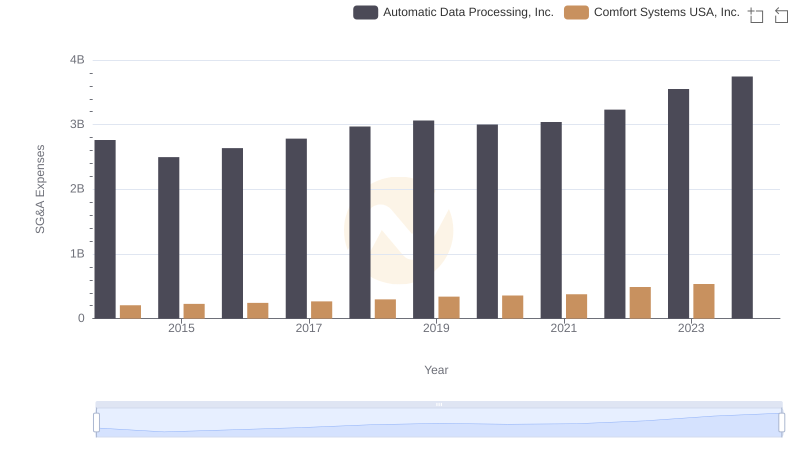

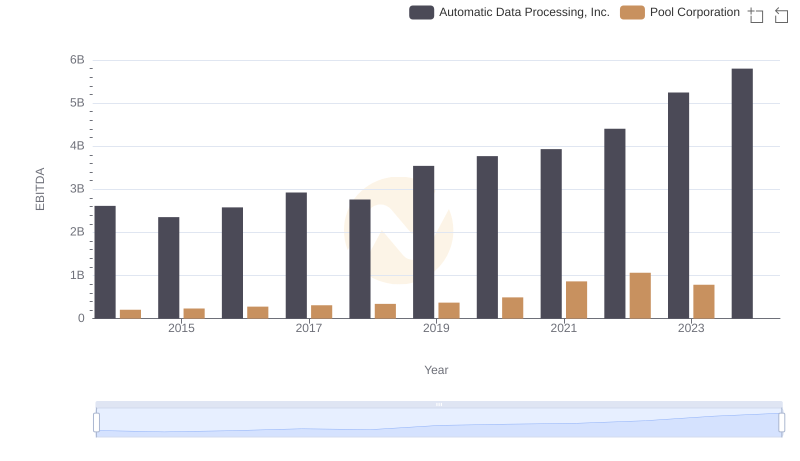

| __timestamp | Automatic Data Processing, Inc. | Pool Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 454470000 |

| Thursday, January 1, 2015 | 2496900000 | 459422000 |

| Friday, January 1, 2016 | 2637000000 | 485228000 |

| Sunday, January 1, 2017 | 2783200000 | 520918000 |

| Monday, January 1, 2018 | 2971500000 | 556284000 |

| Tuesday, January 1, 2019 | 3064200000 | 583679000 |

| Wednesday, January 1, 2020 | 3003000000 | 659931000 |

| Friday, January 1, 2021 | 3040500000 | 786808000 |

| Saturday, January 1, 2022 | 3233200000 | 907629000 |

| Sunday, January 1, 2023 | 3551400000 | 912927000 |

| Monday, January 1, 2024 | 3778900000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, understanding Selling, General, and Administrative (SG&A) expenses is crucial for effective cost management. Over the past decade, Automatic Data Processing, Inc. (ADP) and Pool Corporation have demonstrated distinct trajectories in their SG&A expenditures. From 2014 to 2023, ADP's SG&A expenses have surged by approximately 36%, reflecting strategic investments and operational scaling. In contrast, Pool Corporation has seen a remarkable 101% increase, highlighting its aggressive expansion and market penetration strategies.

While ADP's expenses peaked at $3.74 billion in 2024, Pool Corporation's data for the same year remains elusive, indicating potential reporting delays or strategic shifts. This comparative analysis underscores the importance of SG&A management in sustaining competitive advantage and profitability. As businesses navigate the complexities of financial planning, these insights offer valuable lessons in balancing growth with cost efficiency.

