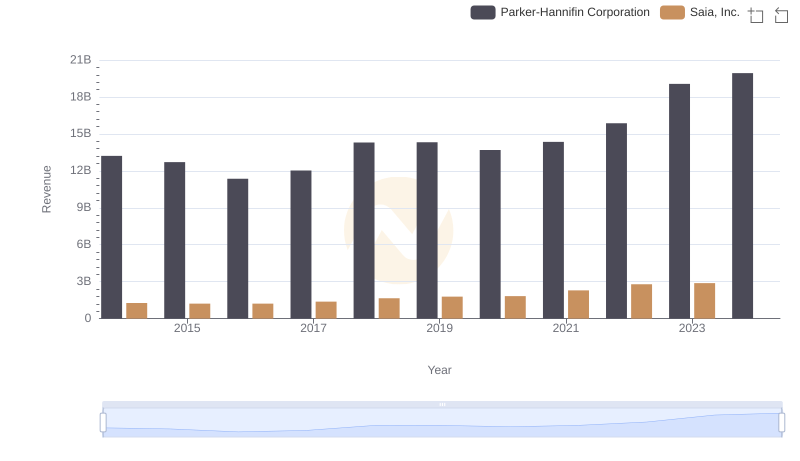

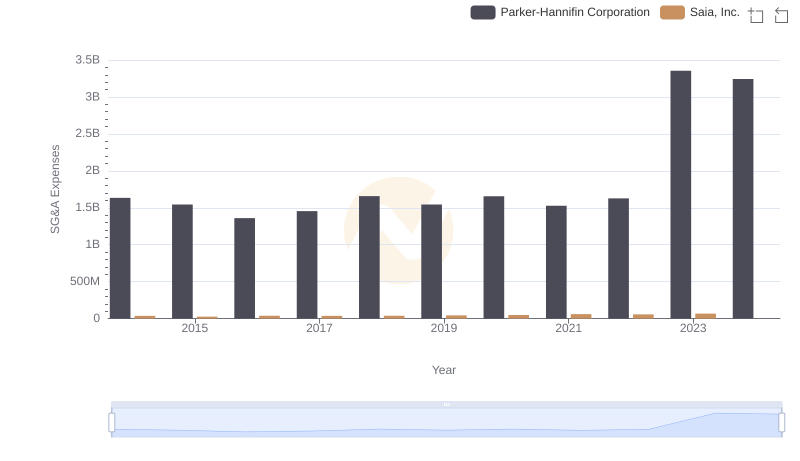

| __timestamp | Parker-Hannifin Corporation | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3027744000 | 159268000 |

| Thursday, January 1, 2015 | 3056499000 | 154120000 |

| Friday, January 1, 2016 | 2537369000 | 159502000 |

| Sunday, January 1, 2017 | 2840350000 | 175046000 |

| Monday, January 1, 2018 | 3539551000 | 230070000 |

| Tuesday, January 1, 2019 | 3616840000 | 249653000 |

| Wednesday, January 1, 2020 | 3409002000 | 283848000 |

| Friday, January 1, 2021 | 3897960000 | 451687000 |

| Saturday, January 1, 2022 | 4474341000 | 590963000 |

| Sunday, January 1, 2023 | 6429302000 | 598932000 |

| Monday, January 1, 2024 | 7127790000 |

Unleashing insights

In the competitive landscape of industrial manufacturing and logistics, Parker-Hannifin Corporation and Saia, Inc. have shown distinct trajectories in their gross profit trends over the past decade. From 2014 to 2023, Parker-Hannifin's gross profit surged by approximately 135%, peaking at an impressive $7.13 billion in 2023. This growth reflects the company's strategic expansions and innovations in motion and control technologies.

Conversely, Saia, Inc., a key player in the transportation sector, experienced a more modest growth of around 276% in the same period, reaching $598 million in 2023. This steady increase underscores Saia's resilience and adaptability in a rapidly evolving market.

While Parker-Hannifin's data for 2024 is available, Saia's figures remain undisclosed, leaving room for speculation on future performance. These trends highlight the dynamic nature of these industries and the companies' ability to navigate economic challenges.

Breaking Down Revenue Trends: Parker-Hannifin Corporation vs Saia, Inc.

