| __timestamp | Equifax Inc. | Hubbell Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 1109000000 |

| Thursday, January 1, 2015 | 1776200000 | 1091800000 |

| Friday, January 1, 2016 | 2031500000 | 1100700000 |

| Sunday, January 1, 2017 | 2151500000 | 1151900000 |

| Monday, January 1, 2018 | 1971700000 | 1300400000 |

| Tuesday, January 1, 2019 | 1985900000 | 1352700000 |

| Wednesday, January 1, 2020 | 2390100000 | 1209300000 |

| Friday, January 1, 2021 | 2943000000 | 1151500000 |

| Saturday, January 1, 2022 | 2945000000 | 1471600000 |

| Sunday, January 1, 2023 | 2930100000 | 1888100000 |

| Monday, January 1, 2024 | 5681100000 | 1904100000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding the gross profit trends of industry giants like Equifax Inc. and Hubbell Incorporated offers valuable insights. From 2014 to 2023, Equifax Inc. demonstrated a robust growth trajectory, with its gross profit surging by approximately 84%, peaking in 2022 and 2023. This growth reflects Equifax's strategic initiatives and market adaptability.

Conversely, Hubbell Incorporated, while starting with a lower gross profit in 2014, showcased a steady upward trend, culminating in a remarkable 70% increase by 2023. This growth underscores Hubbell's resilience and ability to navigate market challenges.

The data reveals a compelling narrative of two companies, each with unique strategies and market positions, yet both achieving significant financial milestones over the past decade. As we look to the future, these trends provide a benchmark for evaluating corporate performance in the financial sector.

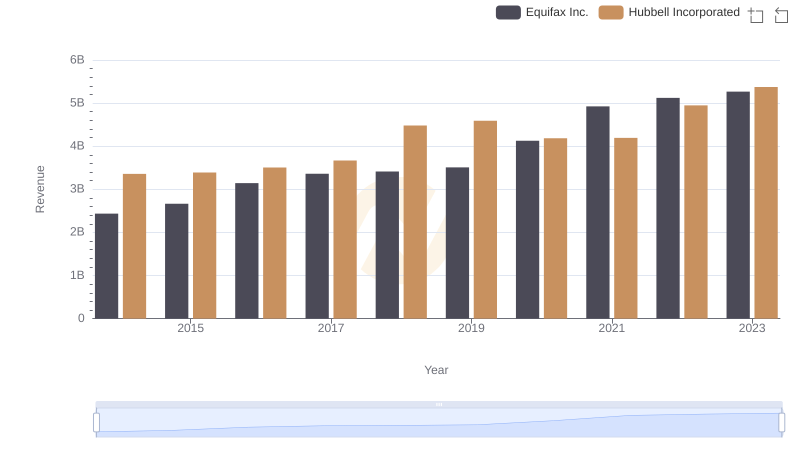

Breaking Down Revenue Trends: Equifax Inc. vs Hubbell Incorporated

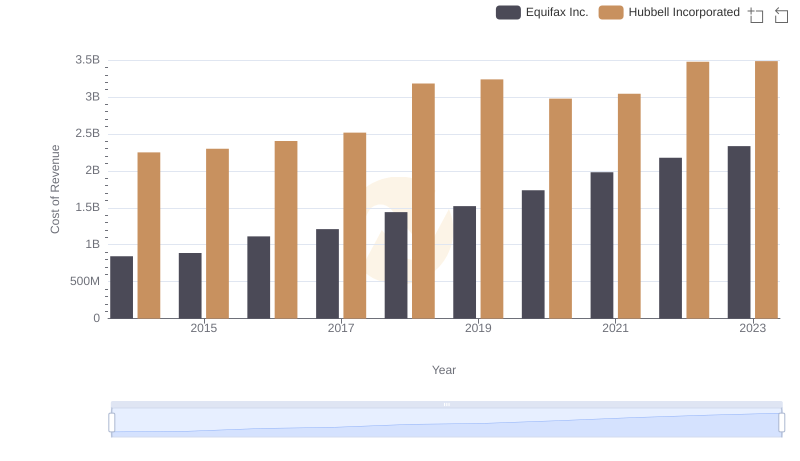

Cost Insights: Breaking Down Equifax Inc. and Hubbell Incorporated's Expenses

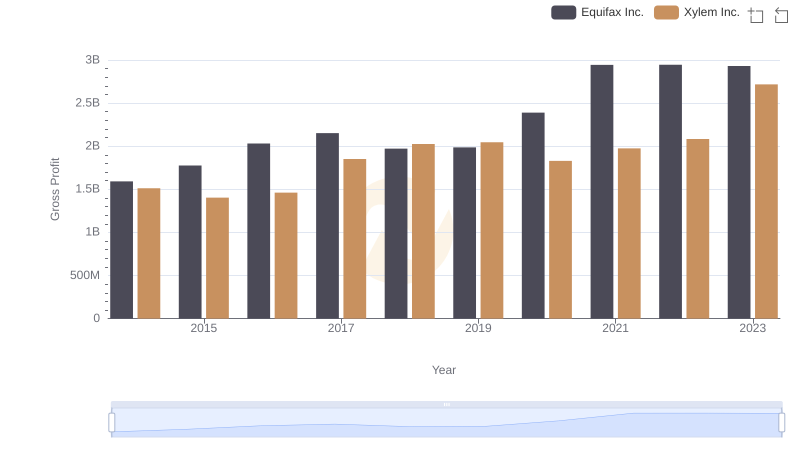

Gross Profit Trends Compared: Equifax Inc. vs Xylem Inc.

