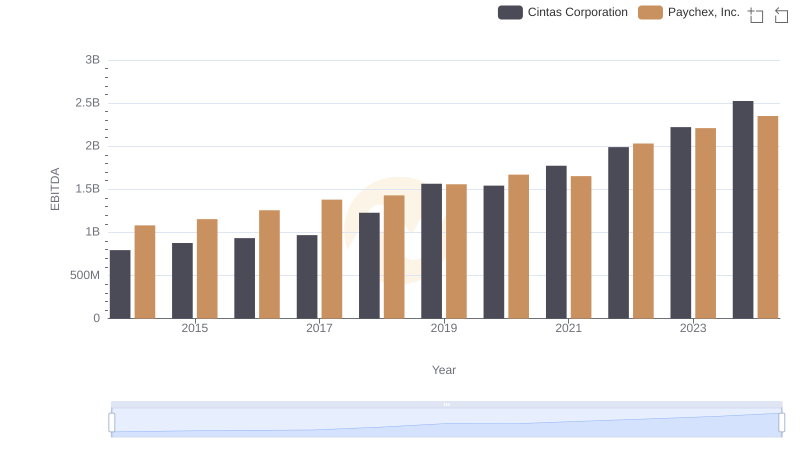

| __timestamp | Cintas Corporation | Paychex, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2637426000 | 732500000 |

| Thursday, January 1, 2015 | 2555549000 | 808000000 |

| Friday, January 1, 2016 | 2775588000 | 857100000 |

| Sunday, January 1, 2017 | 2943086000 | 919600000 |

| Monday, January 1, 2018 | 3568109000 | 1017800000 |

| Tuesday, January 1, 2019 | 3763715000 | 1177800000 |

| Wednesday, January 1, 2020 | 3851372000 | 1280800000 |

| Friday, January 1, 2021 | 3801689000 | 1271200000 |

| Saturday, January 1, 2022 | 4222213000 | 1356300000 |

| Sunday, January 1, 2023 | 4642401000 | 1453000000 |

| Monday, January 1, 2024 | 4910199000 | 1479300000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate expenses, understanding the cost dynamics of industry leaders like Cintas Corporation and Paychex, Inc. offers valuable insights. Over the past decade, Cintas has seen a remarkable 86% increase in its cost of revenue, rising from approximately $2.6 billion in 2014 to nearly $4.9 billion in 2024. This growth reflects Cintas's expanding operations and market reach. In contrast, Paychex, Inc. has experienced a more modest 102% increase, with costs rising from $732 million to $1.48 billion over the same period. This steady growth underscores Paychex's strategic focus on efficiency and scalability. As we delve into these figures, it becomes evident that while both companies are growing, their cost structures reveal different strategic priorities and market responses. This analysis provides a window into the financial strategies shaping these corporate giants in the modern economy.

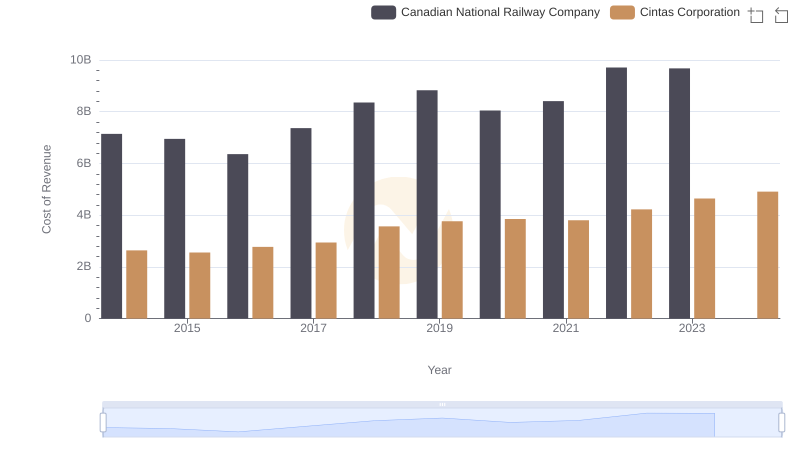

Cost Insights: Breaking Down Cintas Corporation and Canadian National Railway Company's Expenses

Cost of Revenue Comparison: Cintas Corporation vs Roper Technologies, Inc.

