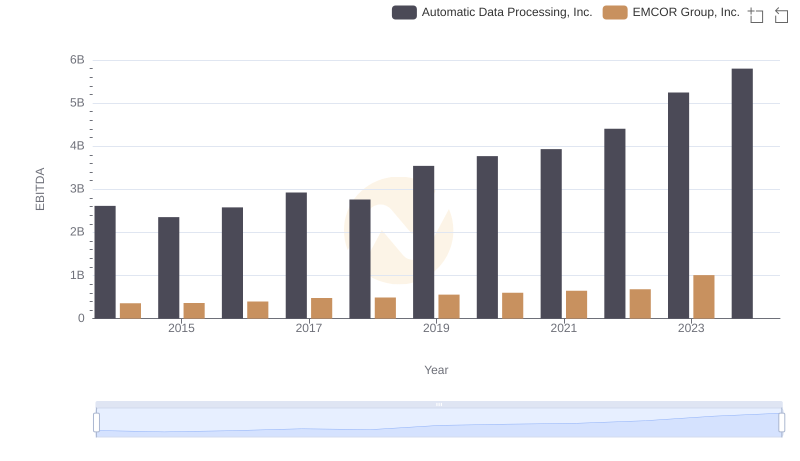

| __timestamp | Automatic Data Processing, Inc. | Hubbell Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 594700000 |

| Thursday, January 1, 2015 | 2355100000 | 533600000 |

| Friday, January 1, 2016 | 2579500000 | 564700000 |

| Sunday, January 1, 2017 | 2927200000 | 585600000 |

| Monday, January 1, 2018 | 2762900000 | 677500000 |

| Tuesday, January 1, 2019 | 3544500000 | 740900000 |

| Wednesday, January 1, 2020 | 3769700000 | 671400000 |

| Friday, January 1, 2021 | 3931600000 | 661000000 |

| Saturday, January 1, 2022 | 4405500000 | 854300000 |

| Sunday, January 1, 2023 | 5244600000 | 1169700000 |

| Monday, January 1, 2024 | 5800000000 | 1291200000 |

Cracking the code

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial indicator of a company's operational efficiency. Over the past decade, Automatic Data Processing, Inc. (ADP) and Hubbell Incorporated have showcased distinct trajectories in their EBITDA performance.

From 2014 to 2023, ADP's EBITDA surged by approximately 122%, reflecting its robust growth strategy and market adaptability. In contrast, Hubbell's EBITDA increased by around 97% during the same period, highlighting its steady yet slower growth pace. Notably, ADP's EBITDA reached its peak in 2024, while Hubbell's data for that year remains unavailable, leaving room for speculation on its future performance.

This comparative analysis underscores the dynamic nature of these industry leaders, offering valuable insights for investors and stakeholders seeking to understand the financial health and strategic direction of these companies.

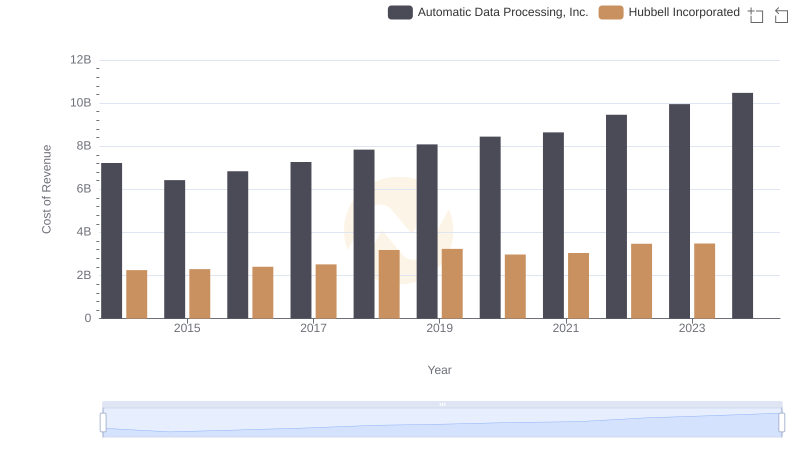

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Hubbell Incorporated

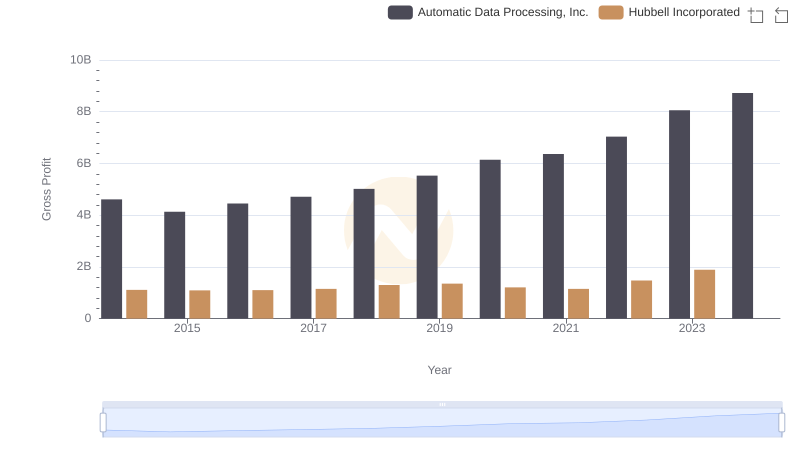

Gross Profit Comparison: Automatic Data Processing, Inc. and Hubbell Incorporated Trends

