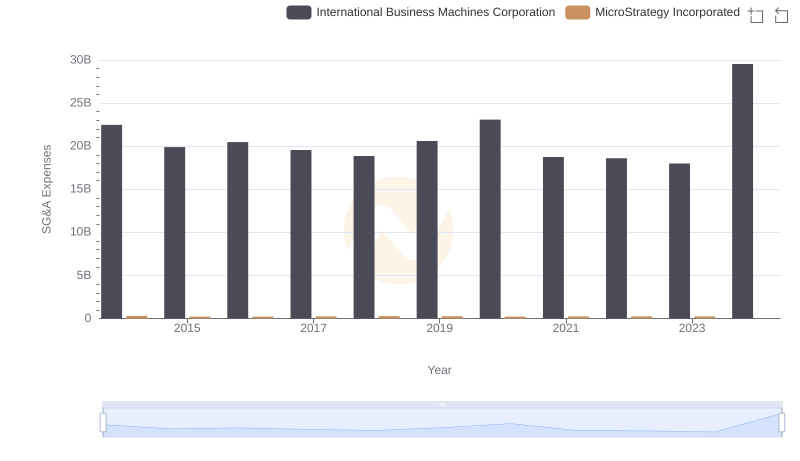

| __timestamp | Amphenol Corporation | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 645100000 | 22472000000 |

| Thursday, January 1, 2015 | 669100000 | 19894000000 |

| Friday, January 1, 2016 | 798200000 | 20279000000 |

| Sunday, January 1, 2017 | 878300000 | 19680000000 |

| Monday, January 1, 2018 | 959500000 | 19366000000 |

| Tuesday, January 1, 2019 | 971400000 | 18724000000 |

| Wednesday, January 1, 2020 | 1014200000 | 20561000000 |

| Friday, January 1, 2021 | 1226300000 | 18745000000 |

| Saturday, January 1, 2022 | 1420900000 | 17483000000 |

| Sunday, January 1, 2023 | 1489900000 | 17997000000 |

| Monday, January 1, 2024 | 1855400000 | 29536000000 |

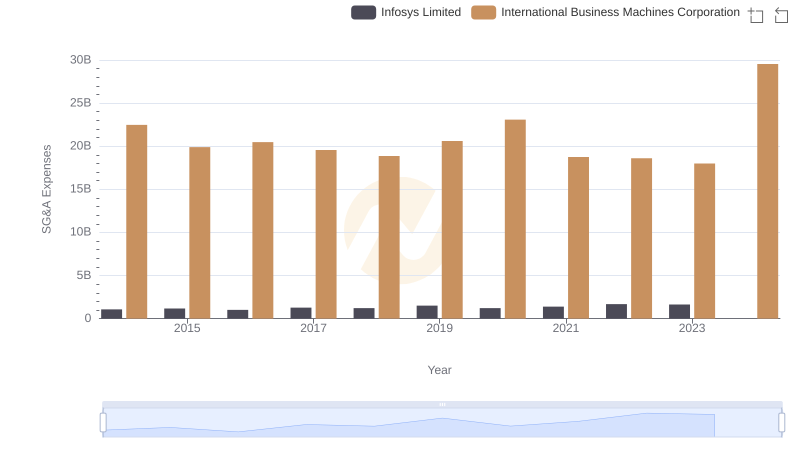

Infusing magic into the data realm

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis compares the SG&A cost management of International Business Machines Corporation (IBM) and Amphenol Corporation from 2014 to 2024. Over this decade, IBM's SG&A expenses have consistently been higher, averaging around $20 billion annually, while Amphenol's expenses have been significantly lower, averaging just over $1 billion. Despite IBM's larger scale, Amphenol demonstrates a more efficient cost management strategy, maintaining a steady increase in SG&A expenses by approximately 10% annually, compared to IBM's fluctuating expenses. Notably, in 2023, Amphenol's expenses rose to $1.49 billion, while IBM's decreased to $17.99 billion, highlighting Amphenol's consistent growth and IBM's efforts to streamline costs. This trend underscores the importance of strategic cost management in enhancing corporate efficiency and competitiveness.

