| __timestamp | Axon Enterprise, Inc. | CNH Industrial N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 2925000000 |

| Thursday, January 1, 2015 | 69698000 | 2317000000 |

| Friday, January 1, 2016 | 108076000 | 2262000000 |

| Sunday, January 1, 2017 | 138692000 | 2330000000 |

| Monday, January 1, 2018 | 156886000 | 2351000000 |

| Tuesday, January 1, 2019 | 212959000 | 2216000000 |

| Wednesday, January 1, 2020 | 307286000 | 2155000000 |

| Friday, January 1, 2021 | 515007000 | 2443000000 |

| Saturday, January 1, 2022 | 401575000 | 1752000000 |

| Sunday, January 1, 2023 | 496874000 | 1863000000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Axon Enterprise, Inc. and CNH Industrial N.V., from 2014 to 2023.

Axon Enterprise, known for its innovative public safety technologies, has seen a remarkable increase in SG&A expenses, growing by over 800% from 2014 to 2023. This surge reflects its aggressive expansion and investment in R&D. In contrast, CNH Industrial, a leader in capital goods, experienced a 36% decrease in SG&A expenses over the same period, indicating a strategic shift towards operational efficiency.

This comparative analysis highlights the diverse strategies of these companies in managing operational costs, offering valuable insights into their financial health and strategic priorities.

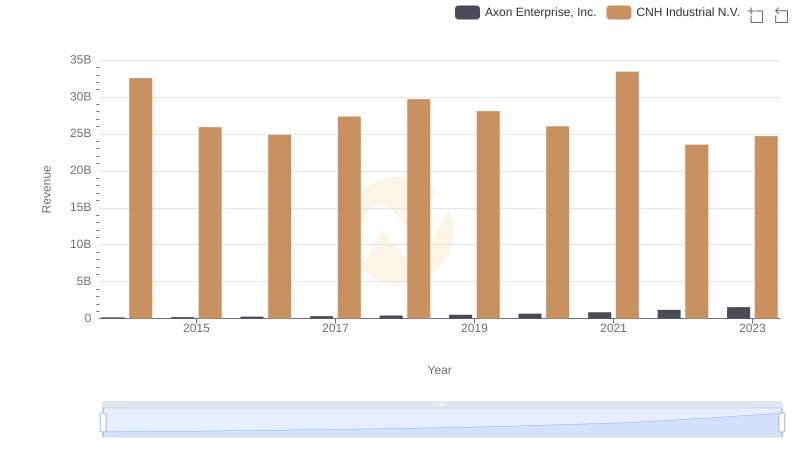

Axon Enterprise, Inc. vs CNH Industrial N.V.: Examining Key Revenue Metrics

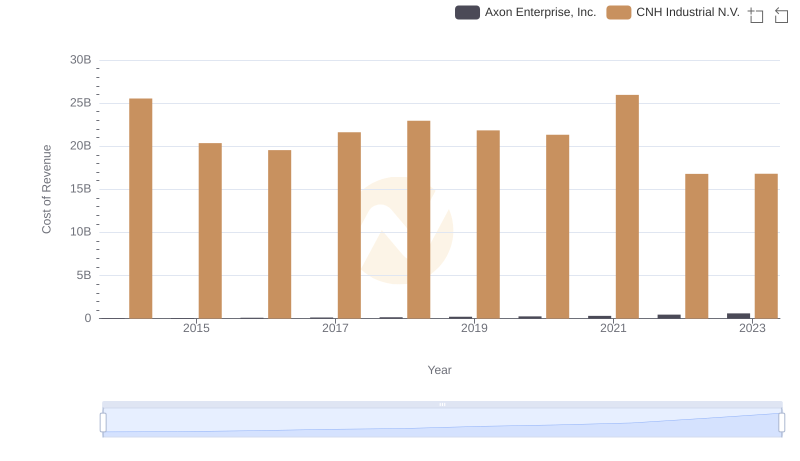

Cost Insights: Breaking Down Axon Enterprise, Inc. and CNH Industrial N.V.'s Expenses