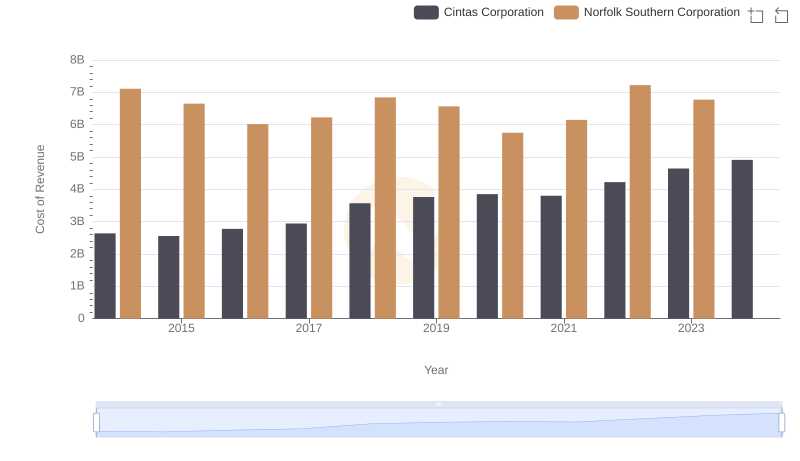

Cost of Revenue: Key Insights for Cintas Corporation and Norfolk Southern Corporation

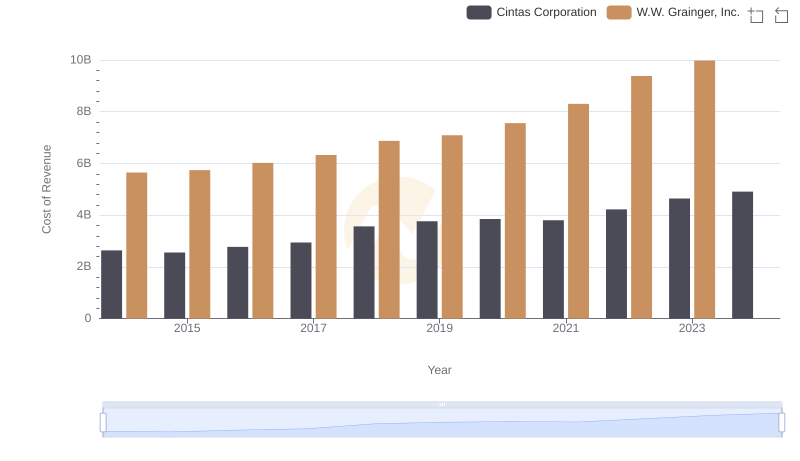

Cintas Corporation vs W.W. Grainger, Inc.: Efficiency in Cost of Revenue Explored

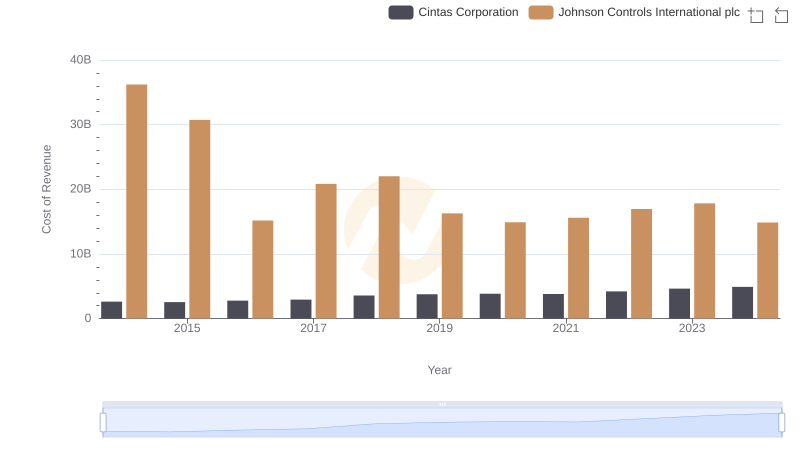

Cost of Revenue: Key Insights for Cintas Corporation and Johnson Controls International plc

