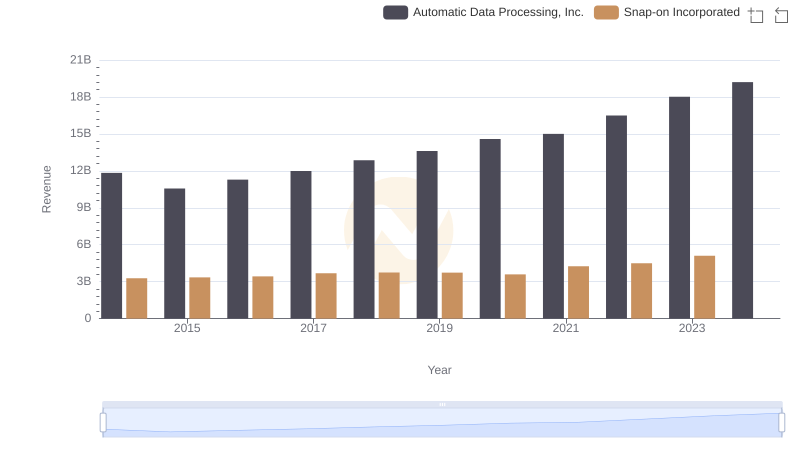

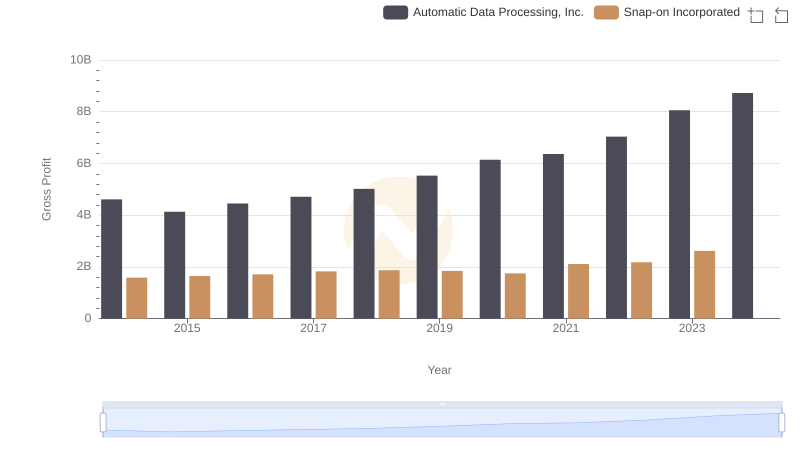

| __timestamp | Automatic Data Processing, Inc. | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 1693400000 |

| Thursday, January 1, 2015 | 6427600000 | 1704500000 |

| Friday, January 1, 2016 | 6840300000 | 1720800000 |

| Sunday, January 1, 2017 | 7269800000 | 1862000000 |

| Monday, January 1, 2018 | 7842600000 | 1870700000 |

| Tuesday, January 1, 2019 | 8086600000 | 1886000000 |

| Wednesday, January 1, 2020 | 8445100000 | 1844000000 |

| Friday, January 1, 2021 | 8640300000 | 2141200000 |

| Saturday, January 1, 2022 | 9461900000 | 2311700000 |

| Sunday, January 1, 2023 | 9953400000 | 2488500000 |

| Monday, January 1, 2024 | 10476700000 | 2329500000 |

Data in motion

In the ever-evolving landscape of corporate finance, understanding the cost of revenue is crucial for evaluating a company's operational efficiency. This analysis focuses on Automatic Data Processing, Inc. (ADP) and Snap-on Incorporated, two giants in their respective industries. Over the past decade, ADP has seen a steady increase in its cost of revenue, rising approximately 45% from 2014 to 2023. This growth reflects ADP's expanding operations and market reach. In contrast, Snap-on Incorporated has experienced a more modest increase of around 47% over the same period, indicating a stable yet consistent growth trajectory. Notably, the data for 2024 is incomplete, highlighting the dynamic nature of financial reporting. These insights provide a window into the strategic decisions and market conditions influencing these companies, offering valuable lessons for investors and industry analysts alike.

