| __timestamp | Axon Enterprise, Inc. | Clean Harbors, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 437921000 |

| Thursday, January 1, 2015 | 69698000 | 414164000 |

| Friday, January 1, 2016 | 108076000 | 422015000 |

| Sunday, January 1, 2017 | 138692000 | 456648000 |

| Monday, January 1, 2018 | 156886000 | 503747000 |

| Tuesday, January 1, 2019 | 212959000 | 484054000 |

| Wednesday, January 1, 2020 | 307286000 | 451044000 |

| Friday, January 1, 2021 | 515007000 | 537962000 |

| Saturday, January 1, 2022 | 401575000 | 627391000 |

| Sunday, January 1, 2023 | 496874000 | 671161000 |

| Monday, January 1, 2024 | 739629000 |

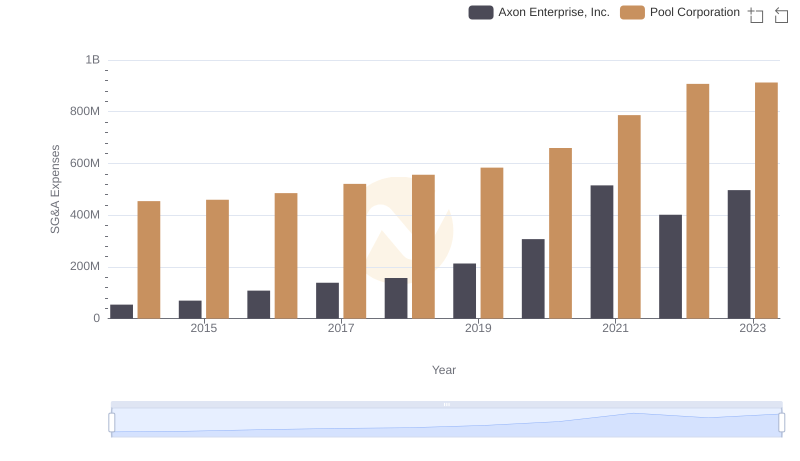

Unleashing the power of data

In the competitive landscape of corporate America, understanding the financial health of companies is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Axon Enterprise, Inc. and Clean Harbors, Inc. over the past decade.

From 2014 to 2023, Axon Enterprise, Inc. saw a staggering increase in SG&A expenses, growing by over 800%. This reflects the company's aggressive expansion and investment in administrative capabilities. Notably, 2021 marked a peak with expenses reaching nearly 515 million, a significant leap from 2014's 54 million.

In contrast, Clean Harbors, Inc. maintained a more stable trajectory, with expenses increasing by approximately 53% over the same period. The company's strategic cost management is evident, with 2023 expenses at 671 million, up from 438 million in 2014.

This comparison highlights the diverse strategies of these industry players, offering insights into their operational priorities.

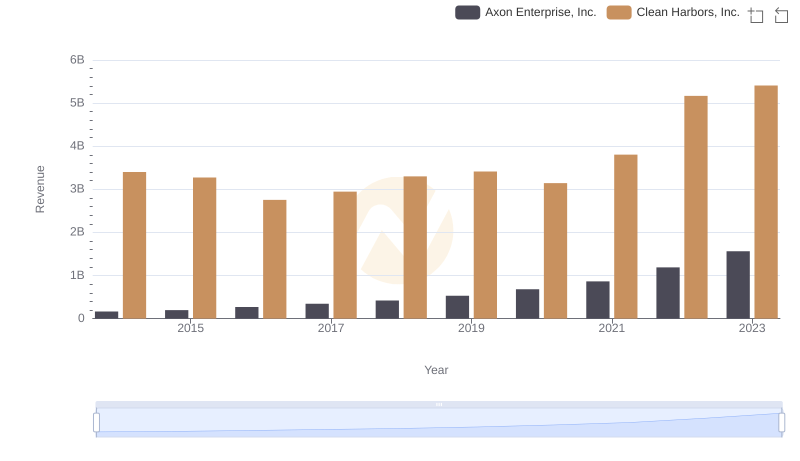

Comparing Revenue Performance: Axon Enterprise, Inc. or Clean Harbors, Inc.?

