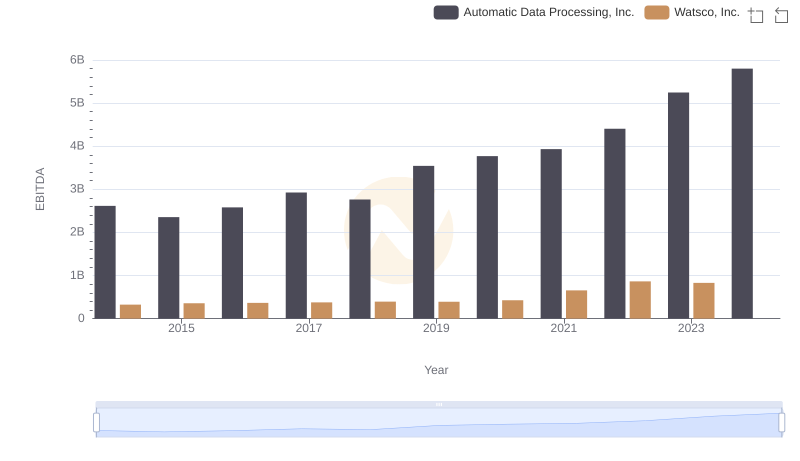

| __timestamp | Automatic Data Processing, Inc. | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 767600000 |

| Thursday, January 1, 2015 | 2355100000 | 848900000 |

| Friday, January 1, 2016 | 2579500000 | 942400000 |

| Sunday, January 1, 2017 | 2927200000 | 971900000 |

| Monday, January 1, 2018 | 2762900000 | 1057400000 |

| Tuesday, January 1, 2019 | 3544500000 | 1067000000 |

| Wednesday, January 1, 2020 | 3769700000 | 991400000 |

| Friday, January 1, 2021 | 3931600000 | 1249100000 |

| Saturday, January 1, 2022 | 4405500000 | 1351500000 |

| Sunday, January 1, 2023 | 5244600000 | 1478800000 |

| Monday, January 1, 2024 | 5800000000 | 1520700000 |

Unleashing insights

In the competitive landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. This analysis juxtaposes Automatic Data Processing, Inc. (ADP) and Snap-on Incorporated over a decade, from 2014 to 2023.

ADP has demonstrated a robust growth trajectory, with its EBITDA increasing by approximately 122% from 2014 to 2023. In contrast, Snap-on Incorporated has seen a more modest rise of about 93% over the same period. Notably, ADP's EBITDA surged past the $5 billion mark in 2023, while Snap-on reached nearly $1.5 billion.

The data reveals a consistent upward trend for both companies, albeit with ADP outpacing Snap-on significantly. The missing data for 2024 suggests a need for further analysis to understand future projections. This comparison underscores the dynamic nature of the industry and the importance of strategic financial management.

