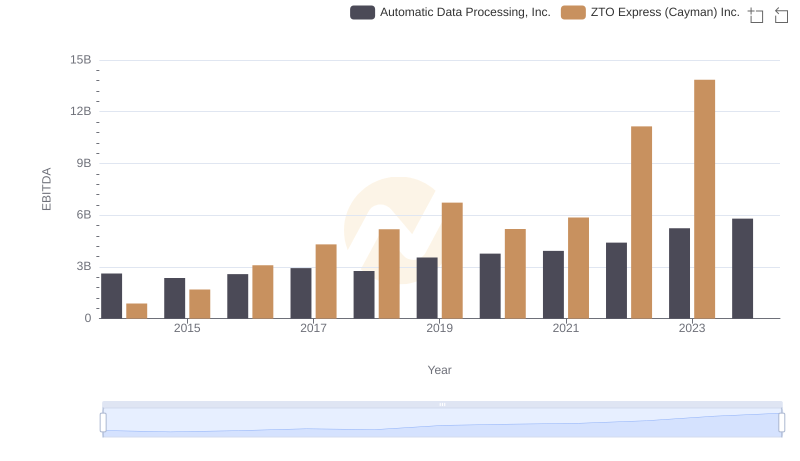

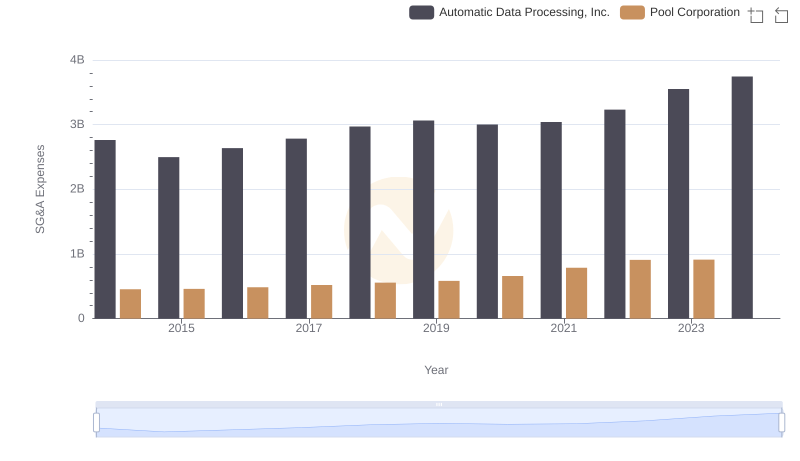

| __timestamp | Automatic Data Processing, Inc. | Pool Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 204752000 |

| Thursday, January 1, 2015 | 2355100000 | 233610000 |

| Friday, January 1, 2016 | 2579500000 | 277836000 |

| Sunday, January 1, 2017 | 2927200000 | 310096000 |

| Monday, January 1, 2018 | 2762900000 | 341804000 |

| Tuesday, January 1, 2019 | 3544500000 | 370520000 |

| Wednesday, January 1, 2020 | 3769700000 | 493425000 |

| Friday, January 1, 2021 | 3931600000 | 862810000 |

| Saturday, January 1, 2022 | 4405500000 | 1064808000 |

| Sunday, January 1, 2023 | 5244600000 | 786707000 |

| Monday, January 1, 2024 | 5800000000 |

Cracking the code

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. This analysis focuses on Automatic Data Processing, Inc. (ADP) and Pool Corporation, two giants in their respective industries. Over the past decade, ADP has demonstrated a robust growth trajectory, with its EBITDA increasing by approximately 122% from 2014 to 2023. In contrast, Pool Corporation, while showing a commendable rise, has experienced a more modest growth of around 384% during the same period.

ADP's EBITDA growth reflects its strategic initiatives and market adaptability, particularly evident in the significant leap from 2022 to 2023. Meanwhile, Pool Corporation's performance, though impressive, highlights the challenges faced in maintaining consistent growth. Notably, data for 2024 is incomplete, indicating potential volatility or strategic shifts. This comparative analysis underscores the importance of EBITDA as a benchmark for financial health and operational efficiency.