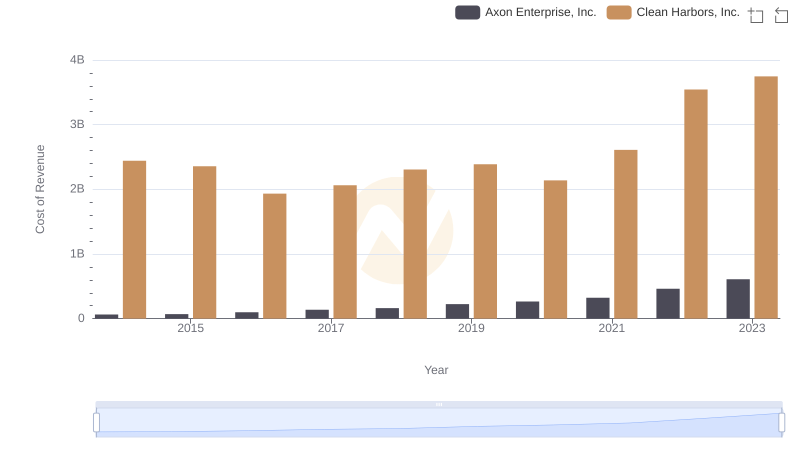

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Clean Harbors, Inc.

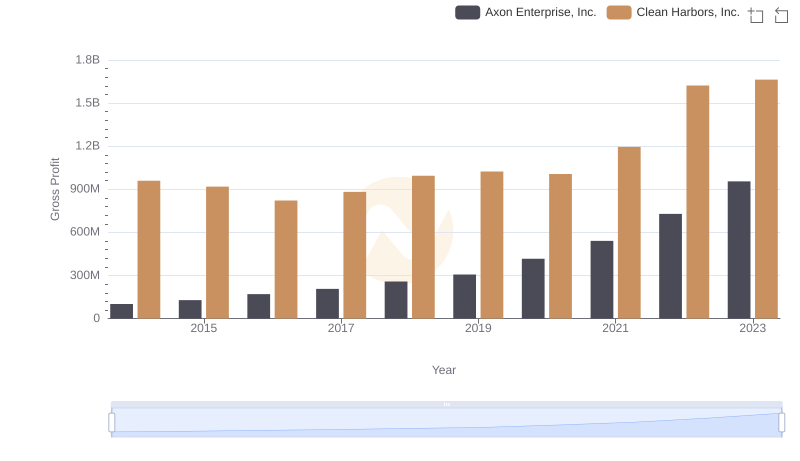

Key Insights on Gross Profit: Axon Enterprise, Inc. vs Clean Harbors, Inc.

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Pool Corporation Trends and Insights

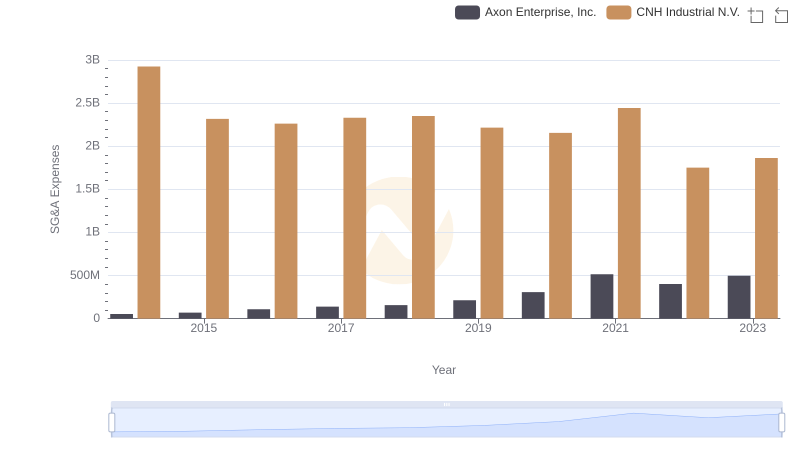

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and CNH Industrial N.V.

