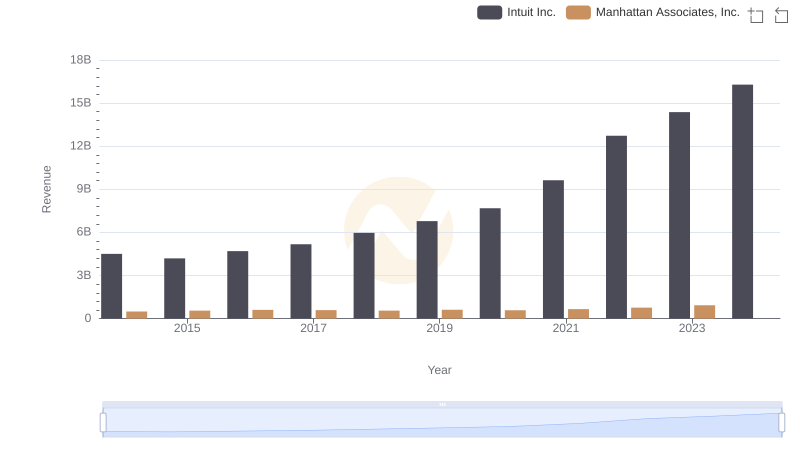

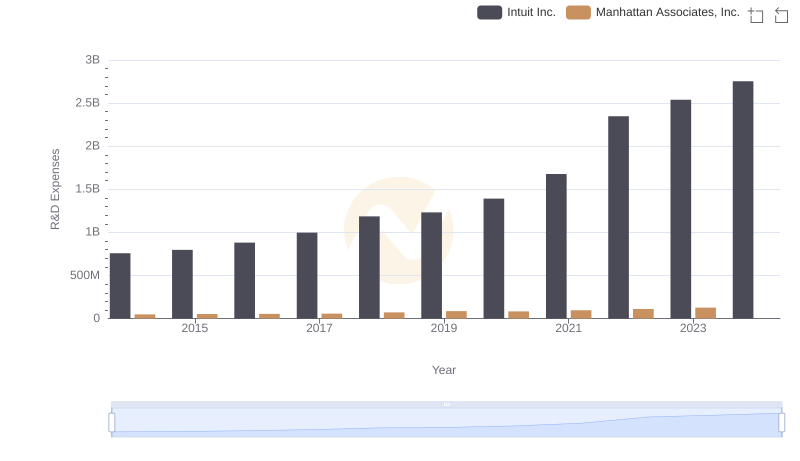

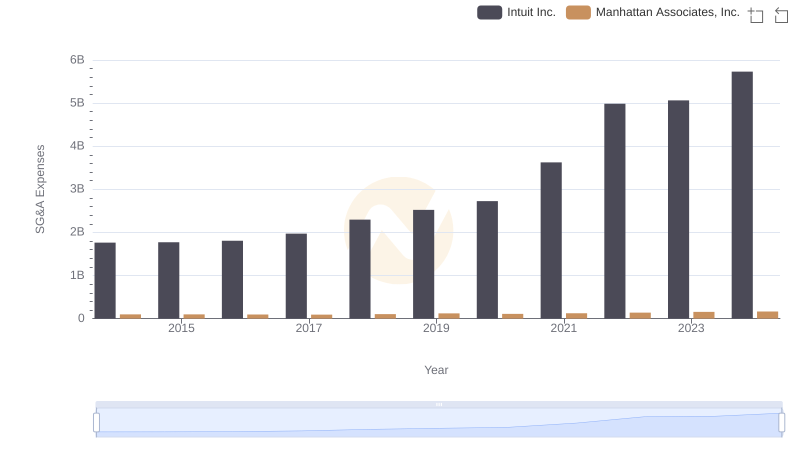

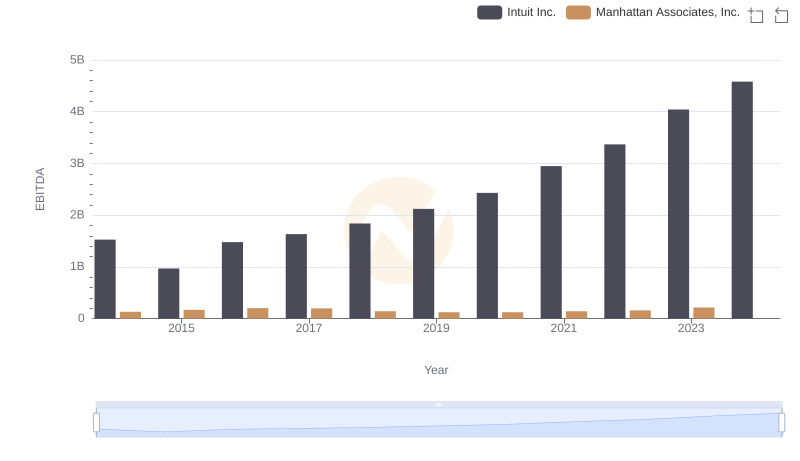

| __timestamp | Intuit Inc. | Manhattan Associates, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 279526000 |

| Thursday, January 1, 2015 | 3467000000 | 320943000 |

| Friday, January 1, 2016 | 3942000000 | 354678000 |

| Sunday, January 1, 2017 | 4368000000 | 348866000 |

| Monday, January 1, 2018 | 4987000000 | 318276000 |

| Tuesday, January 1, 2019 | 5617000000 | 332982000 |

| Wednesday, January 1, 2020 | 6301000000 | 316485000 |

| Friday, January 1, 2021 | 7950000000 | 365816000 |

| Saturday, January 1, 2022 | 10320000000 | 408847000 |

| Sunday, January 1, 2023 | 11225000000 | 498111000 |

| Monday, January 1, 2024 | 12820000000 | 571372000 |

Unleashing insights

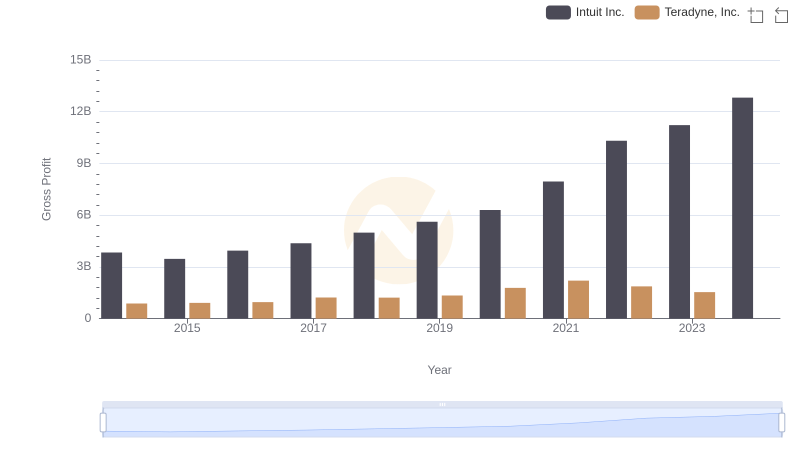

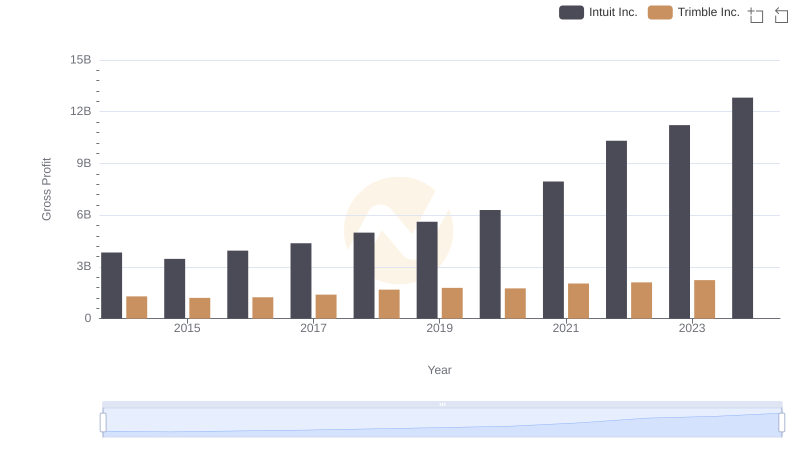

In the ever-evolving landscape of financial technology and supply chain solutions, Intuit Inc. and Manhattan Associates, Inc. have emerged as key players. Over the past decade, Intuit has demonstrated a remarkable growth trajectory, with its gross profit surging by approximately 234% from 2014 to 2023. This growth underscores Intuit's strategic innovations and market adaptability. In contrast, Manhattan Associates, Inc. has shown a steady, albeit more modest, increase of around 78% in the same period, reflecting its consistent performance in the supply chain sector.

The data reveals a significant gap between the two companies, with Intuit's gross profit consistently outpacing that of Manhattan Associates. Notably, the year 2023 marked a peak for both companies, with Intuit reaching its highest gross profit, while Manhattan Associates also achieved its best performance to date. However, data for 2024 is incomplete, leaving room for speculation on future trends.

Annual Revenue Comparison: Intuit Inc. vs Manhattan Associates, Inc.

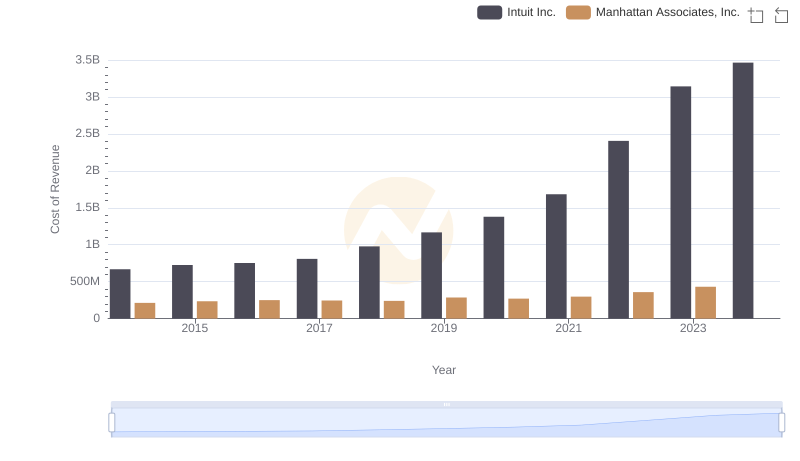

Analyzing Cost of Revenue: Intuit Inc. and Manhattan Associates, Inc.

Gross Profit Analysis: Comparing Intuit Inc. and Teradyne, Inc.

Key Insights on Gross Profit: Intuit Inc. vs Trimble Inc.

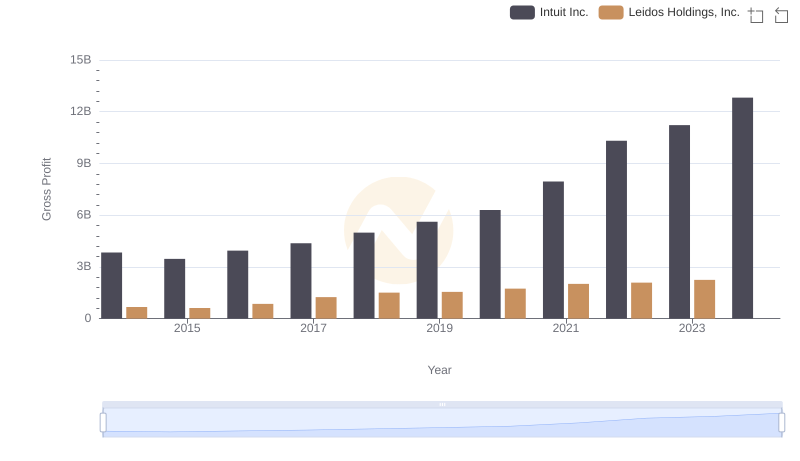

Intuit Inc. and Leidos Holdings, Inc.: A Detailed Gross Profit Analysis

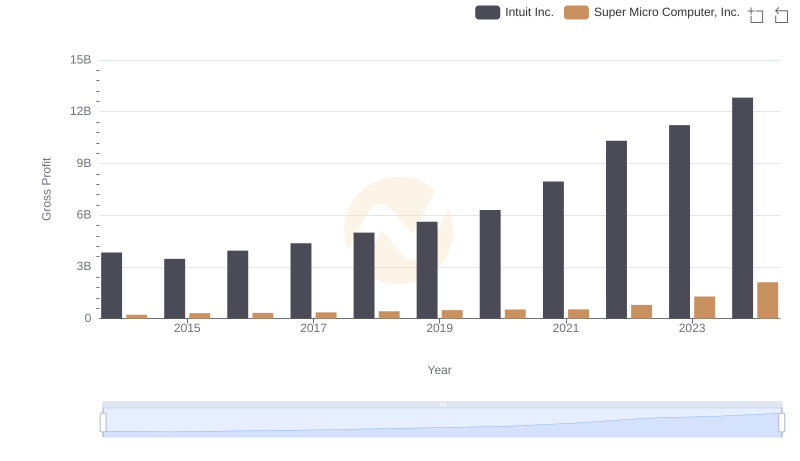

Gross Profit Analysis: Comparing Intuit Inc. and Super Micro Computer, Inc.

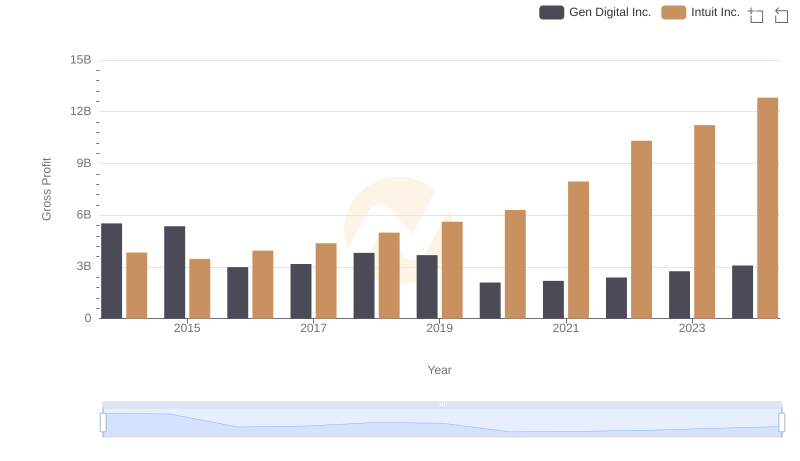

Intuit Inc. vs Gen Digital Inc.: A Gross Profit Performance Breakdown

R&D Spending Showdown: Intuit Inc. vs Manhattan Associates, Inc.

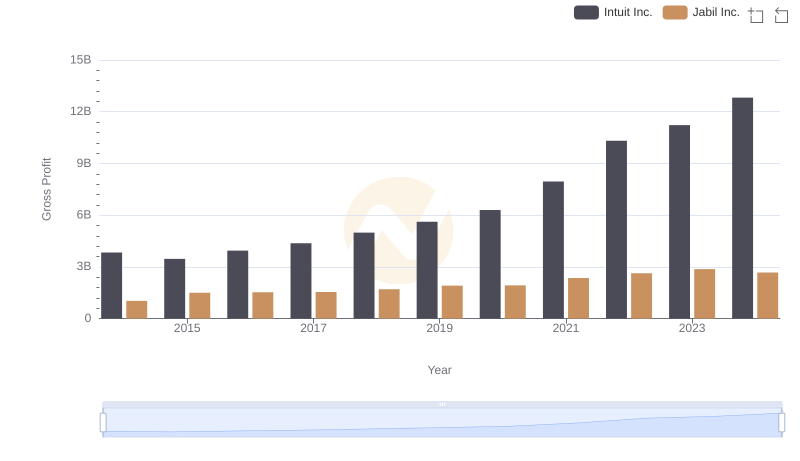

Gross Profit Trends Compared: Intuit Inc. vs Jabil Inc.

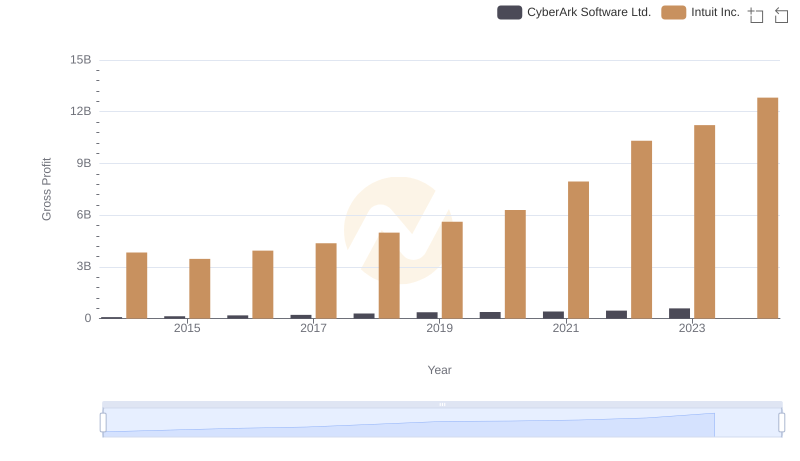

Gross Profit Analysis: Comparing Intuit Inc. and CyberArk Software Ltd.

Intuit Inc. vs Manhattan Associates, Inc.: SG&A Expense Trends

Comprehensive EBITDA Comparison: Intuit Inc. vs Manhattan Associates, Inc.