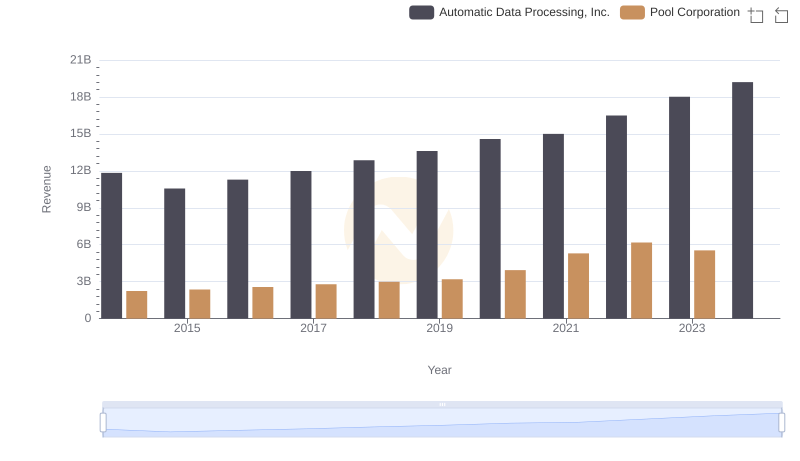

Revenue Showdown: Automatic Data Processing, Inc. vs Pool Corporation

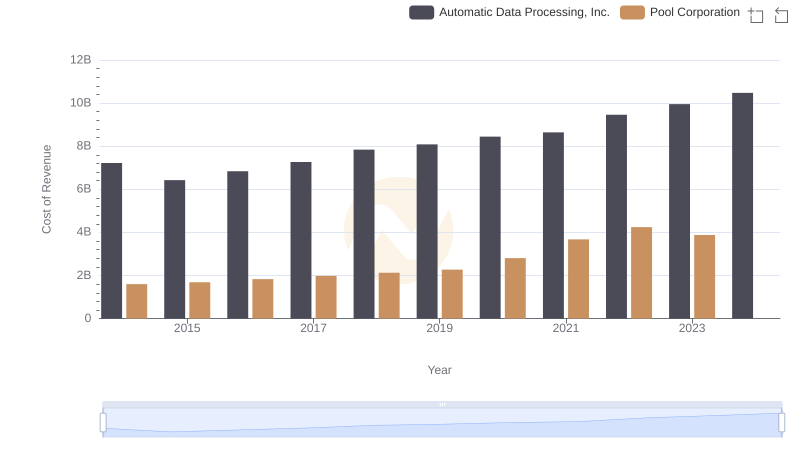

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and Pool Corporation

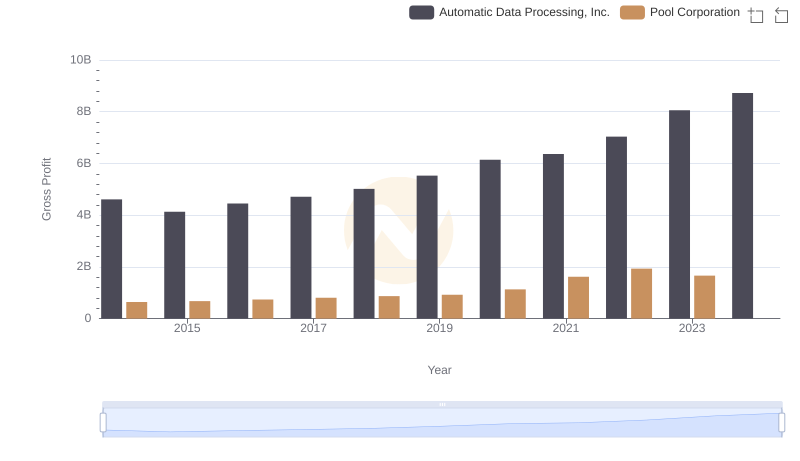

Gross Profit Comparison: Automatic Data Processing, Inc. and Pool Corporation Trends

