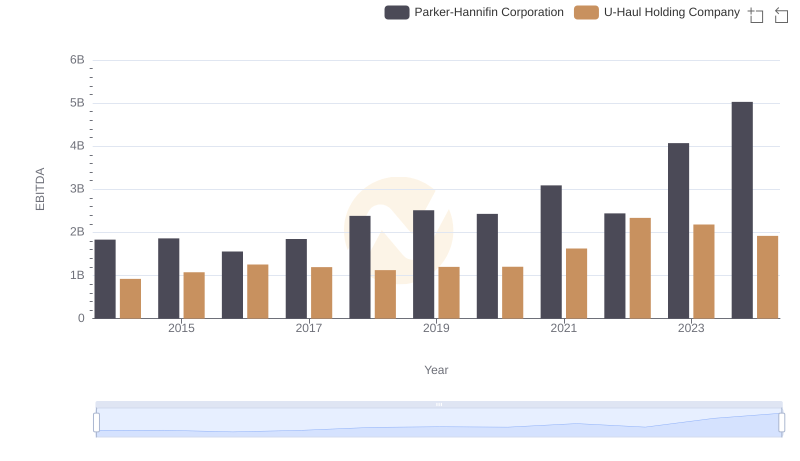

| __timestamp | Parker-Hannifin Corporation | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1832903000 | 144715000 |

| Thursday, January 1, 2015 | 1861551000 | 154995000 |

| Friday, January 1, 2016 | 1558088000 | 156092000 |

| Sunday, January 1, 2017 | 1846306000 | 181629000 |

| Monday, January 1, 2018 | 2382235000 | 243709000 |

| Tuesday, January 1, 2019 | 2513468000 | 271318000 |

| Wednesday, January 1, 2020 | 2431500000 | 312448000 |

| Friday, January 1, 2021 | 3092383000 | 472947000 |

| Saturday, January 1, 2022 | 2441242000 | 627741000 |

| Sunday, January 1, 2023 | 4071687000 | 647607000 |

| Monday, January 1, 2024 | 5028229000 |

Infusing magic into the data realm

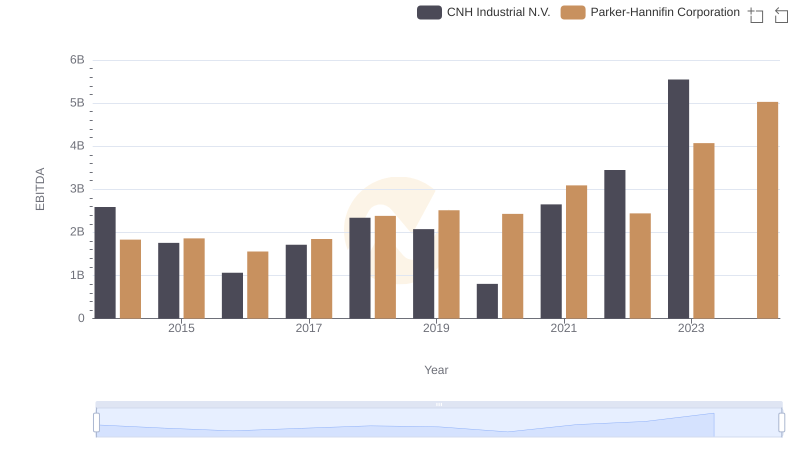

In the competitive landscape of industrial and logistics sectors, Parker-Hannifin Corporation and Saia, Inc. have showcased intriguing EBITDA trajectories from 2014 to 2023. Parker-Hannifin, a leader in motion and control technologies, has seen its EBITDA grow by approximately 175% over this period, peaking at an impressive $5 billion in 2023. This growth underscores its strategic expansions and operational efficiencies.

Conversely, Saia, Inc., a prominent player in the freight and logistics industry, has demonstrated a robust 348% increase in EBITDA, reaching nearly $648 million in 2023. This remarkable growth reflects Saia's successful market penetration and service enhancements.

While Parker-Hannifin's EBITDA dwarfs that of Saia, the latter's growth rate is noteworthy, highlighting its dynamic adaptation in a rapidly evolving market. The data for 2024 remains incomplete, offering a tantalizing glimpse into future possibilities.

