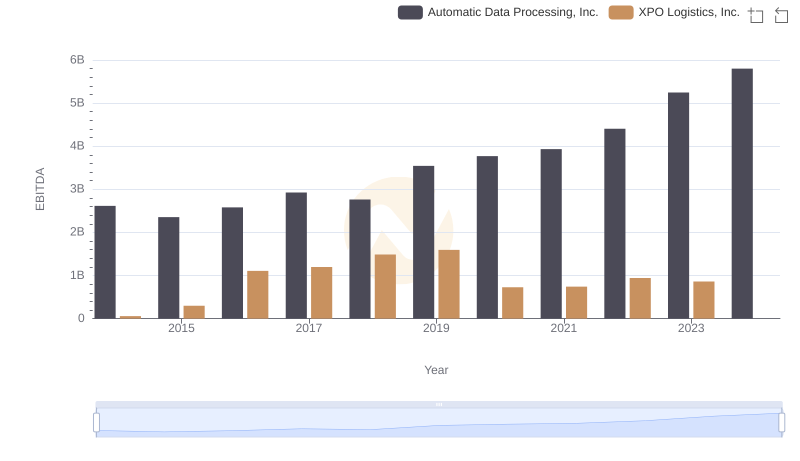

| __timestamp | Automatic Data Processing, Inc. | Expeditors International of Washington, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 643940000 |

| Thursday, January 1, 2015 | 2355100000 | 767496000 |

| Friday, January 1, 2016 | 2579500000 | 716959000 |

| Sunday, January 1, 2017 | 2927200000 | 749570000 |

| Monday, January 1, 2018 | 2762900000 | 850582000 |

| Tuesday, January 1, 2019 | 3544500000 | 817642000 |

| Wednesday, January 1, 2020 | 3769700000 | 1013523000 |

| Friday, January 1, 2021 | 3931600000 | 1975928000 |

| Saturday, January 1, 2022 | 4405500000 | 1916506000 |

| Sunday, January 1, 2023 | 5244600000 | 1087588000 |

| Monday, January 1, 2024 | 5800000000 | 1154330000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. This analysis juxtaposes Automatic Data Processing, Inc. (ADP) and Expeditors International of Washington, Inc. (EXPD) over a decade, from 2014 to 2023. ADP has demonstrated a robust growth trajectory, with its EBITDA surging by approximately 122% from 2014 to 2023. In contrast, EXPD's EBITDA exhibited a more modest growth of around 69% over the same period. Notably, ADP's EBITDA reached its zenith in 2023, while EXPD's data for 2024 remains unavailable, highlighting potential data gaps. This comparison underscores ADP's consistent financial strength, positioning it as a formidable player in its industry. As businesses navigate the complexities of the global market, such insights are invaluable for stakeholders aiming to make informed investment decisions.

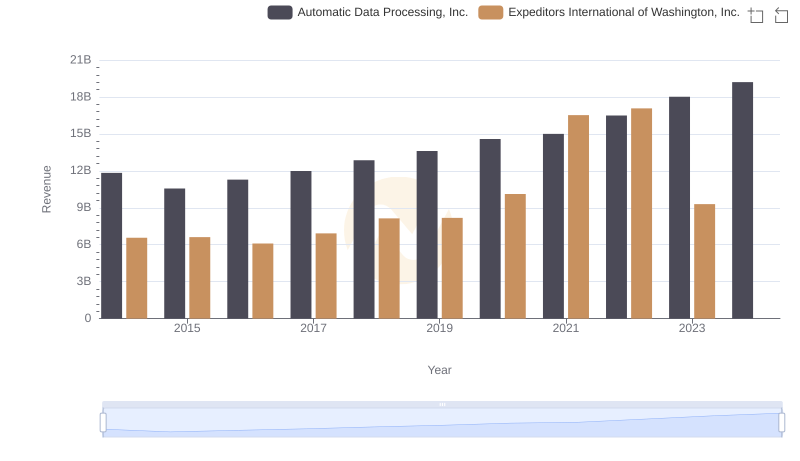

Comparing Revenue Performance: Automatic Data Processing, Inc. or Expeditors International of Washington, Inc.?

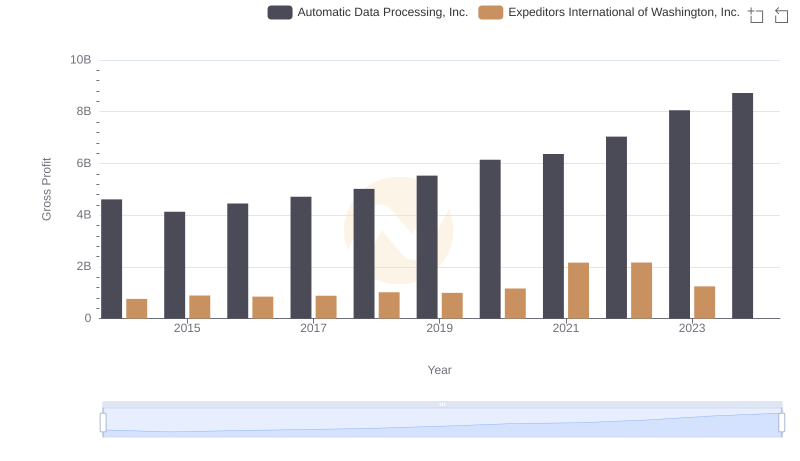

Gross Profit Comparison: Automatic Data Processing, Inc. and Expeditors International of Washington, Inc. Trends