Automatic Data Processing, Inc. and ZTO Express (Cayman) Inc.: A Detailed Examination of EBITDA Performance

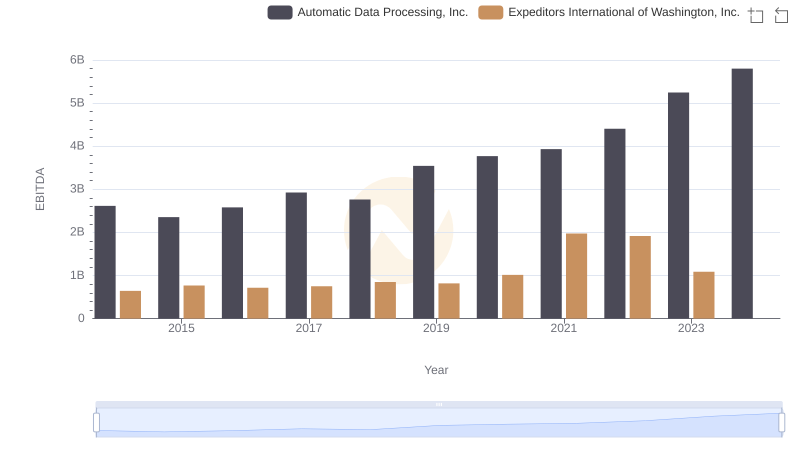

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Expeditors International of Washington, Inc.

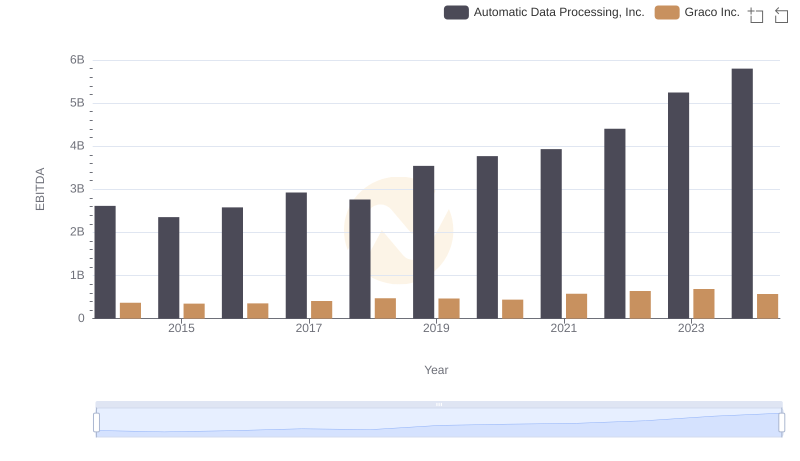

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Graco Inc.

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and Pool Corporation

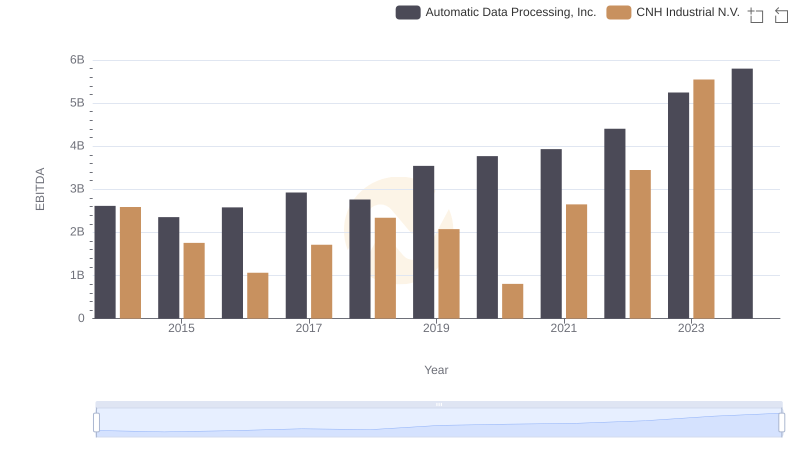

Automatic Data Processing, Inc. vs CNH Industrial N.V.: In-Depth EBITDA Performance Comparison

