| __timestamp | International Business Machines Corporation | MicroStrategy Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 321429000 |

| Thursday, January 1, 2015 | 19894000000 | 229254000 |

| Friday, January 1, 2016 | 20279000000 | 238202000 |

| Sunday, January 1, 2017 | 19680000000 | 254773000 |

| Monday, January 1, 2018 | 19366000000 | 291659000 |

| Tuesday, January 1, 2019 | 18724000000 | 277932000 |

| Wednesday, January 1, 2020 | 20561000000 | 229046000 |

| Friday, January 1, 2021 | 18745000000 | 255642000 |

| Saturday, January 1, 2022 | 17483000000 | 258303000 |

| Sunday, January 1, 2023 | 17997000000 | 264983000 |

| Monday, January 1, 2024 | 29536000000 | 278618000 |

Unleashing insights

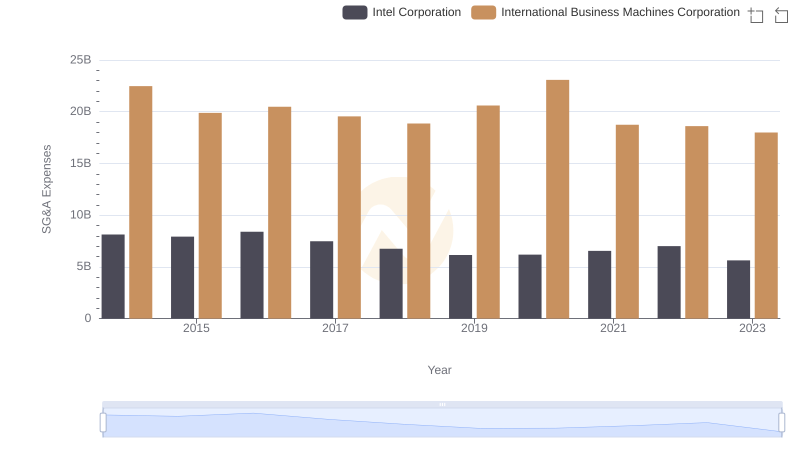

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. From 2014 to 2023, International Business Machines Corporation (IBM) and MicroStrategy Incorporated have showcased contrasting approaches to SG&A cost management. IBM, a tech giant, consistently reported SG&A expenses averaging around $20 billion annually, with a notable peak in 2024. In contrast, MicroStrategy, a smaller player, maintained a more modest average of $262 million, reflecting a leaner operational model.

IBM's SG&A expenses fluctuated, with a significant 30% increase from 2023 to 2024, indicating potential strategic shifts or investments. Meanwhile, MicroStrategy's expenses remained relatively stable, highlighting its disciplined cost control. This comparison underscores the diverse strategies employed by companies of different scales in managing operational costs, offering valuable insights for investors and financial analysts.

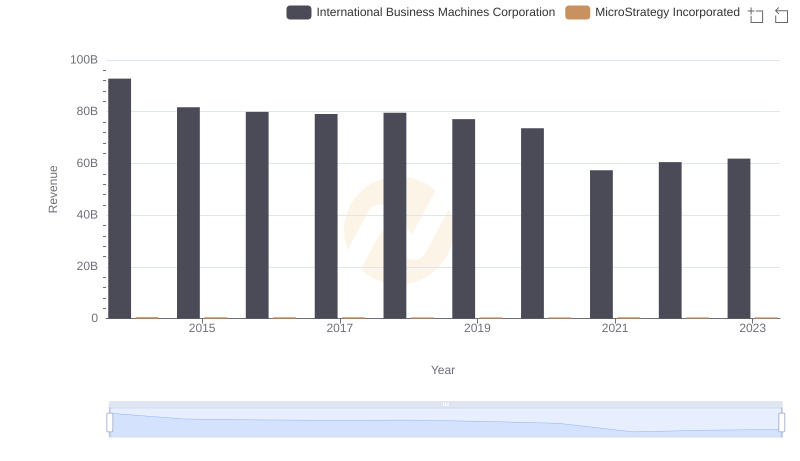

Revenue Insights: International Business Machines Corporation and MicroStrategy Incorporated Performance Compared