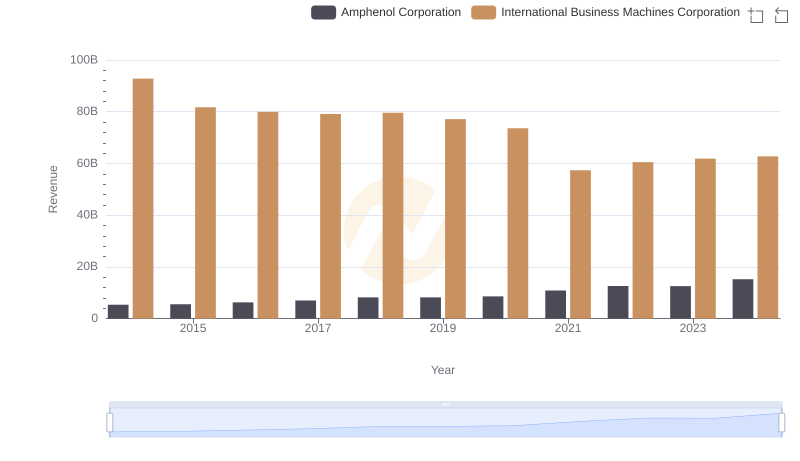

Revenue Insights: International Business Machines Corporation and Amphenol Corporation Performance Compared

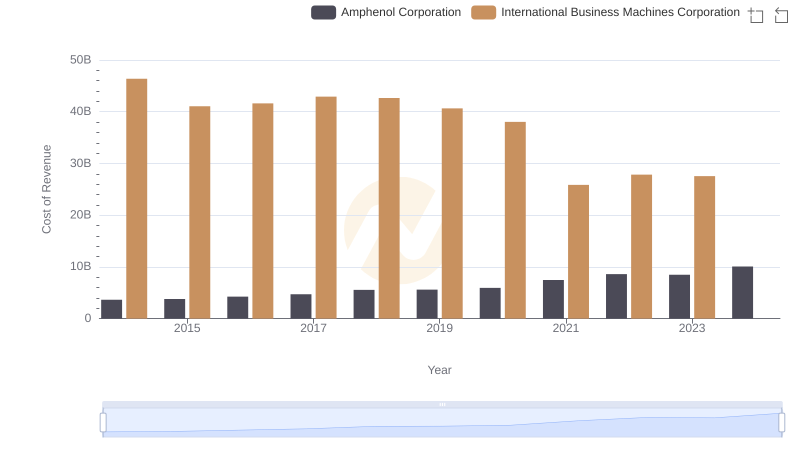

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Amphenol Corporation

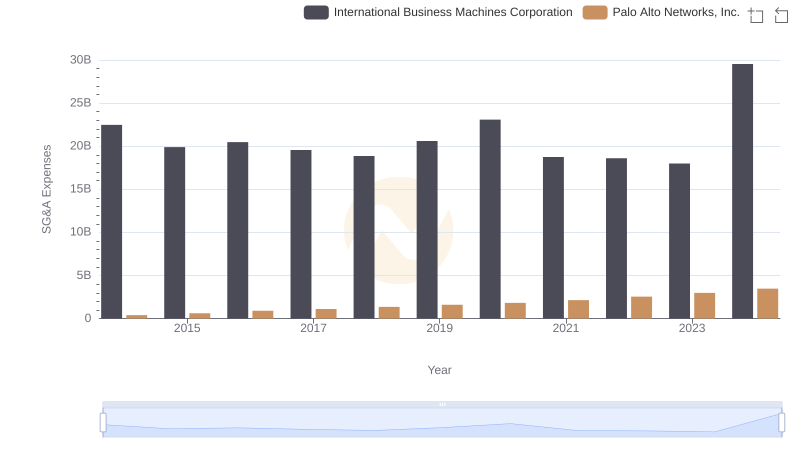

Breaking Down SG&A Expenses: International Business Machines Corporation vs Palo Alto Networks, Inc.

