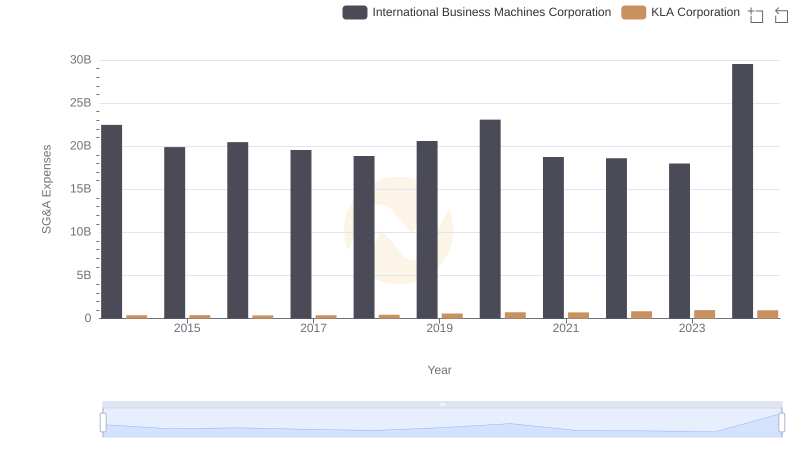

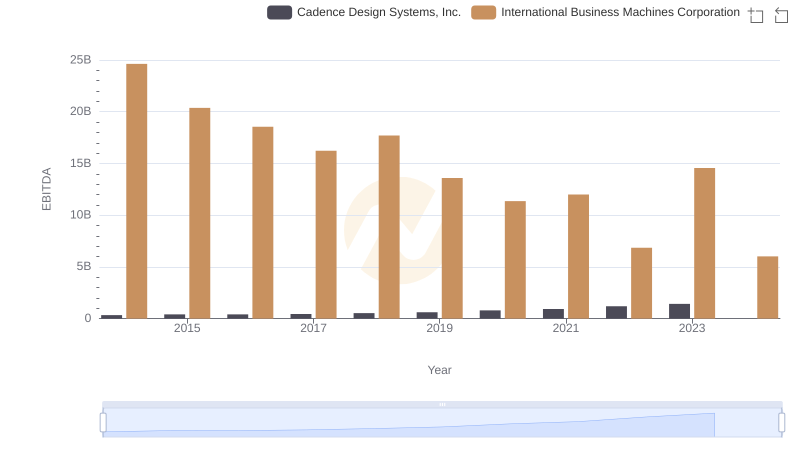

| __timestamp | Cadence Design Systems, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 513307000 | 22472000000 |

| Thursday, January 1, 2015 | 512414000 | 19894000000 |

| Friday, January 1, 2016 | 520300000 | 20279000000 |

| Sunday, January 1, 2017 | 553342000 | 19680000000 |

| Monday, January 1, 2018 | 573075000 | 19366000000 |

| Tuesday, January 1, 2019 | 621479000 | 18724000000 |

| Wednesday, January 1, 2020 | 670885000 | 20561000000 |

| Friday, January 1, 2021 | 749280000 | 18745000000 |

| Saturday, January 1, 2022 | 846340000 | 17483000000 |

| Sunday, January 1, 2023 | 920649000 | 17997000000 |

| Monday, January 1, 2024 | 1039766000 | 29536000000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding Selling, General, and Administrative (SG&A) expenses is crucial for evaluating a company's operational efficiency. This analysis delves into the SG&A expenses of two industry titans: International Business Machines Corporation (IBM) and Cadence Design Systems, Inc., from 2014 to 2023.

IBM, a stalwart in the tech industry, consistently reported SG&A expenses averaging around $20 billion annually, with a notable peak in 2024. This reflects IBM's expansive global operations and its commitment to maintaining a robust administrative framework. In contrast, Cadence Design Systems, a leader in electronic design automation, showcased a steady growth in SG&A expenses, increasing by approximately 80% over the decade. This rise underscores Cadence's strategic investments in scaling its operations and enhancing market presence.

The data reveals a fascinating narrative of how these companies manage their operational costs amidst changing market dynamics, offering valuable insights for investors and industry analysts alike.