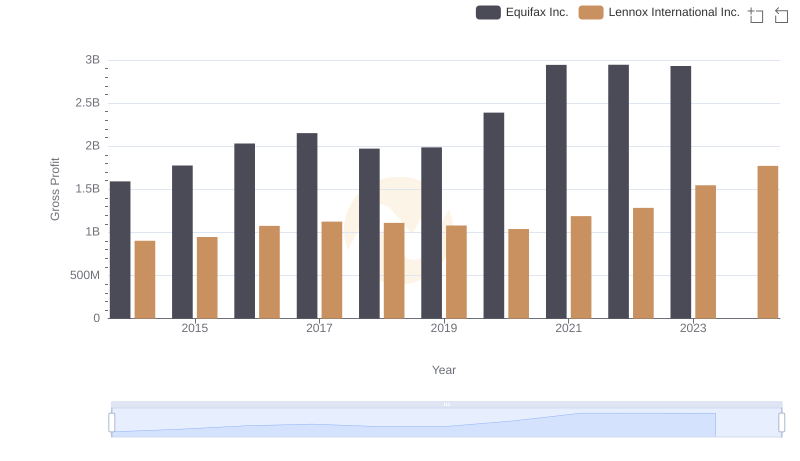

Equifax Inc. vs Lennox International Inc.: A Gross Profit Performance Breakdown

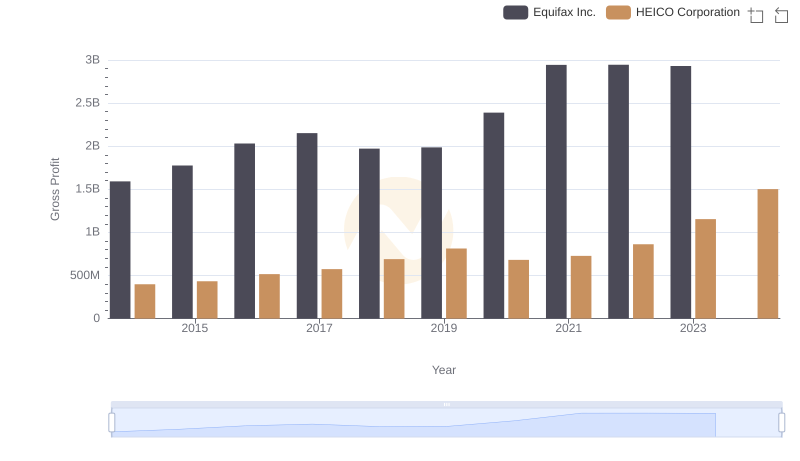

Gross Profit Comparison: Equifax Inc. and HEICO Corporation Trends

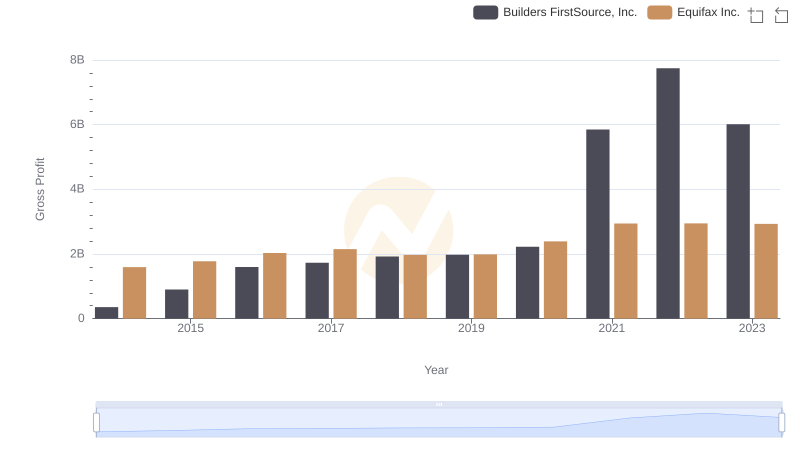

Key Insights on Gross Profit: Equifax Inc. vs Builders FirstSource, Inc.

