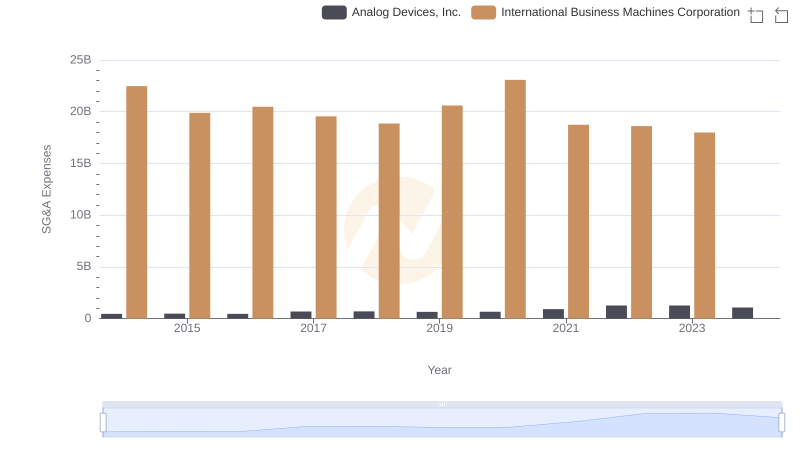

| __timestamp | Analog Devices, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 943421000 | 24962000000 |

| Thursday, January 1, 2015 | 1059384000 | 20268000000 |

| Friday, January 1, 2016 | 1255468000 | 17341000000 |

| Sunday, January 1, 2017 | 1665464000 | 16556000000 |

| Monday, January 1, 2018 | 2706642000 | 16545000000 |

| Tuesday, January 1, 2019 | 2527491000 | 14609000000 |

| Wednesday, January 1, 2020 | 2317701000 | 10555000000 |

| Friday, January 1, 2021 | 2600723000 | 12409000000 |

| Saturday, January 1, 2022 | 5611579000 | 7174000000 |

| Sunday, January 1, 2023 | 6150827000 | 14693000000 |

| Monday, January 1, 2024 | 2032798000 | 6015000000 |

Infusing magic into the data realm

In the ever-evolving landscape of technology, the financial health of companies like International Business Machines Corporation (IBM) and Analog Devices, Inc. (ADI) offers a fascinating glimpse into their strategic maneuvers. Over the past decade, from 2014 to 2024, IBM's EBITDA has shown a significant decline of approximately 76%, dropping from a peak in 2014 to a low in 2024. This trend reflects IBM's ongoing transformation and challenges in adapting to the digital age.

Conversely, ADI has demonstrated remarkable growth, with its EBITDA increasing by over 100% during the same period. This surge underscores ADI's successful expansion in the semiconductor industry, capitalizing on the growing demand for advanced electronic components. The contrasting trajectories of these two giants highlight the dynamic nature of the tech sector, where adaptability and innovation are key to sustaining financial performance.

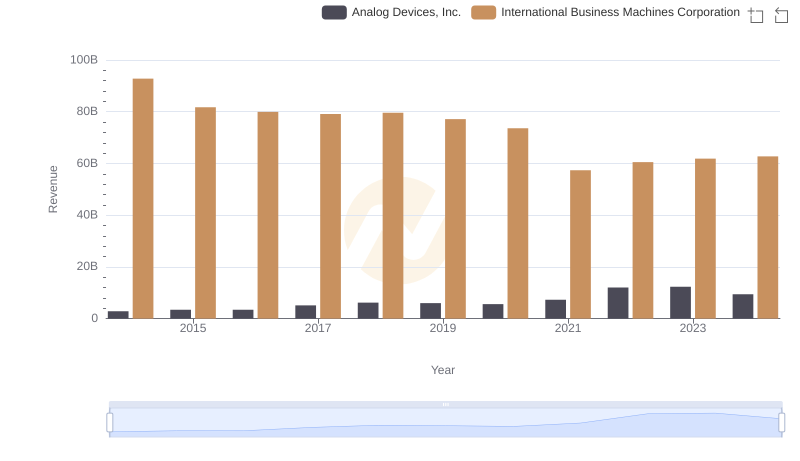

International Business Machines Corporation vs Analog Devices, Inc.: Examining Key Revenue Metrics

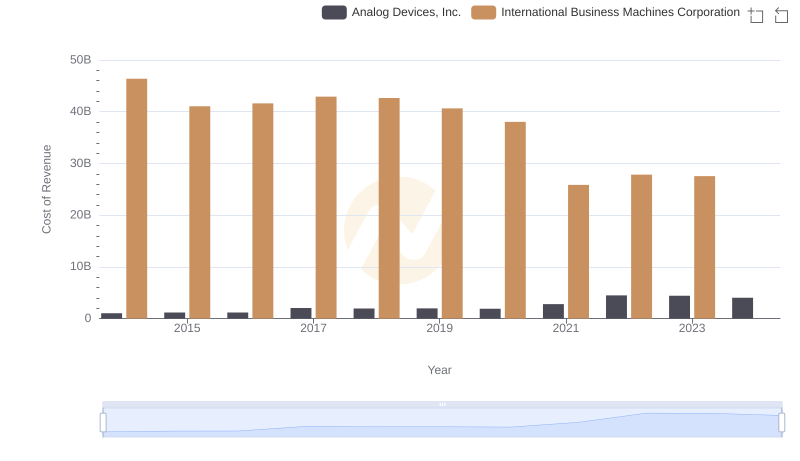

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Analog Devices, Inc.

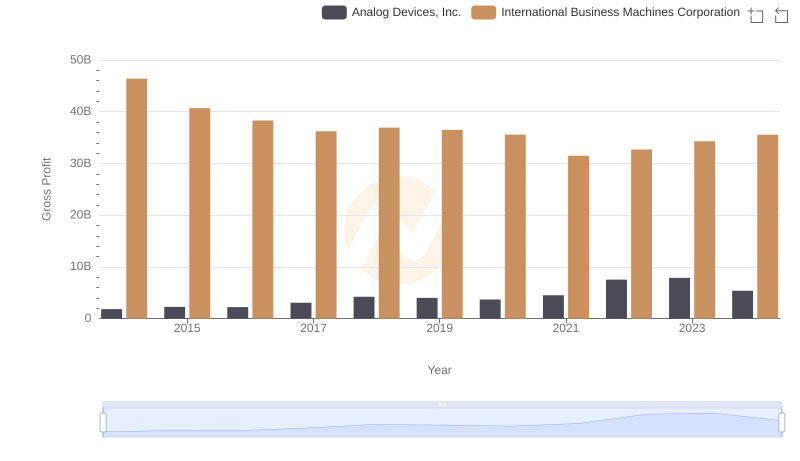

Who Generates Higher Gross Profit? International Business Machines Corporation or Analog Devices, Inc.

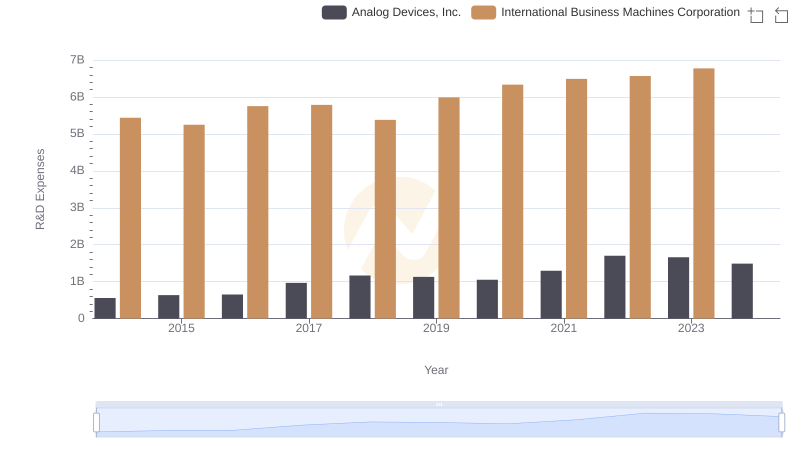

Research and Development Investment: International Business Machines Corporation vs Analog Devices, Inc.