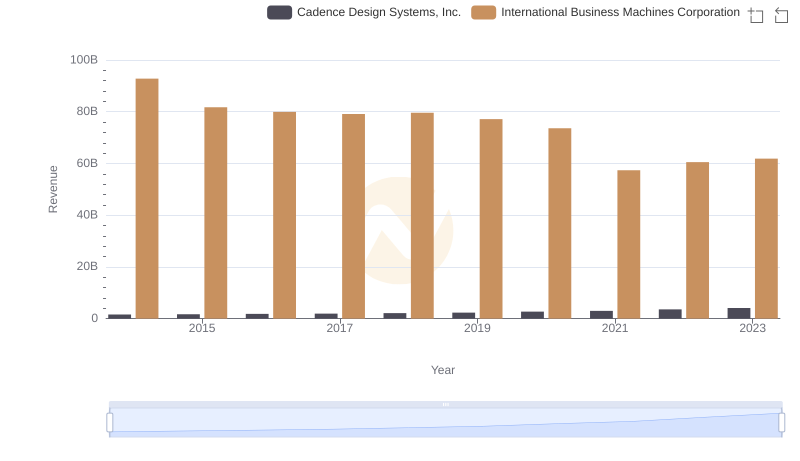

International Business Machines Corporation or Cadence Design Systems, Inc.: Who Leads in Yearly Revenue?

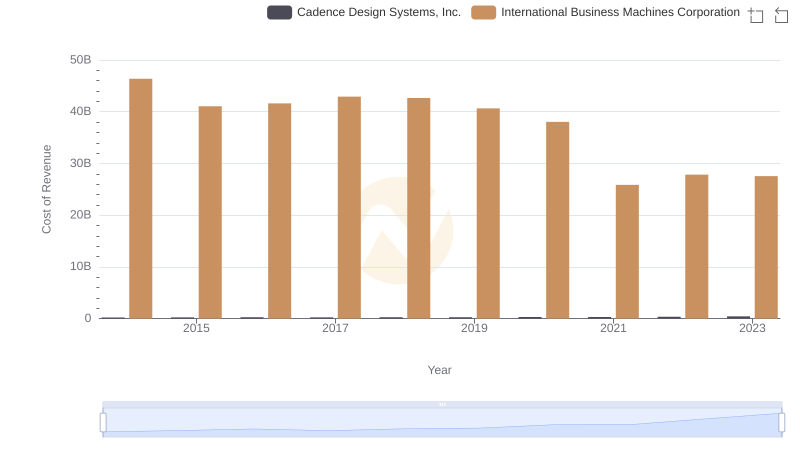

Cost of Revenue Comparison: International Business Machines Corporation vs Cadence Design Systems, Inc.

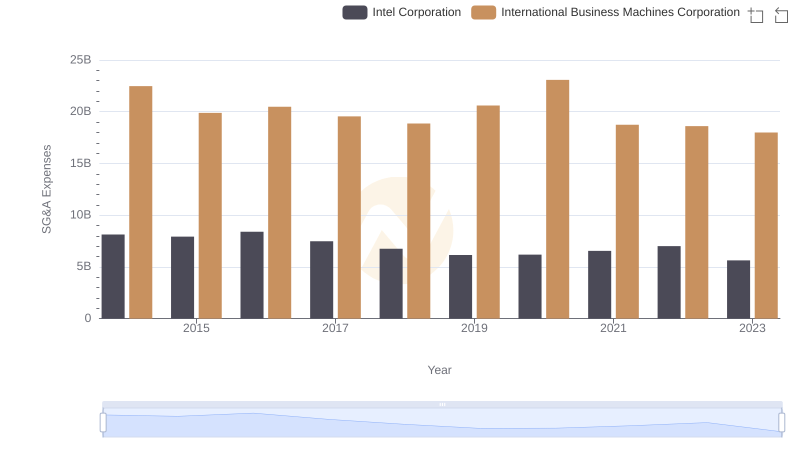

Selling, General, and Administrative Costs: International Business Machines Corporation vs Intel Corporation