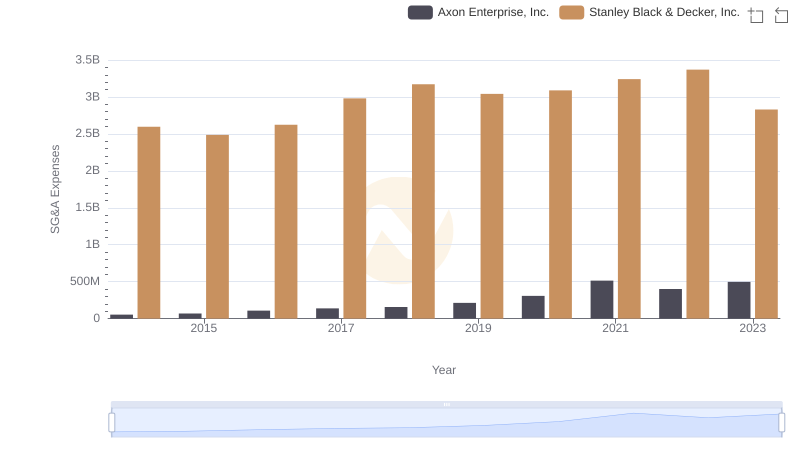

Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.: SG&A Expense Trends

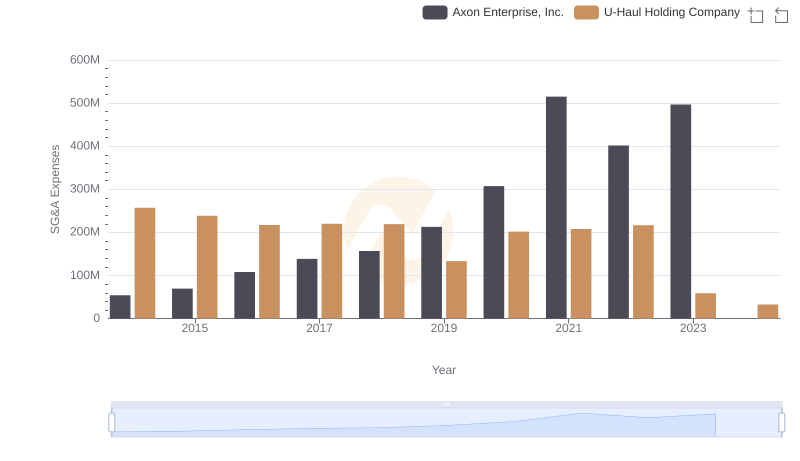

Cost Management Insights: SG&A Expenses for Axon Enterprise, Inc. and U-Haul Holding Company

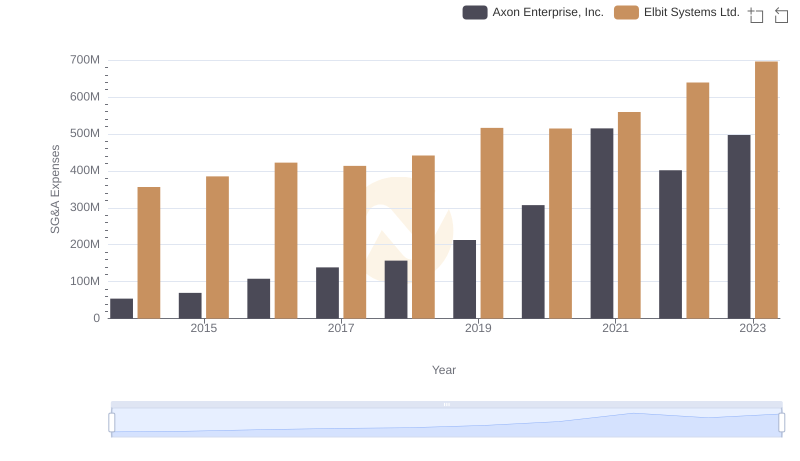

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Elbit Systems Ltd. Trends and Insights

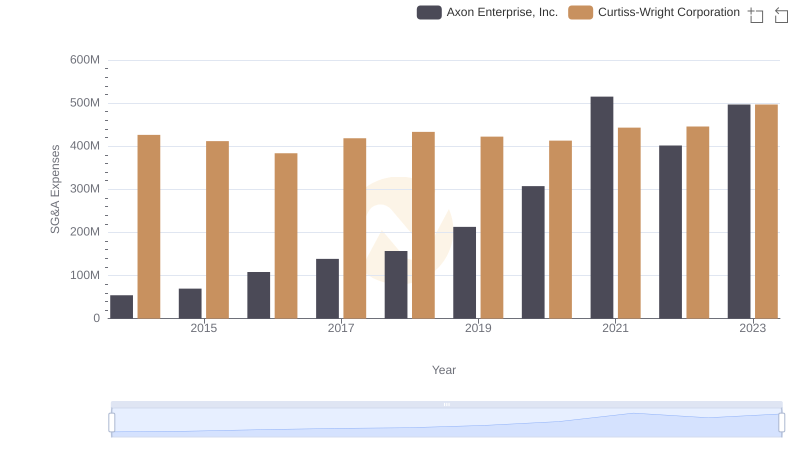

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Curtiss-Wright Corporation Trends and Insights

