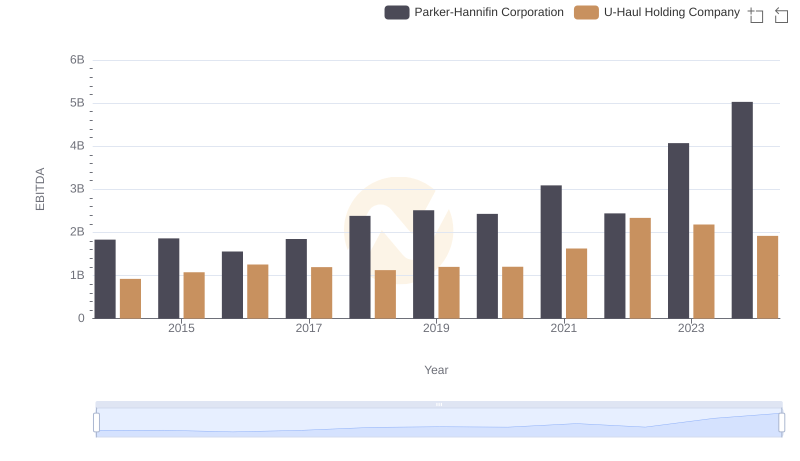

| __timestamp | C.H. Robinson Worldwide, Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 805427000 | 1832903000 |

| Thursday, January 1, 2015 | 924719000 | 1861551000 |

| Friday, January 1, 2016 | 912200000 | 1558088000 |

| Sunday, January 1, 2017 | 868096000 | 1846306000 |

| Monday, January 1, 2018 | 1008812000 | 2382235000 |

| Tuesday, January 1, 2019 | 890425000 | 2513468000 |

| Wednesday, January 1, 2020 | 774995000 | 2431500000 |

| Friday, January 1, 2021 | 1173367000 | 3092383000 |

| Saturday, January 1, 2022 | 1359558000 | 2441242000 |

| Sunday, January 1, 2023 | 613592000 | 4071687000 |

| Monday, January 1, 2024 | 766301000 | 5028229000 |

Unleashing insights

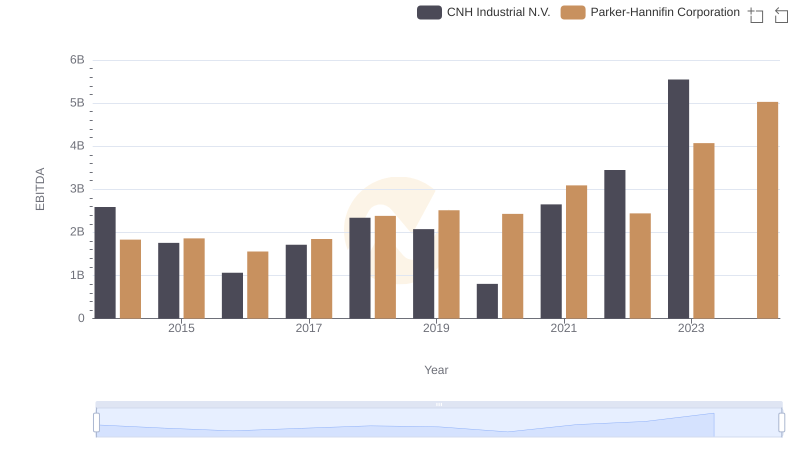

In the ever-evolving landscape of industrial and logistics sectors, understanding financial health is crucial. This analysis delves into the EBITDA trends of Parker-Hannifin Corporation and C.H. Robinson Worldwide, Inc. from 2014 to 2024. Over this decade, Parker-Hannifin has demonstrated a robust growth trajectory, with its EBITDA surging by approximately 175%, peaking at an impressive $5 billion in 2024. In contrast, C.H. Robinson's EBITDA has experienced fluctuations, with a notable decline of around 25% from its 2022 peak to 2023. This divergence highlights Parker-Hannifin's strategic resilience and adaptability in the face of market challenges. As we look towards the future, these insights offer a window into the strategic maneuvers that can drive sustained financial performance in competitive industries.

