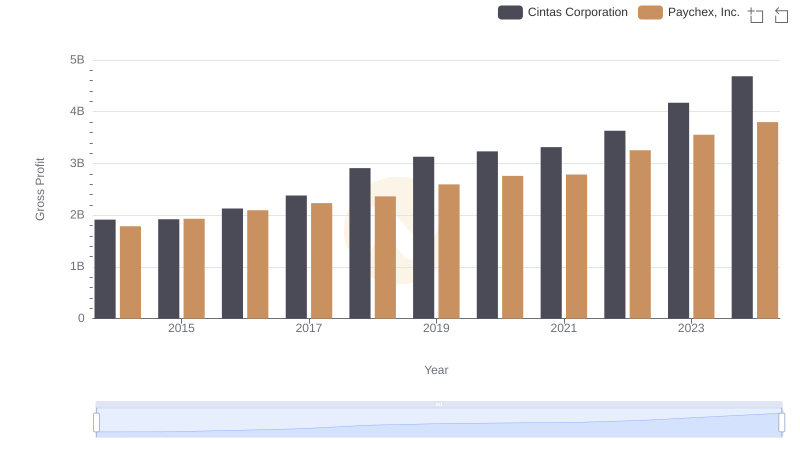

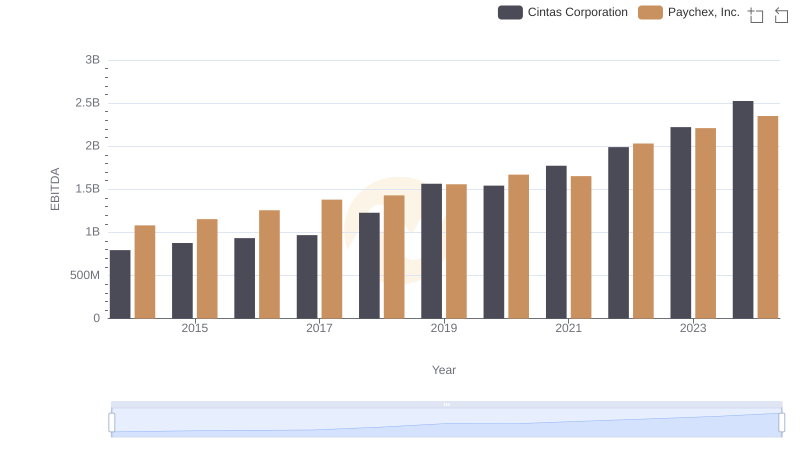

| __timestamp | Cintas Corporation | Paychex, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 803700000 |

| Thursday, January 1, 2015 | 1224930000 | 878000000 |

| Friday, January 1, 2016 | 1348122000 | 948200000 |

| Sunday, January 1, 2017 | 1527380000 | 992100000 |

| Monday, January 1, 2018 | 1916792000 | 1075600000 |

| Tuesday, January 1, 2019 | 1980644000 | 1223400000 |

| Wednesday, January 1, 2020 | 2071052000 | 1299200000 |

| Friday, January 1, 2021 | 1929159000 | 1324900000 |

| Saturday, January 1, 2022 | 2044876000 | 1415400000 |

| Sunday, January 1, 2023 | 2370704000 | 1521000000 |

| Monday, January 1, 2024 | 2617783000 | 1624900000 |

Unleashing the power of data

In the competitive landscape of corporate America, understanding the financial health of companies is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Cintas Corporation and Paychex, Inc. from 2014 to 2024.

Cintas Corporation has shown a consistent upward trend in SG&A expenses, with a remarkable 101% increase over the decade. Starting at approximately $1.3 billion in 2014, the expenses have surged to an estimated $2.6 billion by 2024. This growth reflects Cintas's expanding operations and strategic investments.

Paychex, Inc. has also experienced growth, albeit at a slower pace. From $803 million in 2014, their SG&A expenses have risen by about 102% to $1.6 billion in 2024. This steady increase highlights Paychex's commitment to scaling its services while maintaining operational efficiency.

Both companies demonstrate robust financial strategies, with Cintas focusing on aggressive expansion and Paychex on sustainable growth.

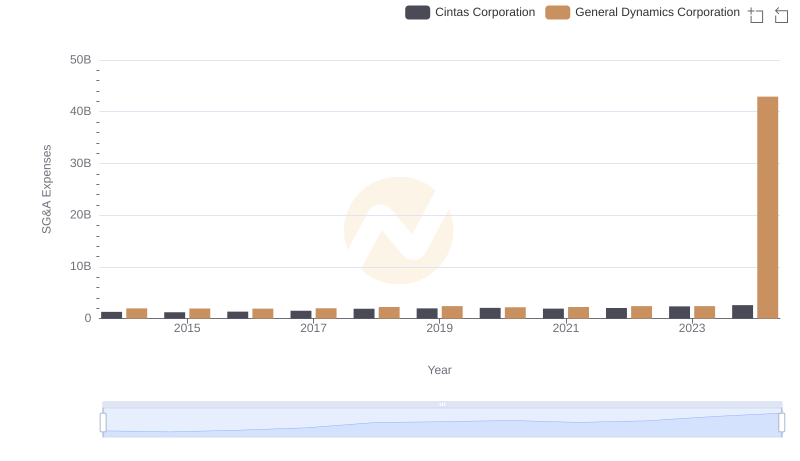

Comparing SG&A Expenses: Cintas Corporation vs General Dynamics Corporation Trends and Insights

