle Companies Incorporated

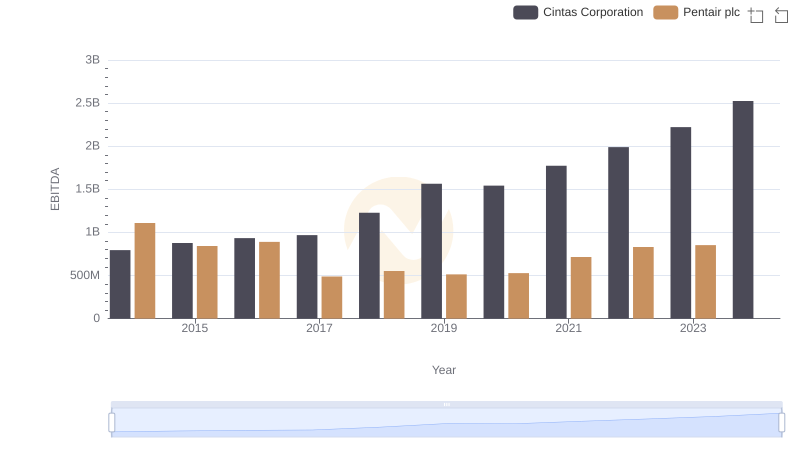

Professional EBITDA Benchmarking: Cintas Corporation vs Pentair plc

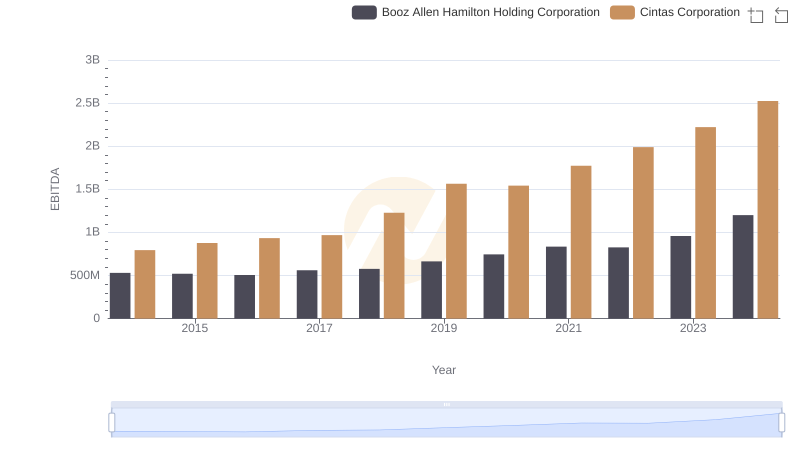

Cintas Corporation and Booz Allen Hamilton Holding Corporation: A Detailed Examination of EBITDA Performance

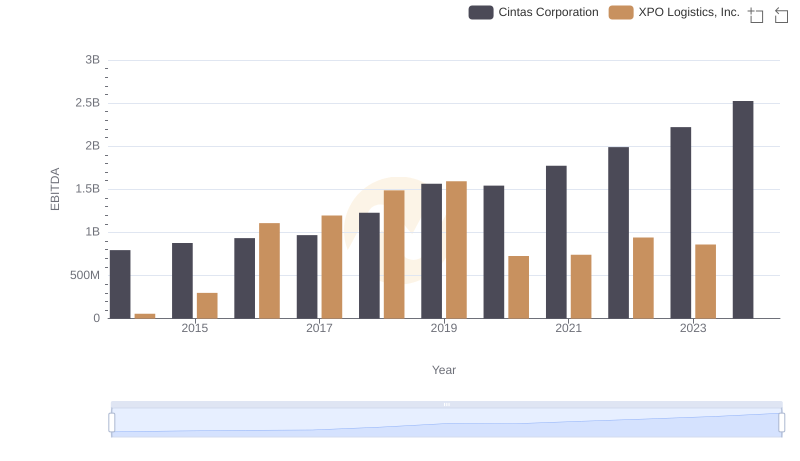

Cintas Corporation and XPO Logistics, Inc.: A Detailed Examination of EBITDA Performance

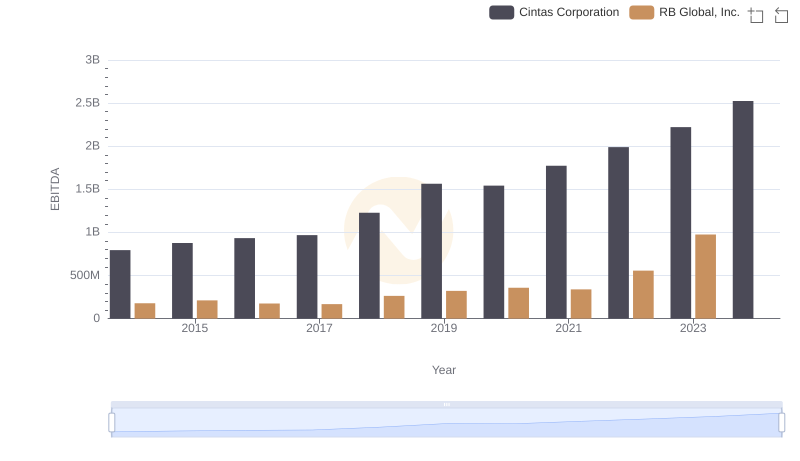

Cintas Corporation and RB Global, Inc.: A Detailed Examination of EBITDA Performance

A Side-by-Side Analysis of EBITDA: Cintas Corporation and IDEX Corporation