| __timestamp | Automatic Data Processing, Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 876815000 |

| Thursday, January 1, 2015 | 2355100000 | 1687285000 |

| Friday, January 1, 2016 | 2579500000 | 3093956000 |

| Sunday, January 1, 2017 | 2927200000 | 4308801000 |

| Monday, January 1, 2018 | 2762900000 | 5185941000 |

| Tuesday, January 1, 2019 | 3544500000 | 6727397000 |

| Wednesday, January 1, 2020 | 3769700000 | 5197064000 |

| Friday, January 1, 2021 | 3931600000 | 5866901000 |

| Saturday, January 1, 2022 | 4405500000 | 11147519000 |

| Sunday, January 1, 2023 | 5244600000 | 13853443000 |

| Monday, January 1, 2024 | 5800000000 |

Unveiling the hidden dimensions of data

Over the past decade, Automatic Data Processing, Inc. (ADP) and ZTO Express (Cayman) Inc. have showcased remarkable EBITDA growth, reflecting their strategic prowess in the global market. From 2014 to 2023, ADP's EBITDA surged by approximately 122%, highlighting its robust financial health and adaptability in the ever-evolving business landscape. Meanwhile, ZTO Express demonstrated an even more impressive trajectory, with its EBITDA skyrocketing by over 1,480% during the same period, underscoring its rapid expansion and dominance in the logistics sector.

In 2023, ZTO Express's EBITDA reached a peak, nearly tripling that of ADP, showcasing its aggressive growth strategy. However, the data for 2024 remains incomplete, leaving room for speculation on future trends. This analysis provides a compelling narrative of two industry giants navigating their financial journeys, offering valuable insights for investors and market enthusiasts.

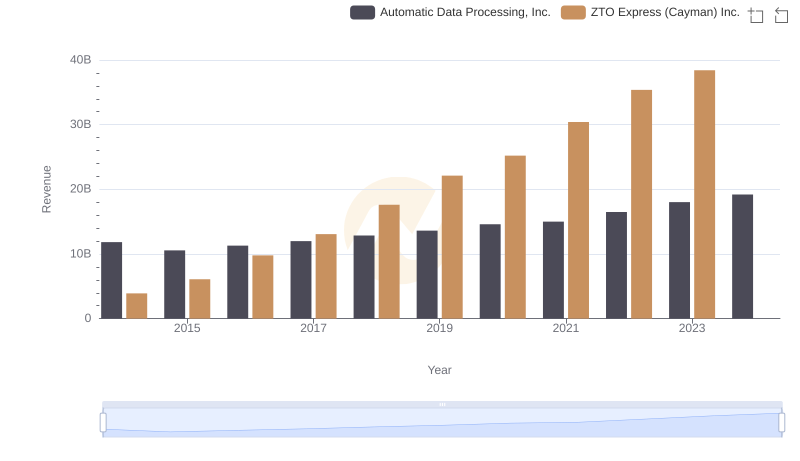

Revenue Insights: Automatic Data Processing, Inc. and ZTO Express (Cayman) Inc. Performance Compared

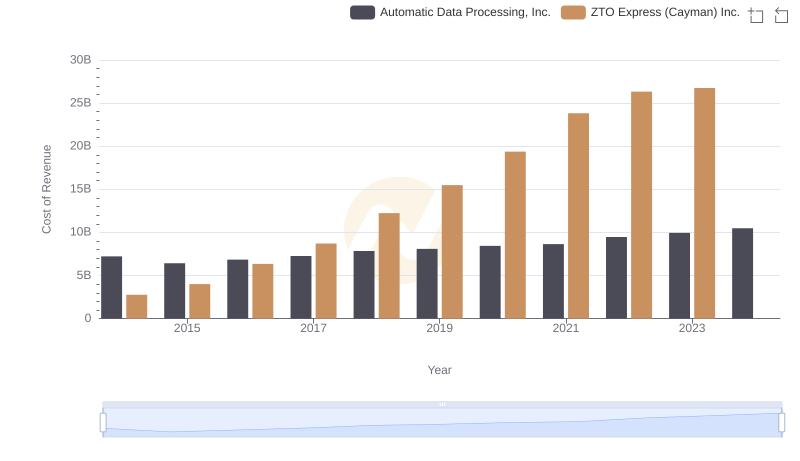

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs ZTO Express (Cayman) Inc.

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs ZTO Express (Cayman) Inc.

