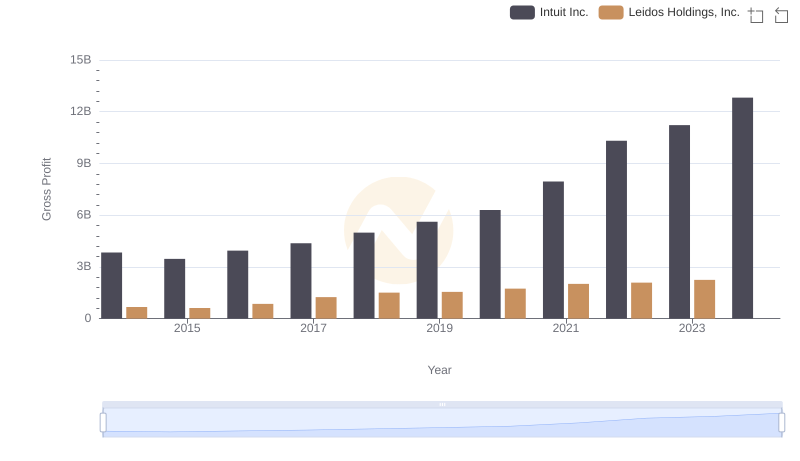

| __timestamp | Intuit Inc. | Jabil Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 1025603000 |

| Thursday, January 1, 2015 | 3467000000 | 1503218000 |

| Friday, January 1, 2016 | 3942000000 | 1527704000 |

| Sunday, January 1, 2017 | 4368000000 | 1545643000 |

| Monday, January 1, 2018 | 4987000000 | 1706792000 |

| Tuesday, January 1, 2019 | 5617000000 | 1913401000 |

| Wednesday, January 1, 2020 | 6301000000 | 1930813000 |

| Friday, January 1, 2021 | 7950000000 | 2359000000 |

| Saturday, January 1, 2022 | 10320000000 | 2632000000 |

| Sunday, January 1, 2023 | 11225000000 | 2867000000 |

| Monday, January 1, 2024 | 12820000000 | 2676000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of the tech and manufacturing sectors, understanding financial health is crucial. This analysis compares the gross profit trends of Intuit Inc., a leader in financial software, and Jabil Inc., a global manufacturing services company, from 2014 to 2024. Over this decade, Intuit's gross profit surged by approximately 234%, reflecting its robust growth and market adaptation. In contrast, Jabil Inc. experienced a more modest increase of around 161%, showcasing steady progress in a competitive industry. Notably, Intuit's gross profit in 2023 was nearly four times that of Jabil, highlighting its dominant position. These trends underscore the dynamic nature of these industries and the importance of strategic innovation and market positioning. As we look to the future, these insights provide a valuable lens through which to view potential investment opportunities and industry shifts.