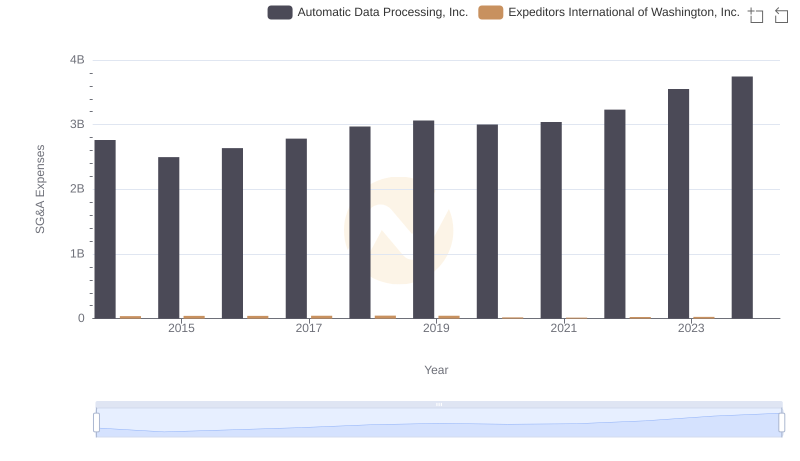

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Expeditors International of Washington, Inc. Trends and Insights

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to XPO Logistics, Inc.

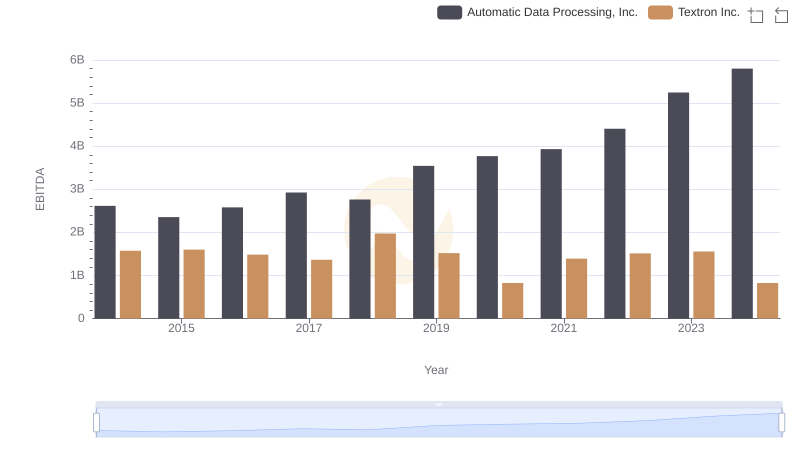

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Textron Inc.

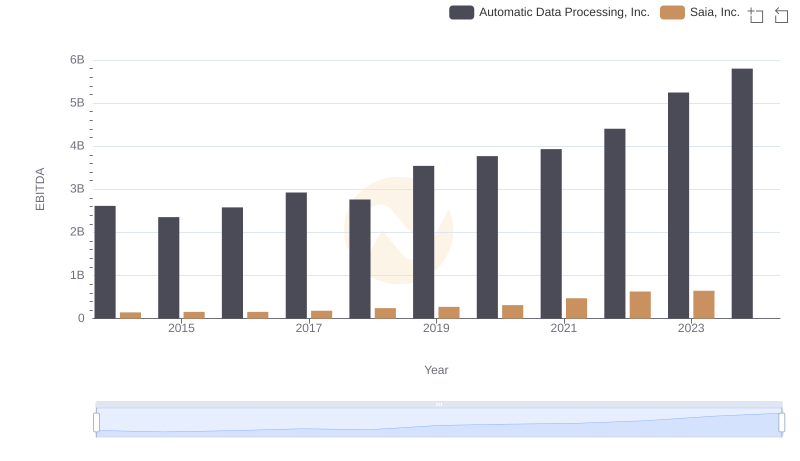

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Saia, Inc.

