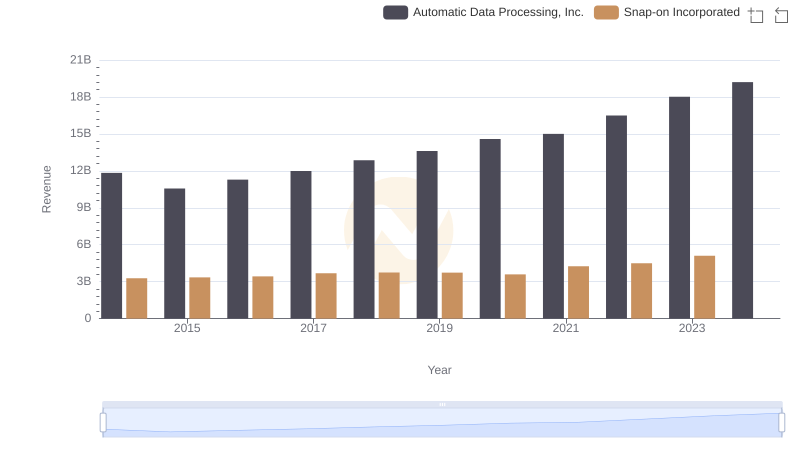

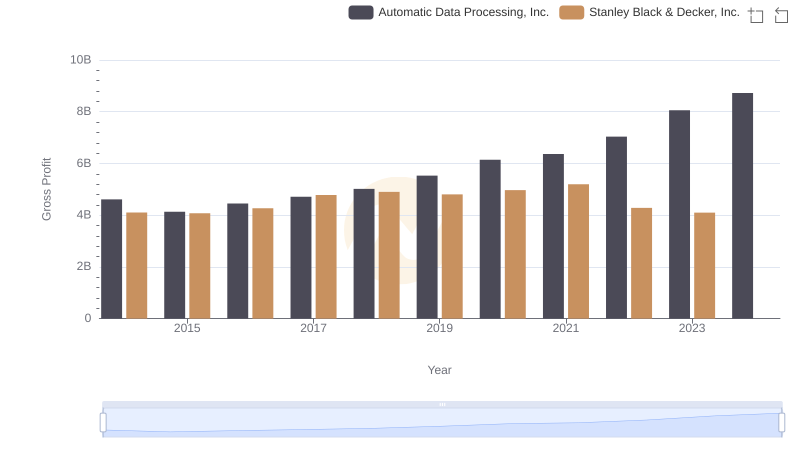

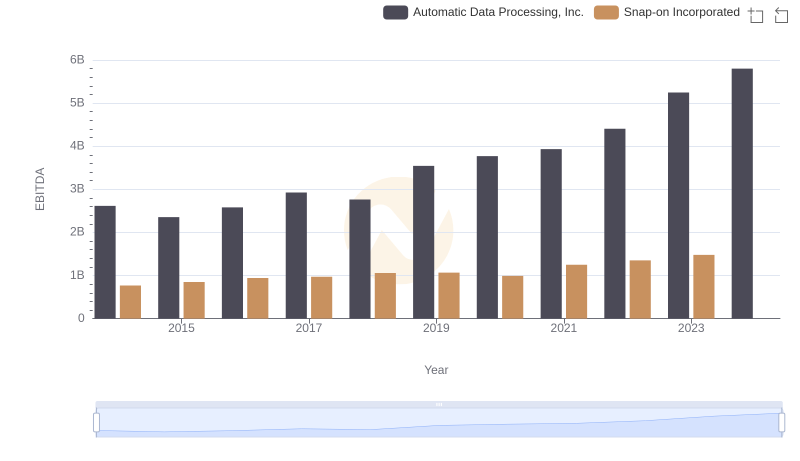

| __timestamp | Automatic Data Processing, Inc. | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 1584300000 |

