| __timestamp | Automatic Data Processing, Inc. | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 1109300000 |

| Thursday, January 1, 2015 | 2355100000 | 842400000 |

| Friday, January 1, 2016 | 2579500000 | 890400000 |

| Sunday, January 1, 2017 | 2927200000 | 488600000 |

| Monday, January 1, 2018 | 2762900000 | 552800000 |

| Tuesday, January 1, 2019 | 3544500000 | 513200000 |

| Wednesday, January 1, 2020 | 3769700000 | 527600000 |

| Friday, January 1, 2021 | 3931600000 | 714400000 |

| Saturday, January 1, 2022 | 4405500000 | 830400000 |

| Sunday, January 1, 2023 | 5244600000 | 852000000 |

| Monday, January 1, 2024 | 5800000000 | 803800000 |

Unleashing the power of data

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial indicator of a company's operational efficiency. Over the past decade, Automatic Data Processing, Inc. (ADP) has demonstrated a robust growth trajectory, with its EBITDA increasing by approximately 122% from 2014 to 2023. In contrast, Pentair plc has experienced a more modest growth of around 30% over the same period.

ADP's consistent upward trend, peaking at an impressive $5.8 billion in 2024, underscores its strategic prowess in the business services sector. Meanwhile, Pentair's EBITDA, which reached its highest at $1.1 billion in 2014, reflects the challenges faced in the industrial manufacturing domain. Notably, the data for 2024 is incomplete for Pentair, highlighting potential gaps in financial reporting.

This comparison not only showcases the financial health of these giants but also offers insights into their strategic directions and market adaptability.

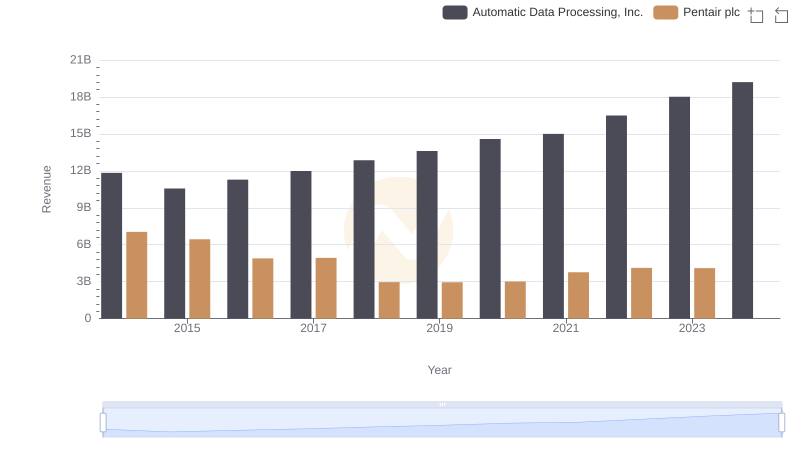

Automatic Data Processing, Inc. vs Pentair plc: Examining Key Revenue Metrics

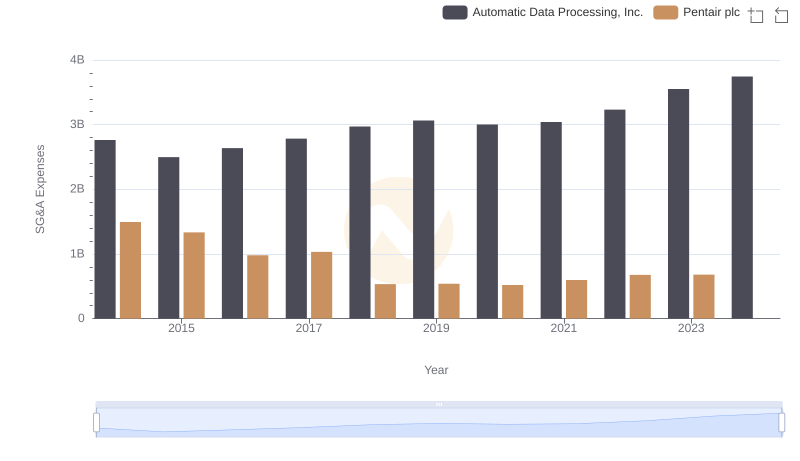

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Pentair plc

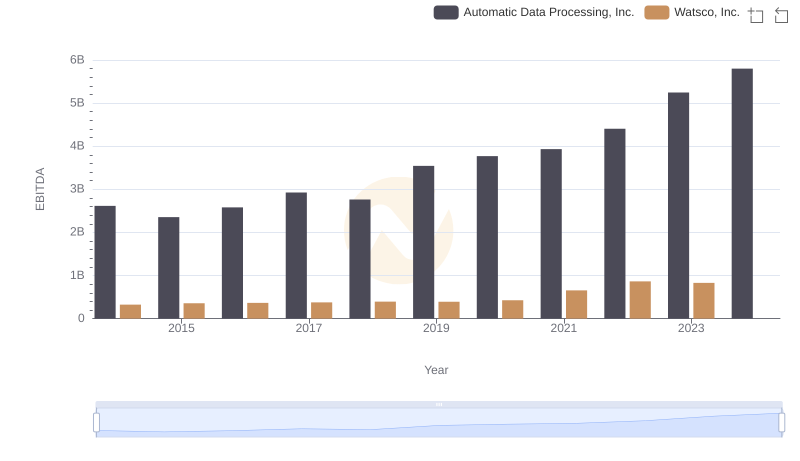

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Watsco, Inc.