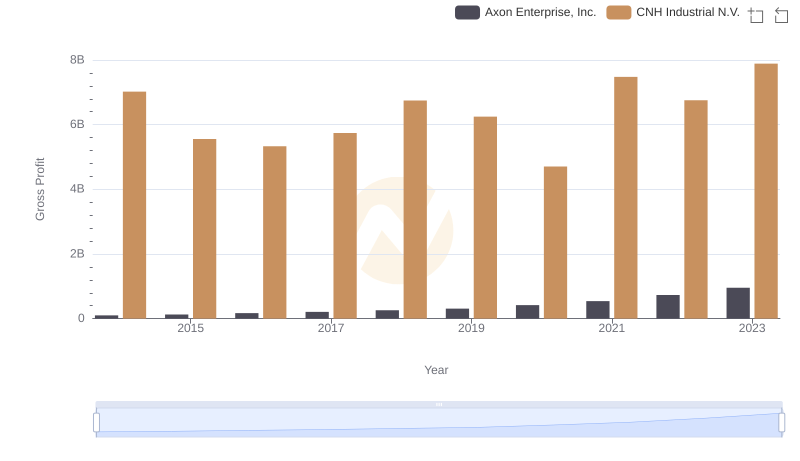

Who Generates Higher Gross Profit? Axon Enterprise, Inc. or CNH Industrial N.V.

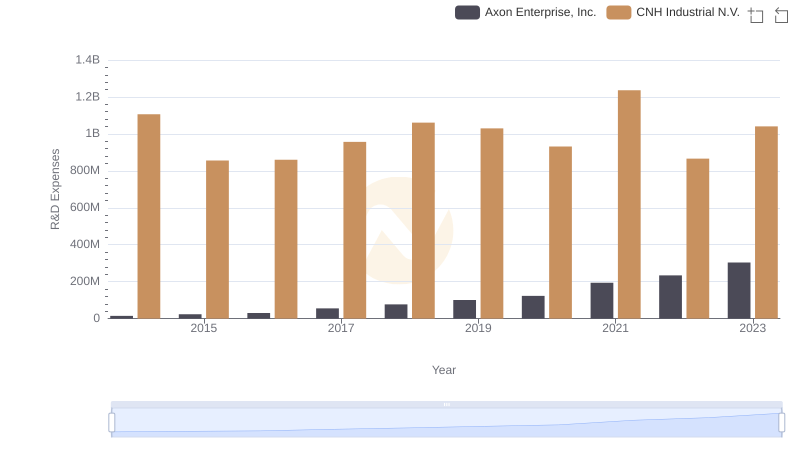

Axon Enterprise, Inc. or CNH Industrial N.V.: Who Invests More in Innovation?

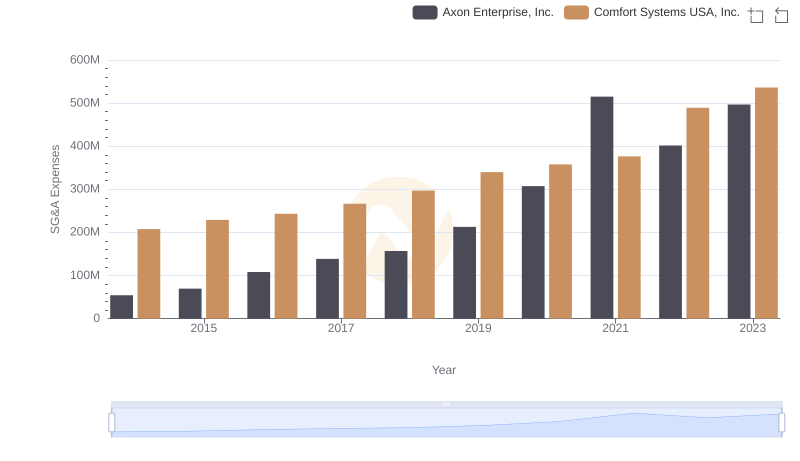

Axon Enterprise, Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?

