| __timestamp | International Business Machines Corporation | Palo Alto Networks, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 407912000 |

| Thursday, January 1, 2015 | 19894000000 | 624261000 |

| Friday, January 1, 2016 | 20279000000 | 914400000 |

| Sunday, January 1, 2017 | 19680000000 | 1117400000 |

| Monday, January 1, 2018 | 19366000000 | 1356200000 |

| Tuesday, January 1, 2019 | 18724000000 | 1605800000 |

| Wednesday, January 1, 2020 | 20561000000 | 1819800000 |

| Friday, January 1, 2021 | 18745000000 | 2144900000 |

| Saturday, January 1, 2022 | 17483000000 | 2553900000 |

| Sunday, January 1, 2023 | 17997000000 | 2991700000 |

| Monday, January 1, 2024 | 29536000000 | 3475000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of technology, the financial strategies of industry leaders like International Business Machines Corporation (IBM) and Palo Alto Networks, Inc. offer a fascinating glimpse into their operational priorities. Over the past decade, IBM's Selling, General, and Administrative (SG&A) expenses have shown a steady pattern, peaking in 2024 with a 30% increase from 2023. This reflects IBM's strategic investments in innovation and global expansion. In contrast, Palo Alto Networks has demonstrated a remarkable growth trajectory, with SG&A expenses surging by over 750% from 2014 to 2024. This underscores their aggressive market penetration and scaling efforts in cybersecurity. As these two titans navigate the complexities of the tech world, their financial footprints reveal much about their future directions and competitive strategies.

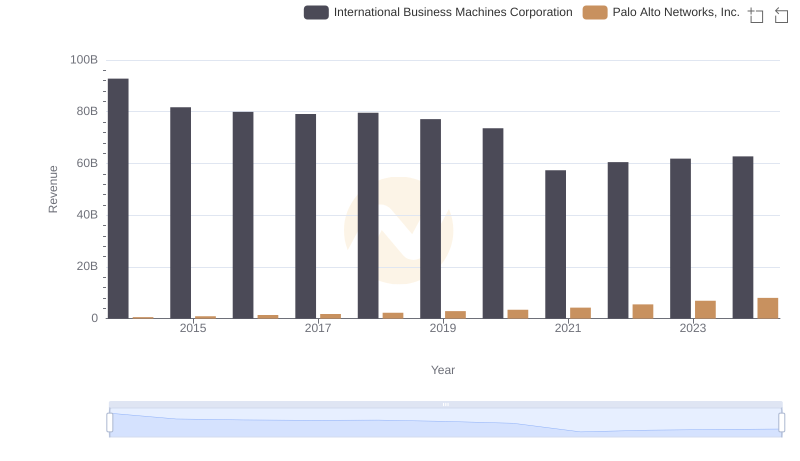

Revenue Insights: International Business Machines Corporation and Palo Alto Networks, Inc. Performance Compared

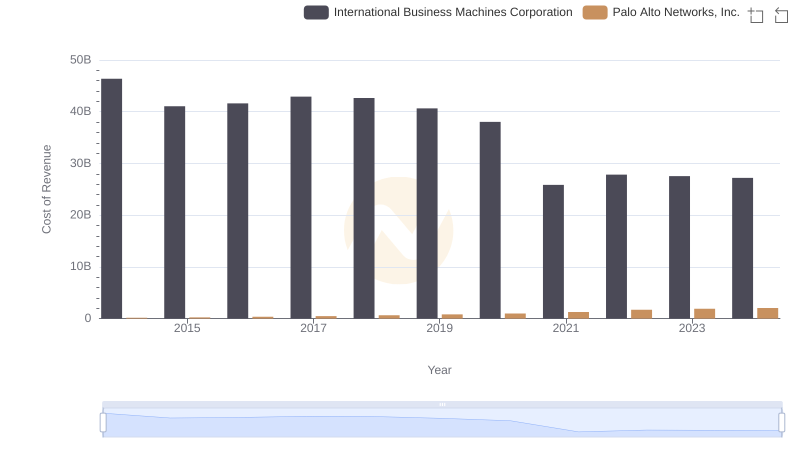

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Palo Alto Networks, Inc.