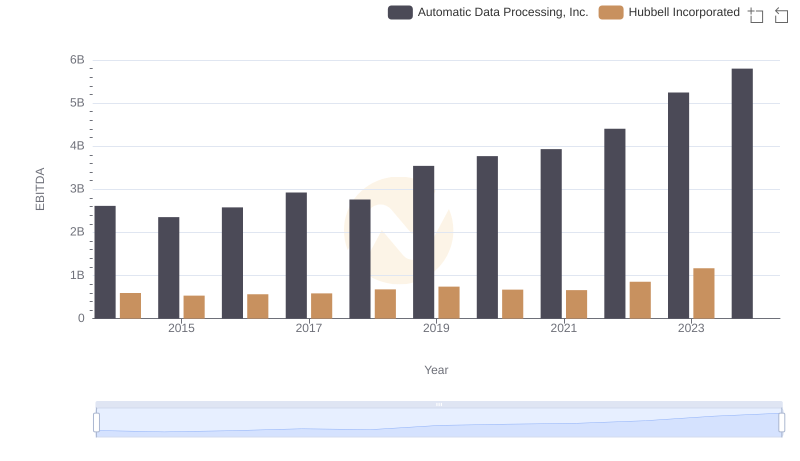

EBITDA Performance Review: Automatic Data Processing, Inc. vs Hubbell Incorporated