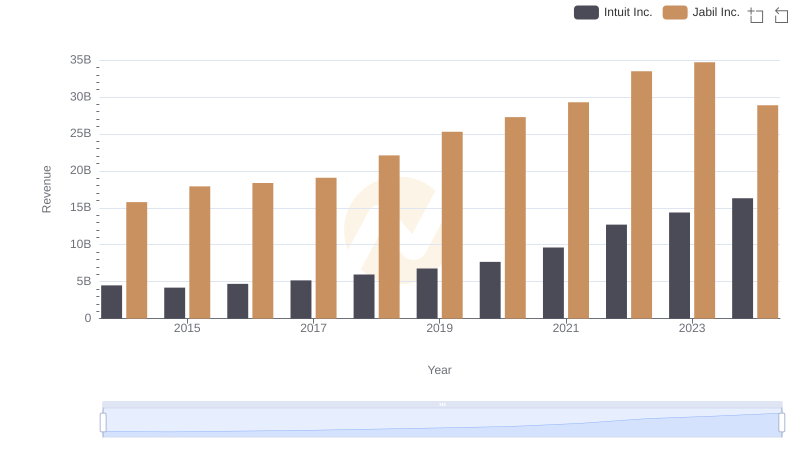

Intuit Inc. and Jabil Inc.: A Comprehensive Revenue Analysis

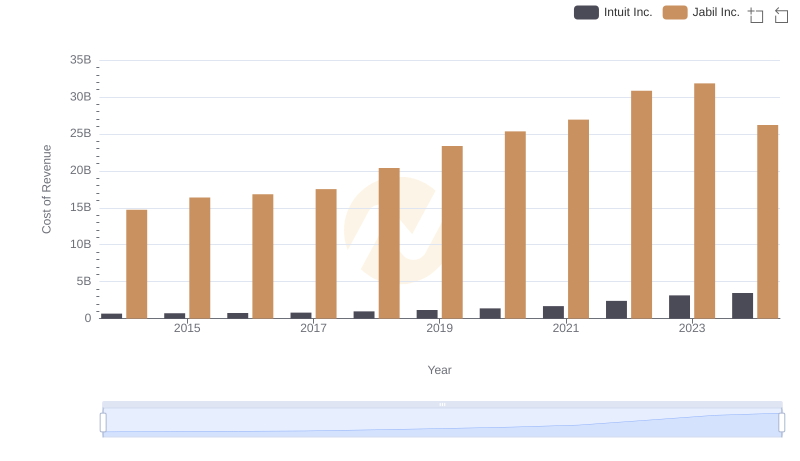

Cost Insights: Breaking Down Intuit Inc. and Jabil Inc.'s Expenses

Intuit Inc. and Leidos Holdings, Inc.: A Detailed Gross Profit Analysis

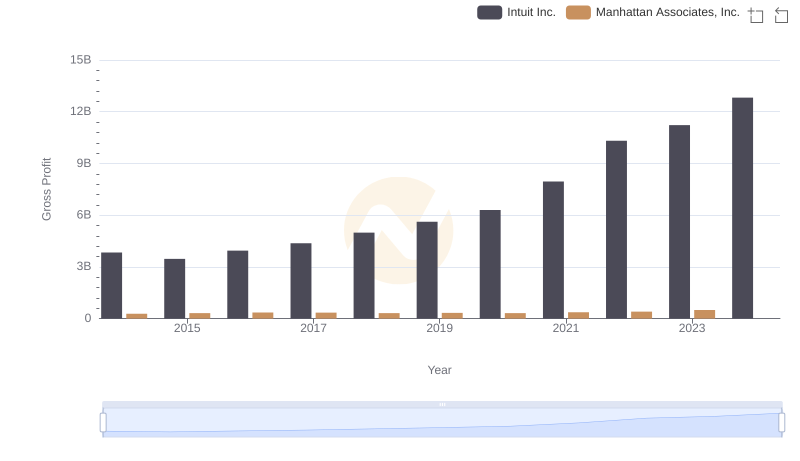

Gross Profit Trends Compared: Intuit Inc. vs Manhattan Associates, Inc.

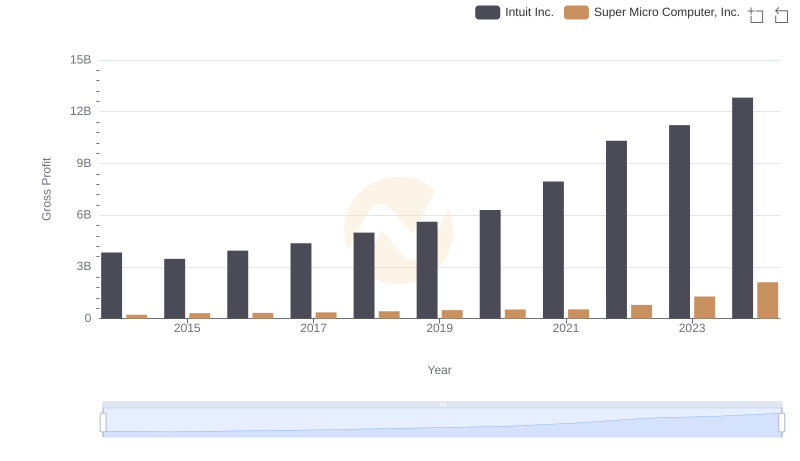

Gross Profit Analysis: Comparing Intuit Inc. and Super Micro Computer, Inc.

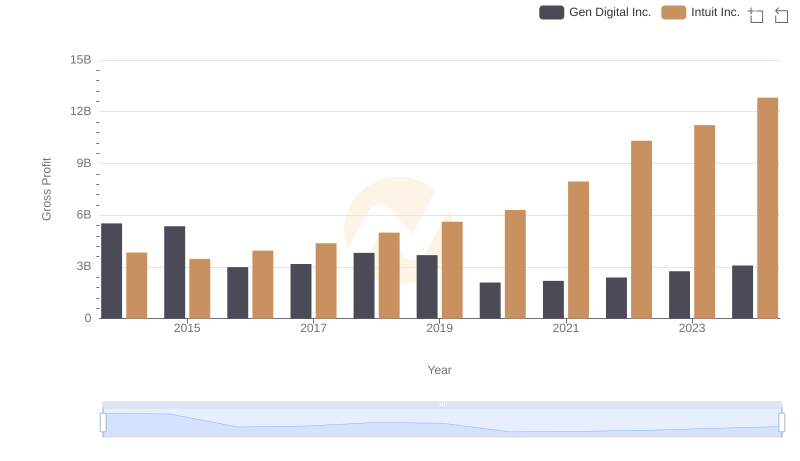

Intuit Inc. vs Gen Digital Inc.: A Gross Profit Performance Breakdown

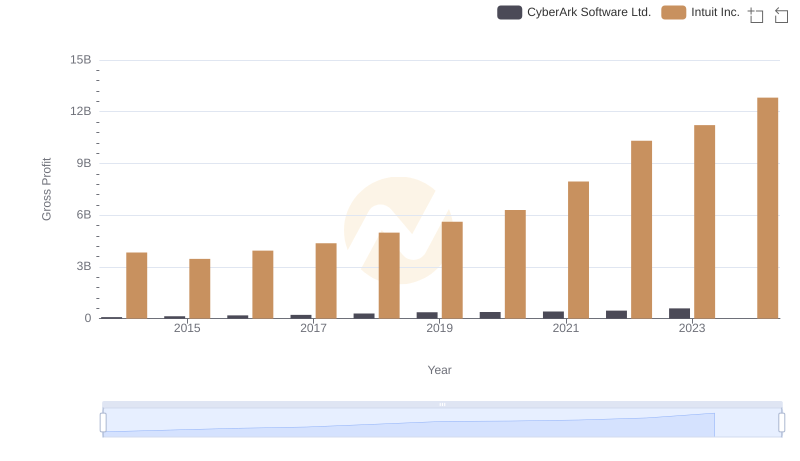

Gross Profit Analysis: Comparing Intuit Inc. and CyberArk Software Ltd.

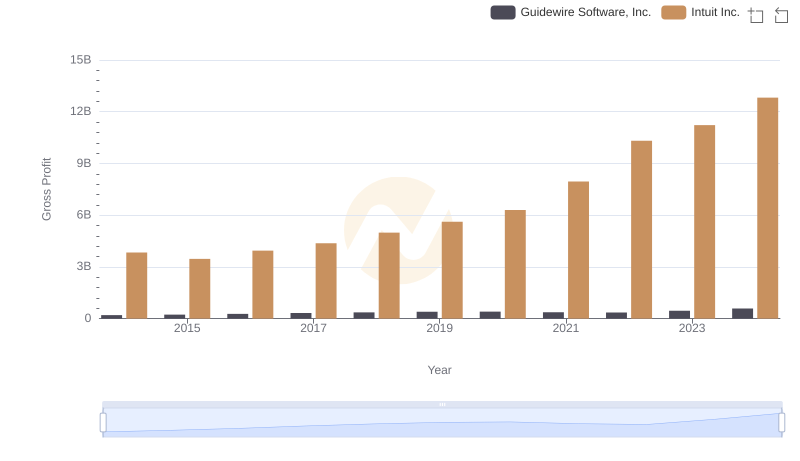

Gross Profit Analysis: Comparing Intuit Inc. and Guidewire Software, Inc.

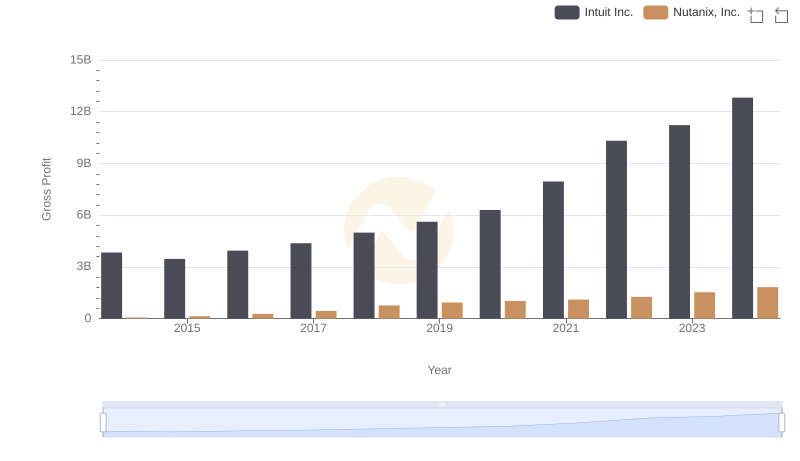

Key Insights on Gross Profit: Intuit Inc. vs Nutanix, Inc.

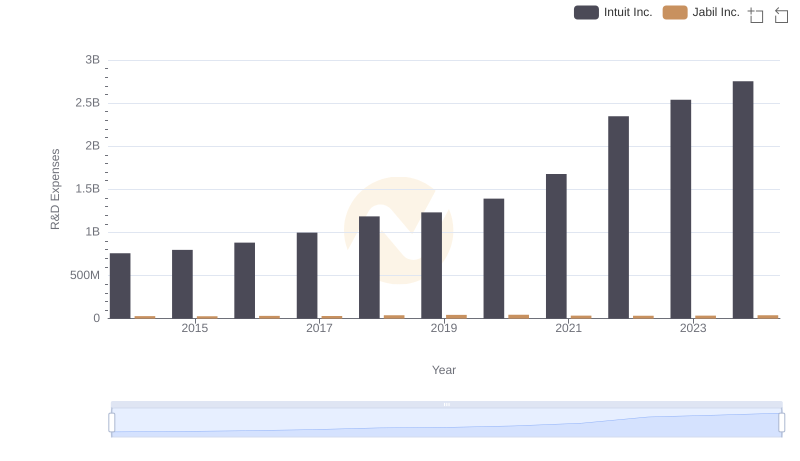

Research and Development: Comparing Key Metrics for Intuit Inc. and Jabil Inc.

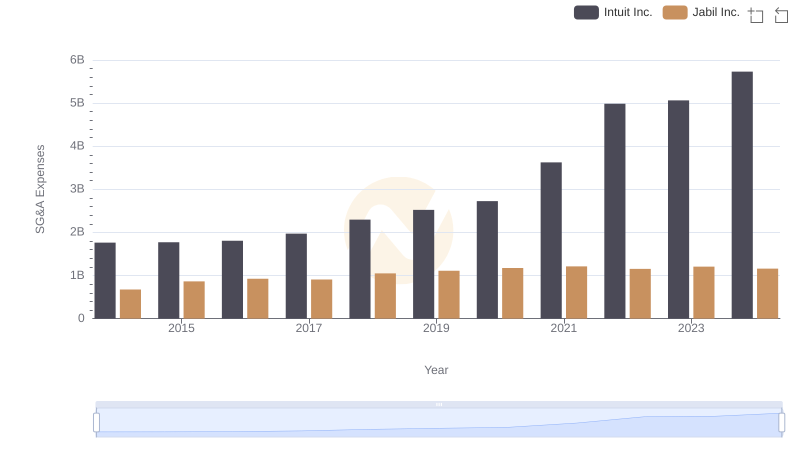

Intuit Inc. vs Jabil Inc.: SG&A Expense Trends

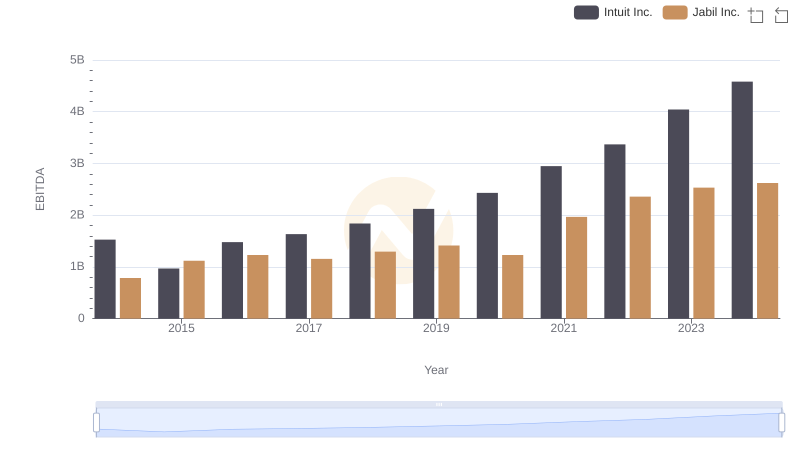

Comprehensive EBITDA Comparison: Intuit Inc. vs Jabil Inc.