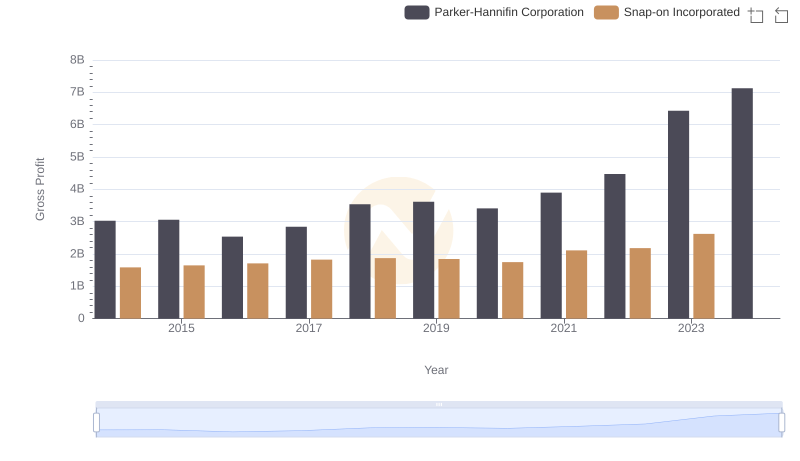

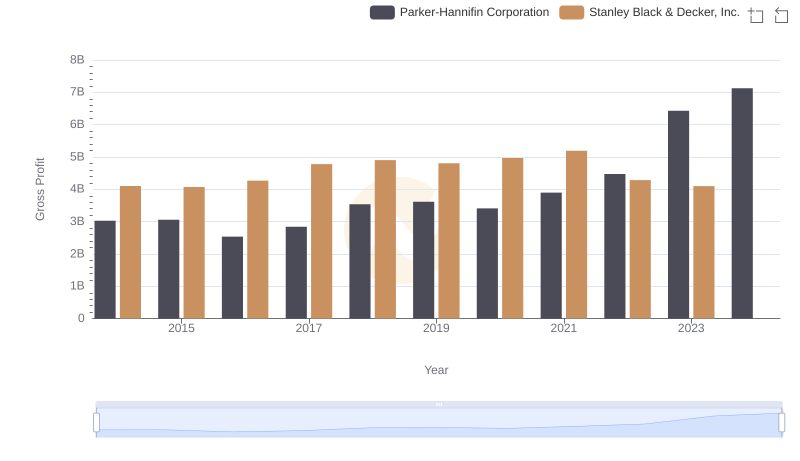

| __timestamp | Parker-Hannifin Corporation | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3027744000 | 4102700000 |

| Thursday, January 1, 2015 | 3056499000 | 4072000000 |

| Friday, January 1, 2016 | 2537369000 | 4267200000 |

| Sunday, January 1, 2017 | 2840350000 | 4778000000 |

| Monday, January 1, 2018 | 3539551000 | 4901900000 |

| Tuesday, January 1, 2019 | 3616840000 | 4805500000 |

| Wednesday, January 1, 2020 | 3409002000 | 4967900000 |

| Friday, January 1, 2021 | 3897960000 | 5194200000 |

| Saturday, January 1, 2022 | 4474341000 | 4284100000 |

| Sunday, January 1, 2023 | 6429302000 | 4098000000 |

| Monday, January 1, 2024 | 7127790000 | 4514400000 |

Data in motion

In the ever-evolving landscape of industrial manufacturing, Parker-Hannifin Corporation and Stanley Black & Decker, Inc. stand as titans. From 2014 to 2023, Parker-Hannifin's gross profit surged by over 135%, peaking at $7.13 billion in 2023. This remarkable growth reflects a strategic focus on innovation and efficiency. Meanwhile, Stanley Black & Decker experienced a more modest trajectory, with gross profits fluctuating around $4.1 billion in recent years. Notably, 2021 marked their highest point at $5.19 billion, showcasing resilience amidst global challenges. However, data for 2024 remains elusive, leaving room for speculation on future trends. This analysis underscores the dynamic nature of the industrial sector, where adaptability and foresight are key. As these companies navigate the complexities of the global market, their financial performance offers valuable insights into the broader economic landscape.