| Thursday, January 1, 2015 | 4133200000 | 1648300000 |

| Friday, January 1, 2016 | 4450200000 | 1709600000 |

| Sunday, January 1, 2017 | 4712600000 | 1824900000 |

| Monday, January 1, 2018 | 5016700000 | 1870000000 |

| Tuesday, January 1, 2019 | 5526700000 | 1844000000 |

| Wednesday, January 1, 2020 | 6144700000 | 1748500000 |

| Friday, January 1, 2021 | 6365100000 | 2110800000 |

| Saturday, January 1, 2022 | 7036400000 | 2181100000 |

| Sunday, January 1, 2023 | 8058800000 | 2619800000 |

| Monday, January 1, 2024 | 8725900000 | 2377900000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding the trajectory of gross profits is crucial for investors and analysts alike. Over the past decade, Automatic Data Processing, Inc. (ADP) and Snap-on Incorporated have demonstrated distinct financial journeys. From 2014 to 2023, ADP's gross profit surged by approximately 89%, reflecting a robust growth trajectory. In contrast, Snap-on's gross profit increased by about 65% during the same period, showcasing steady yet moderate growth.

ADP's financial ascent is particularly notable in the post-2020 era, with a remarkable 42% increase from 2020 to 2023. Meanwhile, Snap-on experienced a significant uptick in 2023, with a 24% rise compared to the previous year. However, data for 2024 remains incomplete, leaving room for speculation on future trends. This analysis underscores the dynamic nature of financial performance and the importance of strategic planning in maintaining competitive advantage.