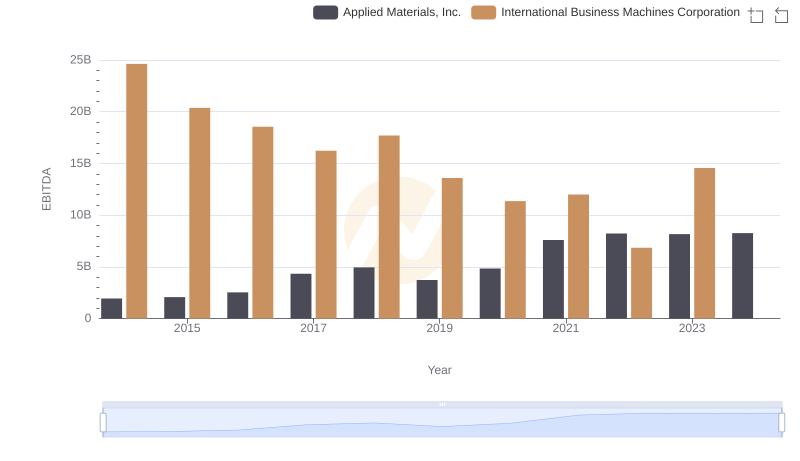

EBITDA Performance Review: International Business Machines Corporation vs Applied Materials, Inc.

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Analog Devices, Inc.

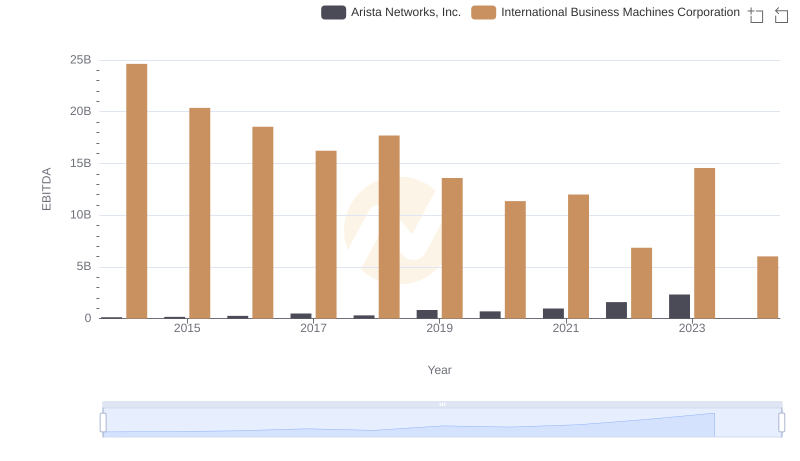

EBITDA Analysis: Evaluating International Business Machines Corporation Against Arista Networks, Inc.

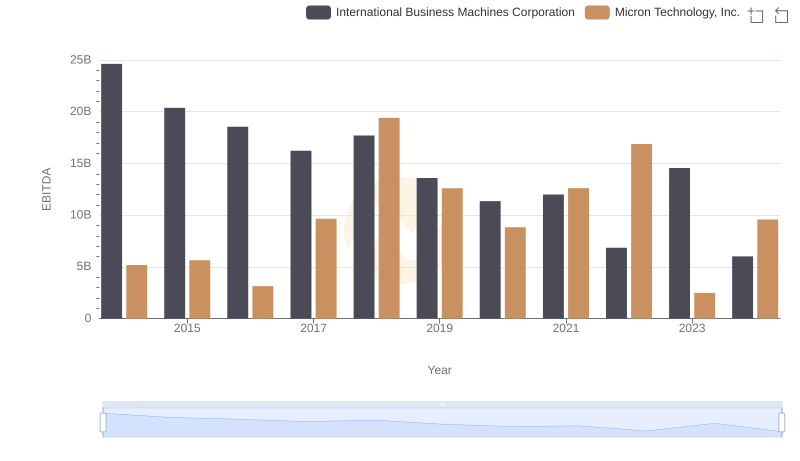

International Business Machines Corporation and Micron Technology, Inc.: A Detailed Examination of EBITDA Performance