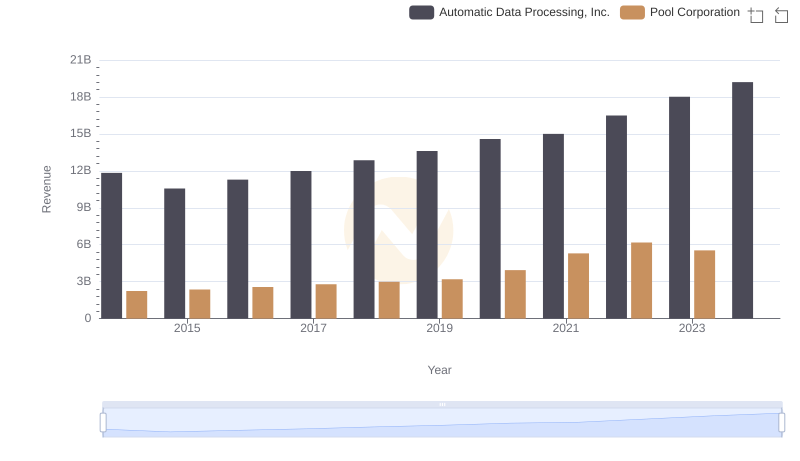

Revenue Showdown: Automatic Data Processing, Inc. vs Pool Corporation

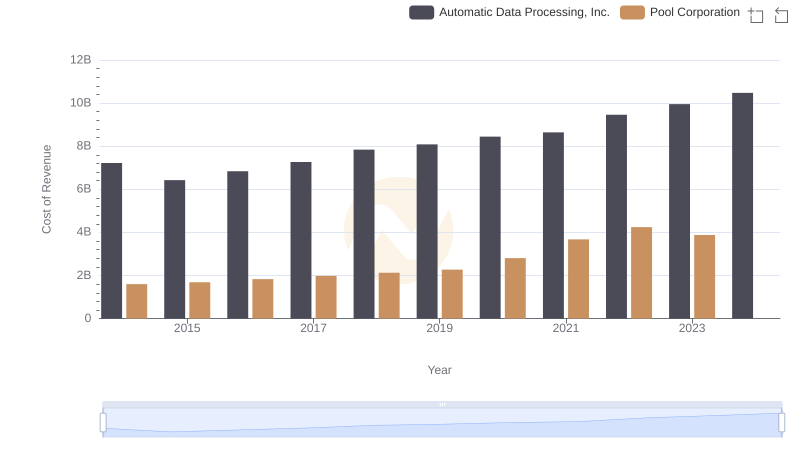

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and Pool Corporation

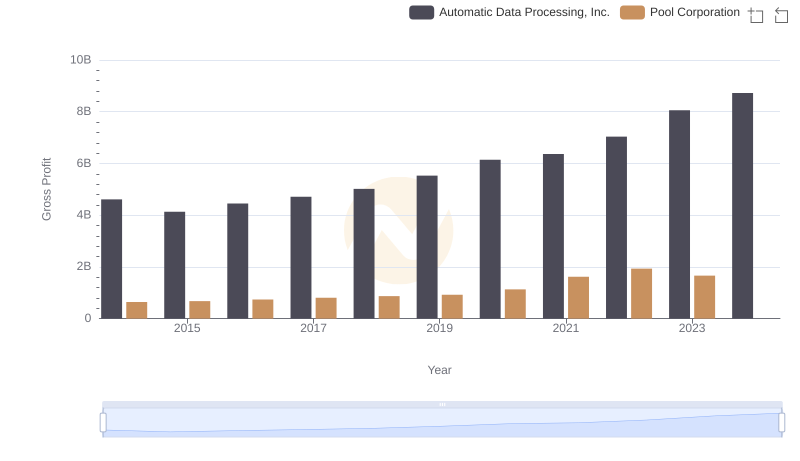

Gross Profit Comparison: Automatic Data Processing, Inc. and Pool Corporation Trends

Selling, General, and Administrative Costs: Automatic Data Processing, Inc. vs Saia, Inc.

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

Automatic Data Processing, Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Pool Corporation

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and U-Haul Holding Company