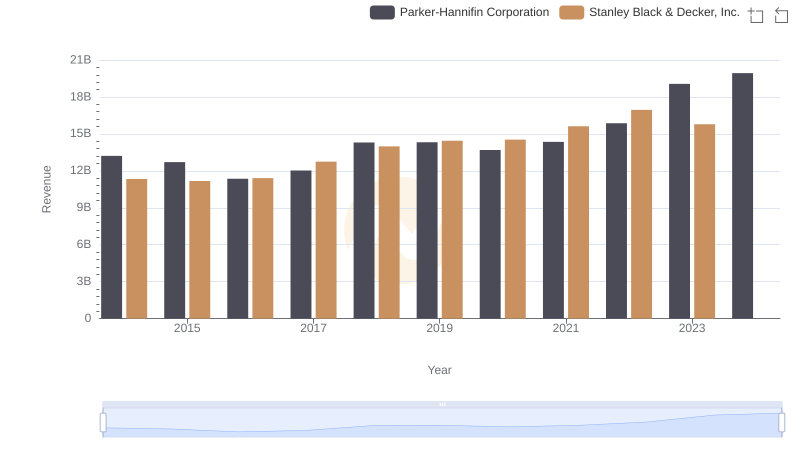

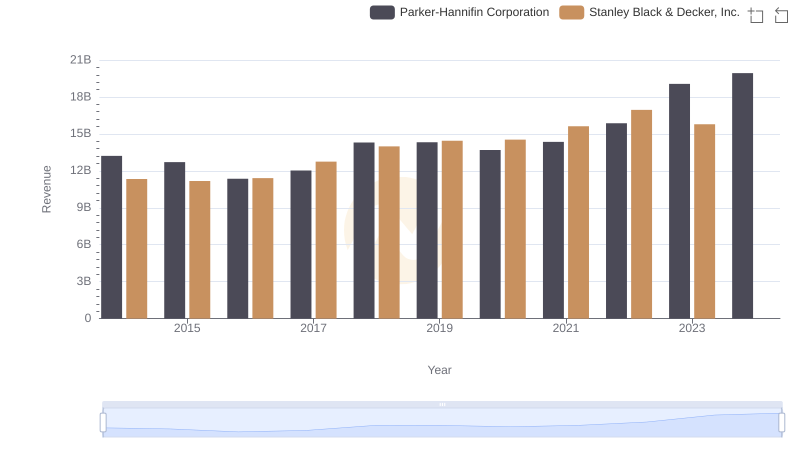

Parker-Hannifin Corporation and Stanley Black & Decker, Inc.: A Comprehensive Revenue Analysis

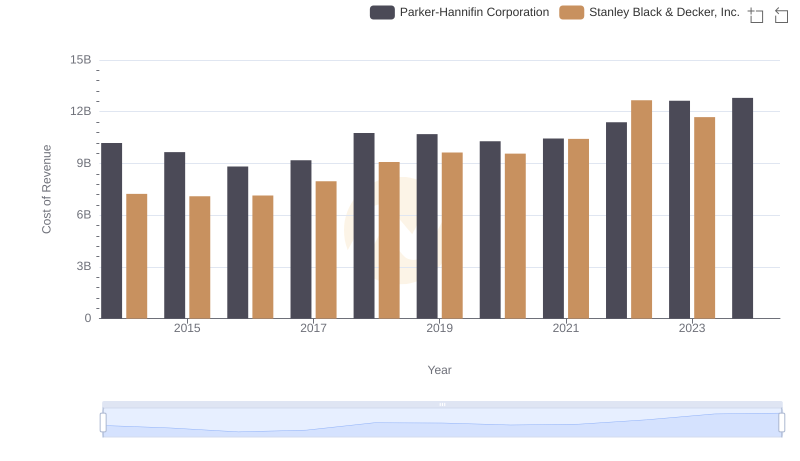

Cost of Revenue Trends: Parker-Hannifin Corporation vs Stanley Black & Decker, Inc.

Gross Profit Trends Compared: Parker-Hannifin Corporation vs Snap-on Incorporated

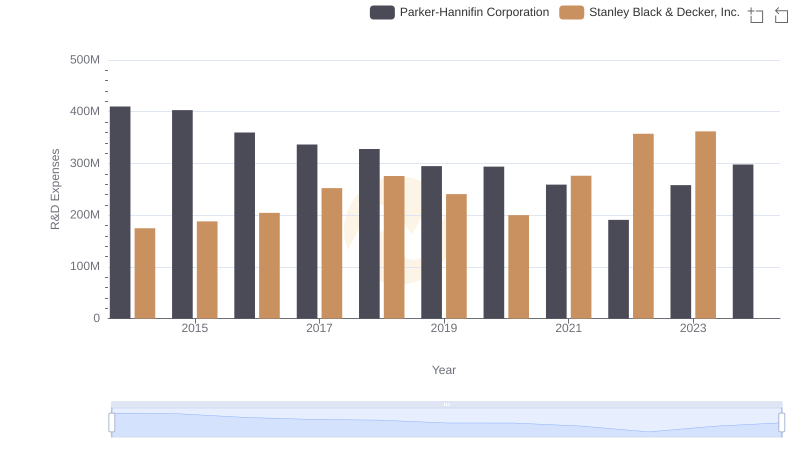

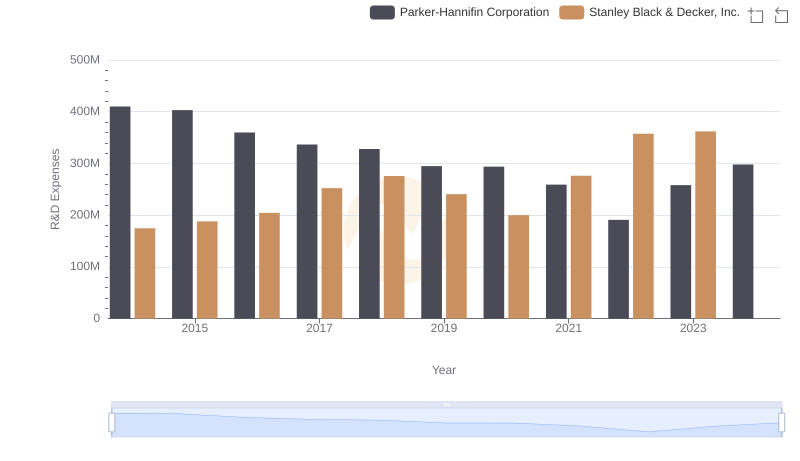

Research and Development Expenses Breakdown: Parker-Hannifin Corporation vs Stanley Black & Decker, Inc.