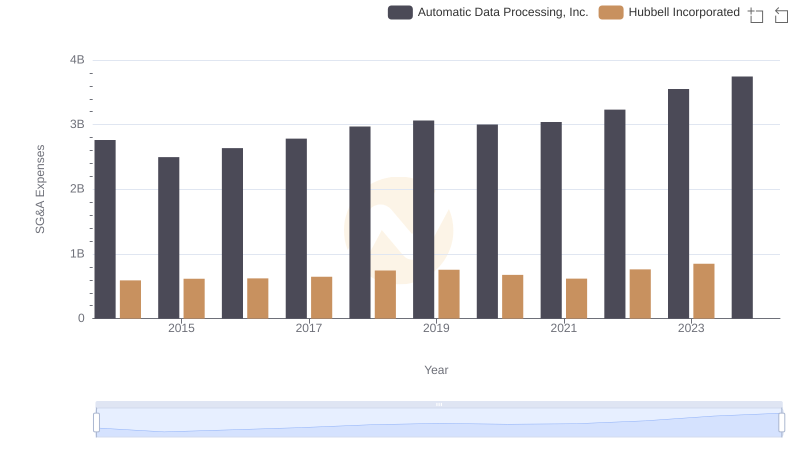

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Hubbell Incorporated Trends and Insights

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs EMCOR Group, Inc.

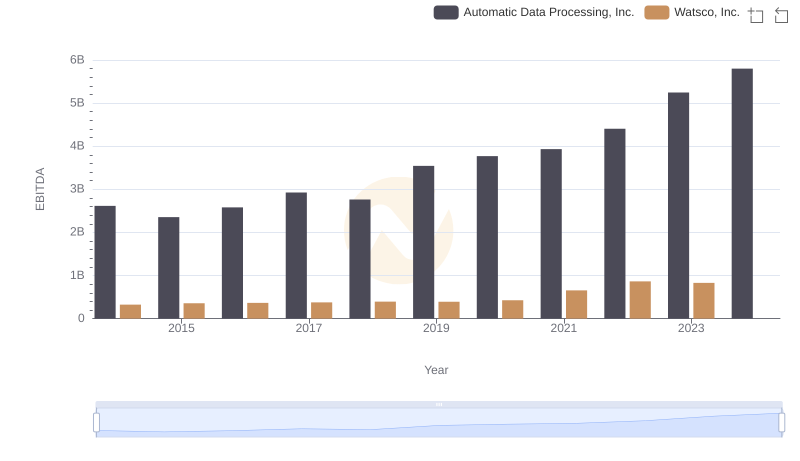

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Watsco, Inc.

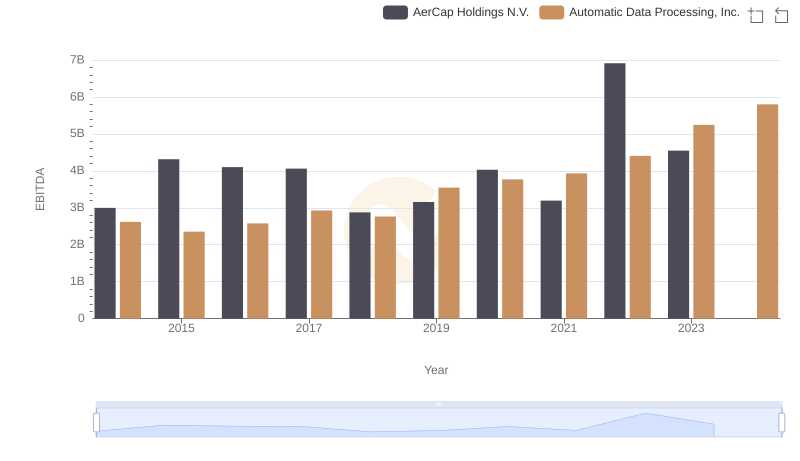

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

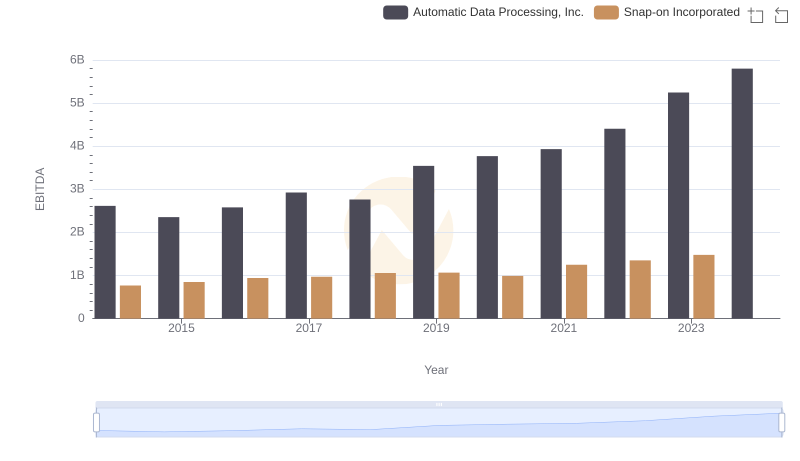

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Snap-on Incorporated

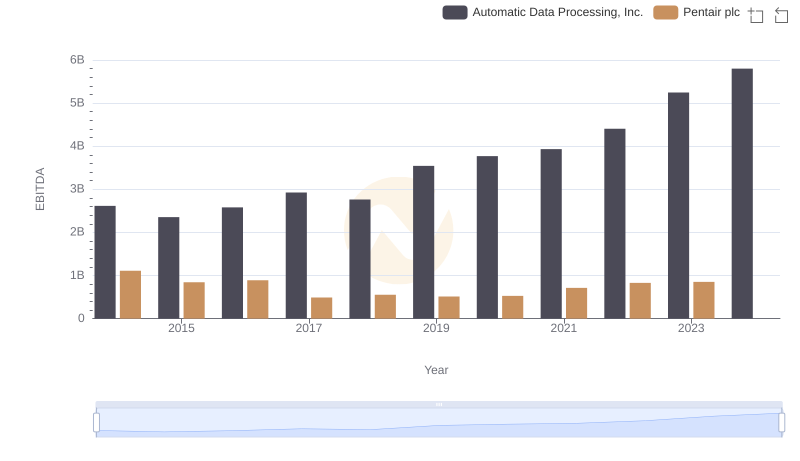

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Pentair plc

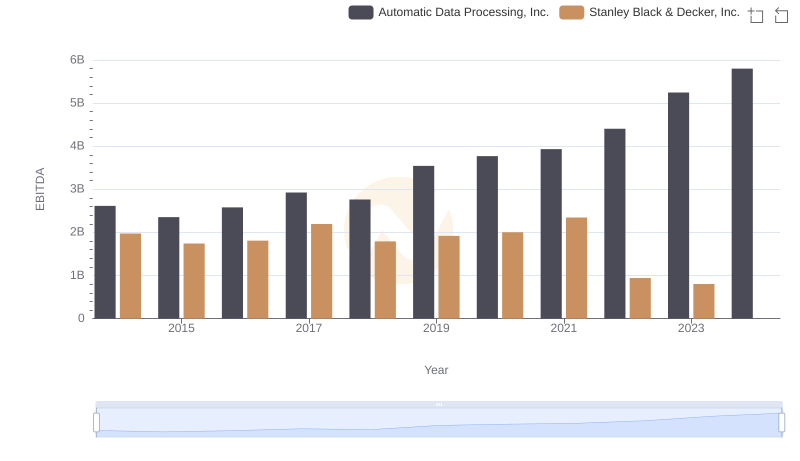

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

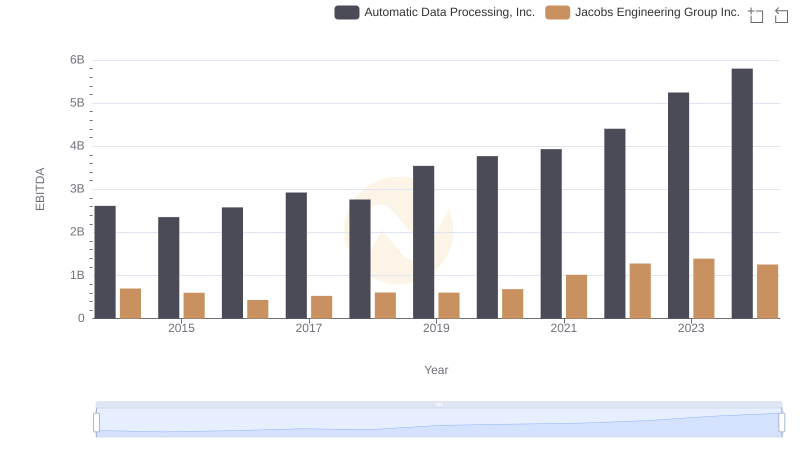

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.