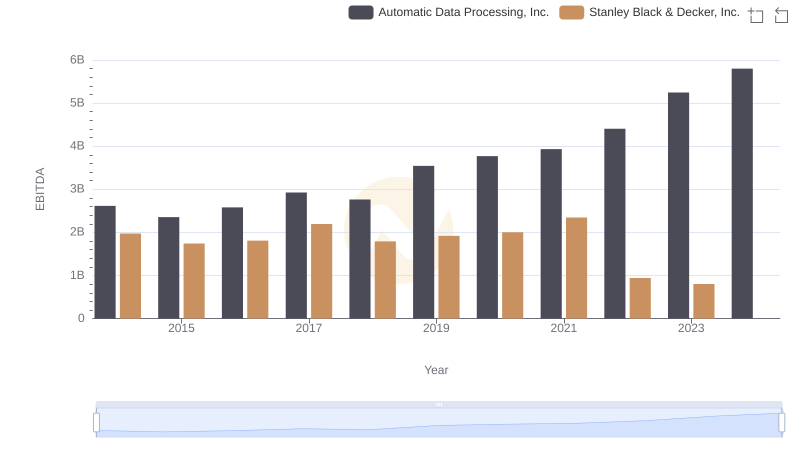

Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison

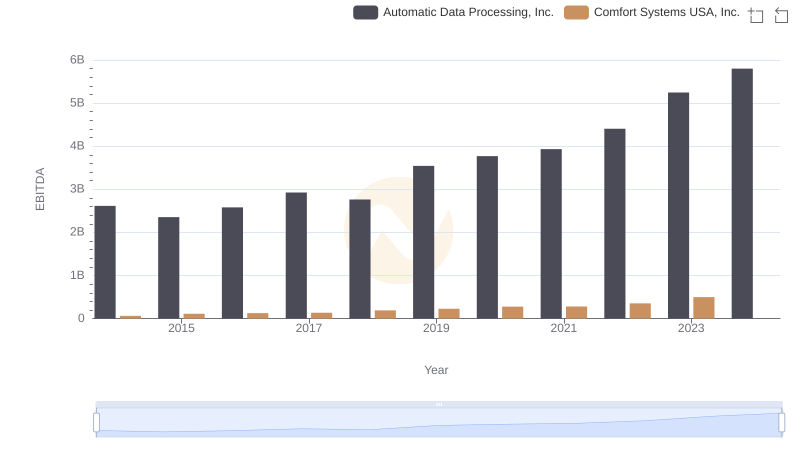

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Comfort Systems USA, Inc.

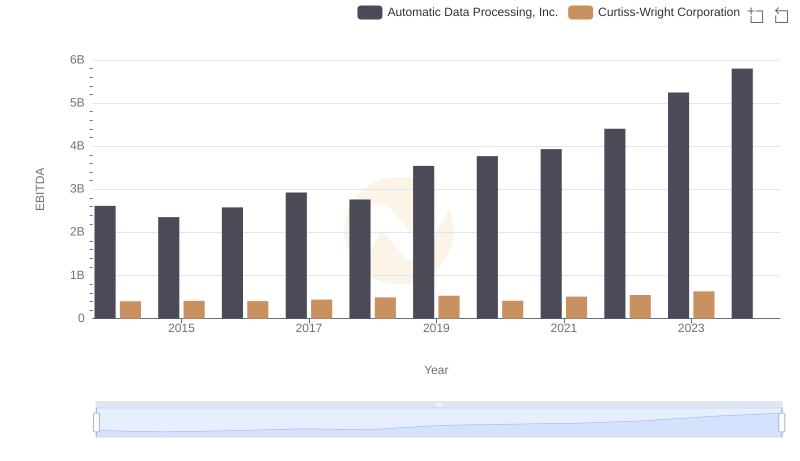

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Curtiss-Wright Corporation