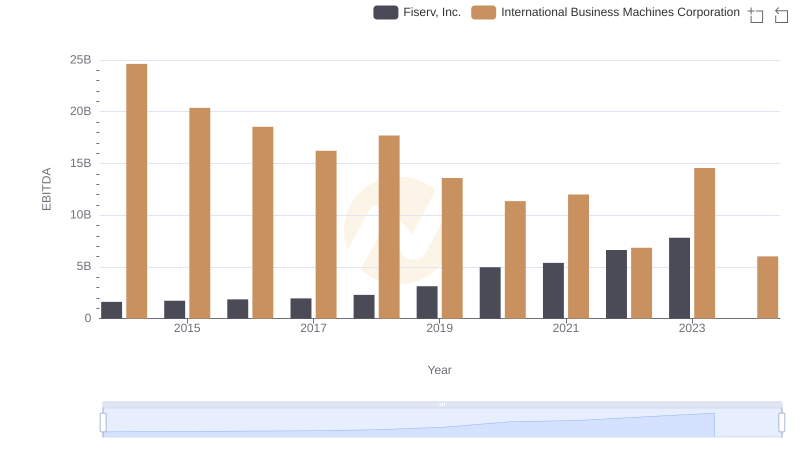

| __timestamp | Fiserv, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 975000000 | 22472000000 |

| Thursday, January 1, 2015 | 1034000000 | 19894000000 |

| Friday, January 1, 2016 | 1101000000 | 20279000000 |

| Sunday, January 1, 2017 | 1150000000 | 19680000000 |

| Monday, January 1, 2018 | 1228000000 | 19366000000 |

| Tuesday, January 1, 2019 | 3284000000 | 18724000000 |

| Wednesday, January 1, 2020 | 5652000000 | 20561000000 |

| Friday, January 1, 2021 | 5810000000 | 18745000000 |

| Saturday, January 1, 2022 | 6059000000 | 17483000000 |

| Sunday, January 1, 2023 | 6576000000 | 17997000000 |

| Monday, January 1, 2024 | 6564000000 | 29536000000 |

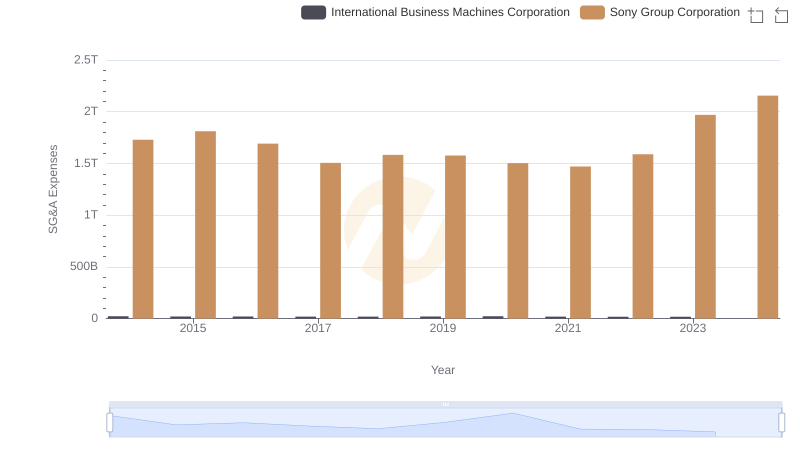

Data in motion

In the ever-evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial. This analysis compares the SG&A expenses of two industry titans: International Business Machines Corporation (IBM) and Fiserv, Inc., from 2014 to 2023.

IBM has consistently maintained a higher SG&A expense, averaging around $20 billion annually. Despite a slight dip in 2023, IBM's expenses have shown resilience, peaking in 2024. This reflects IBM's ongoing investment in innovation and market expansion.

Conversely, Fiserv has experienced a remarkable growth trajectory, with SG&A expenses increasing by over 570% from 2014 to 2023. This surge underscores Fiserv's aggressive expansion strategy and adaptation to the digital age.

Note: Data for 2024 is incomplete for Fiserv, indicating potential future insights.

