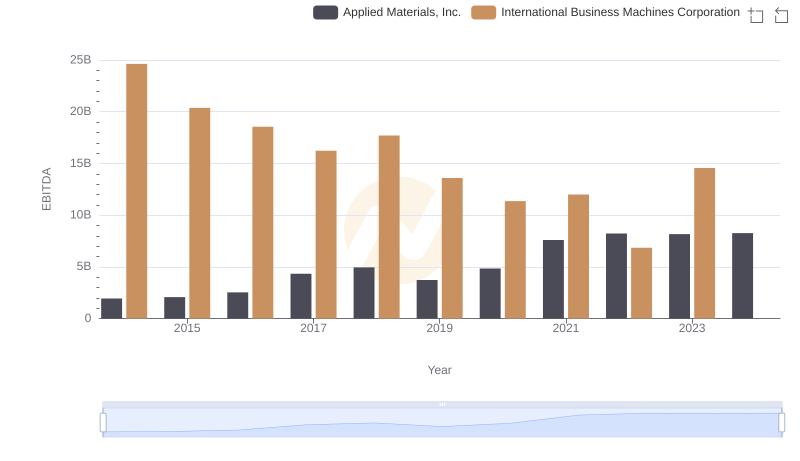

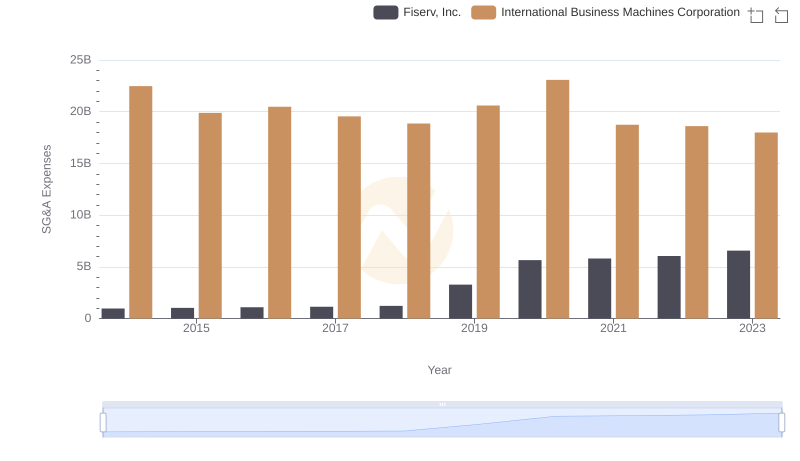

| __timestamp | Fiserv, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1614000000 | 24962000000 |

| Thursday, January 1, 2015 | 1728000000 | 20268000000 |

| Friday, January 1, 2016 | 1856000000 | 17341000000 |

| Sunday, January 1, 2017 | 1961000000 | 16556000000 |

| Monday, January 1, 2018 | 2300000000 | 16545000000 |

| Tuesday, January 1, 2019 | 3126000000 | 14609000000 |

| Wednesday, January 1, 2020 | 4963000000 | 10555000000 |

| Friday, January 1, 2021 | 5392000000 | 12409000000 |

| Saturday, January 1, 2022 | 6636000000 | 7174000000 |

| Sunday, January 1, 2023 | 7813000000 | 14693000000 |

| Monday, January 1, 2024 | 5879000000 | 6015000000 |

Infusing magic into the data realm

In the ever-evolving landscape of technology and financial services, the EBITDA performance of International Business Machines Corporation (IBM) and Fiserv, Inc. offers a fascinating glimpse into their financial health over the past decade. From 2014 to 2023, IBM's EBITDA has shown a notable decline, dropping from a peak of approximately $24.6 billion in 2014 to around $14.6 billion in 2023. This represents a decrease of nearly 41%, reflecting the challenges faced by the tech giant in adapting to new market dynamics.

Conversely, Fiserv has demonstrated a robust growth trajectory, with its EBITDA surging from $1.6 billion in 2014 to $7.8 billion in 2023, marking an impressive increase of over 380%. This growth underscores Fiserv's strategic positioning in the financial services sector. Notably, the data for 2024 is incomplete, leaving room for speculation on future trends.