Axon Enterprise, Inc. and Avery Dennison Corporation: SG&A Spending Patterns Compared

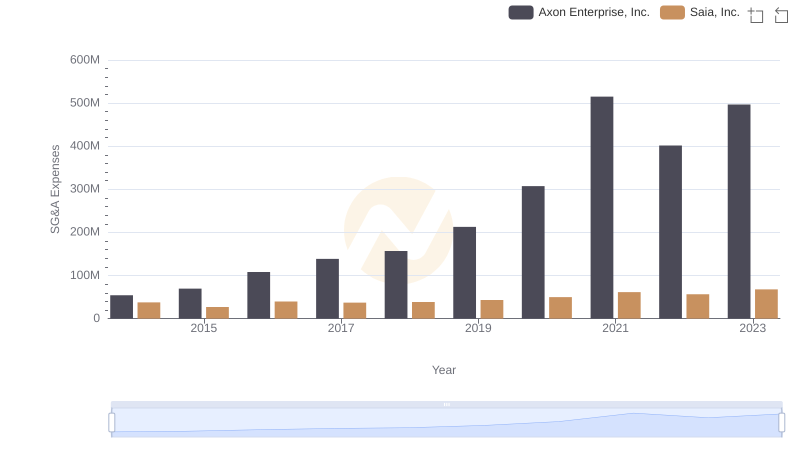

Axon Enterprise, Inc. and Saia, Inc.: SG&A Spending Patterns Compared

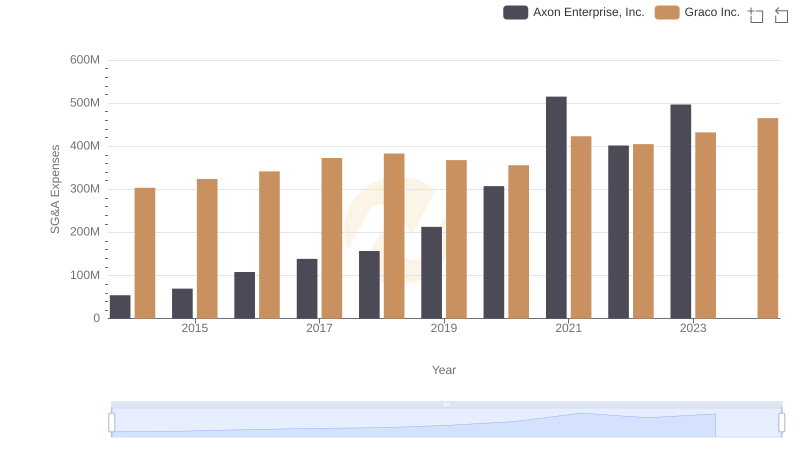

Cost Management Insights: SG&A Expenses for Axon Enterprise, Inc. and Graco Inc.

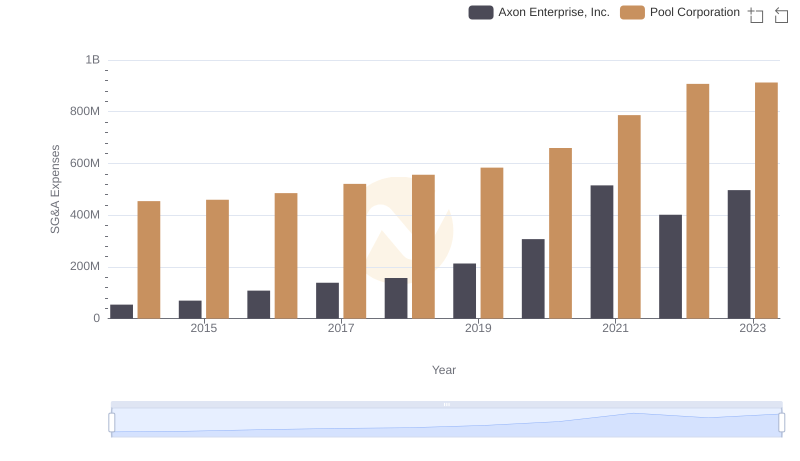

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Pool Corporation Trends and Insights