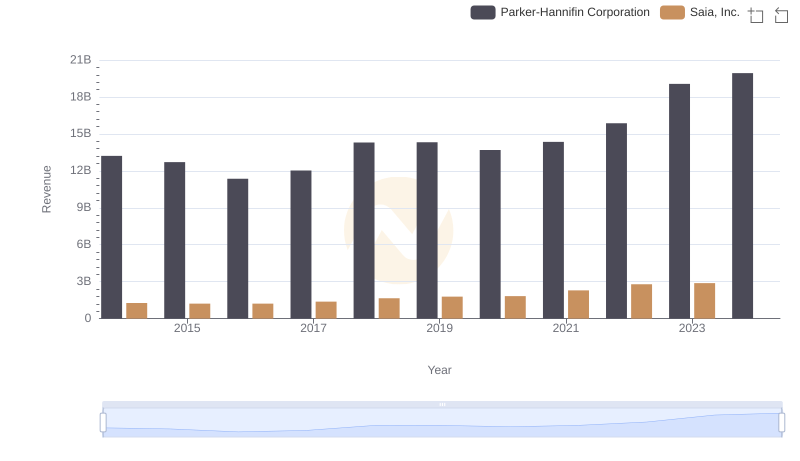

Breaking Down Revenue Trends: Parker-Hannifin Corporation vs Saia, Inc.

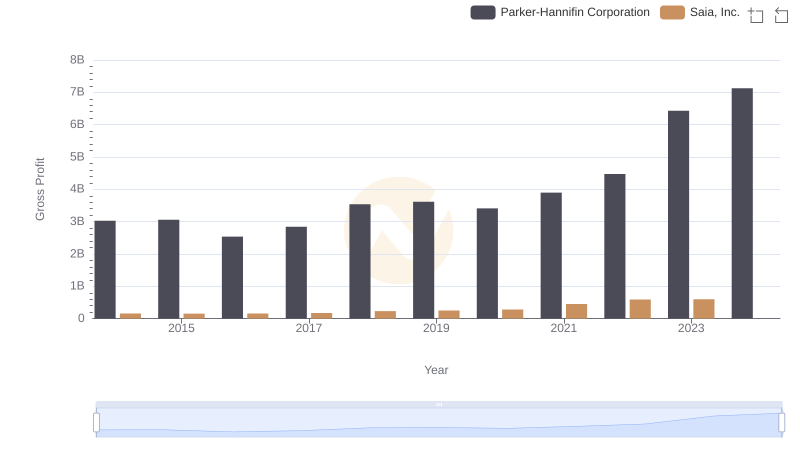

Gross Profit Trends Compared: Parker-Hannifin Corporation vs Saia, Inc.