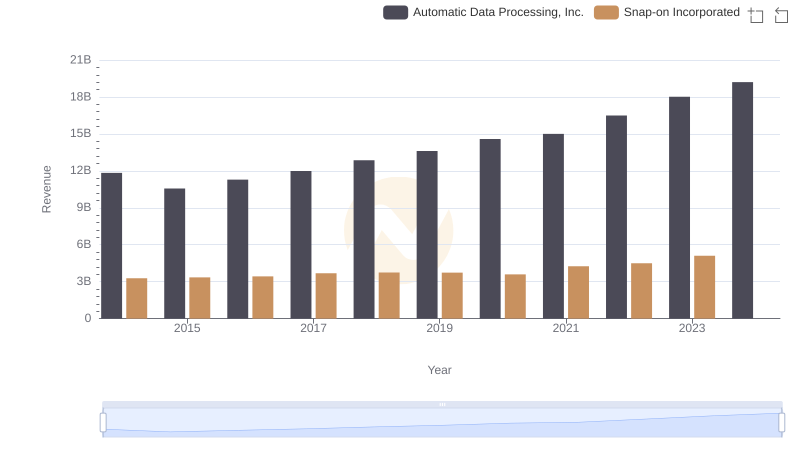

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs Snap-on Incorporated

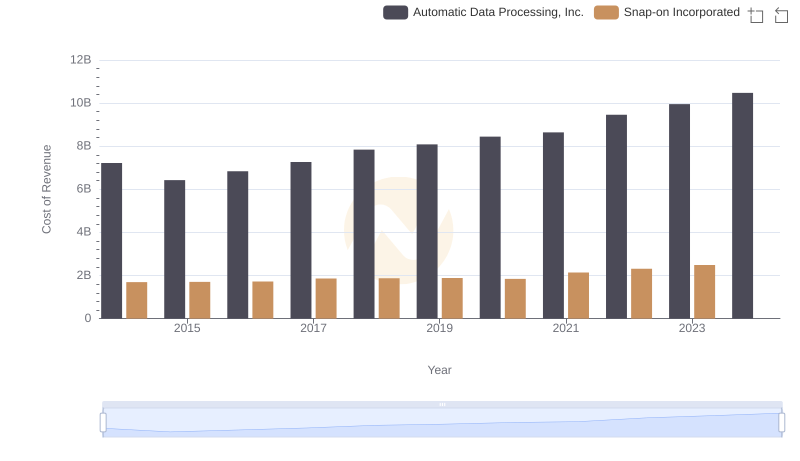

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Snap-on Incorporated

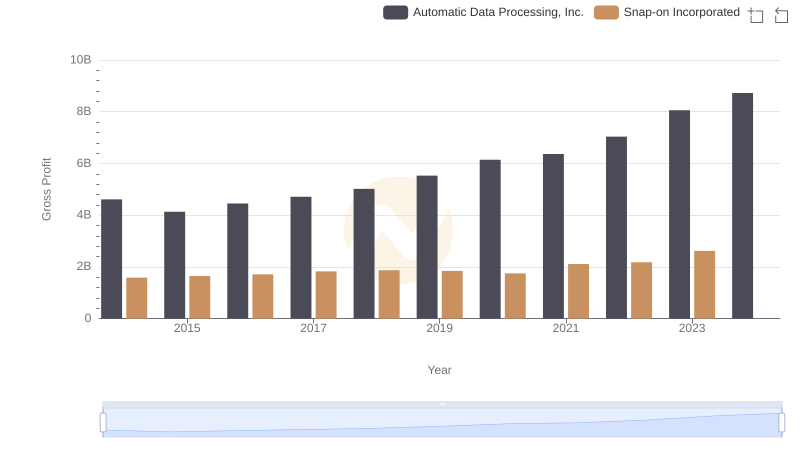

Automatic Data Processing, Inc. and Snap-on Incorporated: A Detailed Gross Profit Analysis

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Snap-on Incorporated

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Watsco, Inc.

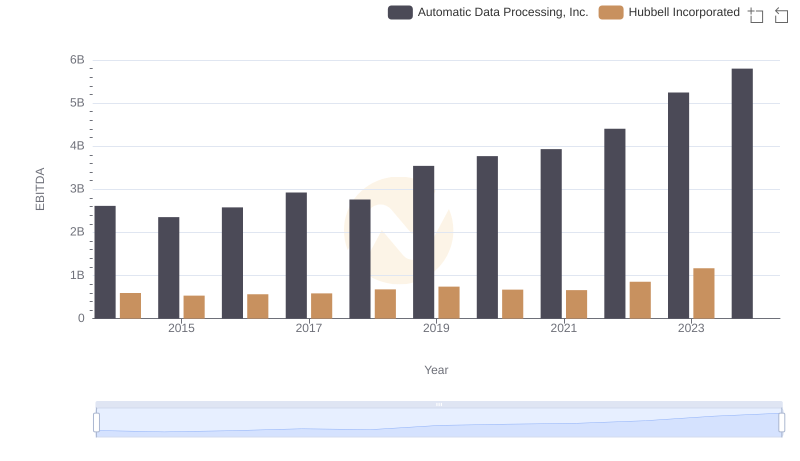

EBITDA Performance Review: Automatic Data Processing, Inc. vs Hubbell Incorporated