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Infosys Limited

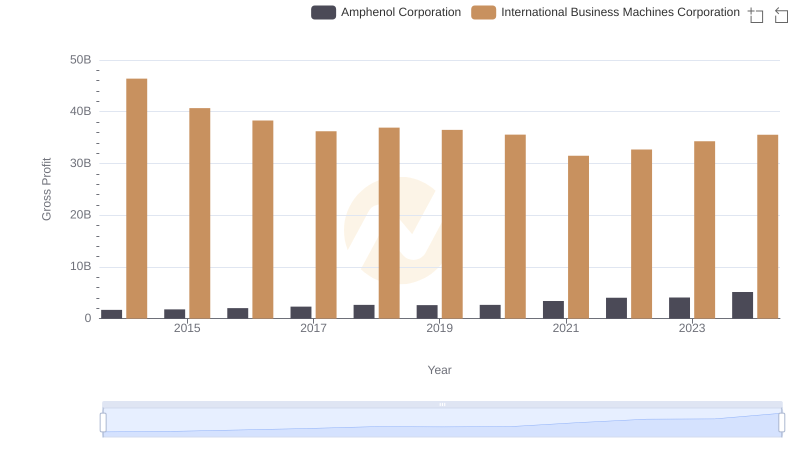

Who Generates Higher Gross Profit? International Business Machines Corporation or Amphenol Corporation

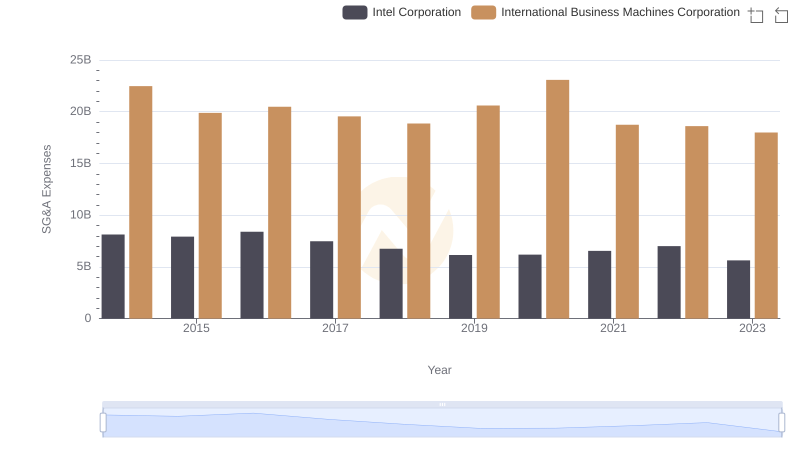

Selling, General, and Administrative Costs: International Business Machines Corporation vs Intel Corporation

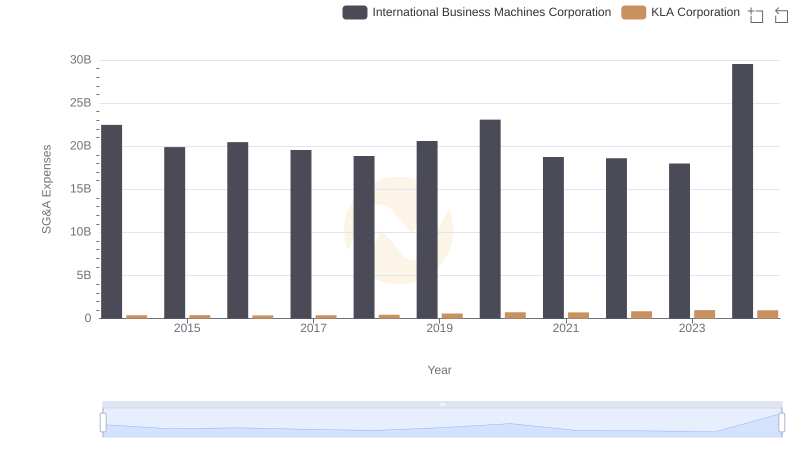

Selling, General, and Administrative Costs: International Business Machines Corporation vs KLA Corporation

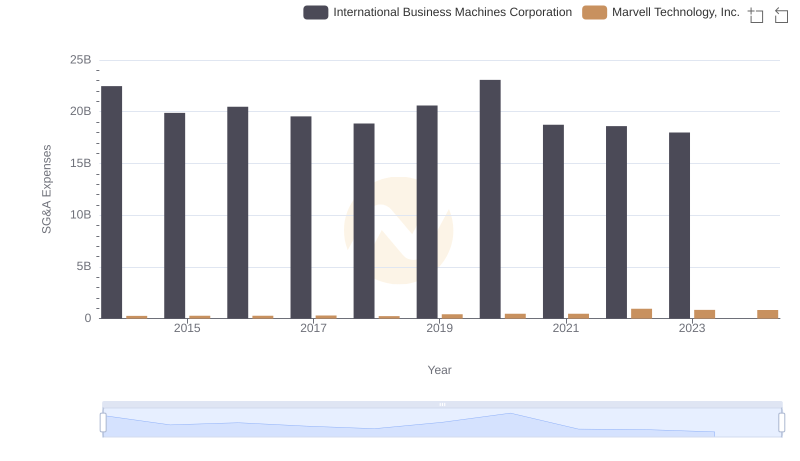

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Marvell Technology, Inc.