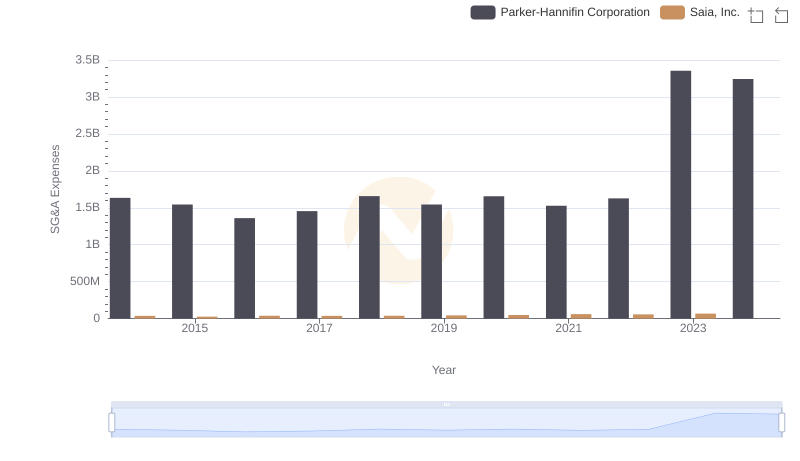

Parker-Hannifin Corporation and Saia, Inc.: SG&A Spending Patterns Compared

EBITDA Metrics Evaluated: Parker-Hannifin Corporation vs U-Haul Holding Company

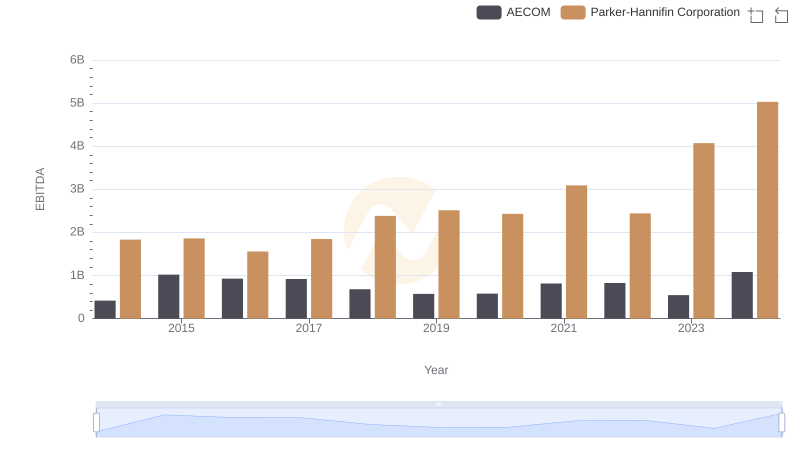

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to AECOM

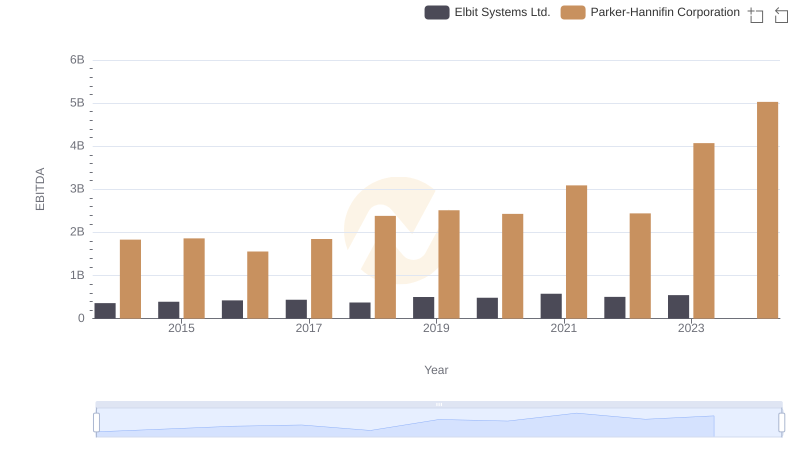

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs Elbit Systems Ltd.

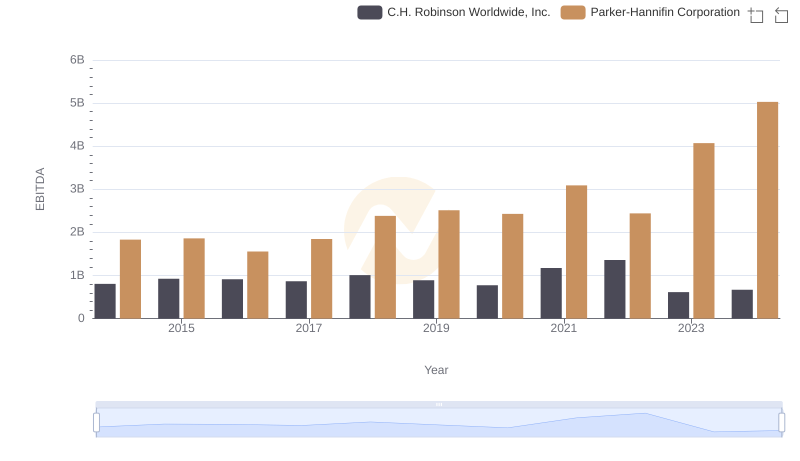

A Side-by-Side Analysis of EBITDA: Parker-Hannifin Corporation and C.H. Robinson Worldwide, Inc.

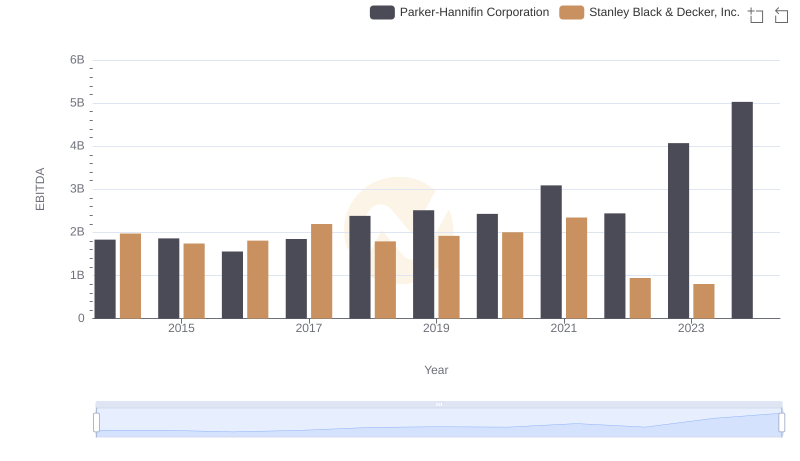

Parker-Hannifin Corporation vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs CNH Industrial N.V.

EBITDA Performance Review: Parker-Hannifin Corporation vs Curtiss-Wright Corporation