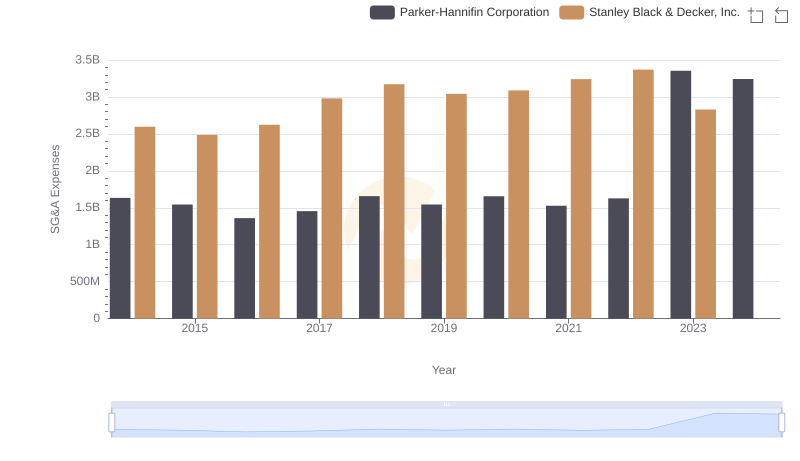

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and Stanley Black & Decker, Inc.

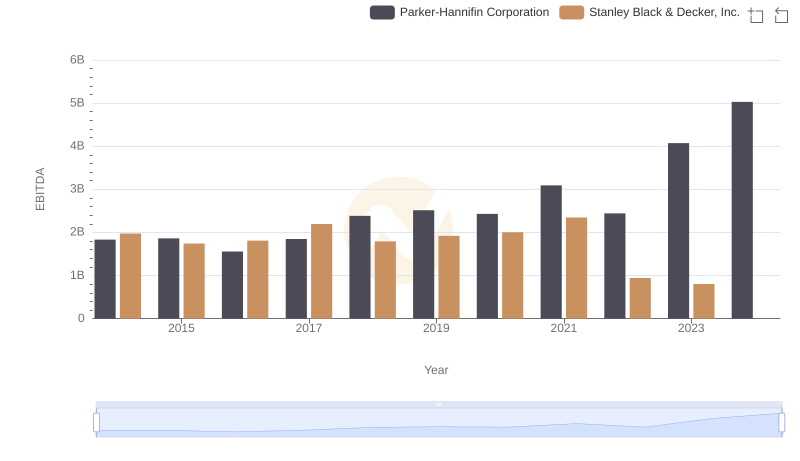

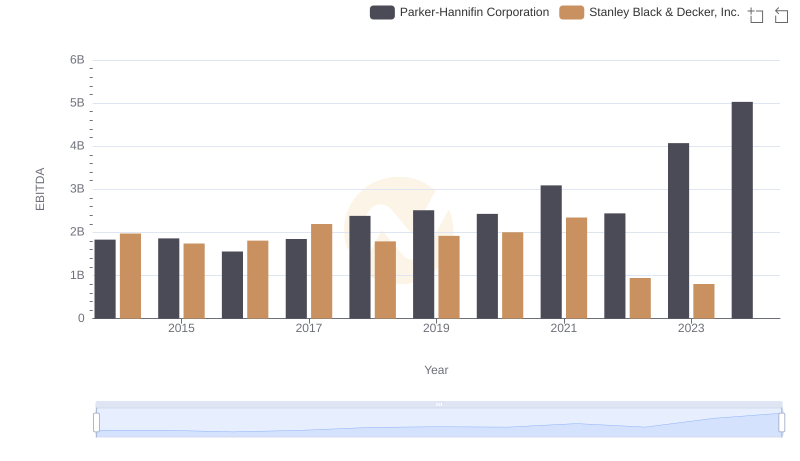

Comparative EBITDA Analysis: Parker-Hannifin Corporation vs Stanley Black & Decker, Inc.

Parker-Hannifin Corporation and Stanley Black & Decker, Inc.: A Comprehensive Revenue Analysis

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Stanley Black & Decker, Inc.

Gross Profit Comparison: Parker-Hannifin Corporation and Stanley Black & Decker, Inc. Trends

Parker-Hannifin Corporation or Stanley Black & Decker, Inc.: Who Invests More in Innovation?

Parker-Hannifin Corporation vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison