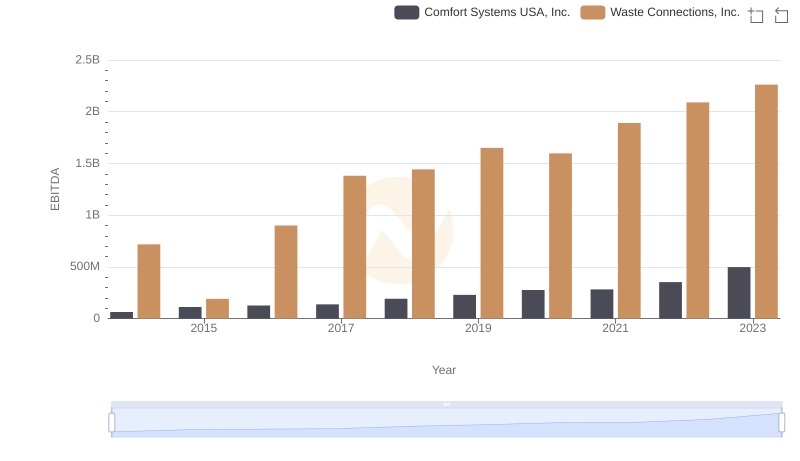

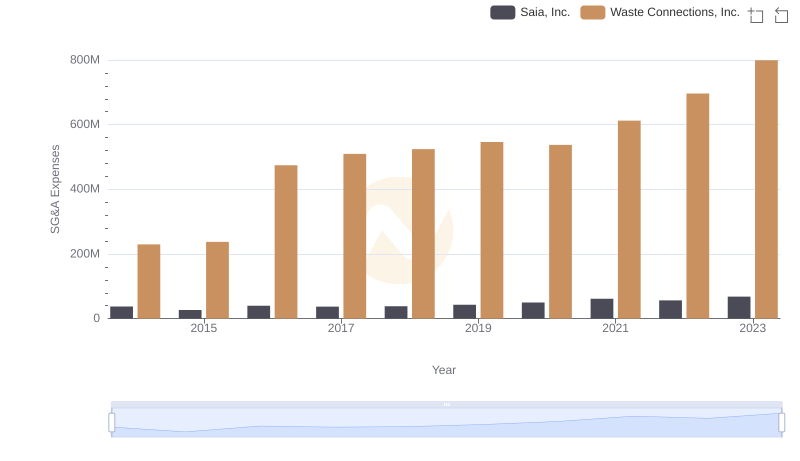

| __timestamp | Comfort Systems USA, Inc. | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 207652000 | 229474000 |

| Thursday, January 1, 2015 | 228965000 | 237484000 |

| Friday, January 1, 2016 | 243201000 | 474263000 |

| Sunday, January 1, 2017 | 266586000 | 509638000 |

| Monday, January 1, 2018 | 296986000 | 524388000 |

| Tuesday, January 1, 2019 | 340005000 | 546278000 |

| Wednesday, January 1, 2020 | 357777000 | 537632000 |

| Friday, January 1, 2021 | 376309000 | 612337000 |

| Saturday, January 1, 2022 | 489344000 | 696467000 |

| Sunday, January 1, 2023 | 536188999 | 799119000 |

| Monday, January 1, 2024 | 883445000 |

Unleashing the power of data

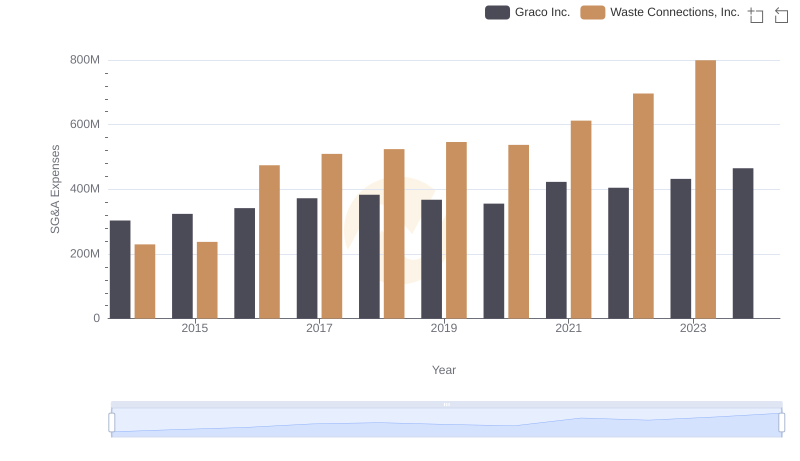

In the past decade, Waste Connections, Inc. and Comfort Systems USA, Inc. have demonstrated significant shifts in their Selling, General, and Administrative (SG&A) expenses, reflecting broader industry trends. Waste Connections, a leader in waste management, saw its SG&A expenses grow by approximately 250% from 2014 to 2023, peaking at nearly $800 million. This increase underscores the company's strategic investments in operational efficiency and expansion. Meanwhile, Comfort Systems USA, a key player in the HVAC sector, experienced a 160% rise in SG&A expenses over the same period, reaching over $530 million. This growth highlights the company's focus on scaling operations and enhancing service delivery. The data reveals a consistent upward trend in operational costs, emphasizing the importance of strategic financial management in maintaining competitive advantage in these dynamic industries.

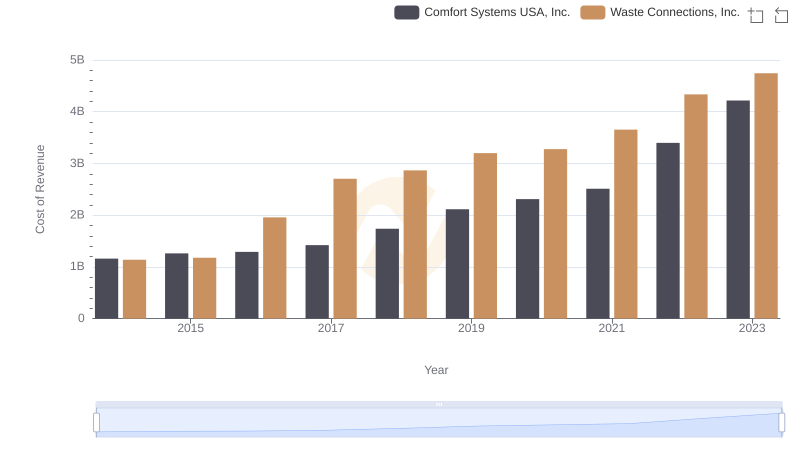

Cost of Revenue Comparison: Waste Connections, Inc. vs Comfort Systems USA, Inc.

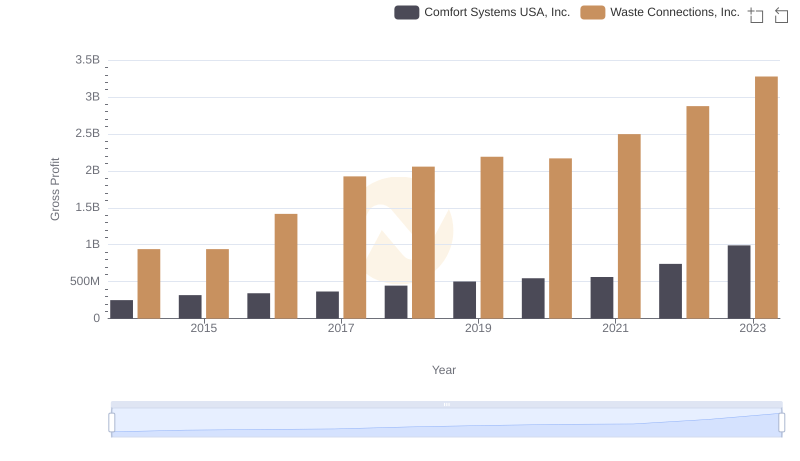

Gross Profit Trends Compared: Waste Connections, Inc. vs Comfort Systems USA, Inc.

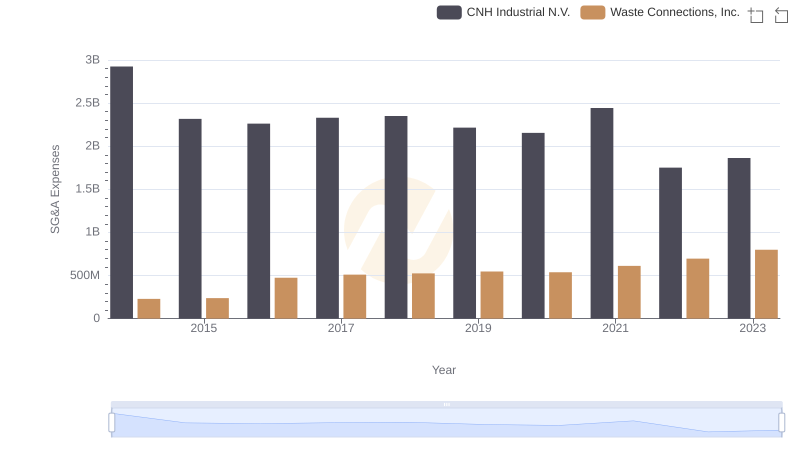

Waste Connections, Inc. vs CNH Industrial N.V.: SG&A Expense Trends

Operational Costs Compared: SG&A Analysis of Waste Connections, Inc. and Graco Inc.

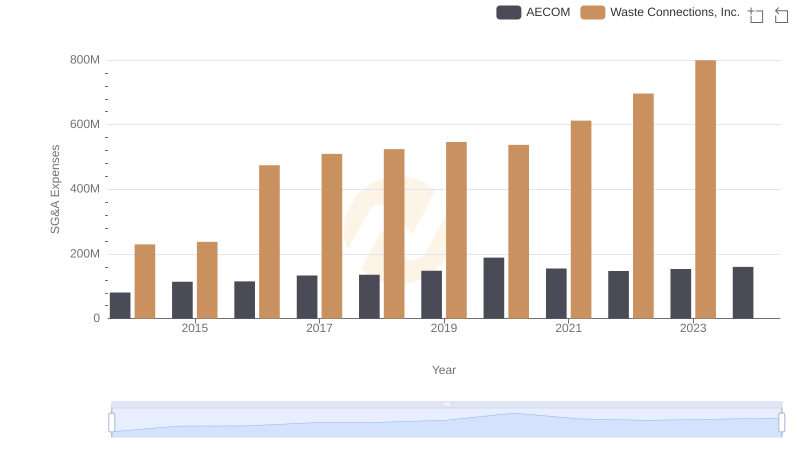

Comparing SG&A Expenses: Waste Connections, Inc. vs AECOM Trends and Insights

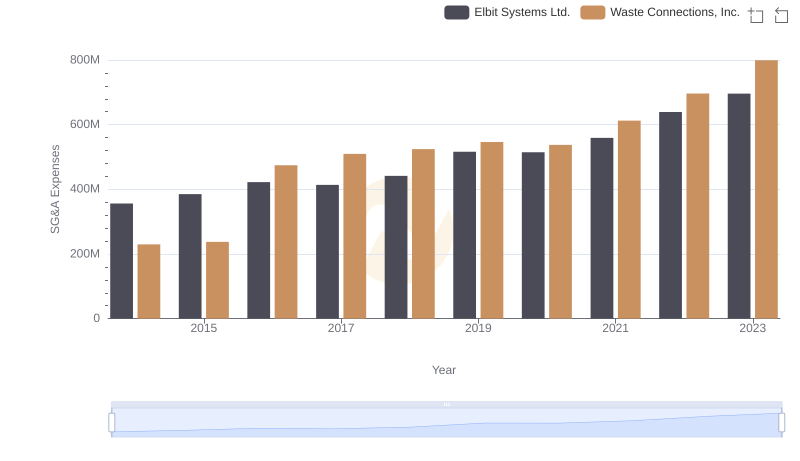

Waste Connections, Inc. and Elbit Systems Ltd.: SG&A Spending Patterns Compared

Waste Connections, Inc. vs Comfort Systems USA, Inc.: In-Depth EBITDA Performance Comparison

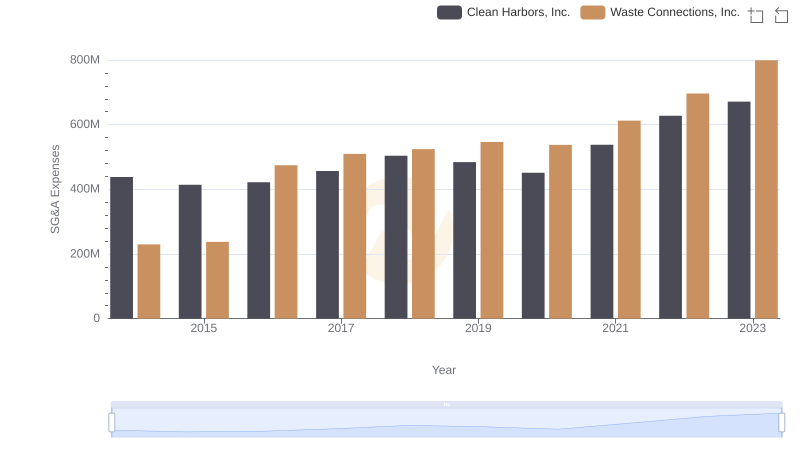

Selling, General, and Administrative Costs: Waste Connections, Inc. vs Clean Harbors, Inc.

SG&A Efficiency Analysis: Comparing Waste Connections, Inc. and Saia, Inc.