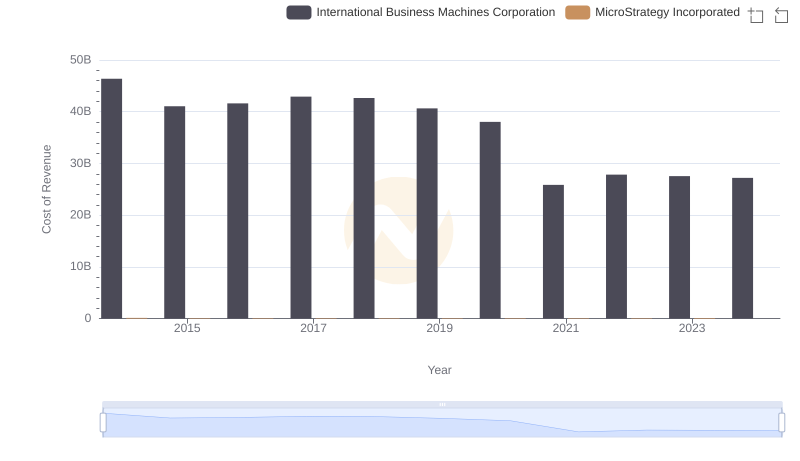

Cost of Revenue: Key Insights for International Business Machines Corporation and MicroStrategy Incorporated

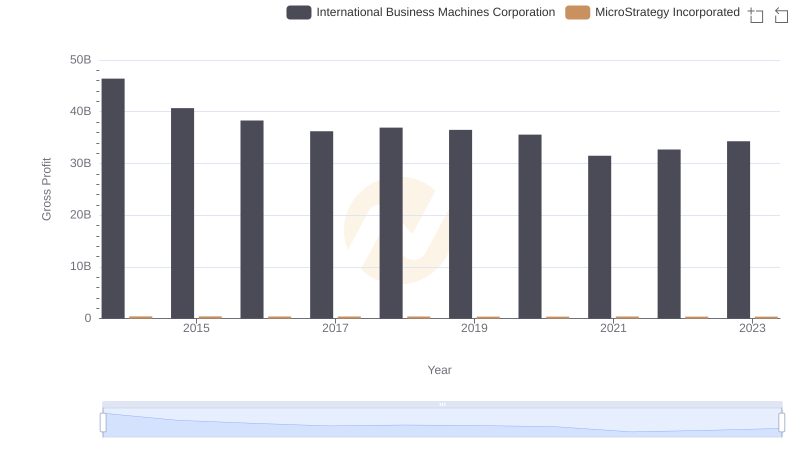

International Business Machines Corporation vs MicroStrategy Incorporated: A Gross Profit Performance Breakdown

R&D Spending Showdown: International Business Machines Corporation vs MicroStrategy Incorporated

Selling, General, and Administrative Costs: International Business Machines Corporation vs Intel Corporation

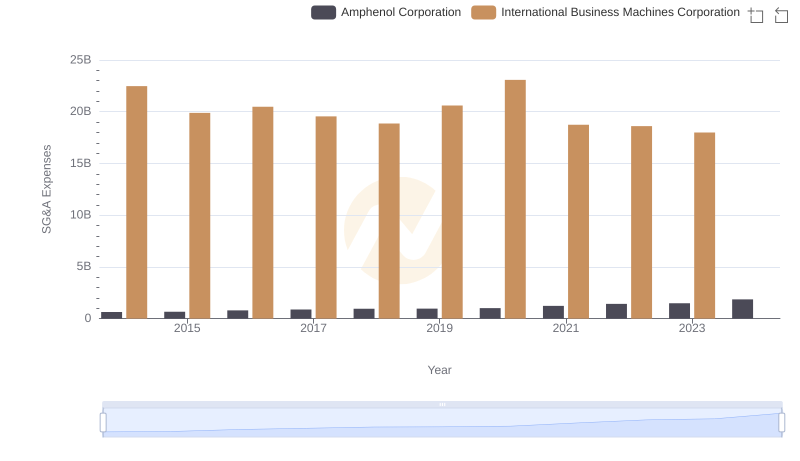

International Business Machines Corporation or Amphenol Corporation: Who Manages SG&A Costs Better?