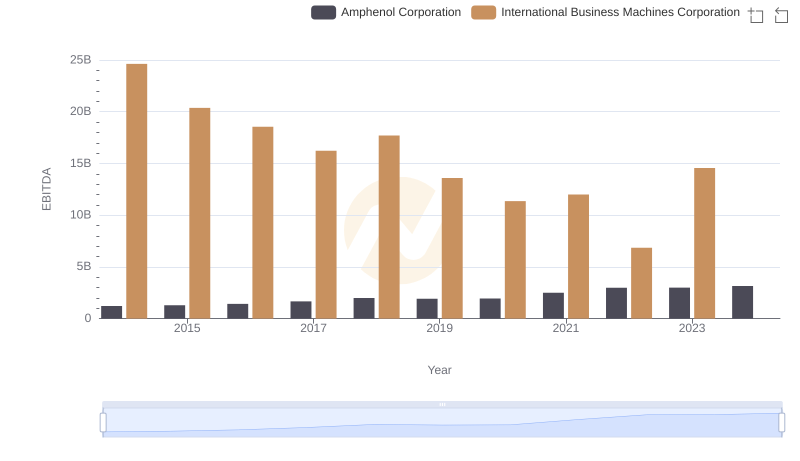

A Side-by-Side Analysis of EBITDA: International Business Machines Corporation and Amphenol Corporation

International Business Machines Corporation or MicroStrategy Incorporated: Who Manages SG&A Costs Better?

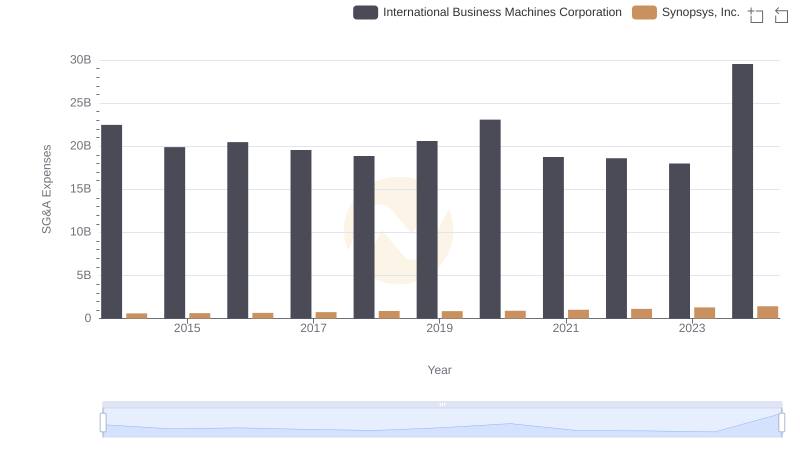

International Business Machines Corporation or Synopsys, Inc.: Who Manages SG&A Costs Better?

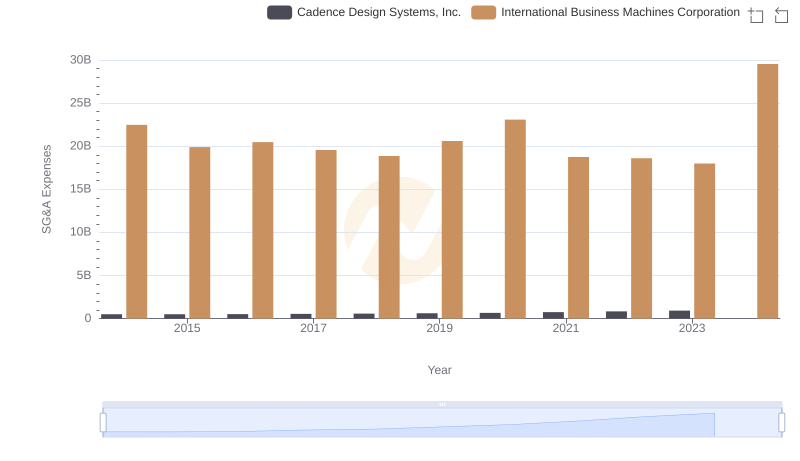

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and Cadence Design Systems, Inc.