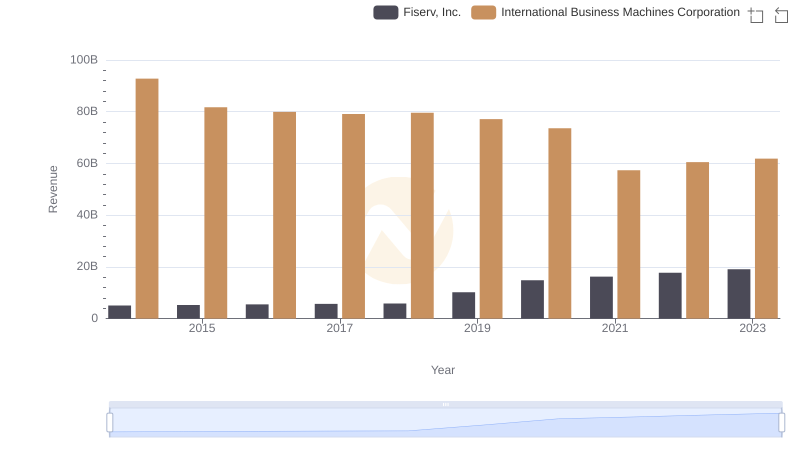

Breaking Down Revenue Trends: International Business Machines Corporation vs Fiserv, Inc.

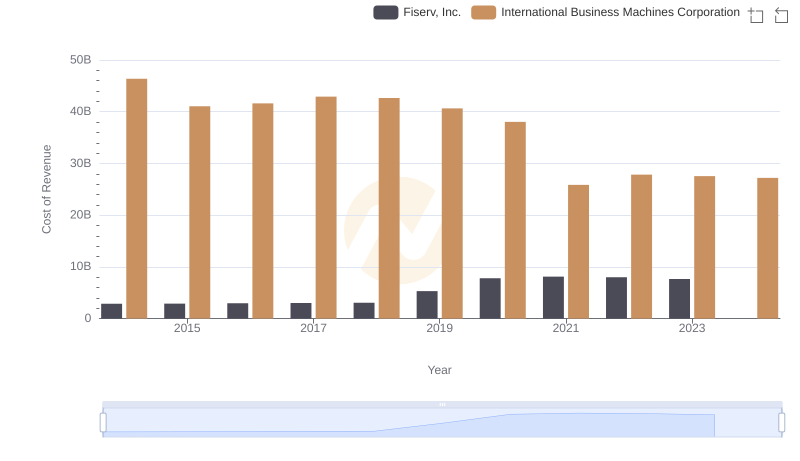

Analyzing Cost of Revenue: International Business Machines Corporation and Fiserv, Inc.

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Sony Group Corporation

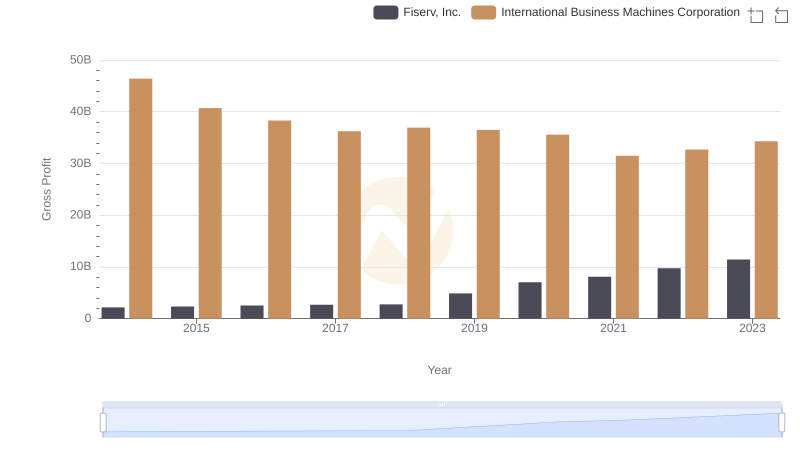

Key Insights on Gross Profit: International Business Machines Corporation vs Fiserv, Inc.