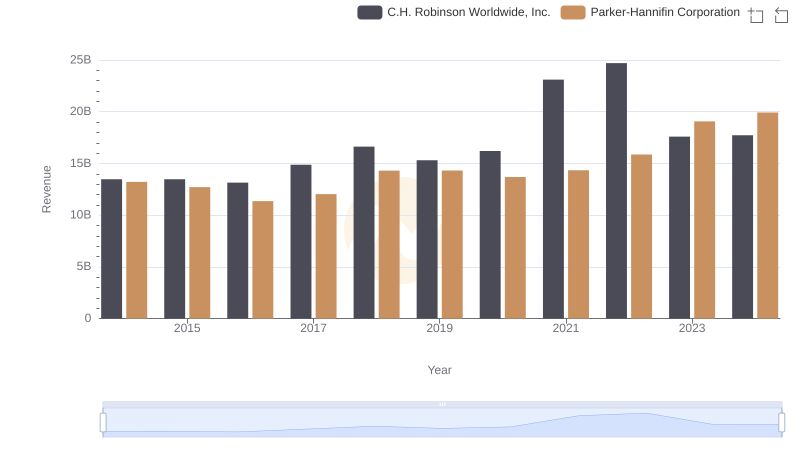

Revenue Insights: Parker-Hannifin Corporation and C.H. Robinson Worldwide, Inc. Performance Compared

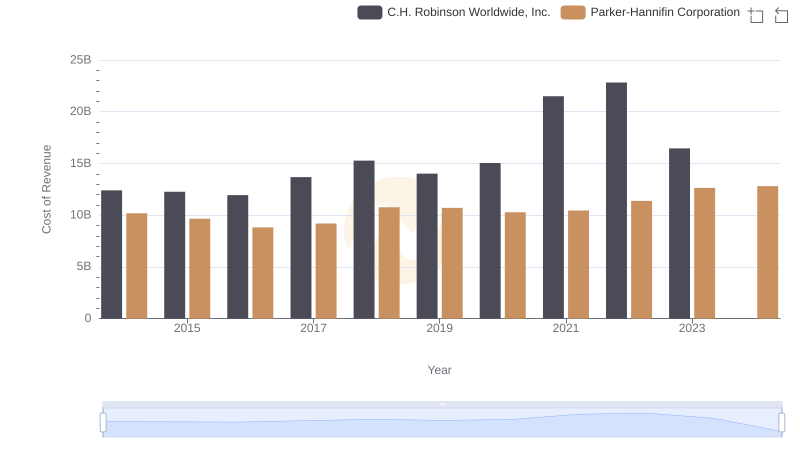

Cost of Revenue Trends: Parker-Hannifin Corporation vs C.H. Robinson Worldwide, Inc.

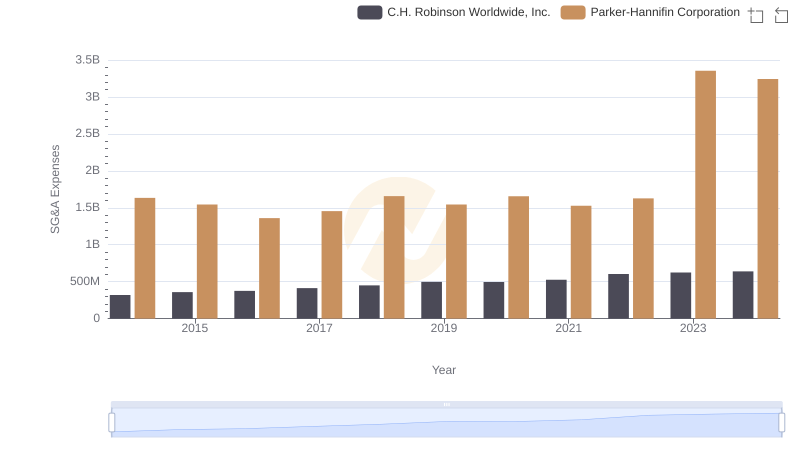

Parker-Hannifin Corporation and C.H. Robinson Worldwide, Inc.: SG&A Spending Patterns Compared