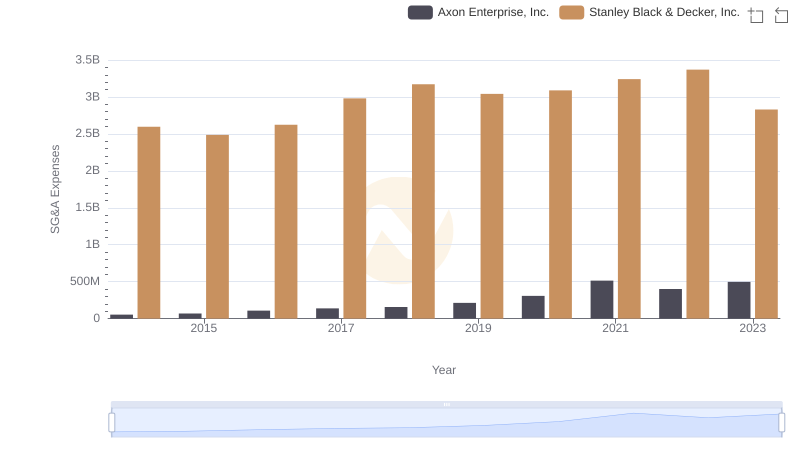

Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.: SG&A Expense Trends

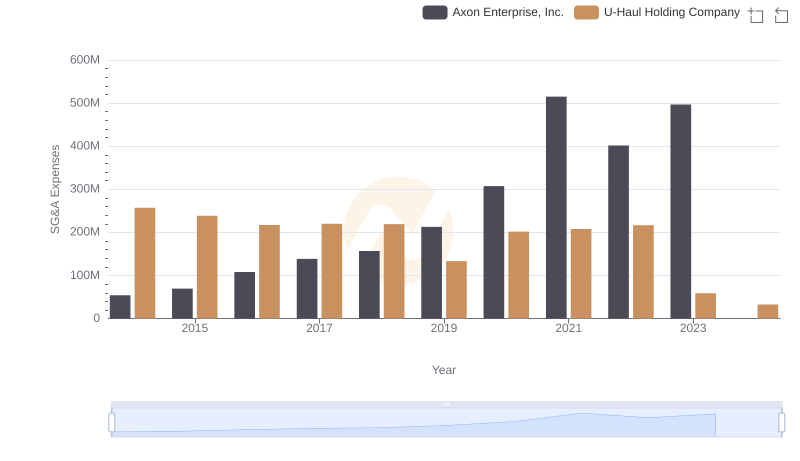

Cost Management Insights: SG&A Expenses for Axon Enterprise, Inc. and U-Haul Holding Company

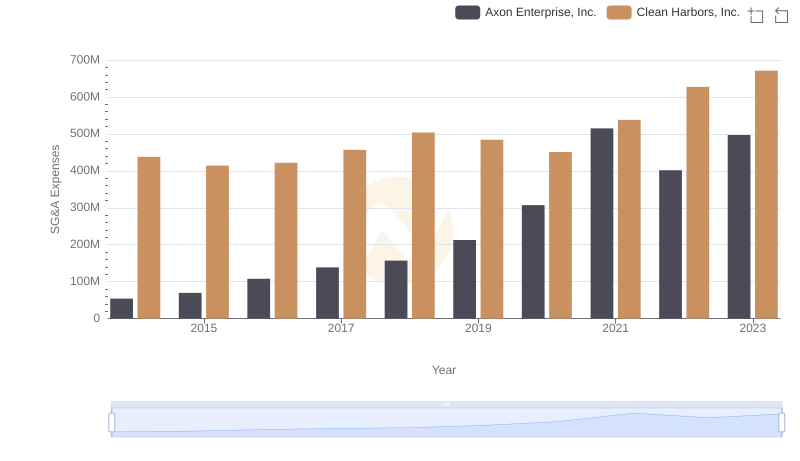

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Clean Harbors, Inc. Trends and Insights