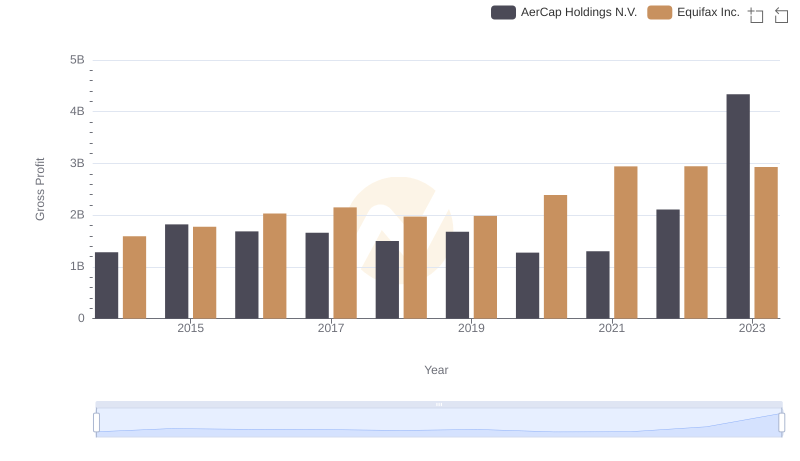

Key Insights on Gross Profit: Equifax Inc. vs AerCap Holdings N.V.

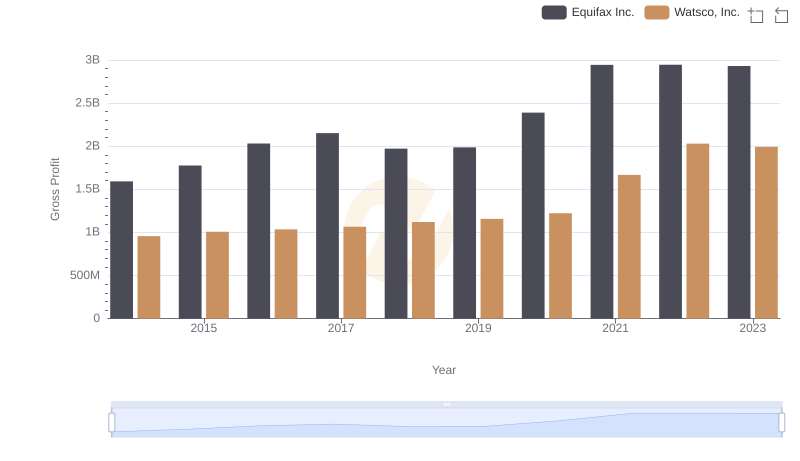

Equifax Inc. vs Watsco, Inc.: A Gross Profit Performance Breakdown

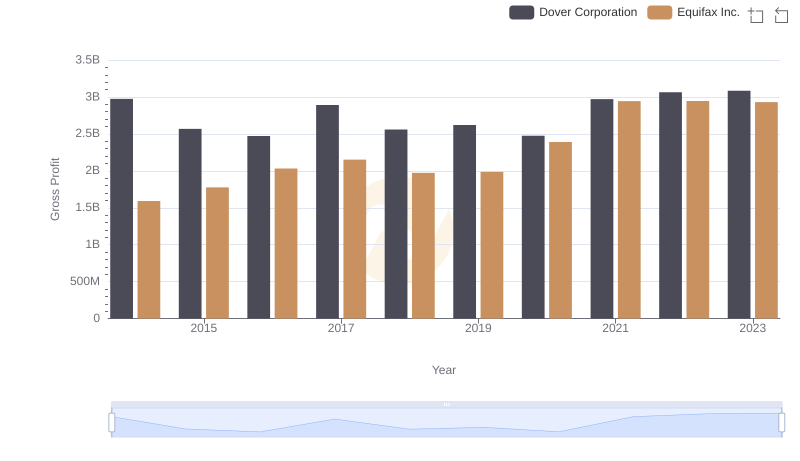

Equifax Inc. vs Dover Corporation: A Gross Profit Performance Breakdown

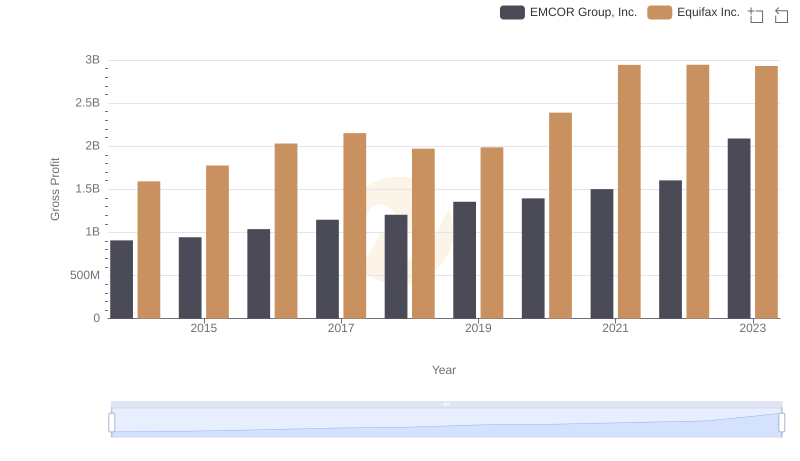

Key Insights on Gross Profit: Equifax Inc. vs EMCOR Group, Inc.