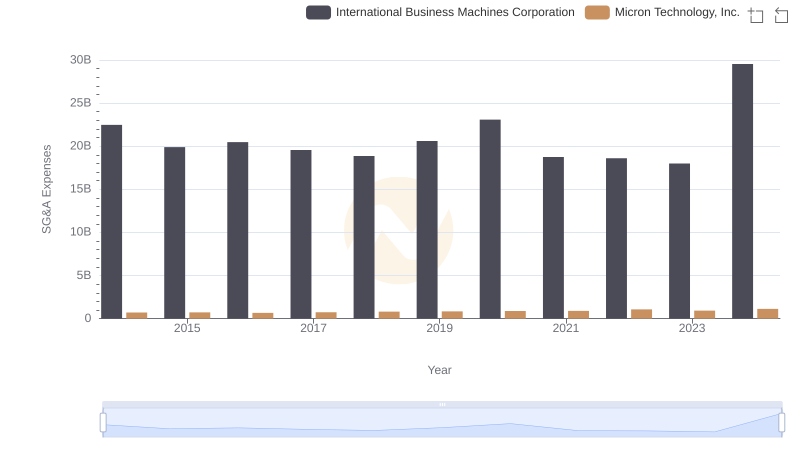

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Micron Technology, Inc.

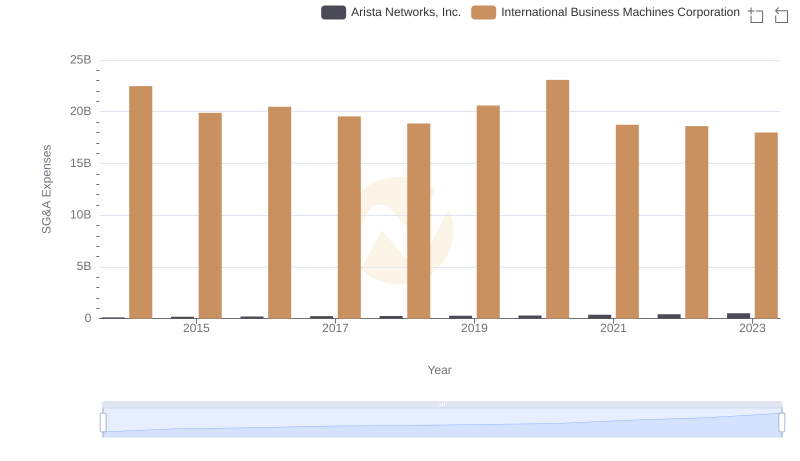

Comparing SG&A Expenses: International Business Machines Corporation vs Arista Networks, Inc. Trends and Insights

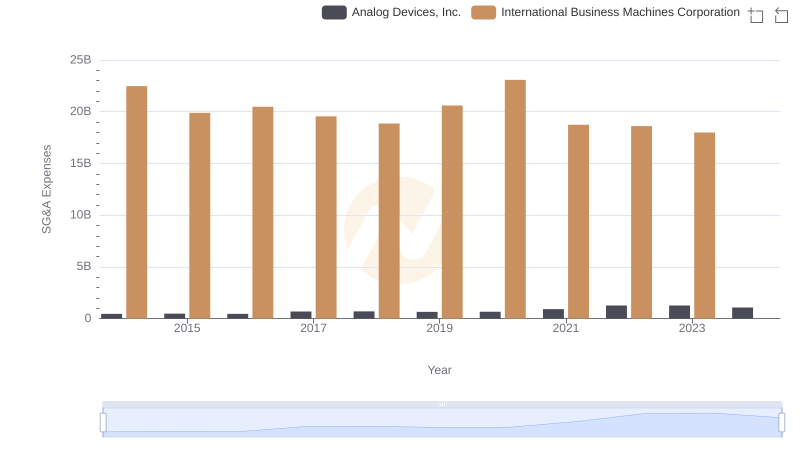

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Analog Devices, Inc.