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs ZTO Express (Cayman) Inc. Trends and Insights

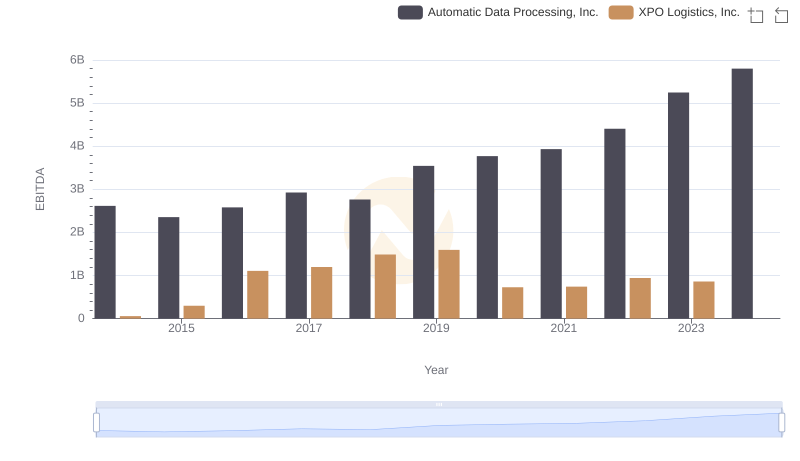

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to XPO Logistics, Inc.

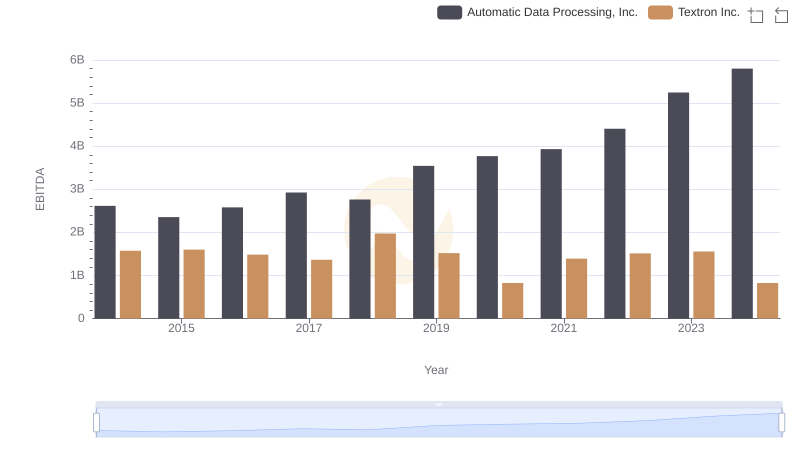

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Textron Inc.

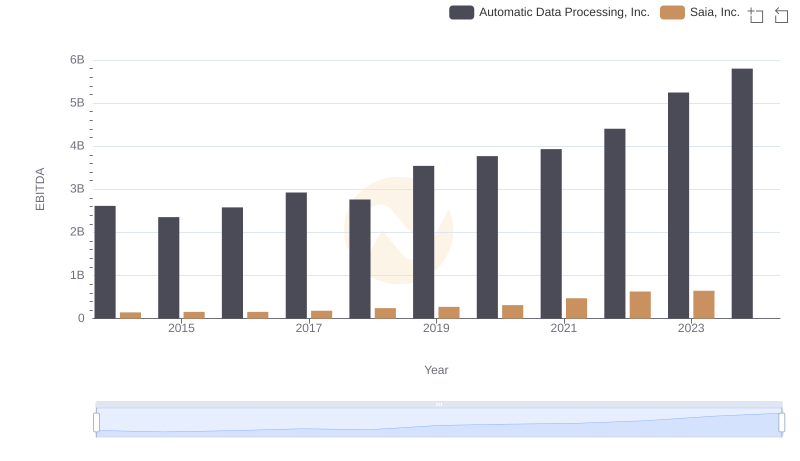

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Saia, Inc.

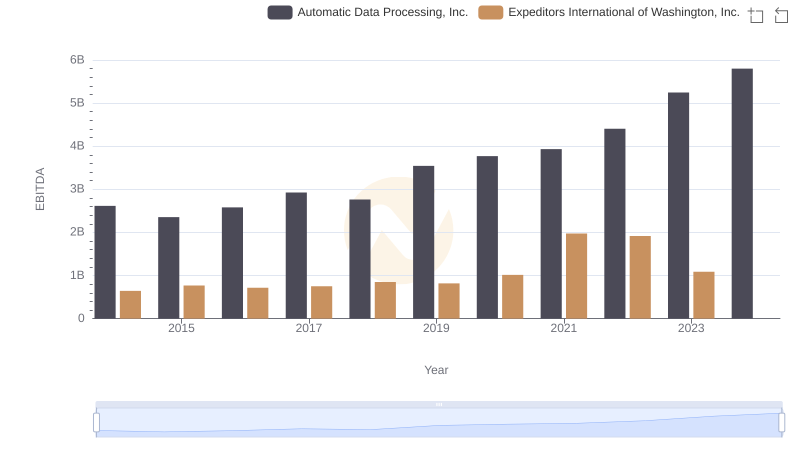

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Expeditors International of Washington, Inc.