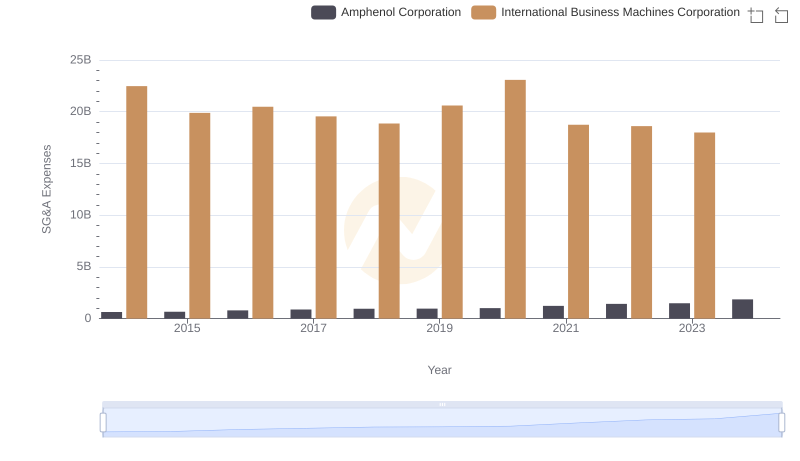

International Business Machines Corporation or Amphenol Corporation: Who Manages SG&A Costs Better?

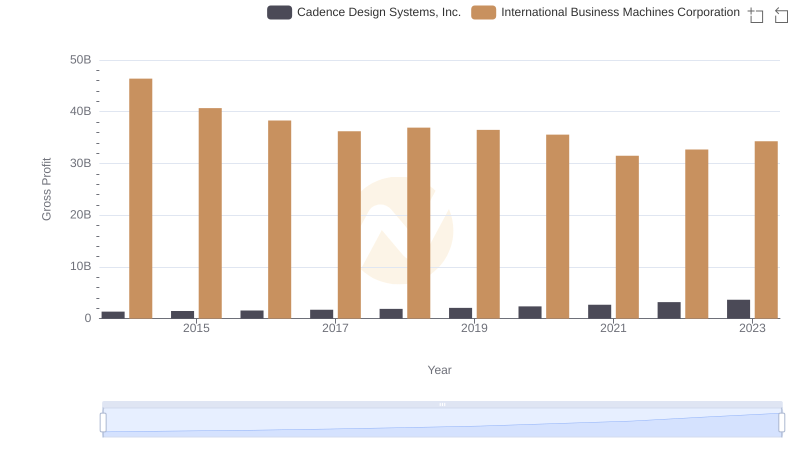

Gross Profit Analysis: Comparing International Business Machines Corporation and Cadence Design Systems, Inc.

Selling, General, and Administrative Costs: International Business Machines Corporation vs KLA Corporation

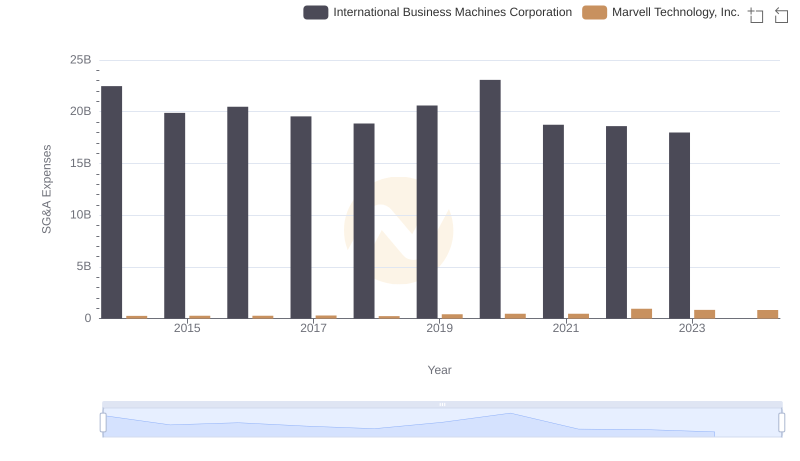

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Marvell Technology, Inc.

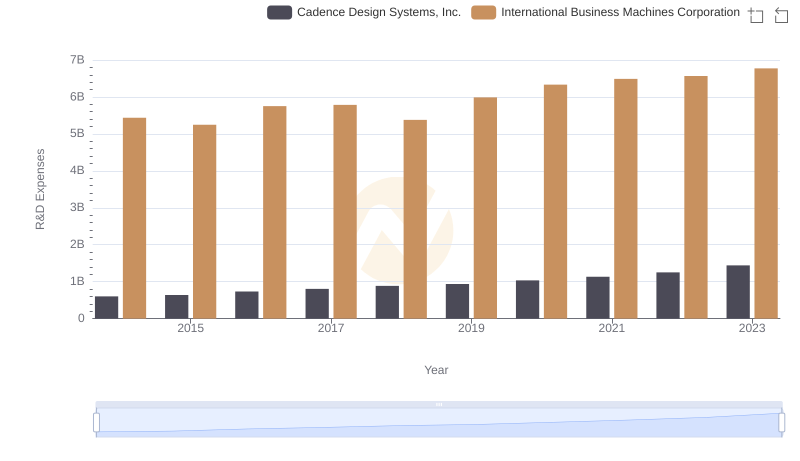

International Business Machines Corporation or Cadence Design Systems, Inc.: Who Invests More in Innovation?