Parker-Hannifin Corporation vs Comfort Systems USA, Inc.: A Gross Profit Performance Breakdown

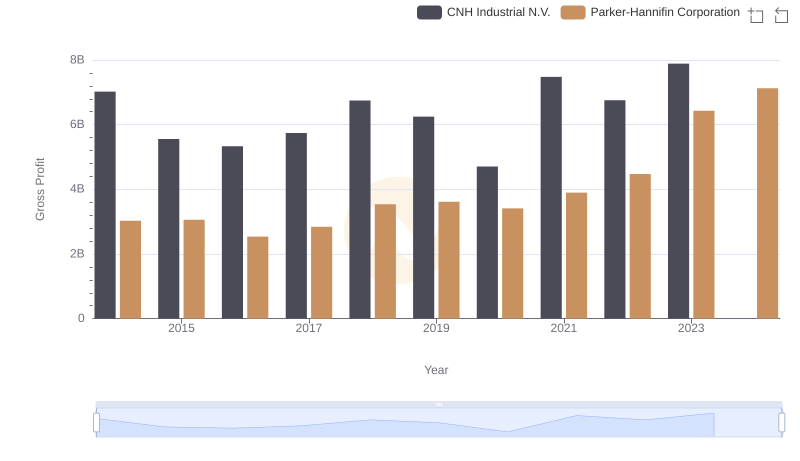

Parker-Hannifin Corporation and CNH Industrial N.V.: A Detailed Gross Profit Analysis

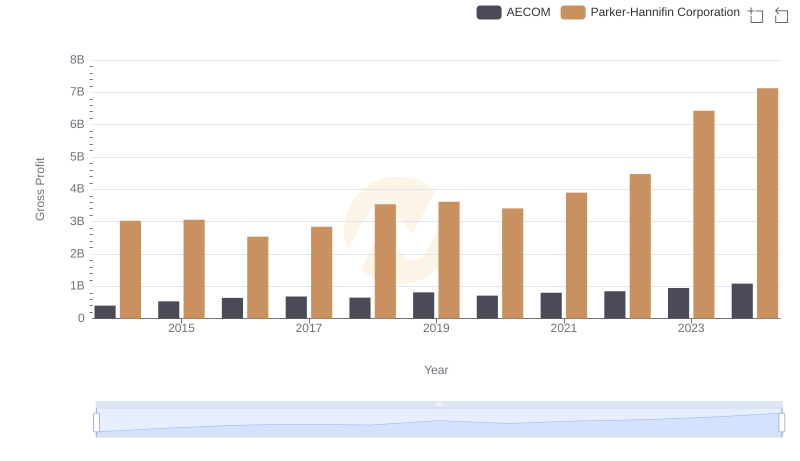

Gross Profit Comparison: Parker-Hannifin Corporation and AECOM Trends

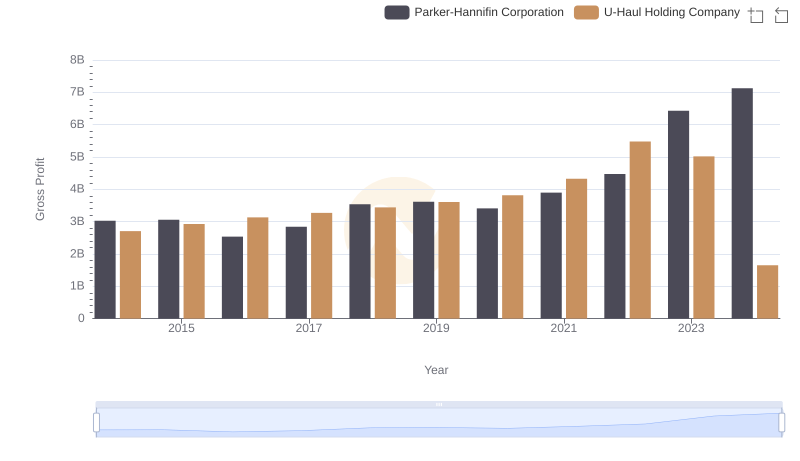

Gross Profit Trends Compared: Parker-Hannifin Corporation vs U-Haul Holding Company