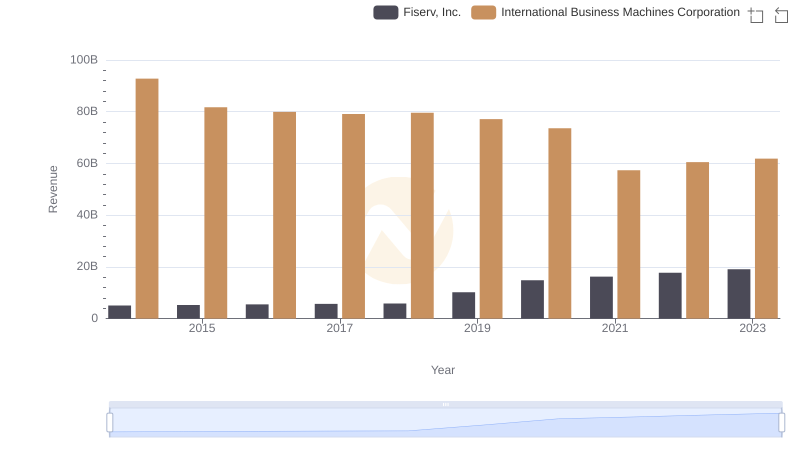

Breaking Down Revenue Trends: International Business Machines Corporation vs Fiserv, Inc.

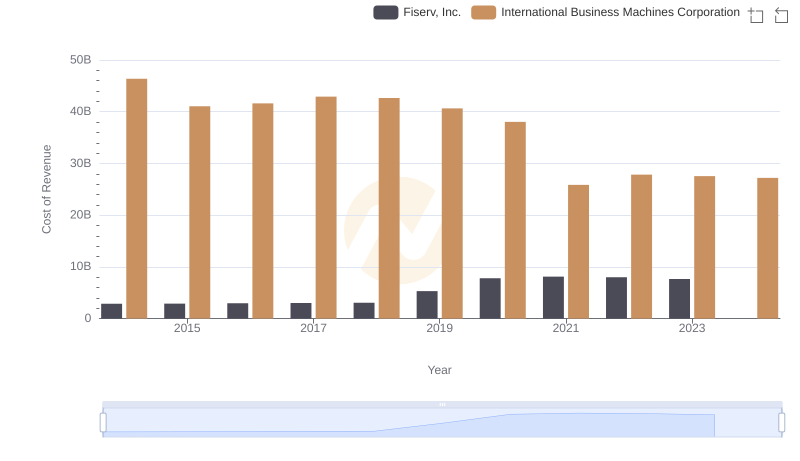

Analyzing Cost of Revenue: International Business Machines Corporation and Fiserv, Inc.

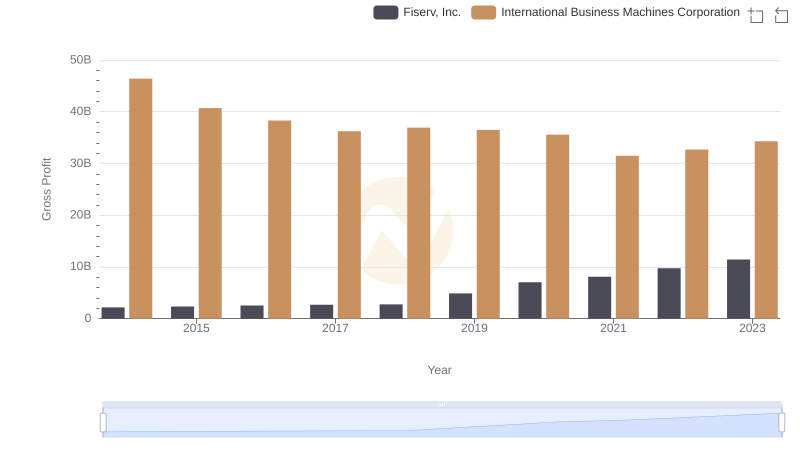

Key Insights on Gross Profit: International Business Machines Corporation vs Fiserv, Inc.

EBITDA Performance Review: International Business Machines Corporation vs Applied Materials, Inc.