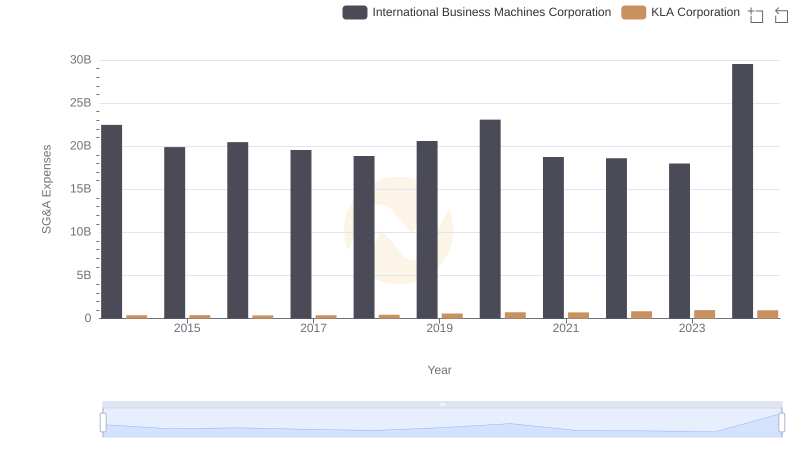

Selling, General, and Administrative Costs: International Business Machines Corporation vs KLA Corporation

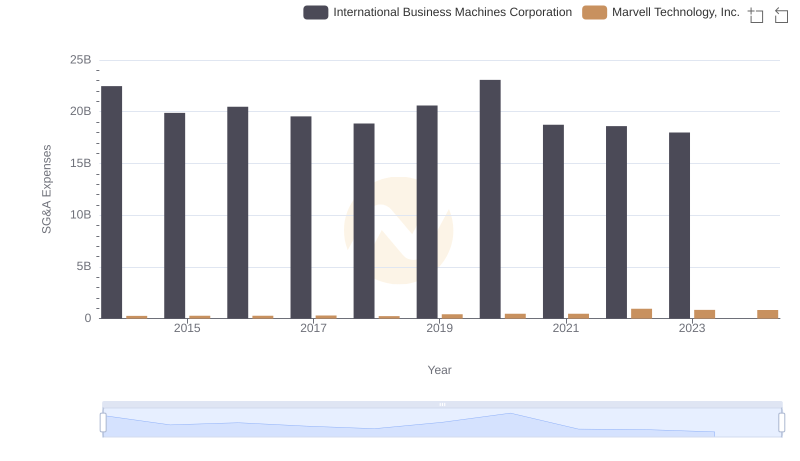

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Marvell Technology, Inc.

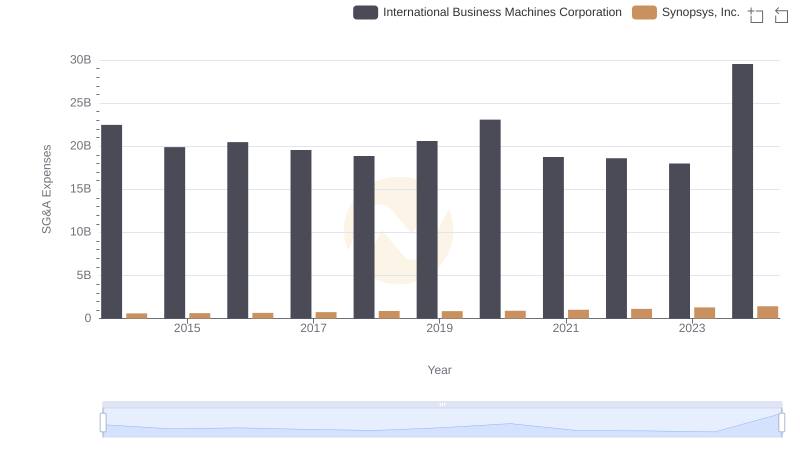

International Business Machines Corporation or Synopsys, Inc.: Who Manages SG&A Costs Better?

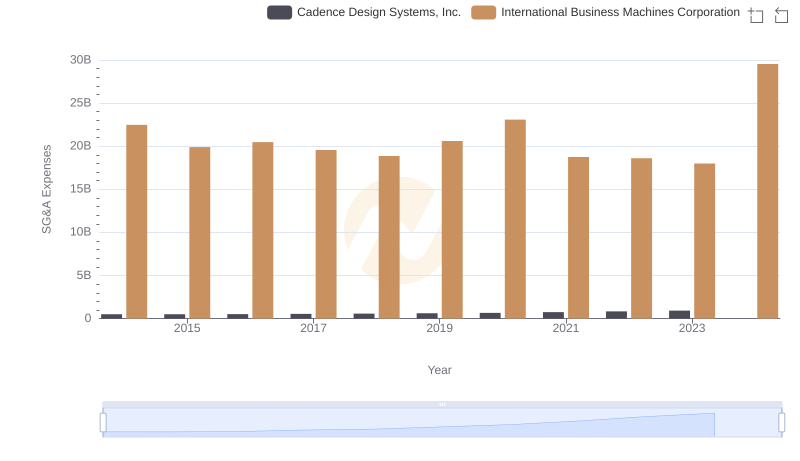

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and Cadence Design Systems, Inc.

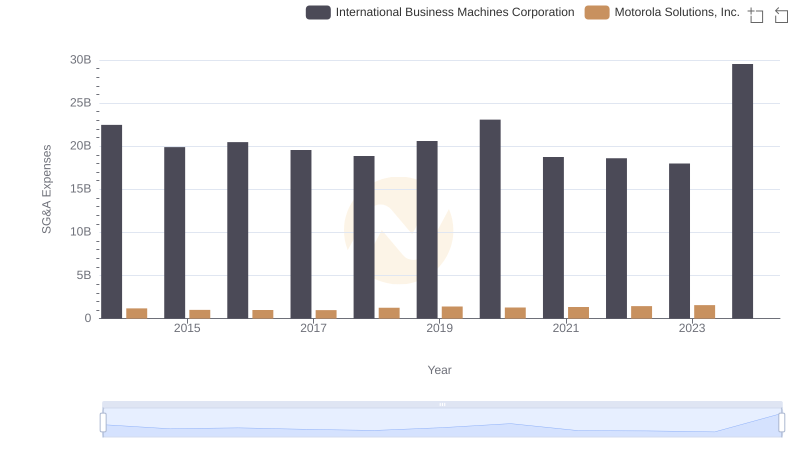

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and Motorola Solutions, Inc.

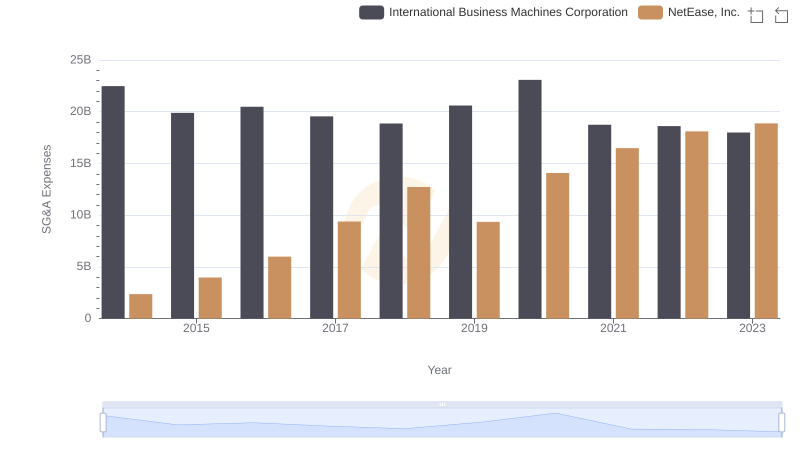

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and NetEase, Inc.