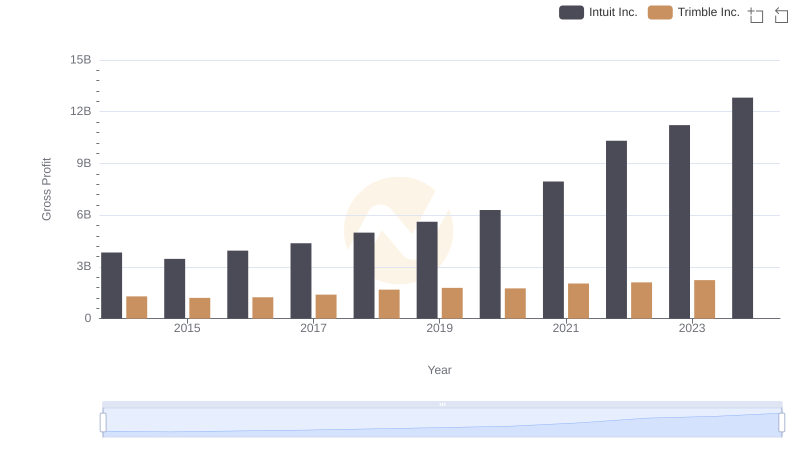

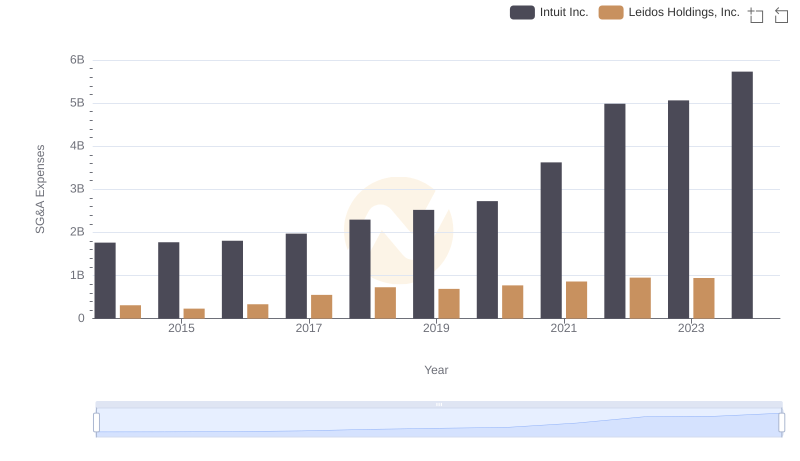

| __timestamp | Intuit Inc. | Leidos Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 671000000 |

| Thursday, January 1, 2015 | 3467000000 | 618000000 |

| Friday, January 1, 2016 | 3942000000 | 852000000 |

| Sunday, January 1, 2017 | 4368000000 | 1247000000 |

| Monday, January 1, 2018 | 4987000000 | 1504000000 |

| Tuesday, January 1, 2019 | 5617000000 | 1548000000 |

| Wednesday, January 1, 2020 | 6301000000 | 1737000000 |

| Friday, January 1, 2021 | 7950000000 | 2014000000 |

| Saturday, January 1, 2022 | 10320000000 | 2084000000 |

| Sunday, January 1, 2023 | 11225000000 | 2244000000 |

| Monday, January 1, 2024 | 12820000000 | 2798000000 |

Infusing magic into the data realm

In the ever-evolving landscape of financial technology and defense contracting, Intuit Inc. and Leidos Holdings, Inc. have demonstrated remarkable growth in gross profit over the past decade. From 2014 to 2023, Intuit Inc. has seen its gross profit soar by approximately 230%, reflecting its robust expansion in the financial software sector. In contrast, Leidos Holdings, Inc. has achieved a commendable 235% increase, underscoring its strategic advancements in defense and technology solutions.

While 2024 data for Leidos is missing, the upward trend for both companies is undeniable, marking a decade of financial success and strategic growth.

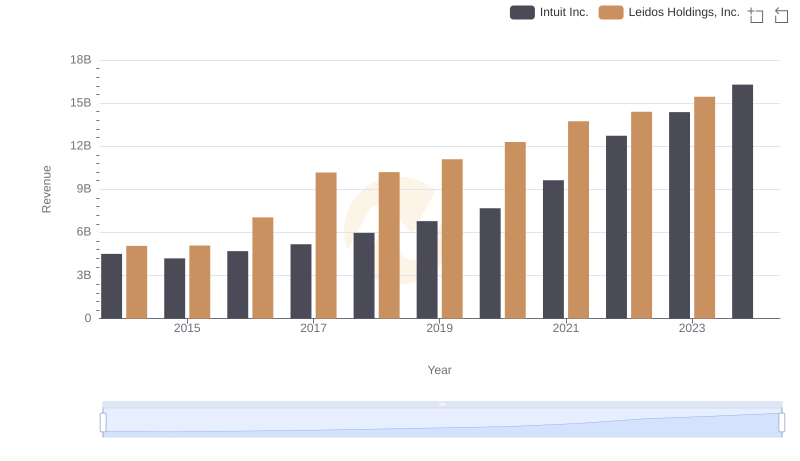

Intuit Inc. vs Leidos Holdings, Inc.: Examining Key Revenue Metrics

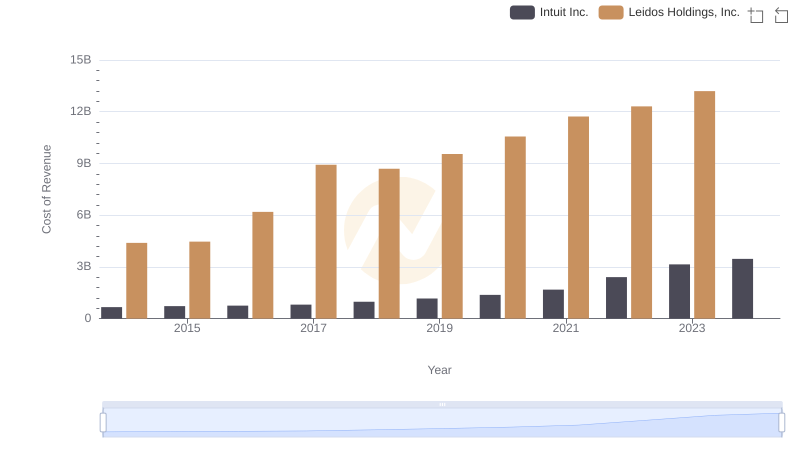

Intuit Inc. vs Leidos Holdings, Inc.: Efficiency in Cost of Revenue Explored

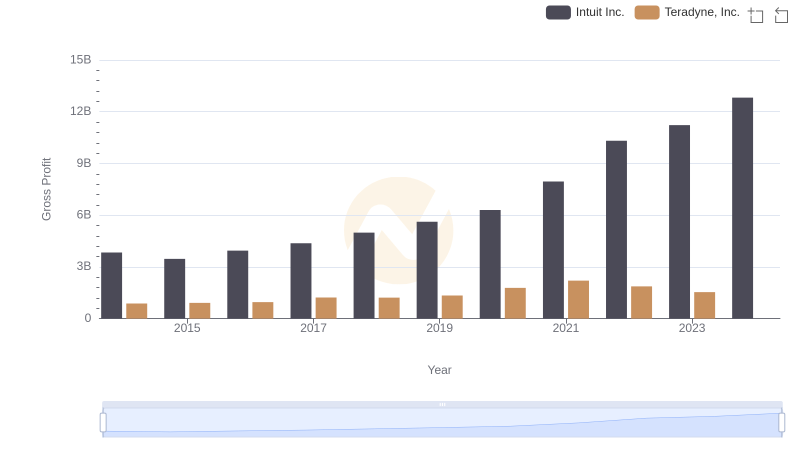

Gross Profit Analysis: Comparing Intuit Inc. and Teradyne, Inc.

Key Insights on Gross Profit: Intuit Inc. vs Trimble Inc.

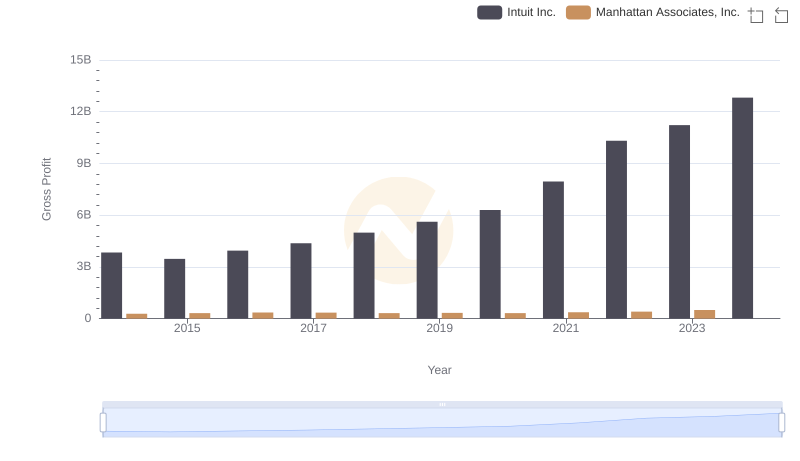

Gross Profit Trends Compared: Intuit Inc. vs Manhattan Associates, Inc.

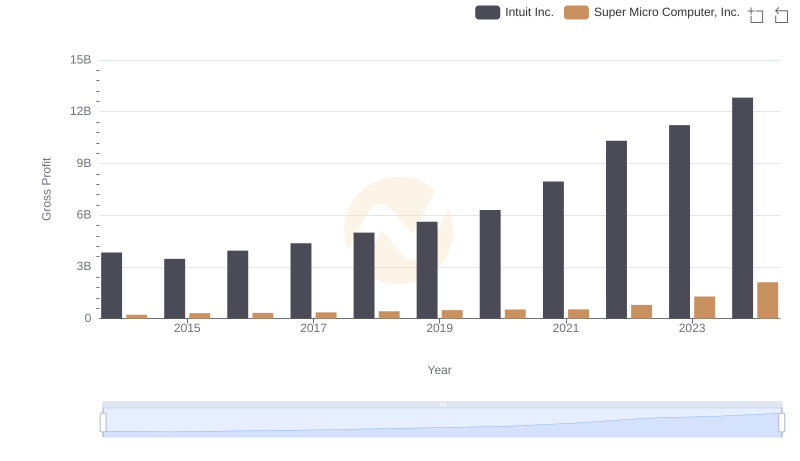

Gross Profit Analysis: Comparing Intuit Inc. and Super Micro Computer, Inc.

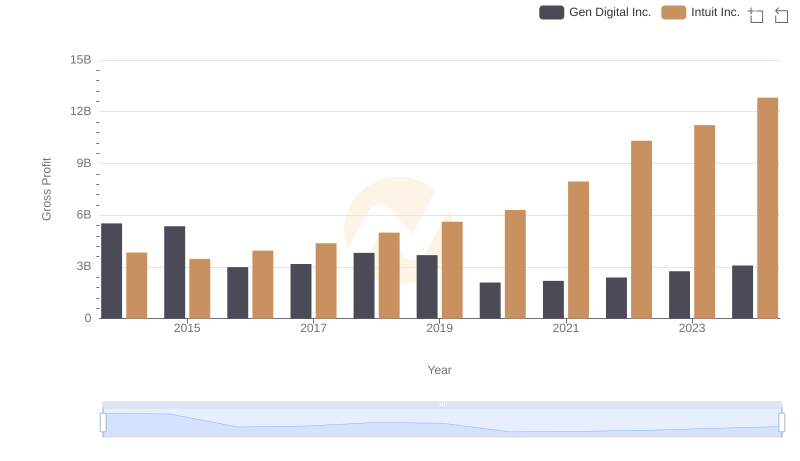

Intuit Inc. vs Gen Digital Inc.: A Gross Profit Performance Breakdown

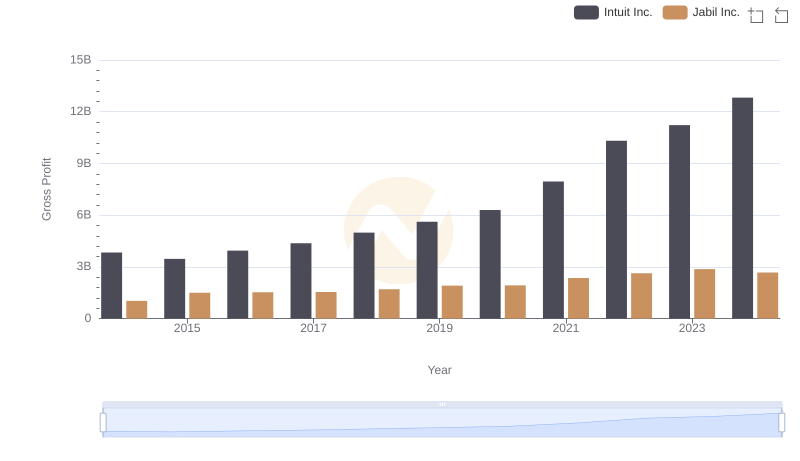

Gross Profit Trends Compared: Intuit Inc. vs Jabil Inc.

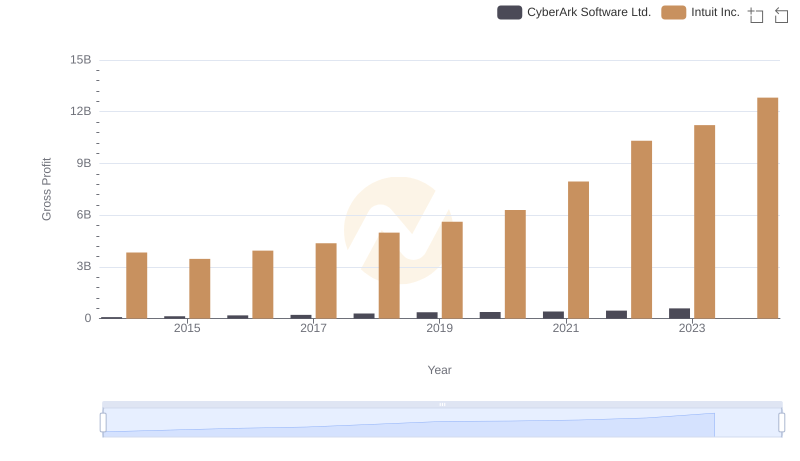

Gross Profit Analysis: Comparing Intuit Inc. and CyberArk Software Ltd.

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Leidos Holdings, Inc.

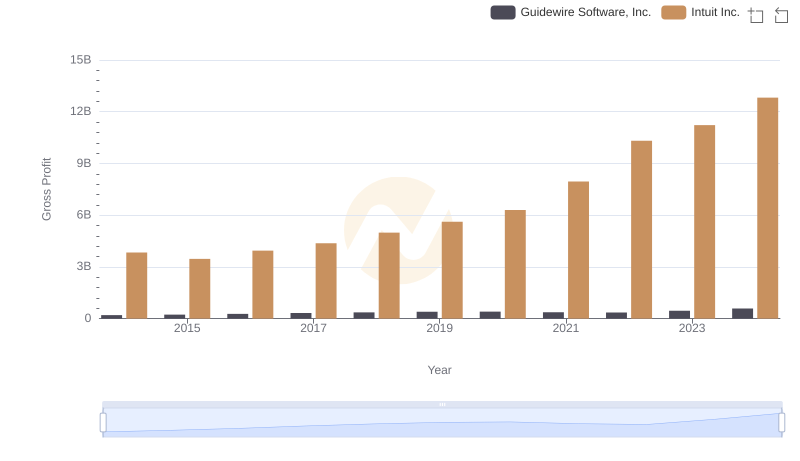

Gross Profit Analysis: Comparing Intuit Inc. and Guidewire Software, Inc.

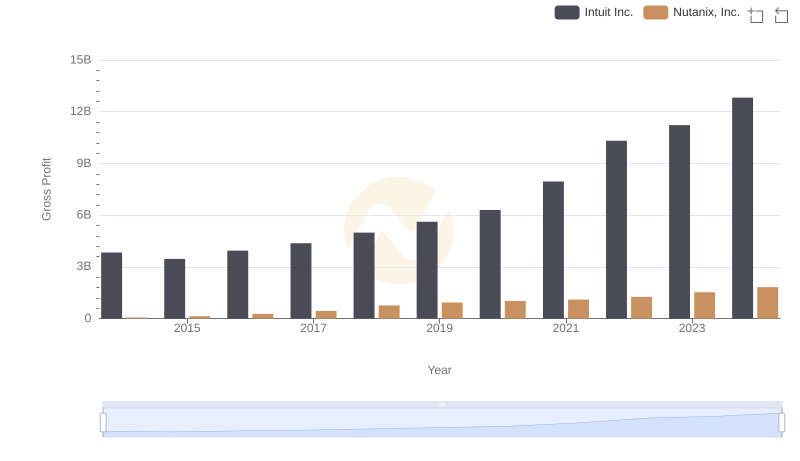

Key Insights on Gross Profit: Intuit Inc. vs Nutanix, Inc.