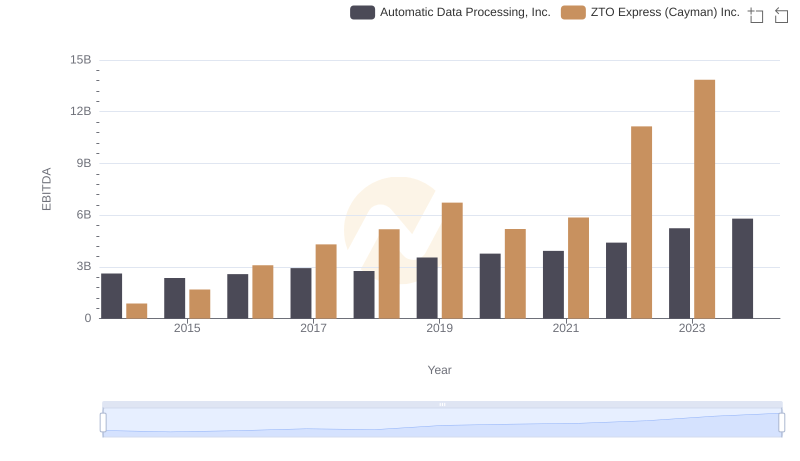

Automatic Data Processing, Inc. and ZTO Express (Cayman) Inc.: A Detailed Examination of EBITDA Performance

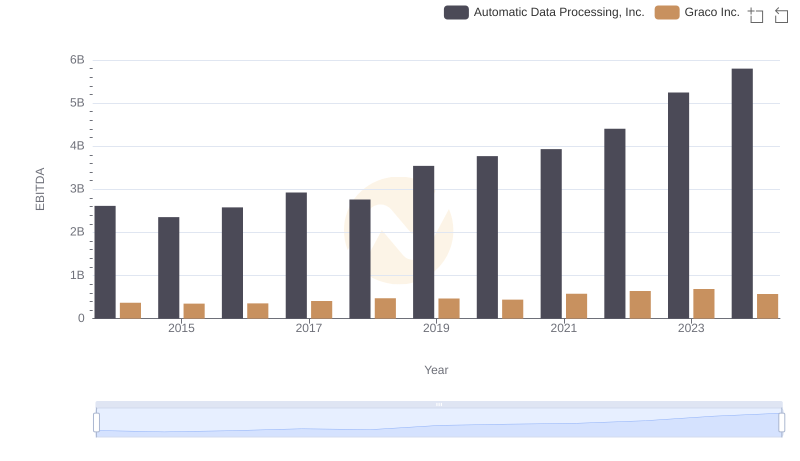

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Graco Inc.

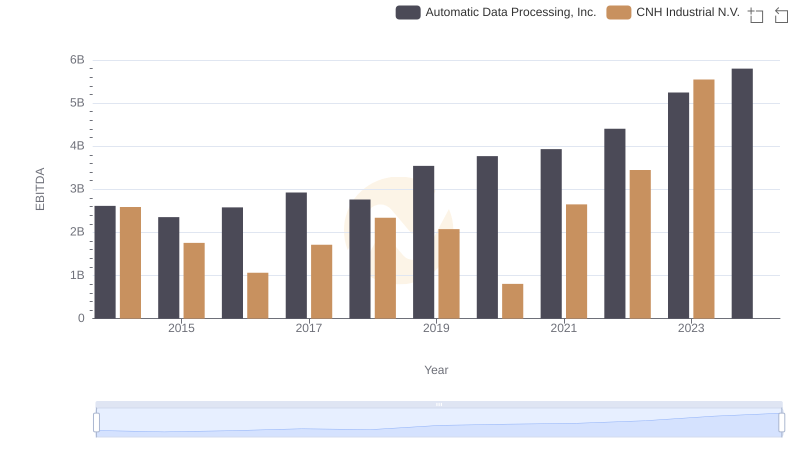

Automatic Data Processing, Inc. vs CNH Industrial N.V.: In-Depth EBITDA Performance Comparison

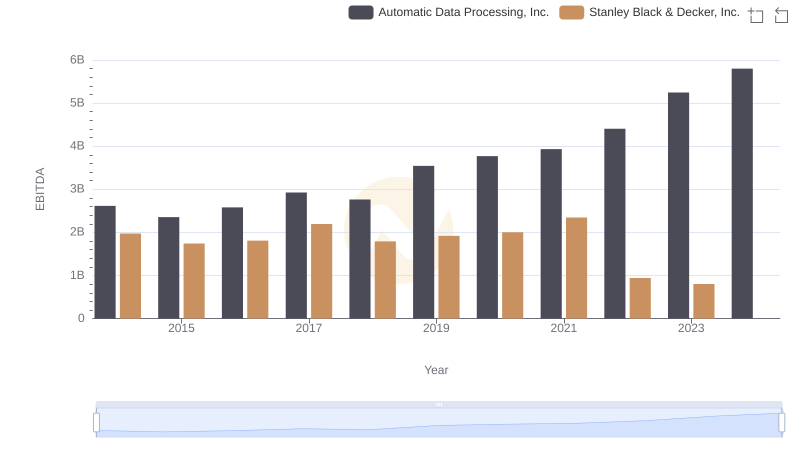

Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison