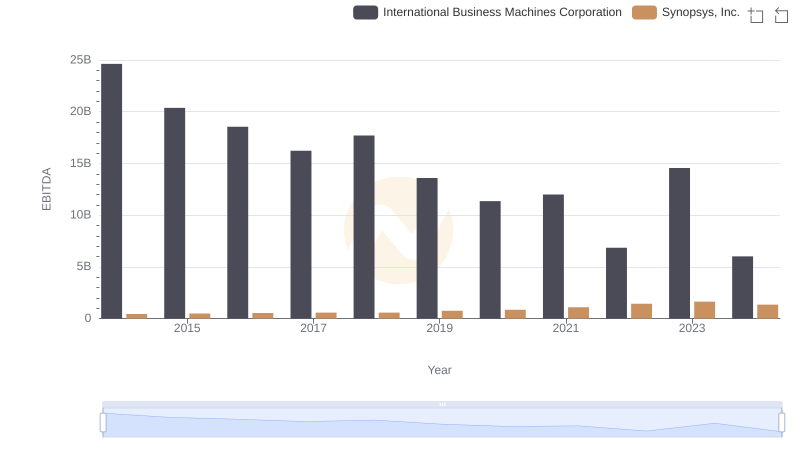

| __timestamp | International Business Machines Corporation | Synopsys, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 608294000 |

| Thursday, January 1, 2015 | 19894000000 | 639504000 |

| Friday, January 1, 2016 | 20279000000 | 668330000 |

| Sunday, January 1, 2017 | 19680000000 | 746092000 |

| Monday, January 1, 2018 | 19366000000 | 885538000 |

| Tuesday, January 1, 2019 | 18724000000 | 862108000 |

| Wednesday, January 1, 2020 | 20561000000 | 916540000 |

| Friday, January 1, 2021 | 18745000000 | 1035479000 |

| Saturday, January 1, 2022 | 17483000000 | 1133617000 |

| Sunday, January 1, 2023 | 17997000000 | 1299327000 |

| Monday, January 1, 2024 | 29536000000 | 1427838000 |

Infusing magic into the data realm

In the ever-evolving landscape of technology giants, managing operational costs is crucial for sustained growth and profitability. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry leaders: International Business Machines Corporation (IBM) and Synopsys, Inc., from 2014 to 2024.

IBM, a stalwart in the tech industry, has consistently reported higher SG&A expenses, averaging around $20 billion annually. However, a notable spike occurred in 2024, with expenses reaching nearly $30 billion, a 50% increase from the previous year. In contrast, Synopsys, a leader in electronic design automation, has maintained a more modest SG&A expense profile, averaging under $1 billion annually. Despite a steady increase, Synopsys' expenses in 2024 were only about 5% of IBM's.

This comparison highlights IBM's expansive operational scale, while Synopsys showcases efficient cost management, crucial for its niche market leadership.

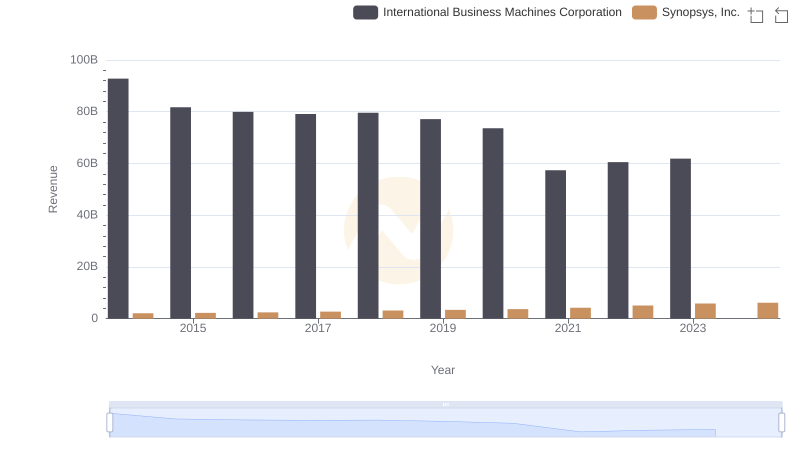

International Business Machines Corporation vs Synopsys, Inc.: Annual Revenue Growth Compared

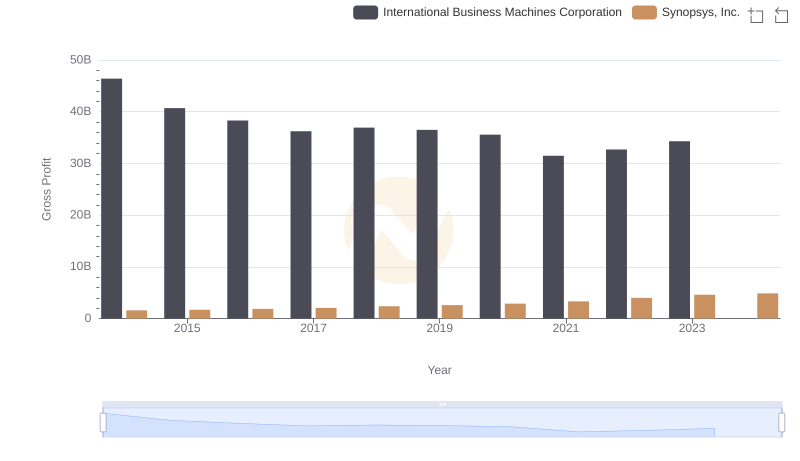

Cost of Revenue Comparison: International Business Machines Corporation vs Synopsys, Inc.

Key Insights on Gross Profit: International Business Machines Corporation vs Synopsys, Inc.

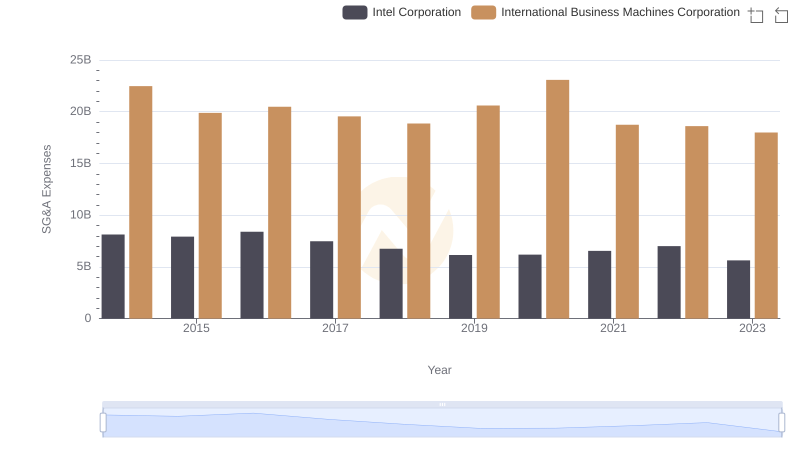

Selling, General, and Administrative Costs: International Business Machines Corporation vs Intel Corporation

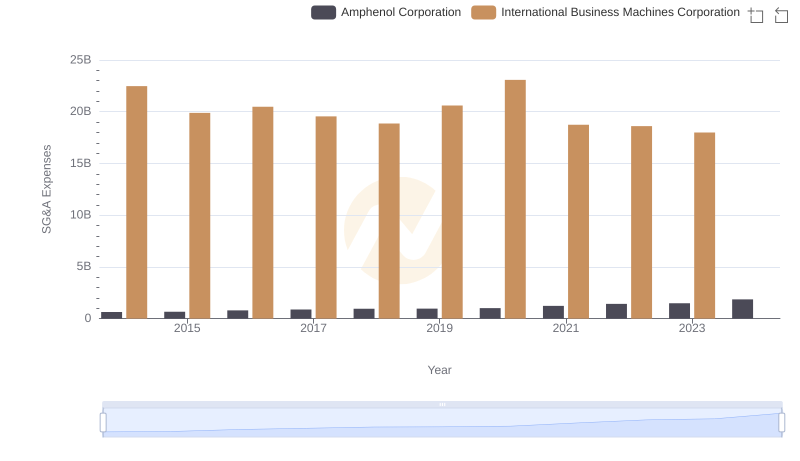

International Business Machines Corporation or Amphenol Corporation: Who Manages SG&A Costs Better?

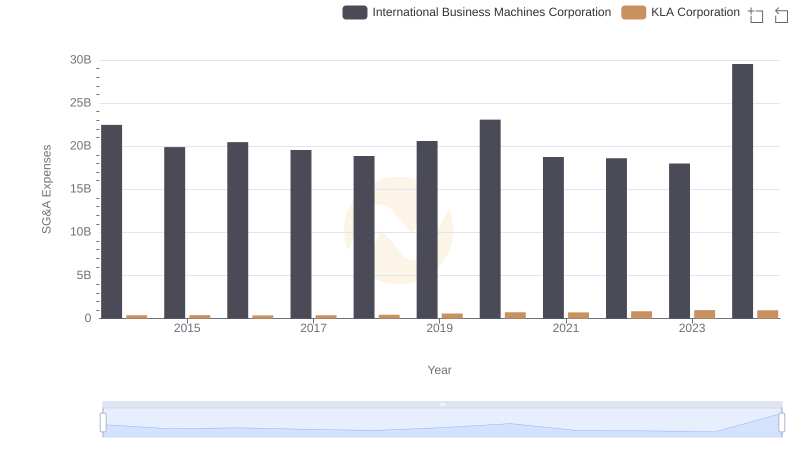

Selling, General, and Administrative Costs: International Business Machines Corporation vs KLA Corporation

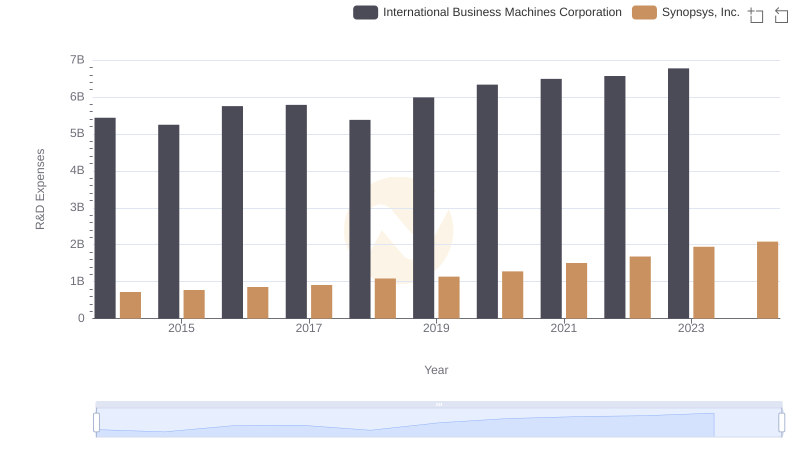

Who Prioritizes Innovation? R&D Spending Compared for International Business Machines Corporation and Synopsys, Inc.

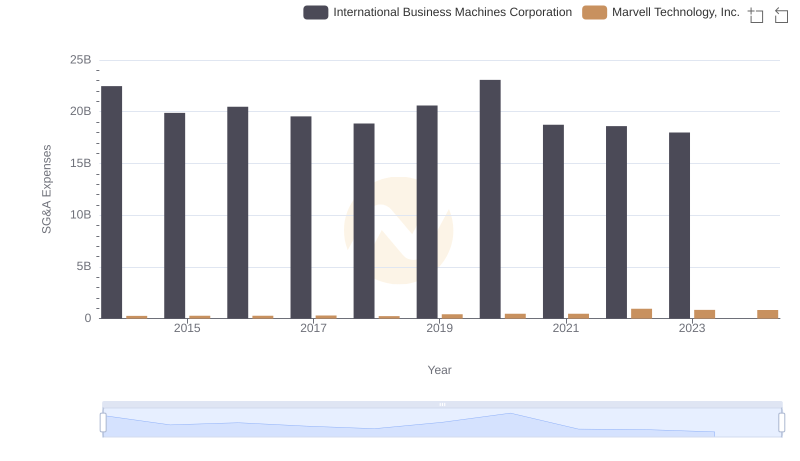

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Marvell Technology, Inc.

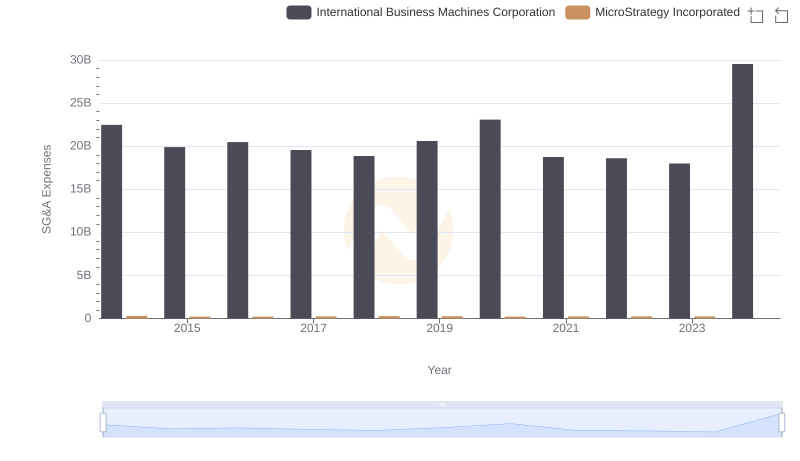

International Business Machines Corporation or MicroStrategy Incorporated: Who Manages SG&A Costs Better?

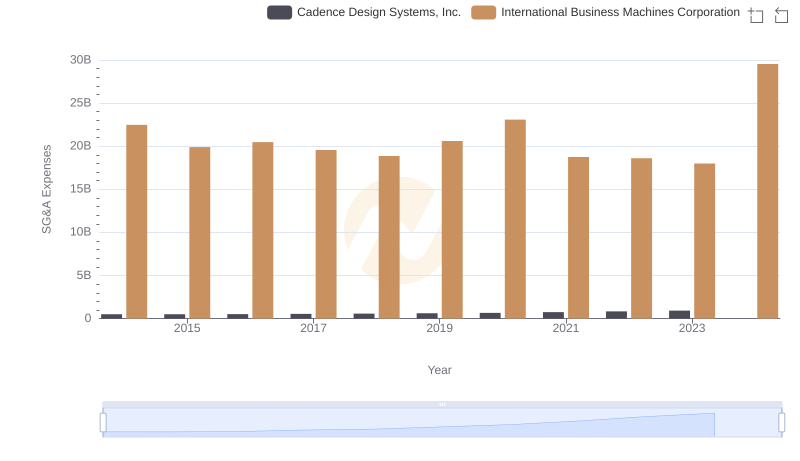

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and Cadence Design Systems, Inc.

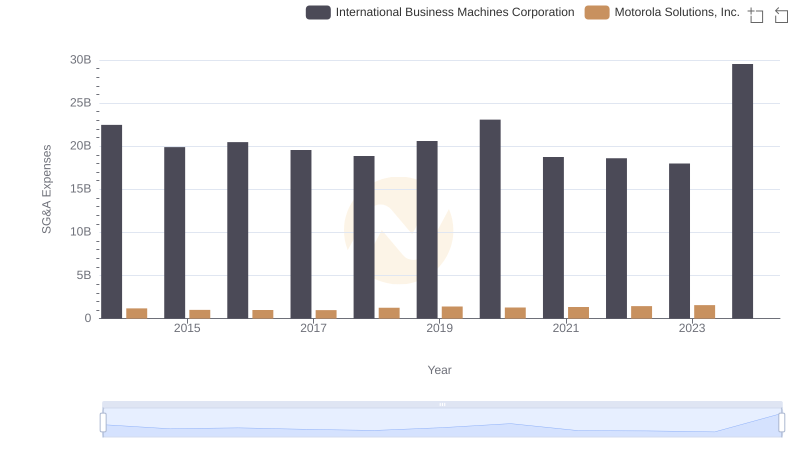

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and Motorola Solutions, Inc.

International Business Machines Corporation and Synopsys, Inc.: A Detailed Examination of EBITDA Performance