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and Watsco, Inc.

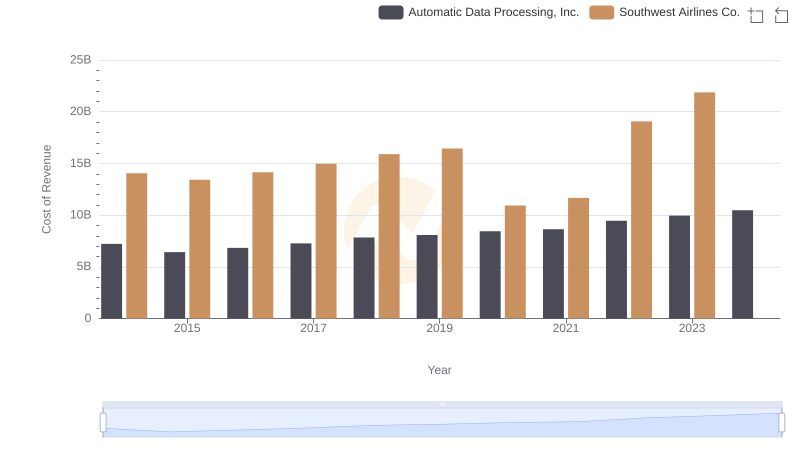

Automatic Data Processing, Inc. vs Southwest Airlines Co.: Efficiency in Cost of Revenue Explored

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs Snap-on Incorporated

Cost Insights: Breaking Down Automatic Data Processing, Inc. and TransUnion's Expenses

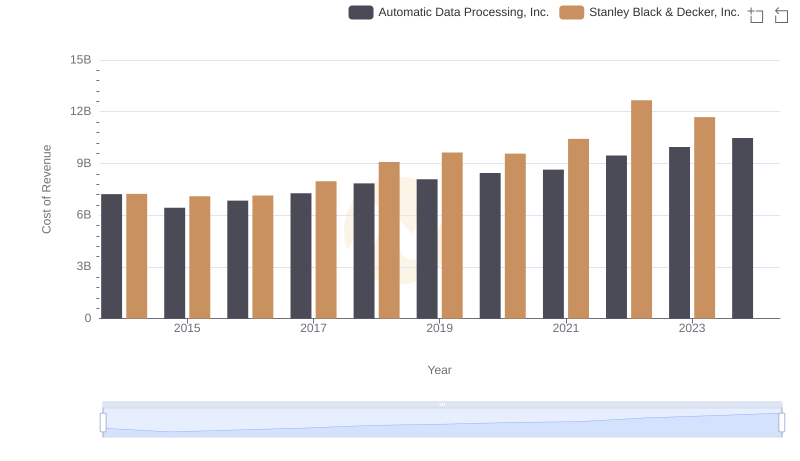

Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

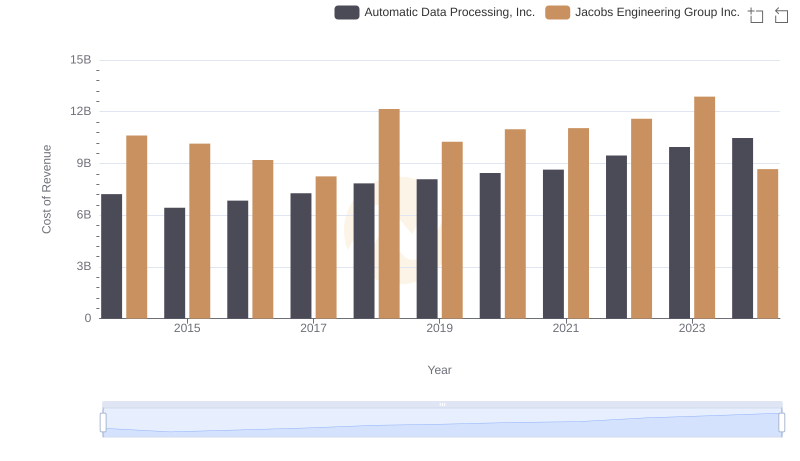

Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.: Efficiency in Cost of Revenue Explored