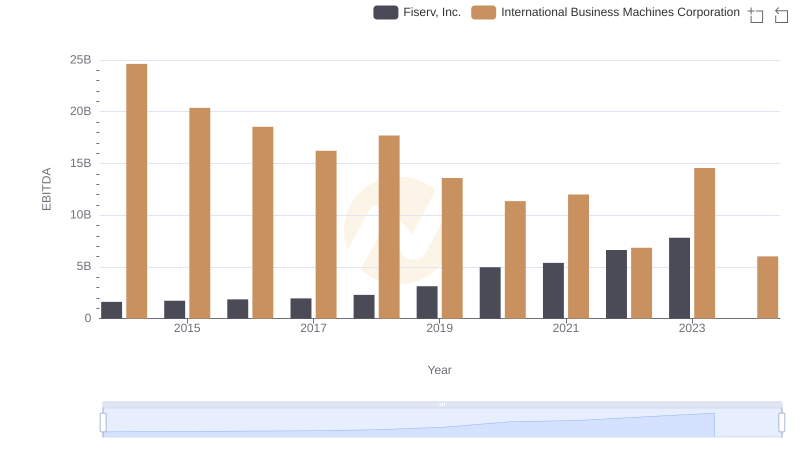

International Business Machines Corporation vs Fiserv, Inc.: In-Depth EBITDA Performance Comparison

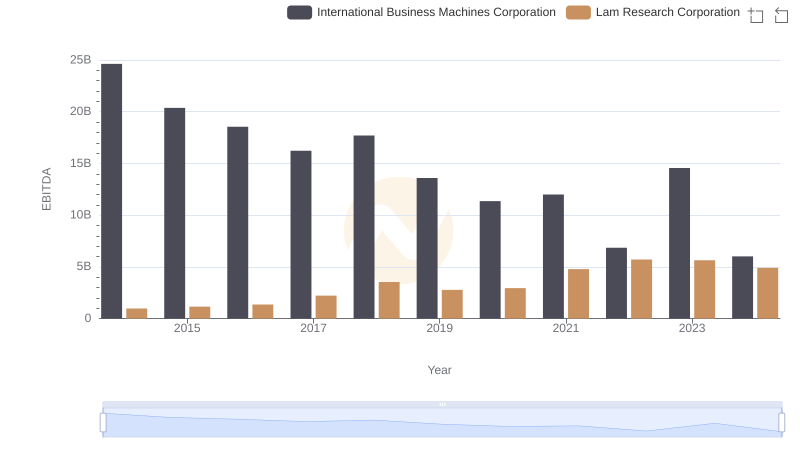

Professional EBITDA Benchmarking: International Business Machines Corporation vs Lam Research Corporation

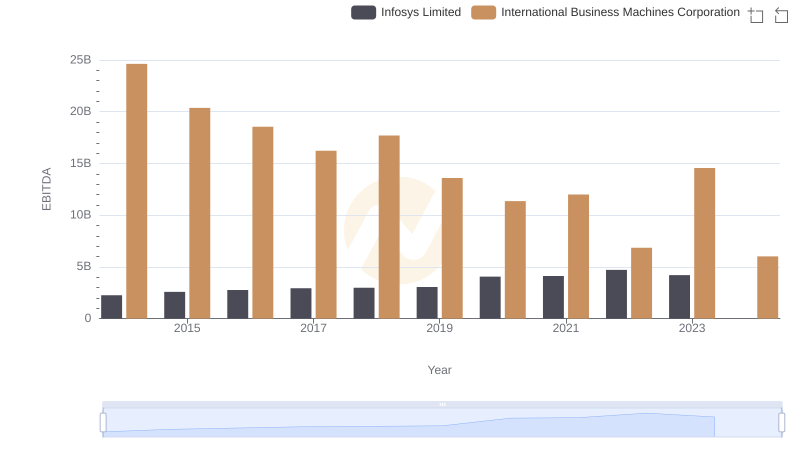

EBITDA Metrics Evaluated: International Business Machines Corporation vs Infosys Limited