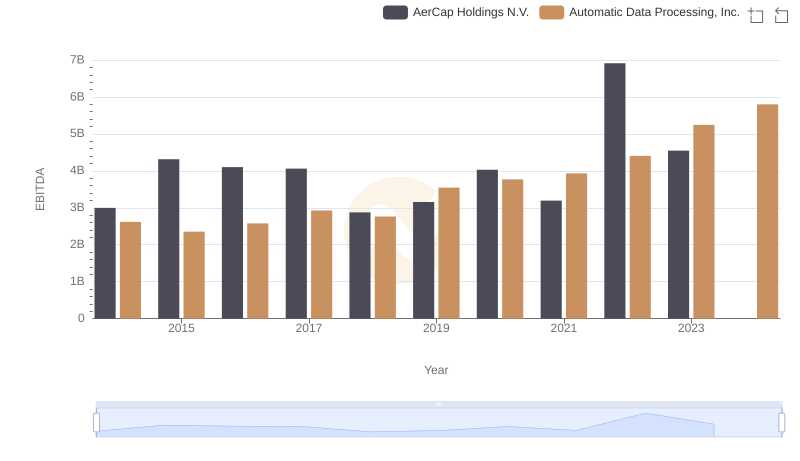

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

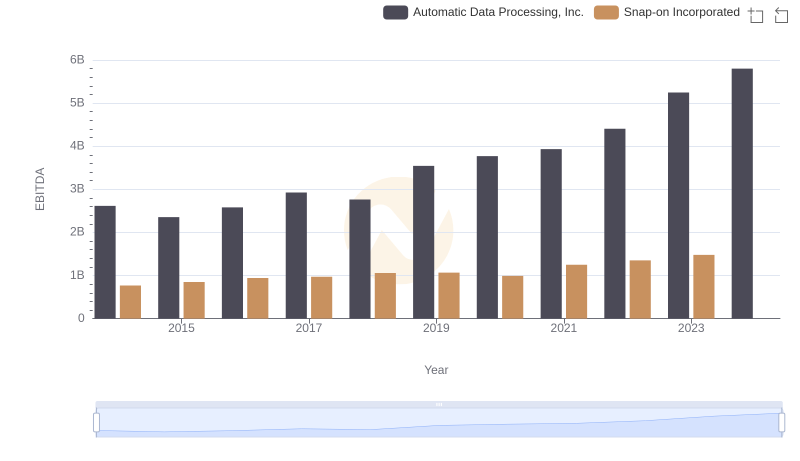

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Snap-on Incorporated

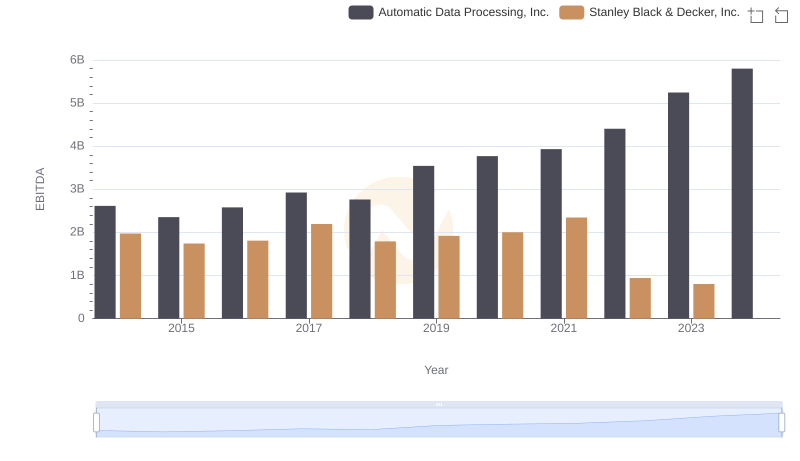

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

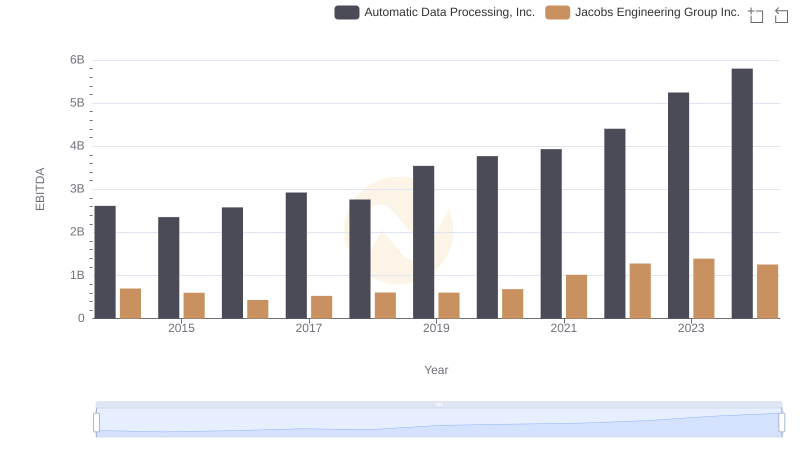

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.

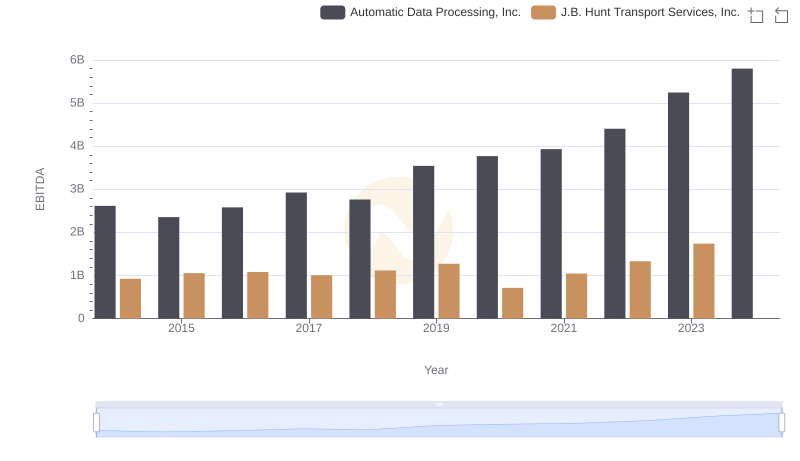

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to J.B. Hunt Transport Services, Inc.

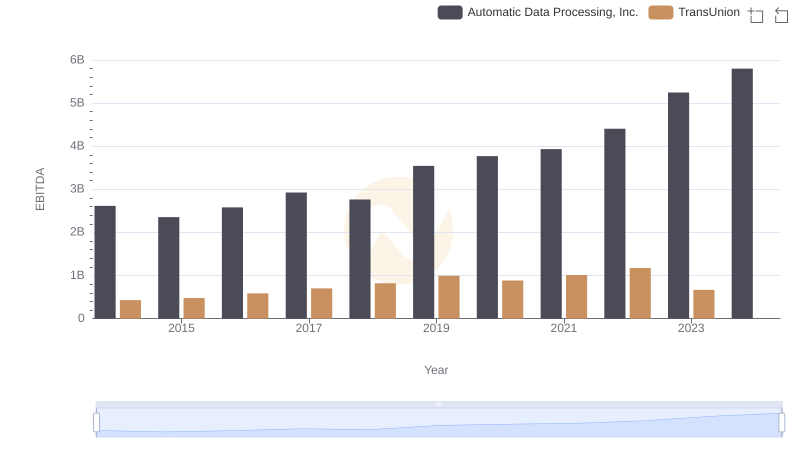

Automatic Data Processing, Inc. vs TransUnion: In-Depth EBITDA Performance Comparison