Comparing SG&A Expenses: International Business Machines Corporation vs Fiserv, Inc. Trends and Insights

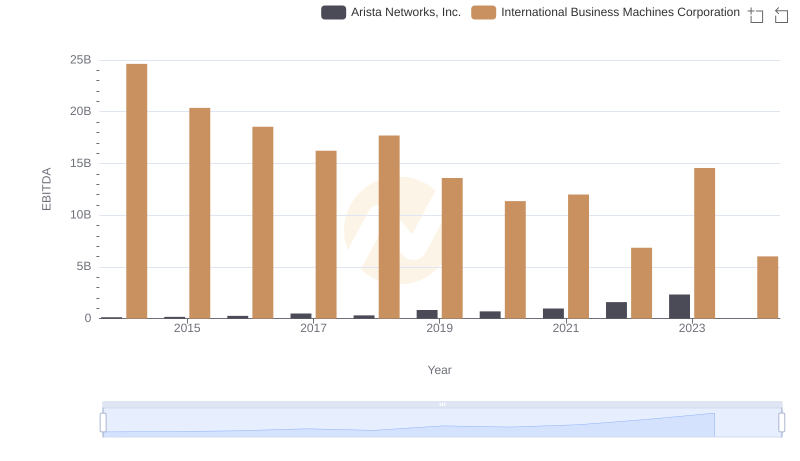

EBITDA Analysis: Evaluating International Business Machines Corporation Against Arista Networks, Inc.

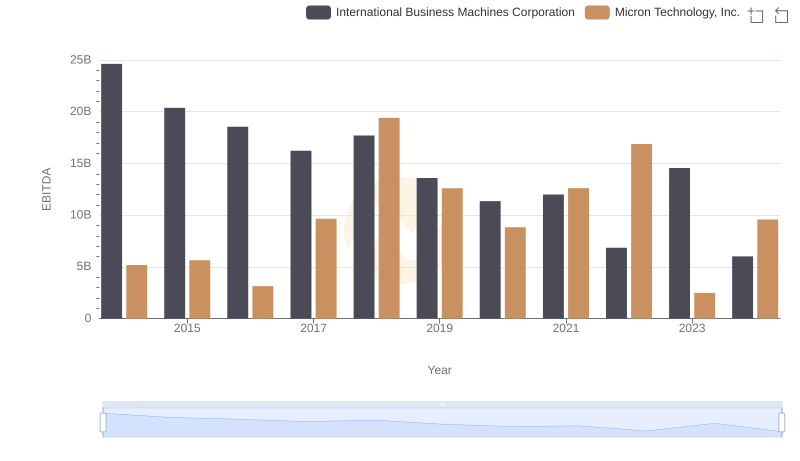

International Business Machines Corporation and Micron Technology, Inc.: A Detailed Examination of EBITDA Performance

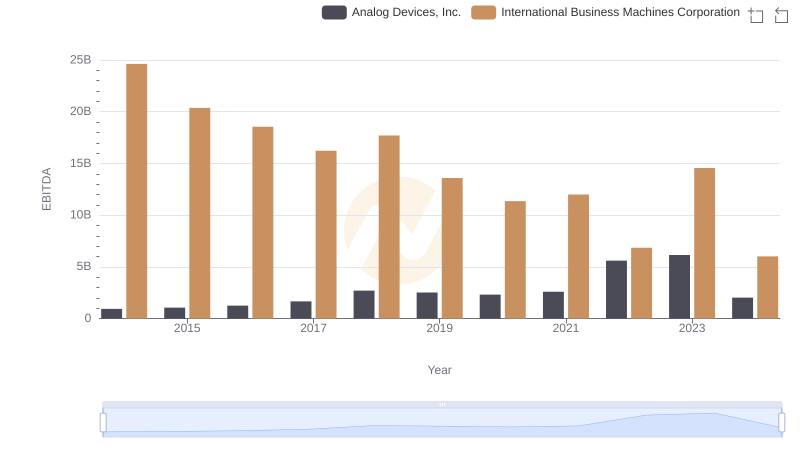

EBITDA Analysis: Evaluating International Business Machines Corporation Against Analog Devices, Inc.