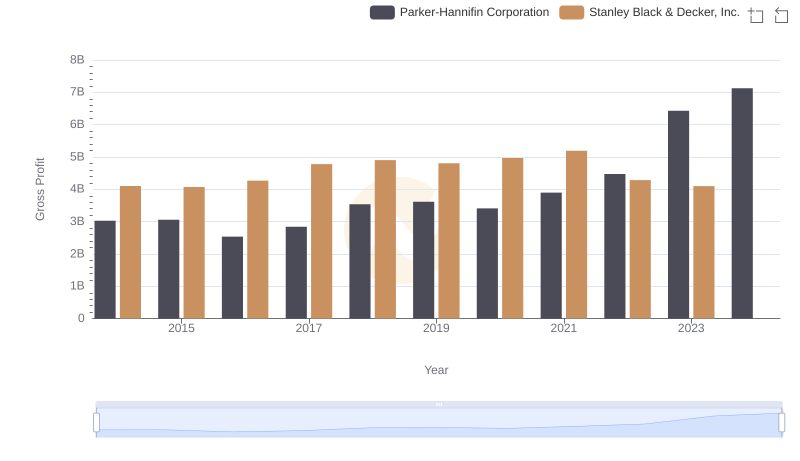

Gross Profit Comparison: Parker-Hannifin Corporation and Stanley Black & Decker, Inc. Trends

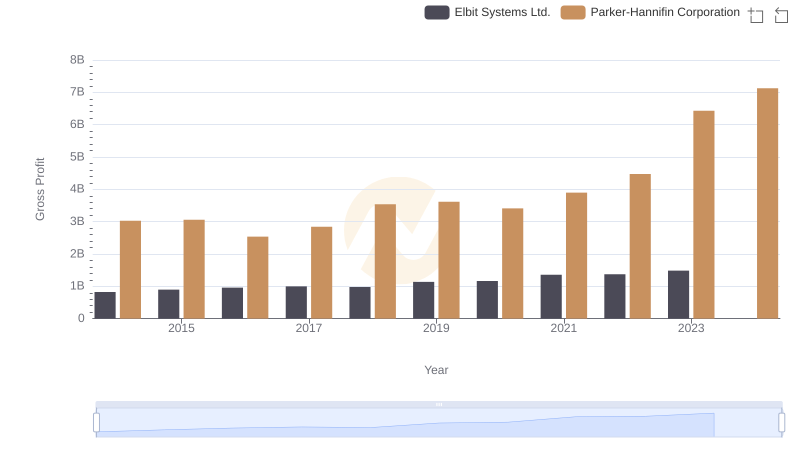

Gross Profit Trends Compared: Parker-Hannifin Corporation vs Elbit Systems Ltd.

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Curtiss-Wright Corporation

Parker-Hannifin Corporation and Saia, Inc.: SG&A Spending Patterns Compared

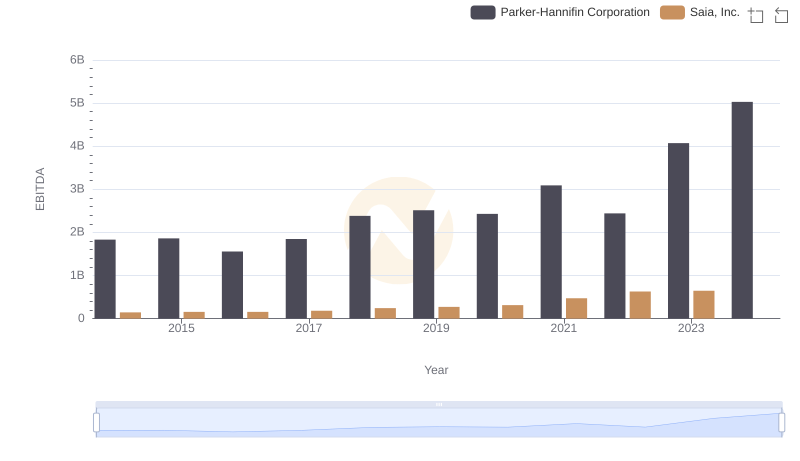

Parker-Hannifin Corporation vs Saia, Inc.: In-Depth EBITDA Performance Comparison