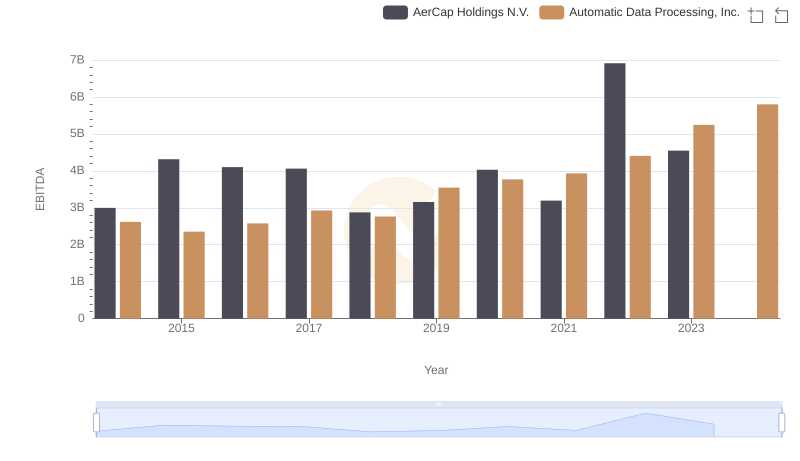

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

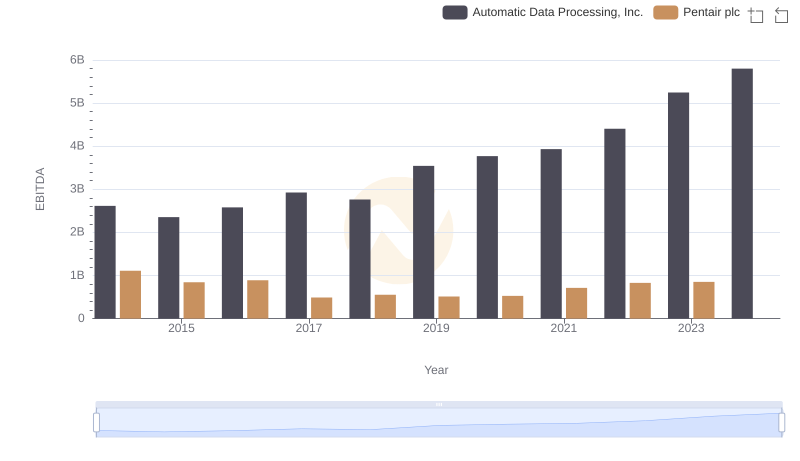

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Pentair plc

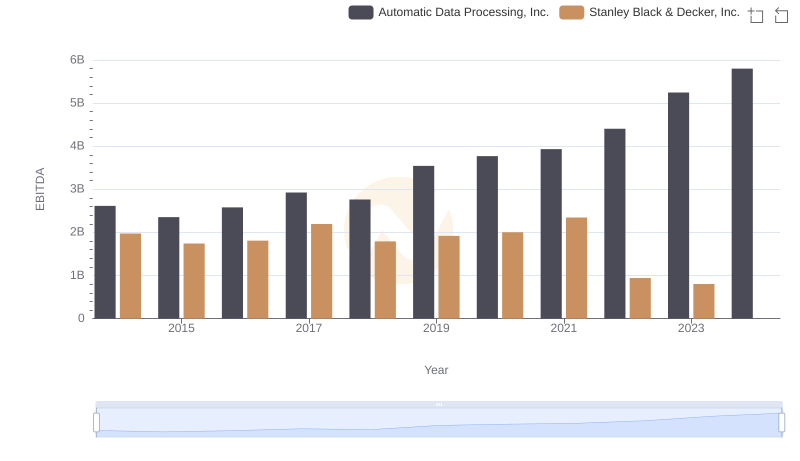

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

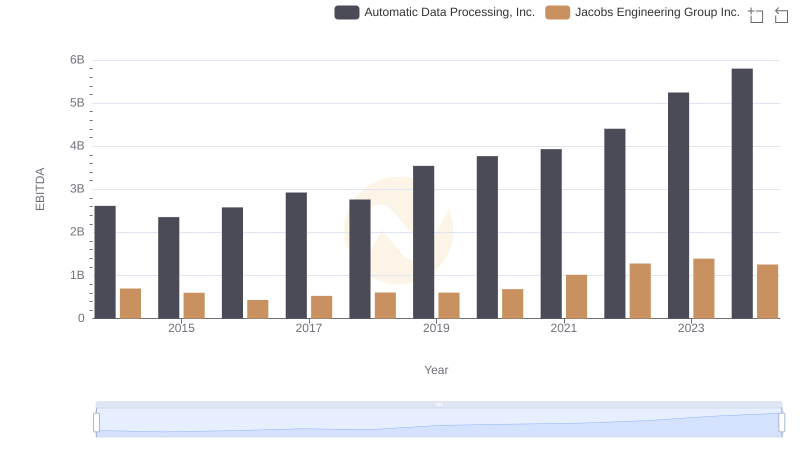