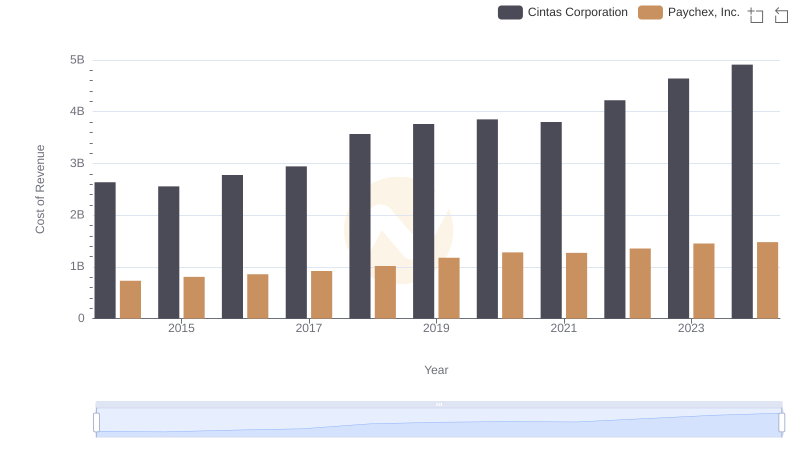

Cost Insights: Breaking Down Cintas Corporation and Paychex, Inc.'s Expenses

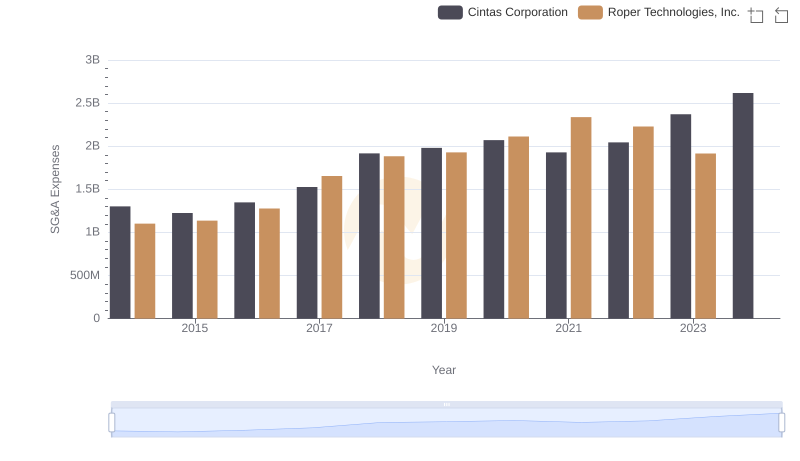

Comparing SG&A Expenses: Cintas Corporation vs Roper Technologies, Inc. Trends and Insights

Key Insights on Gross Profit: Cintas Corporation vs Paychex, Inc.