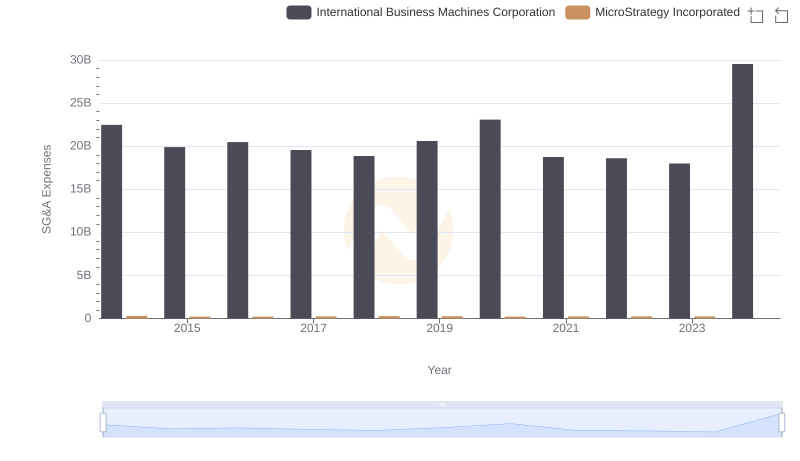

International Business Machines Corporation or MicroStrategy Incorporated: Who Manages SG&A Costs Better?

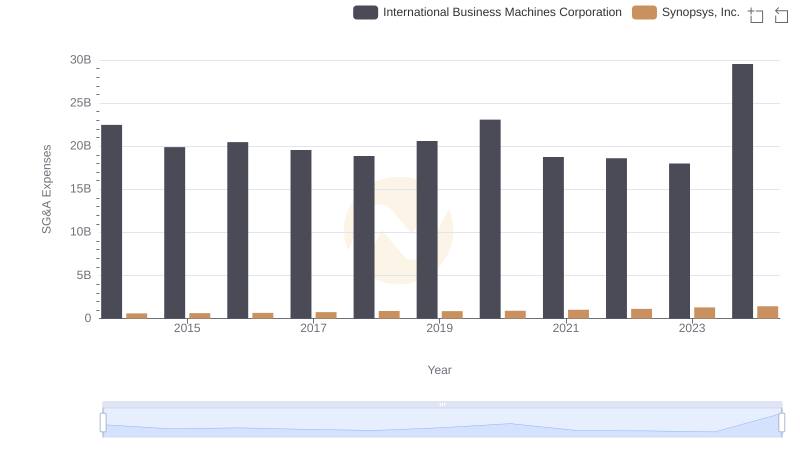

International Business Machines Corporation or Synopsys, Inc.: Who Manages SG&A Costs Better?

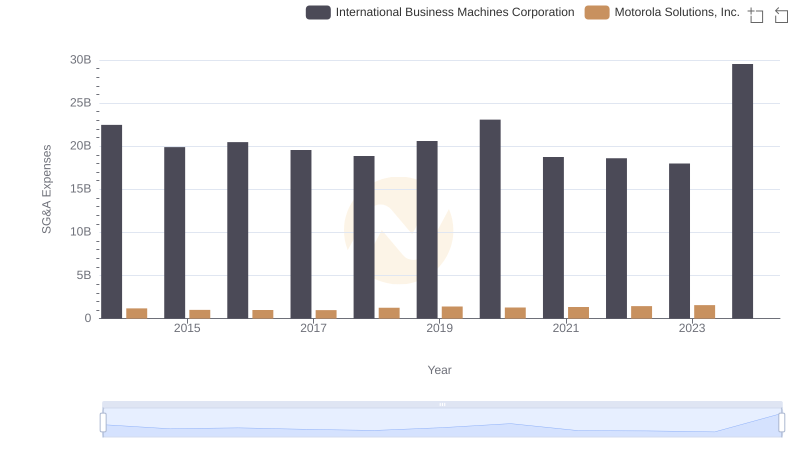

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and Motorola Solutions, Inc.

EBITDA Analysis: Evaluating International Business Machines Corporation Against Cadence Design Systems, Inc.