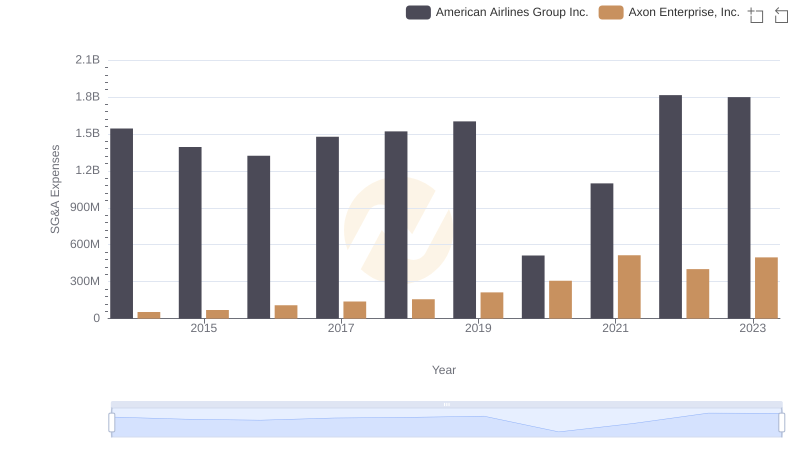

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or American Airlines Group Inc.

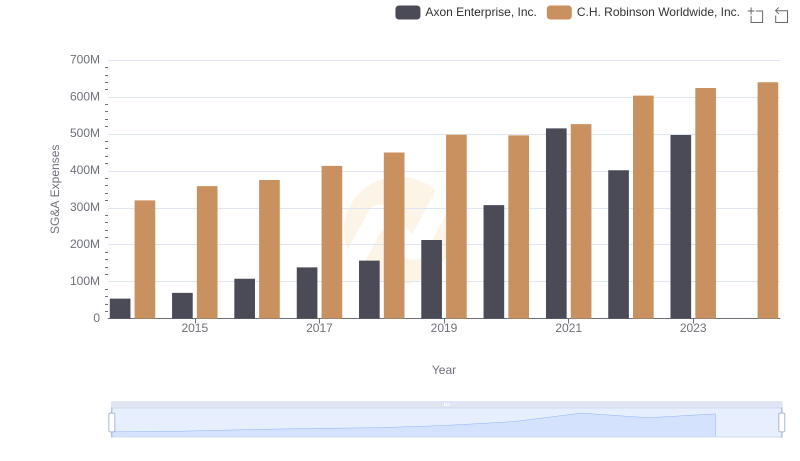

Axon Enterprise, Inc. vs C.H. Robinson Worldwide, Inc.: SG&A Expense Trends

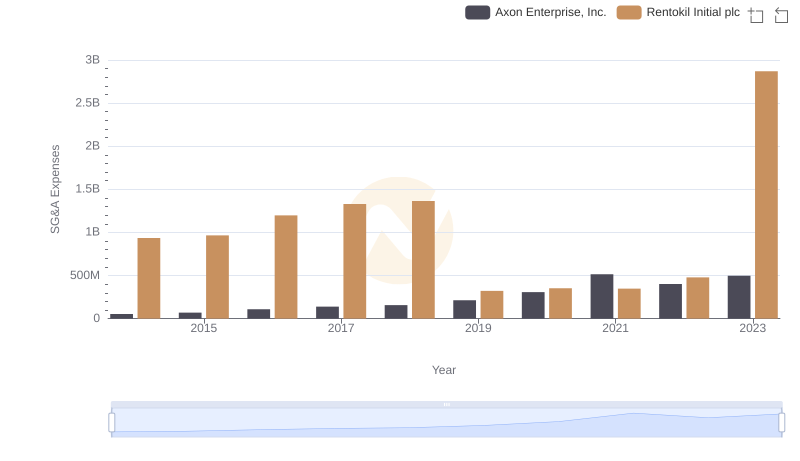

Axon Enterprise, Inc. vs Rentokil Initial plc: SG&A Expense Trends