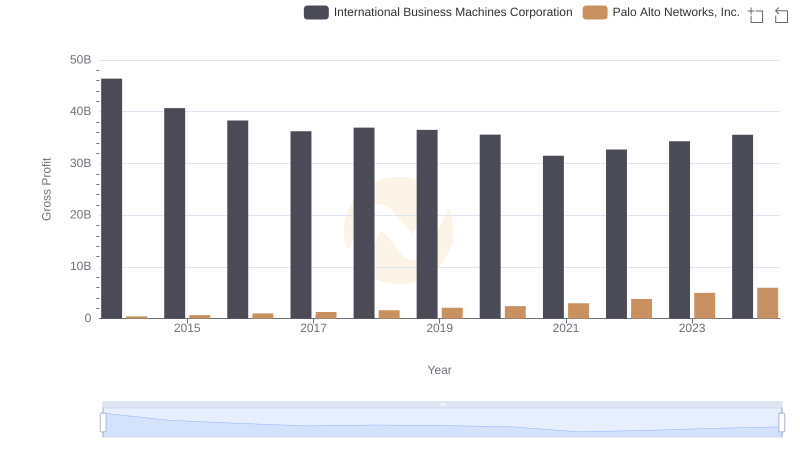

Gross Profit Trends Compared: International Business Machines Corporation vs Palo Alto Networks, Inc.

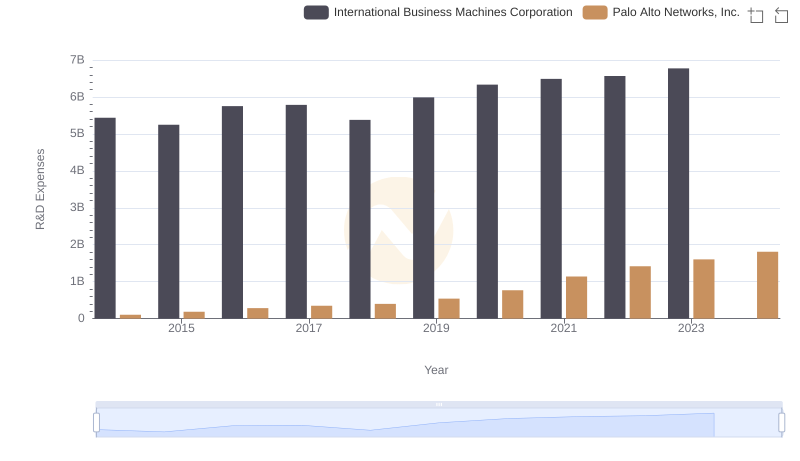

Analyzing R&D Budgets: International Business Machines Corporation vs Palo Alto Networks, Inc.

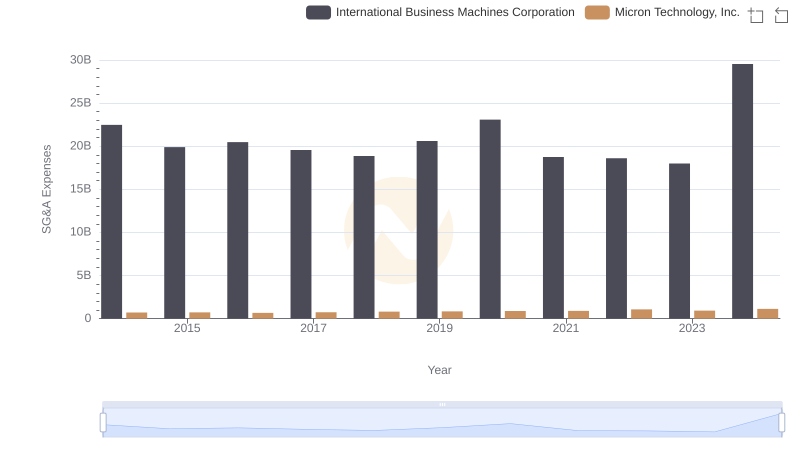

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Micron Technology, Inc.

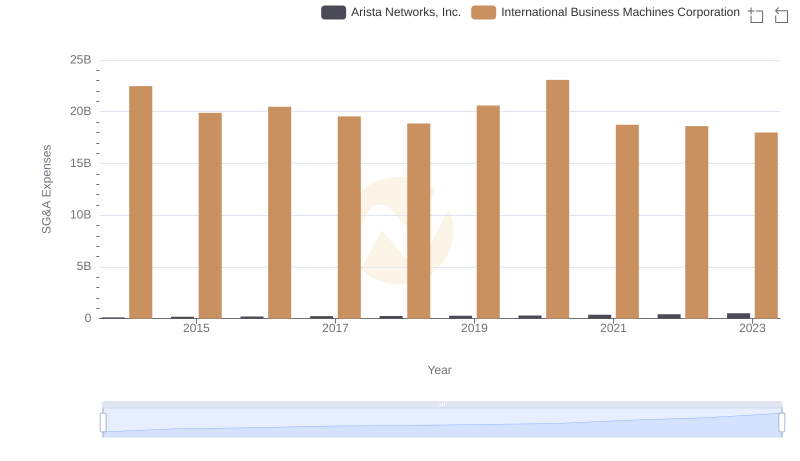

Comparing SG&A Expenses: International Business Machines Corporation vs Arista Networks, Inc. Trends and Insights