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.

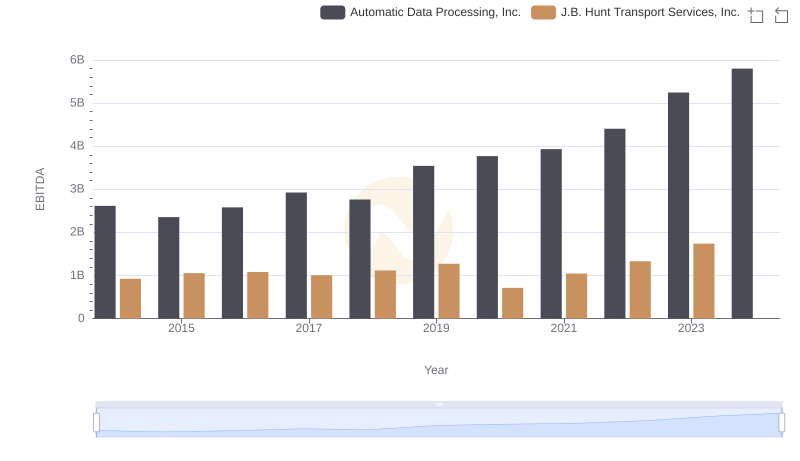

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to J.B. Hunt Transport Services, Inc.

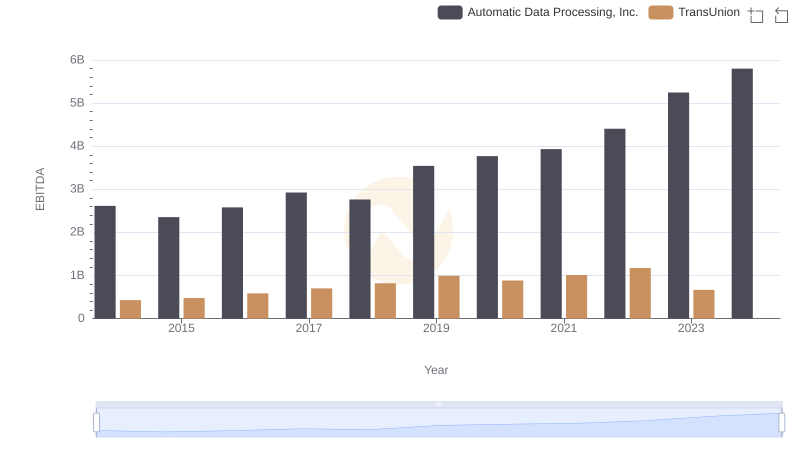

Automatic Data Processing, Inc. vs TransUnion: In-Depth EBITDA Performance Comparison