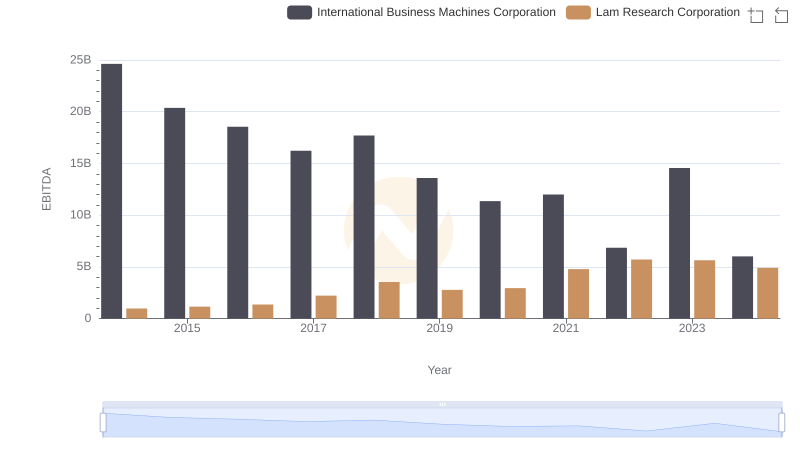

Professional EBITDA Benchmarking: International Business Machines Corporation vs Lam Research Corporation

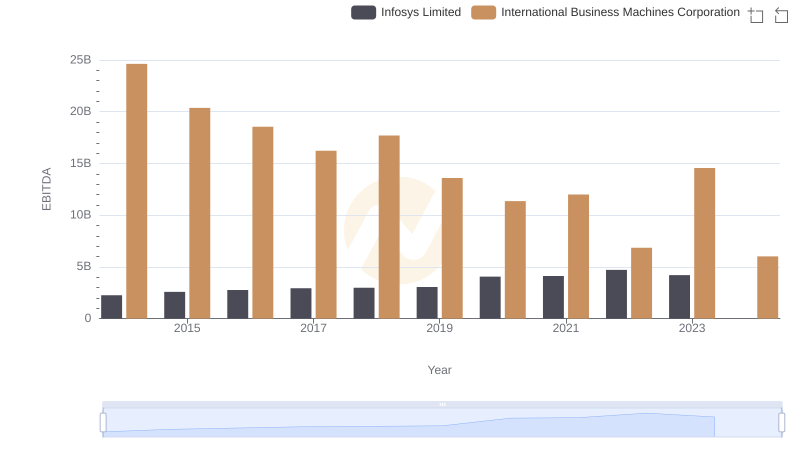

EBITDA Metrics Evaluated: International Business Machines Corporation vs Infosys Limited

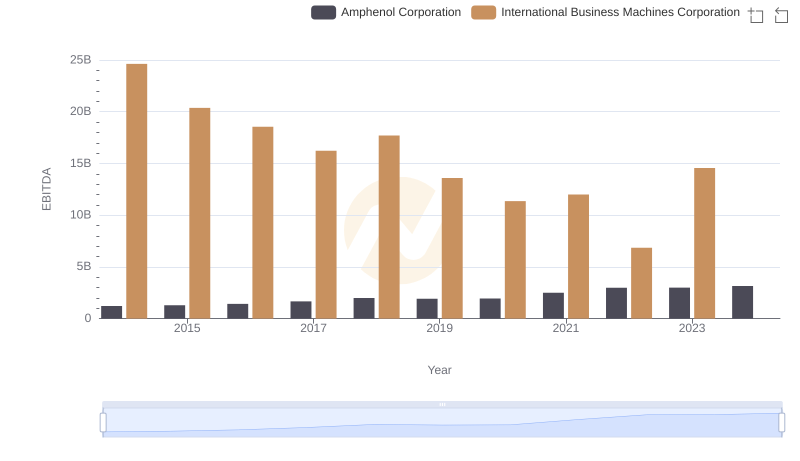

A Side-by-Side Analysis of EBITDA: International Business Machines Corporation and Amphenol Corporation