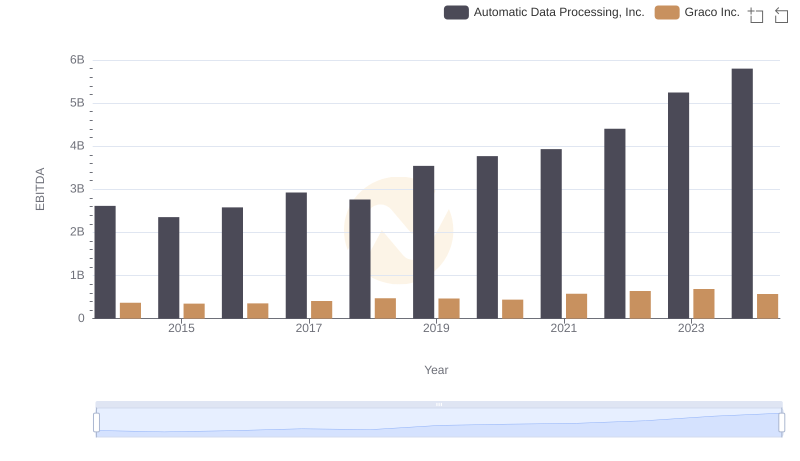

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Graco Inc.

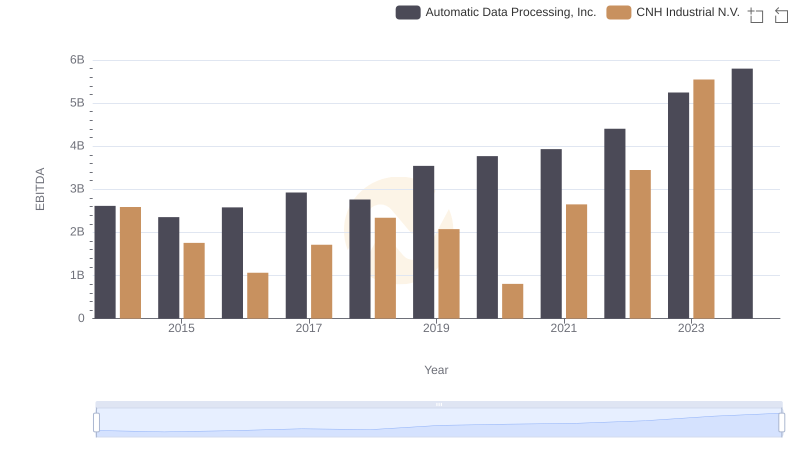

Automatic Data Processing, Inc. vs CNH Industrial N.V.: In-Depth EBITDA Performance Comparison

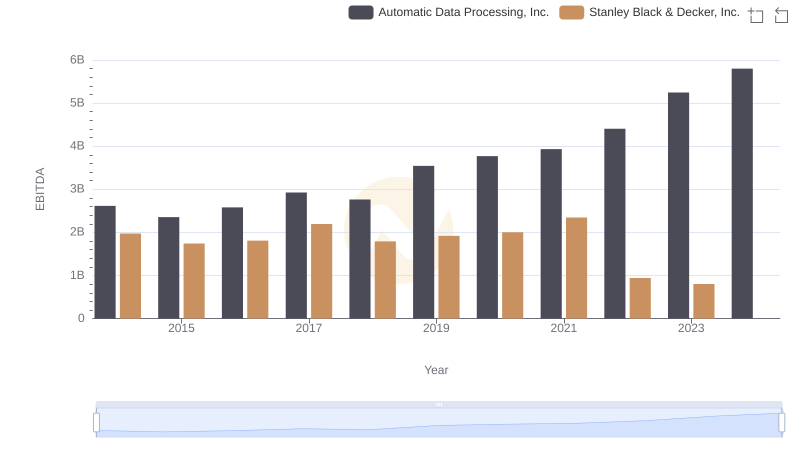

Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison