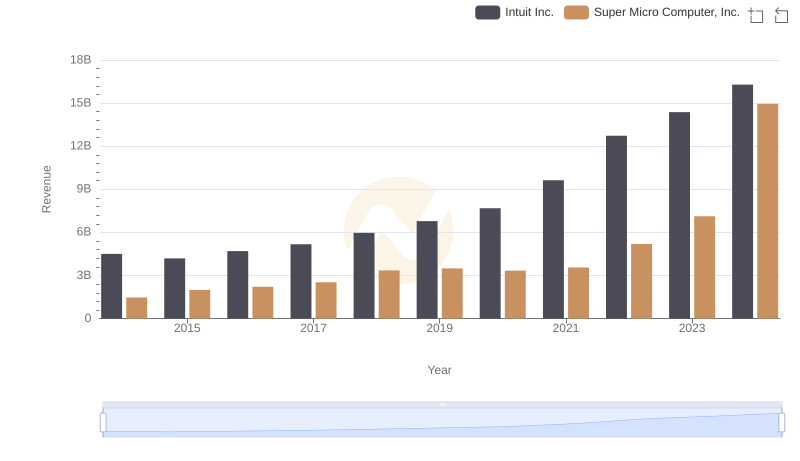

| __timestamp | Intuit Inc. | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 225545000 |

| Thursday, January 1, 2015 | 3467000000 | 320231000 |

| Friday, January 1, 2016 | 3942000000 | 331525000 |

| Sunday, January 1, 2017 | 4368000000 | 358566000 |

| Monday, January 1, 2018 | 4987000000 | 429994000 |

| Tuesday, January 1, 2019 | 5617000000 | 495522000 |

| Wednesday, January 1, 2020 | 6301000000 | 526210000 |

| Friday, January 1, 2021 | 7950000000 | 534538000 |

| Saturday, January 1, 2022 | 10320000000 | 800001000 |

| Sunday, January 1, 2023 | 11225000000 | 1283012000 |

| Monday, January 1, 2024 | 12820000000 | 2111729000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of technology, financial performance is a key indicator of a company's resilience and adaptability. Over the past decade, Intuit Inc. has demonstrated a remarkable growth trajectory in gross profit, surging by approximately 234% from 2014 to 2024. This growth reflects Intuit's strategic innovations and market expansion, particularly in financial software solutions. In contrast, Super Micro Computer, Inc. has also shown impressive growth, with its gross profit increasing by nearly 837% during the same period. This growth underscores Super Micro's ability to capitalize on the rising demand for high-performance computing solutions. While Intuit's gross profit in 2024 is nearly six times that of Super Micro, the latter's rapid growth rate highlights its potential to capture a larger market share. As we look to the future, these trends suggest a dynamic competitive landscape in the tech industry.

Breaking Down Revenue Trends: Intuit Inc. vs Super Micro Computer, Inc.

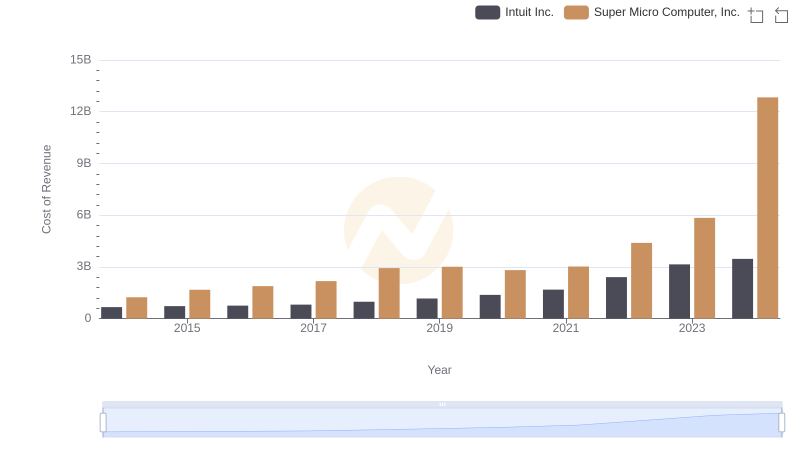

Cost of Revenue: Key Insights for Intuit Inc. and Super Micro Computer, Inc.

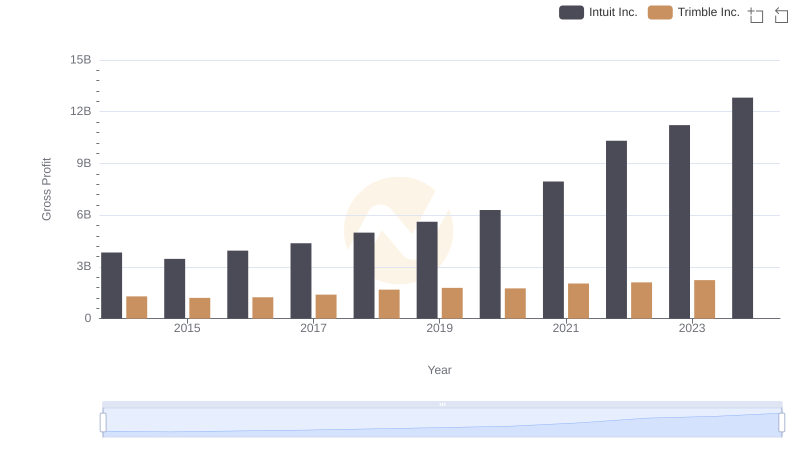

Key Insights on Gross Profit: Intuit Inc. vs Trimble Inc.

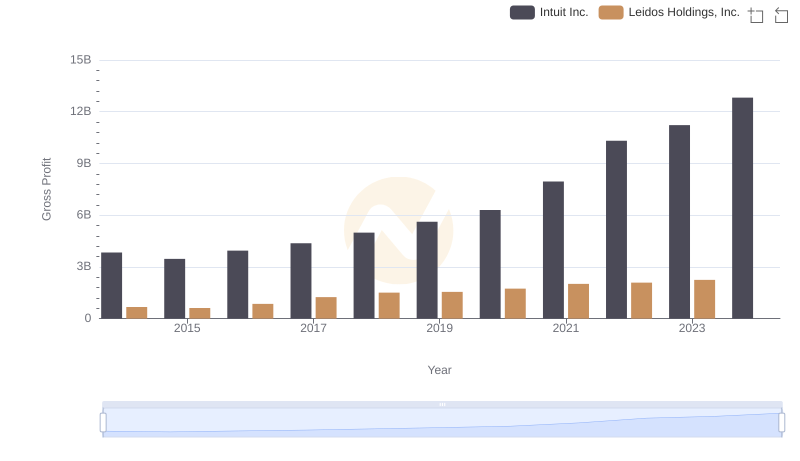

Intuit Inc. and Leidos Holdings, Inc.: A Detailed Gross Profit Analysis

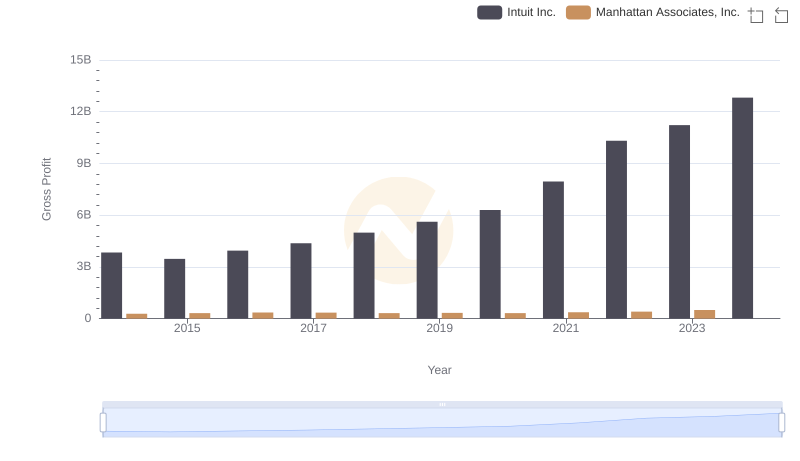

Gross Profit Trends Compared: Intuit Inc. vs Manhattan Associates, Inc.

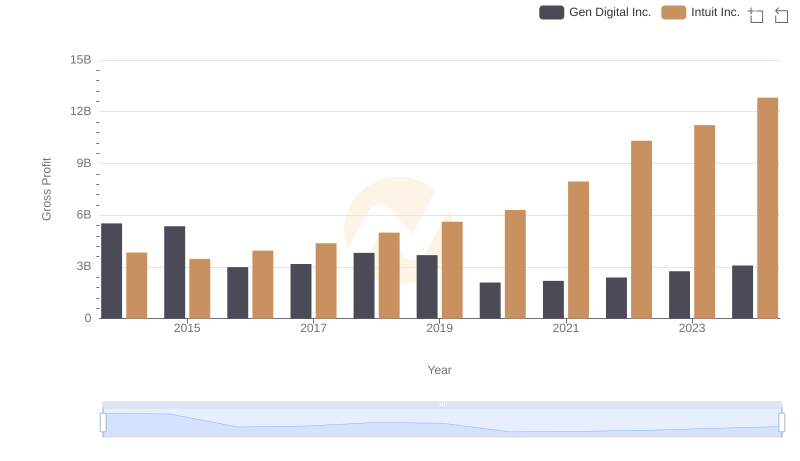

Intuit Inc. vs Gen Digital Inc.: A Gross Profit Performance Breakdown

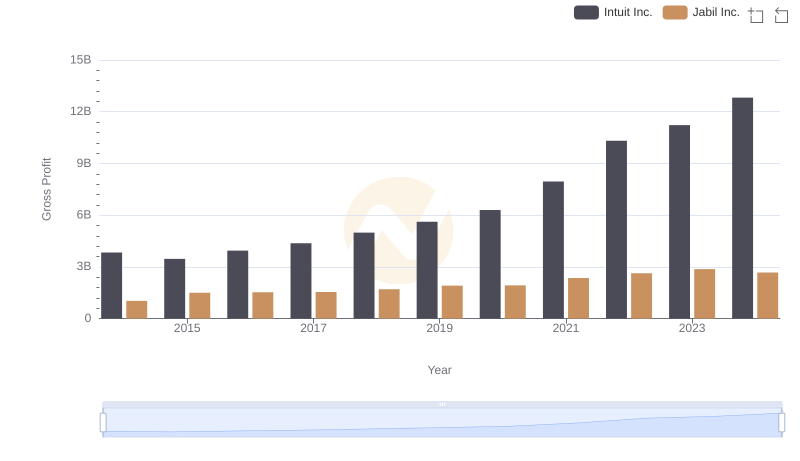

Gross Profit Trends Compared: Intuit Inc. vs Jabil Inc.

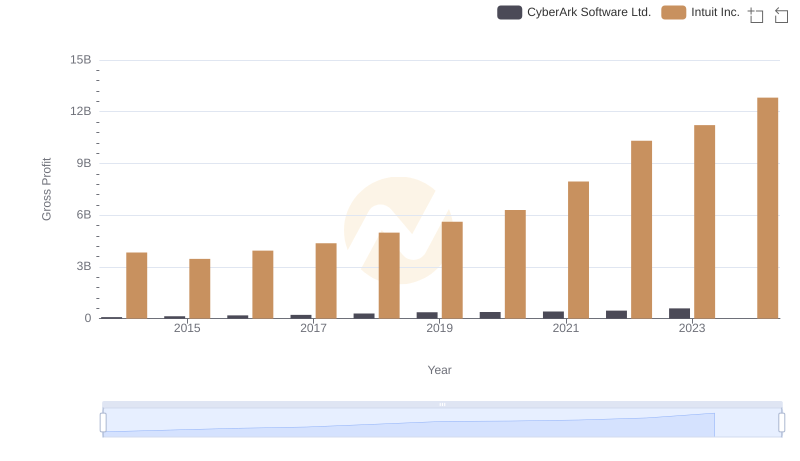

Gross Profit Analysis: Comparing Intuit Inc. and CyberArk Software Ltd.

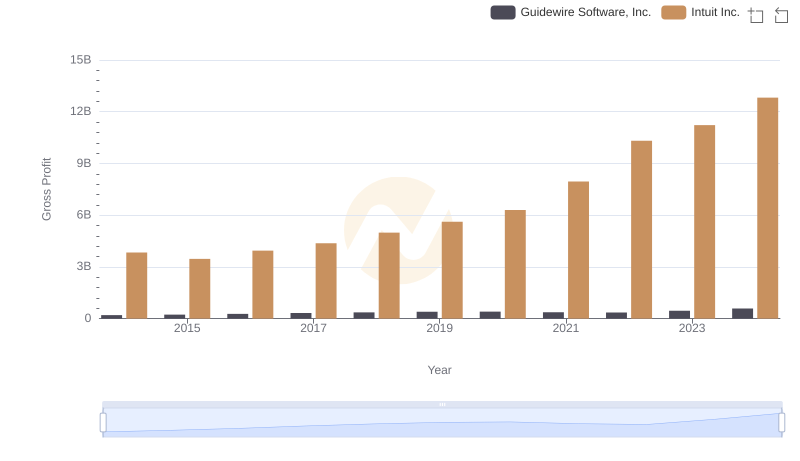

Gross Profit Analysis: Comparing Intuit Inc. and Guidewire Software, Inc.