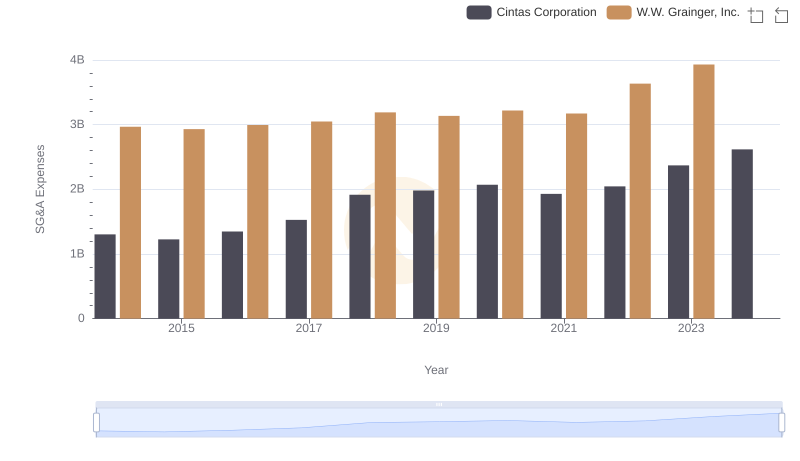

Cintas Corporation vs W.W. Grainger, Inc.: SG&A Expense Trends

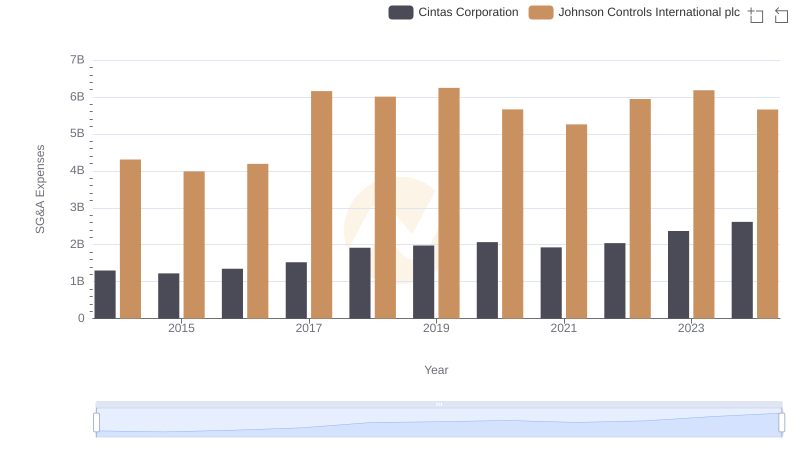

Cintas Corporation and Johnson Controls International plc: SG&A Spending Patterns Compared

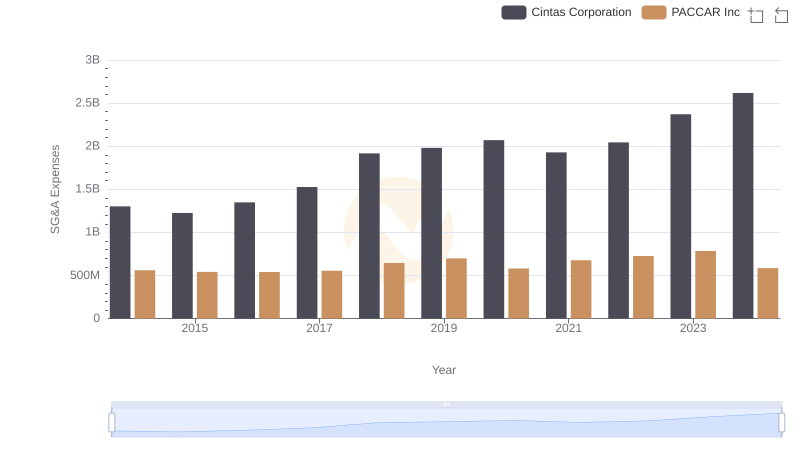

Cost Management Insights: SG&A Expenses for Cintas Corporation and PACCAR Inc

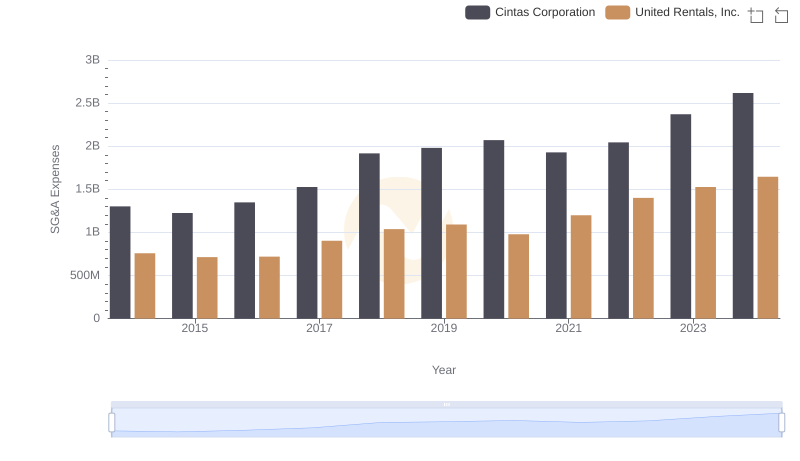

Cost Management Insights: SG&A Expenses for Cintas Corporation and United Rentals, Inc.

Comparative EBITDA Analysis: Cintas Corporation vs Paychex, Inc.

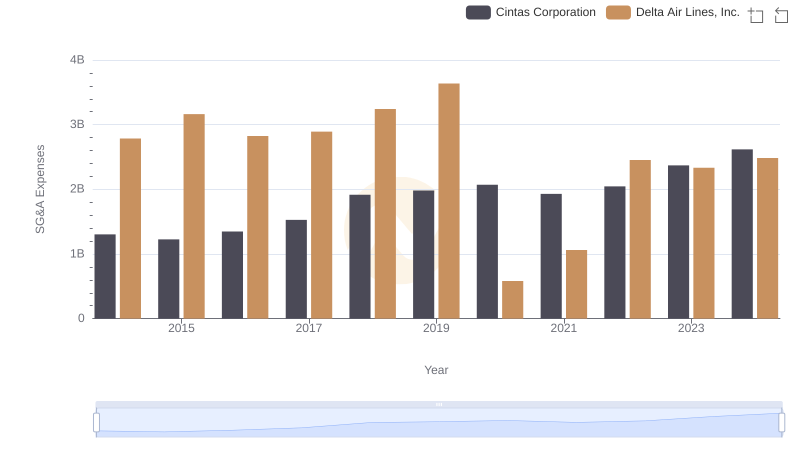

Cost Management Insights: SG&A Expenses for Cintas Corporation and Delta Air Lines, Inc.