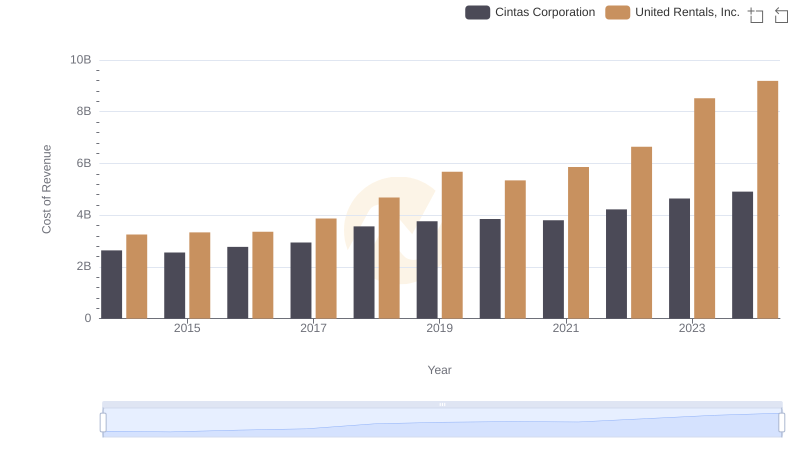

Comparing Cost of Revenue Efficiency: Cintas Corporation vs United Rentals, Inc.

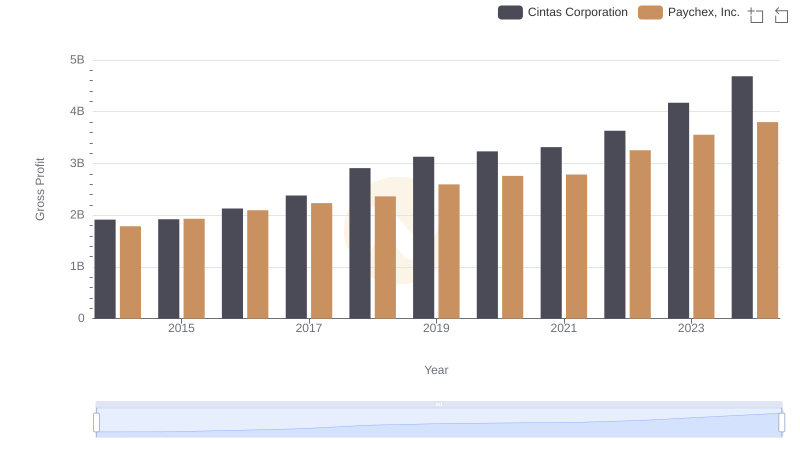

Key Insights on Gross Profit: Cintas Corporation vs Paychex, Inc.

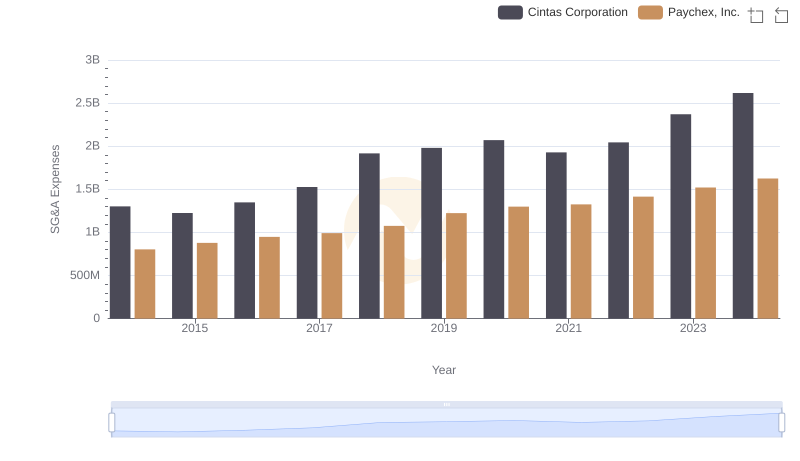

Comparing SG&A Expenses: Cintas Corporation vs Paychex, Inc. Trends and Insights

Comparative EBITDA Analysis: Cintas Corporation vs Paychex, Inc.