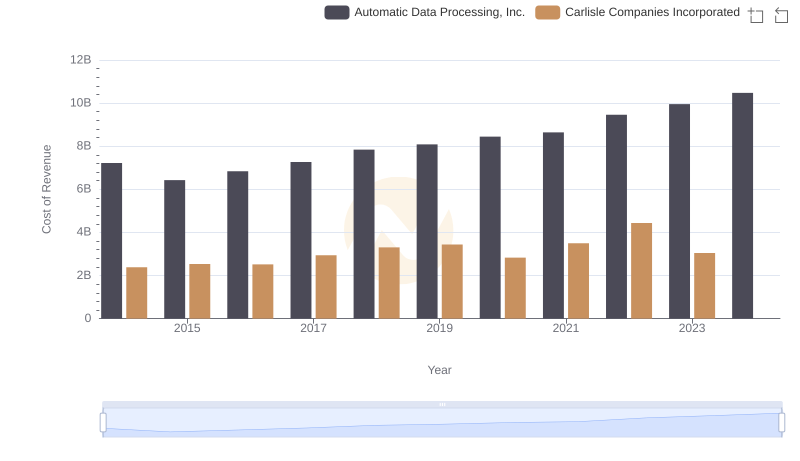

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Carlisle Companies Incorporated

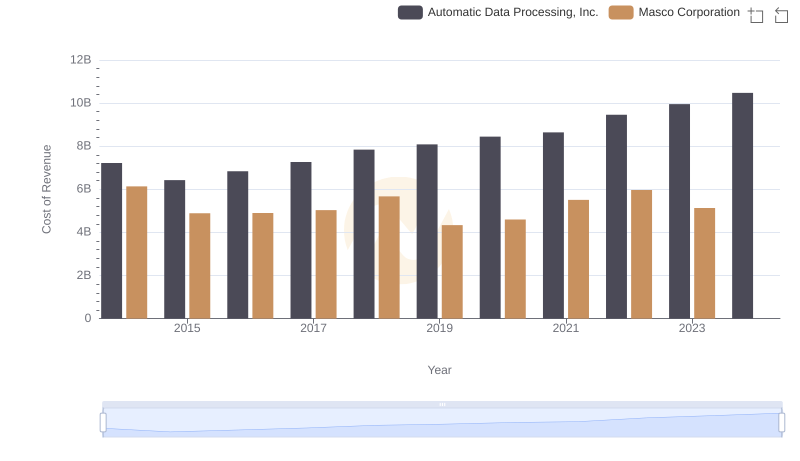

Cost of Revenue Trends: Automatic Data Processing, Inc. vs Masco Corporation

Automatic Data Processing, Inc. and Snap-on Incorporated: A Detailed Gross Profit Analysis

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Snap-on Incorporated

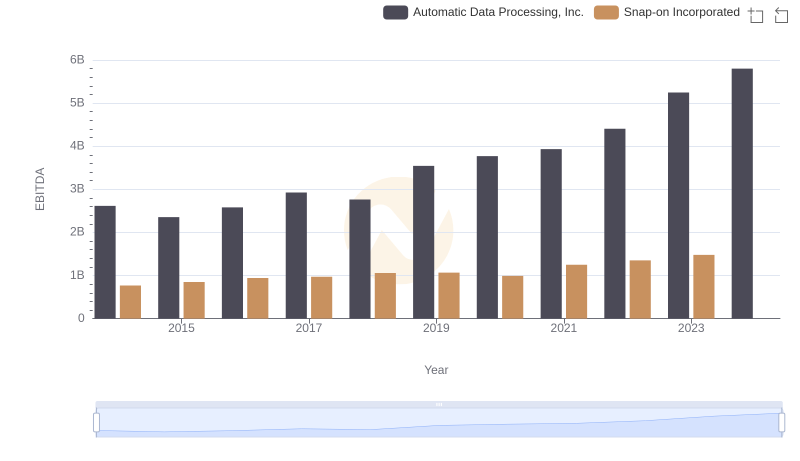

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Snap-on Incorporated