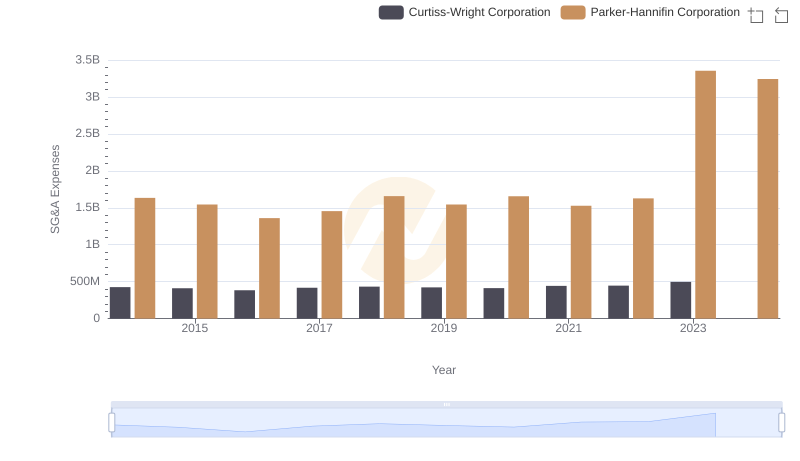

| __timestamp | Curtiss-Wright Corporation | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 401669000 | 1832903000 |

| Thursday, January 1, 2015 | 412042000 | 1861551000 |

| Friday, January 1, 2016 | 405217000 | 1558088000 |

| Sunday, January 1, 2017 | 441085000 | 1846306000 |

| Monday, January 1, 2018 | 493171000 | 2382235000 |

| Tuesday, January 1, 2019 | 530221000 | 2513468000 |

| Wednesday, January 1, 2020 | 414499000 | 2431500000 |

| Friday, January 1, 2021 | 509134000 | 3092383000 |

| Saturday, January 1, 2022 | 548202000 | 2441242000 |

| Sunday, January 1, 2023 | 630635000 | 4071687000 |

| Monday, January 1, 2024 | 674592000 | 5028229000 |

Cracking the code

In the competitive landscape of industrial manufacturing, Parker-Hannifin Corporation and Curtiss-Wright Corporation have showcased remarkable EBITDA growth over the past decade. From 2014 to 2023, Parker-Hannifin's EBITDA surged by approximately 122%, peaking at an impressive $4.07 billion in 2023. This growth trajectory highlights Parker-Hannifin's strategic prowess in expanding its market share and optimizing operational efficiencies.

Conversely, Curtiss-Wright Corporation, while maintaining steady growth, saw its EBITDA increase by around 57% during the same period, reaching $630 million in 2023. This consistent performance underscores Curtiss-Wright's resilience and adaptability in a rapidly evolving industry.

The data for 2024 remains incomplete, offering a tantalizing glimpse into the future potential of these industrial giants. As both companies continue to innovate, stakeholders eagerly anticipate the next chapter in their financial narratives.

Parker-Hannifin Corporation or Curtiss-Wright Corporation: Who Leads in Yearly Revenue?

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Curtiss-Wright Corporation

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Curtiss-Wright Corporation

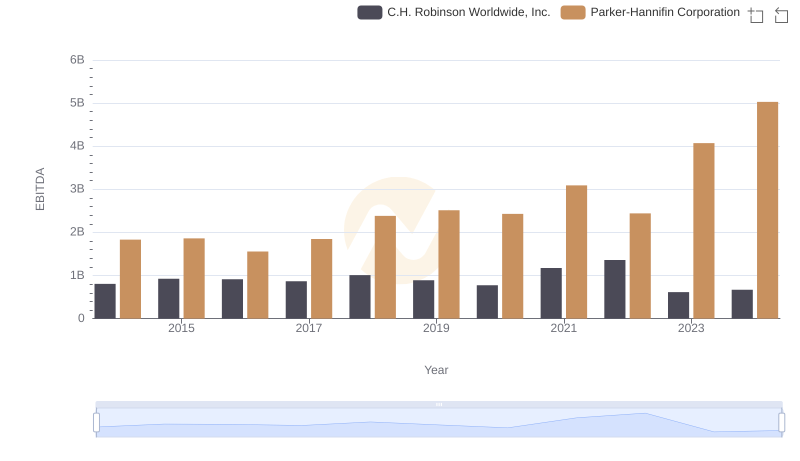

A Side-by-Side Analysis of EBITDA: Parker-Hannifin Corporation and C.H. Robinson Worldwide, Inc.

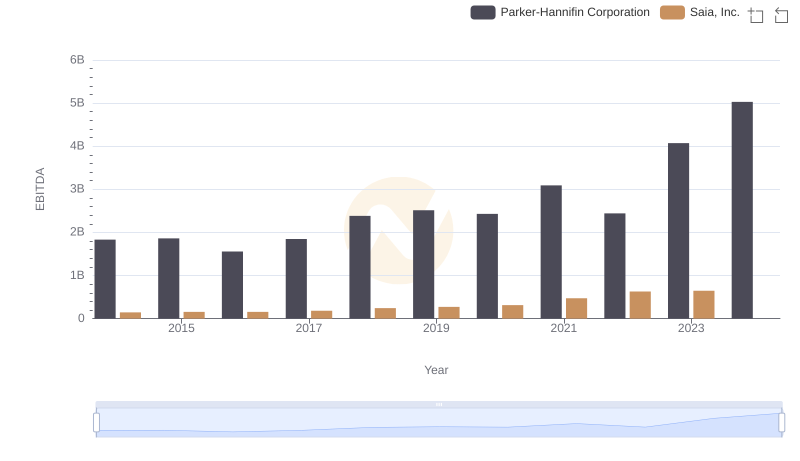

Parker-Hannifin Corporation vs Saia, Inc.: In-Depth EBITDA Performance Comparison