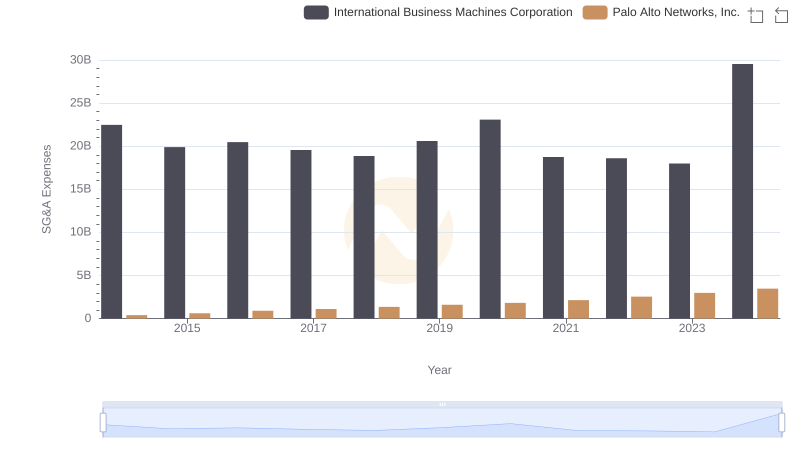

Breaking Down SG&A Expenses: International Business Machines Corporation vs Palo Alto Networks, Inc.

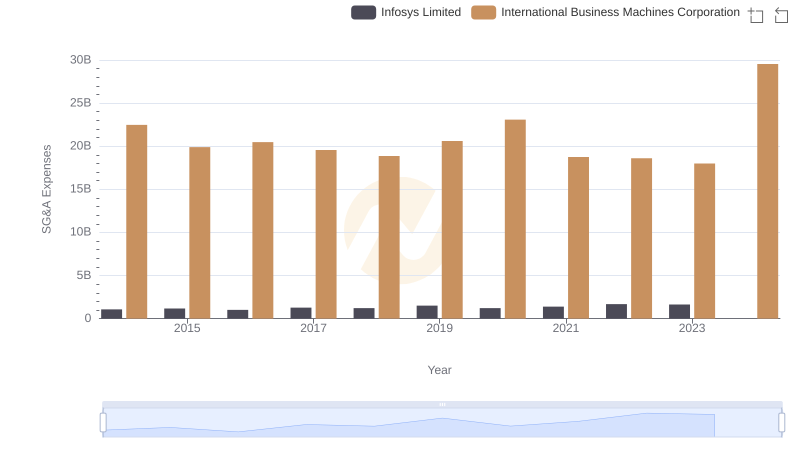

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Infosys Limited

International Business Machines Corporation vs Fiserv, Inc.: In-Depth EBITDA Performance Comparison

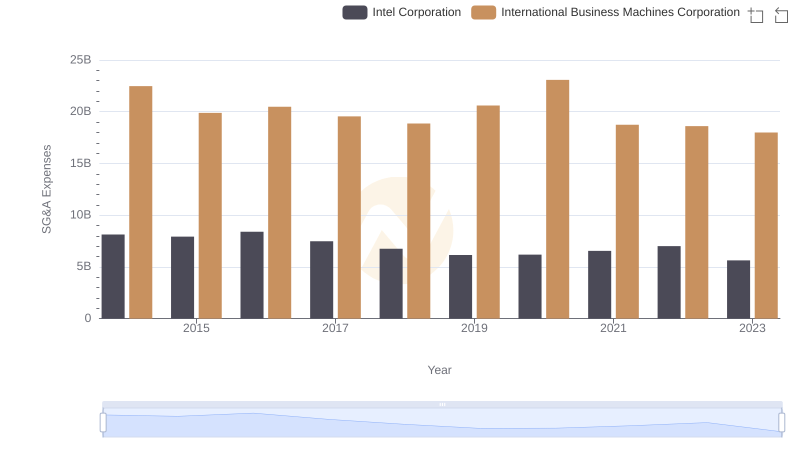

Selling, General, and Administrative Costs: International Business Machines Corporation vs Intel Corporation