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs Snap-on Incorporated

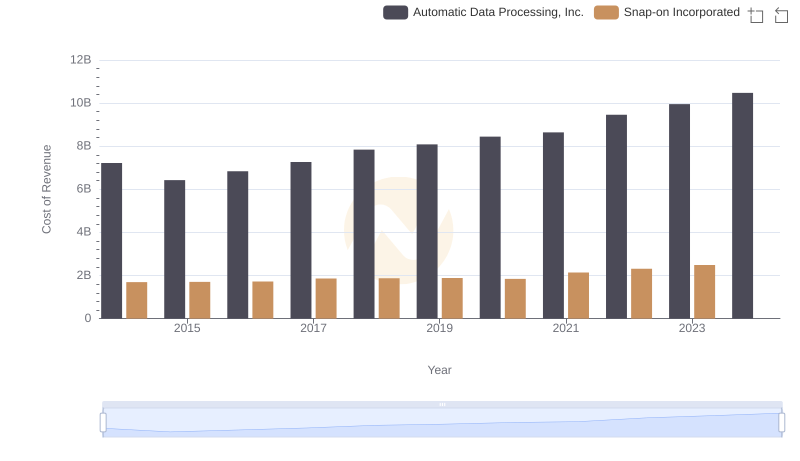

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Snap-on Incorporated

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

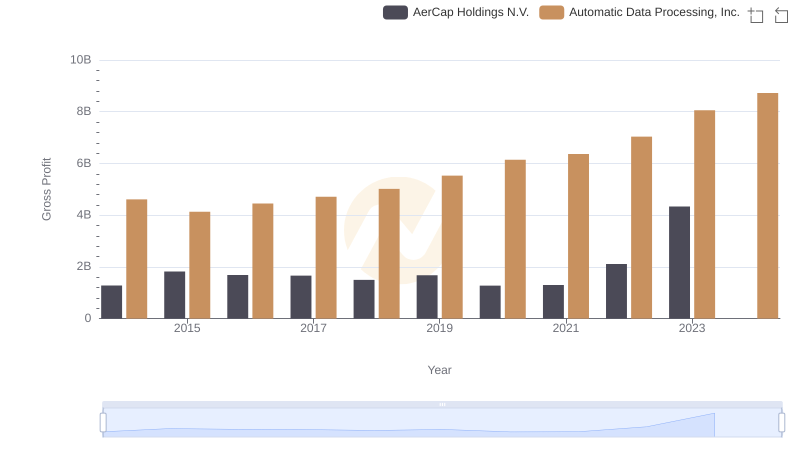

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

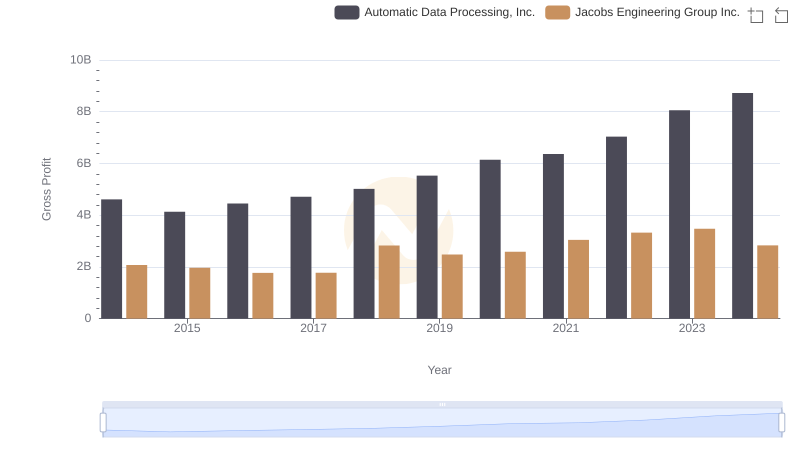

Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.: A Gross Profit Performance Breakdown

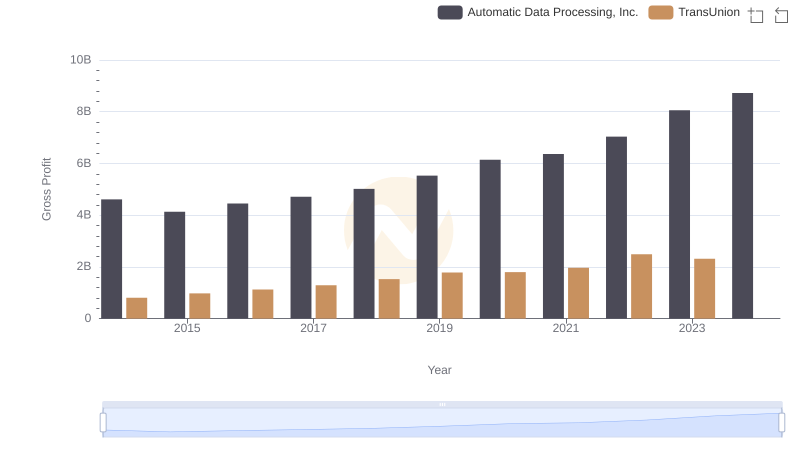

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs TransUnion

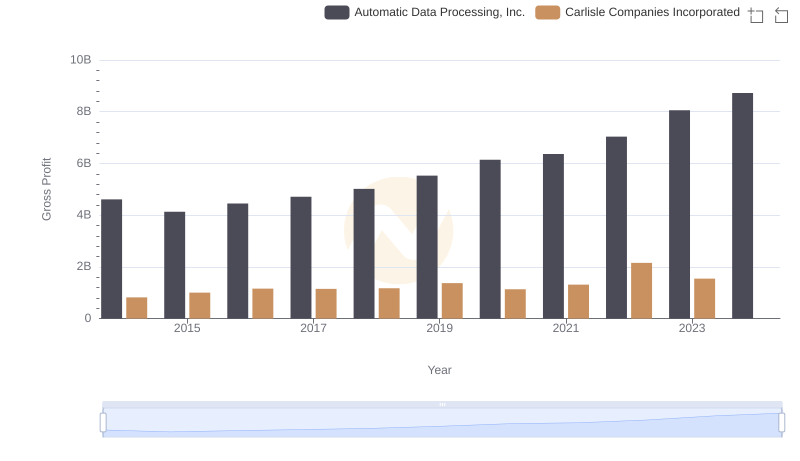

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or Carlisle Companies Incorporated

Automatic Data Processing, Inc. and J.B. Hunt Transport Services, Inc.: A Detailed Gross Profit Analysis

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Snap-on Incorporated

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Snap-on Incorporated