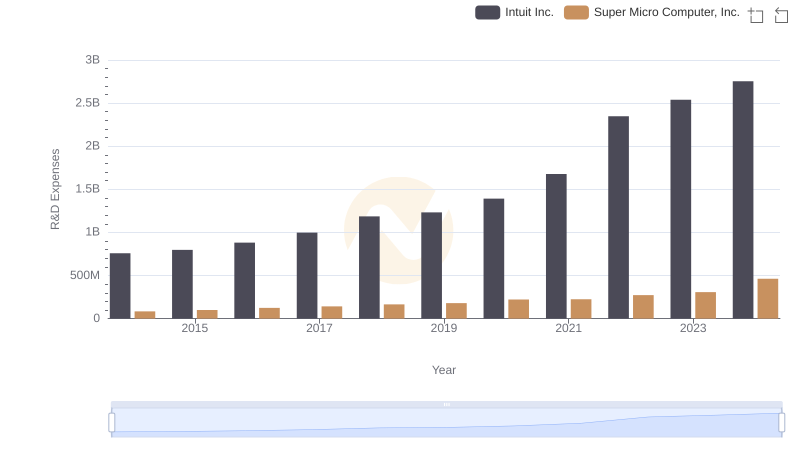

Intuit Inc. or Super Micro Computer, Inc.: Who Invests More in Innovation?

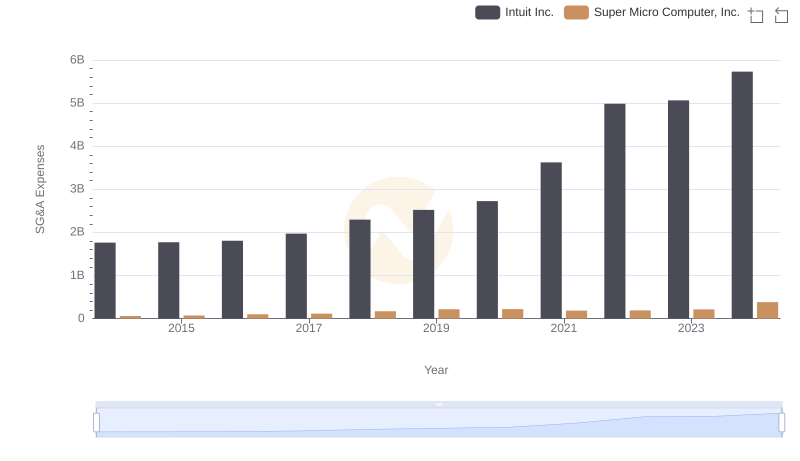

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Super Micro Computer, Inc.

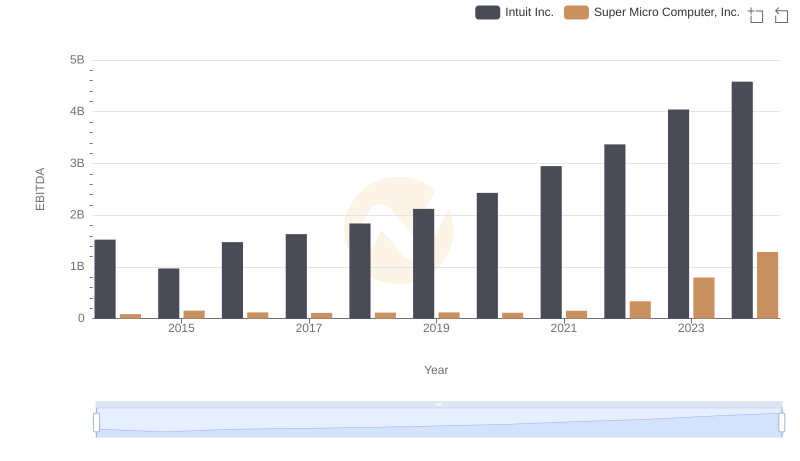

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Super Micro Computer, Inc.