EBITDA Metrics Evaluated: Parker-Hannifin Corporation vs U-Haul Holding Company

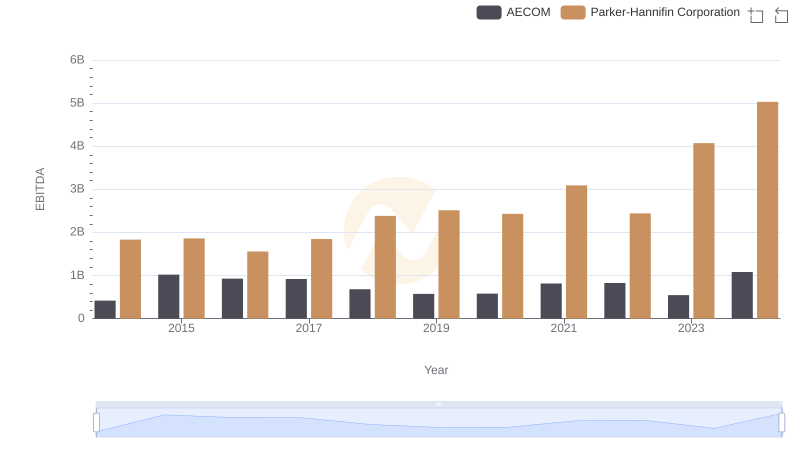

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to AECOM

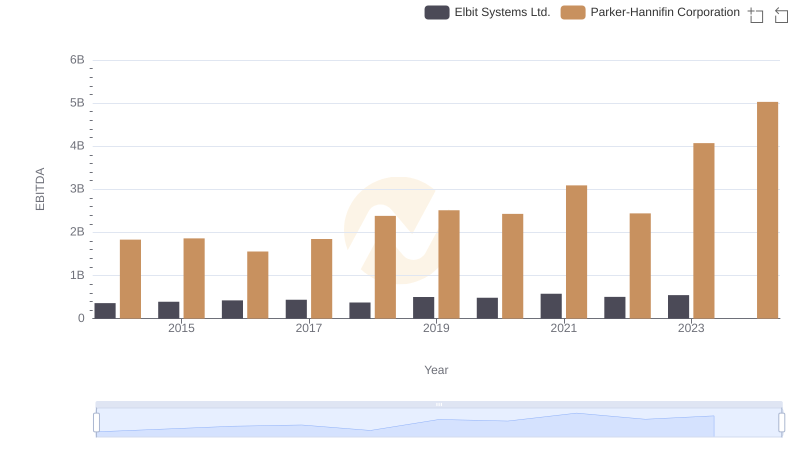

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs Elbit Systems Ltd.

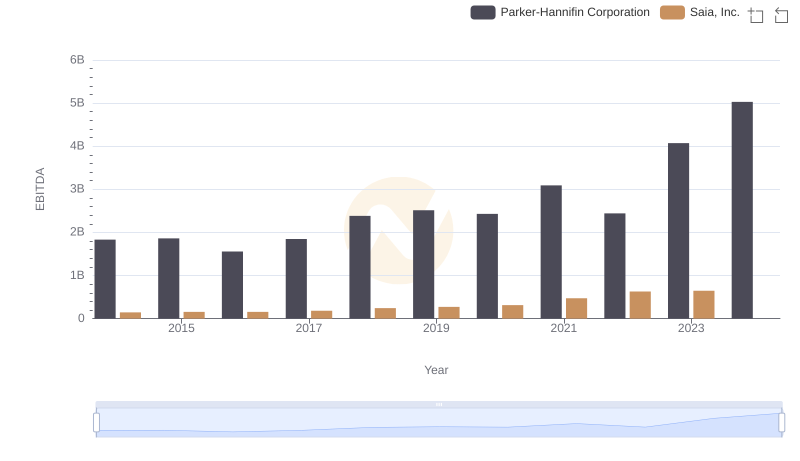

Parker-Hannifin Corporation vs Saia, Inc.: In-Depth EBITDA Performance Comparison

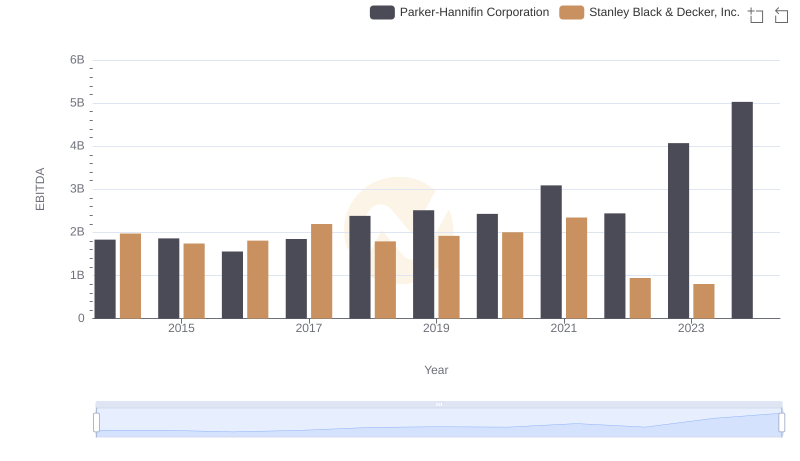

Parker-Hannifin Corporation vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs CNH Industrial N.V.

EBITDA Performance Review: Parker-Hannifin Corporation vs Curtiss-Wright Corporation