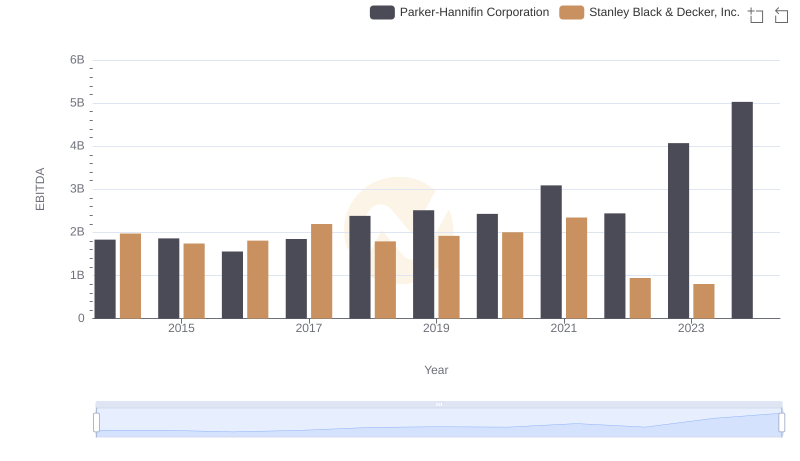

Parker-Hannifin Corporation vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison

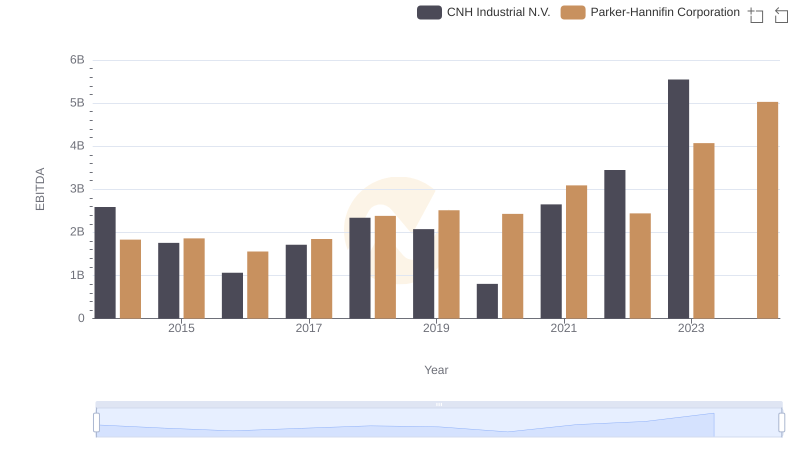

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs CNH Industrial N.V.

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and Curtiss-Wright Corporation

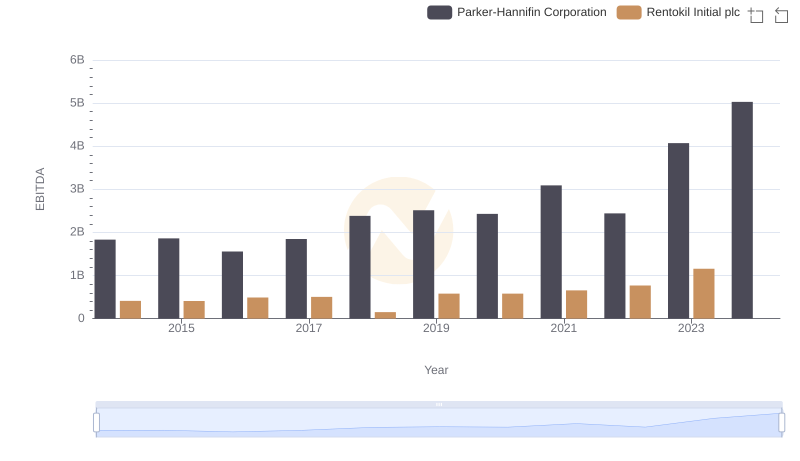

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to Rentokil Initial plc

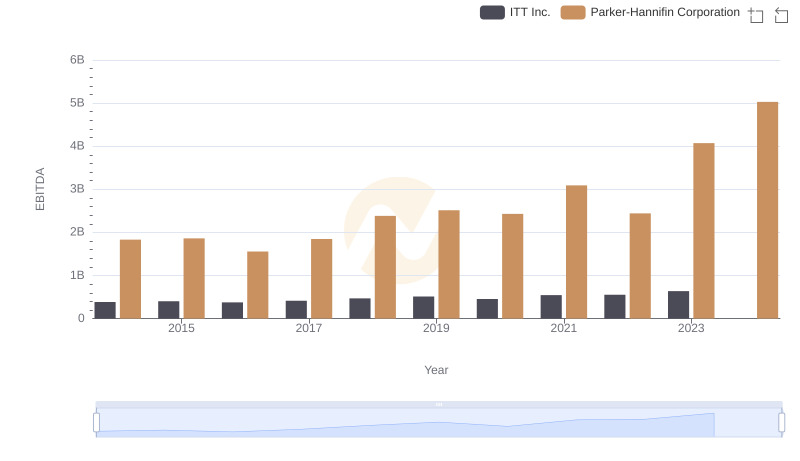

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to ITT Inc.