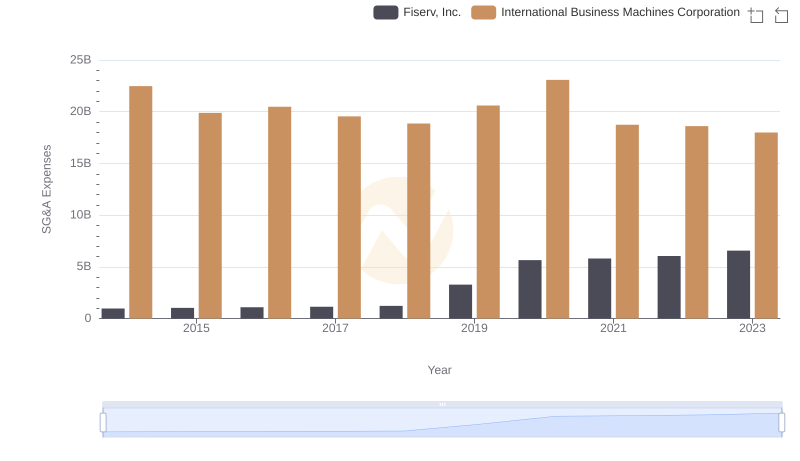

Comparing SG&A Expenses: International Business Machines Corporation vs Fiserv, Inc. Trends and Insights

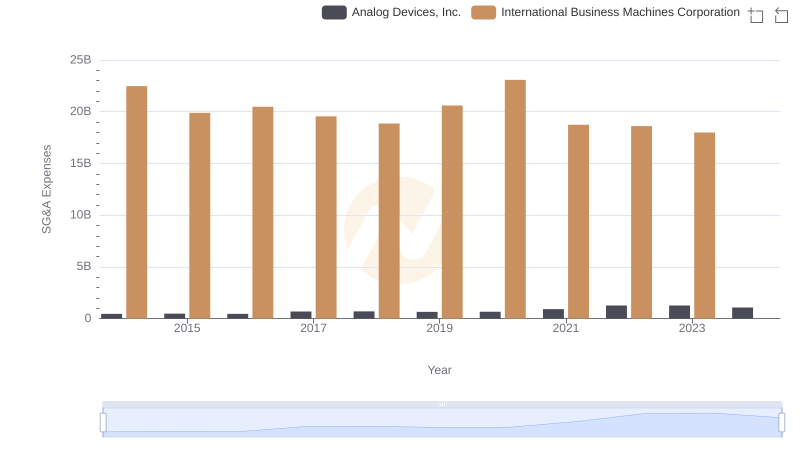

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Analog Devices, Inc.

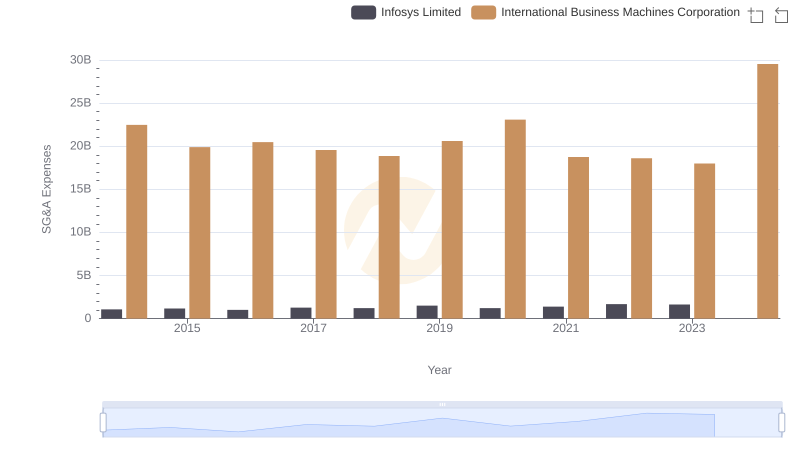

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Infosys Limited

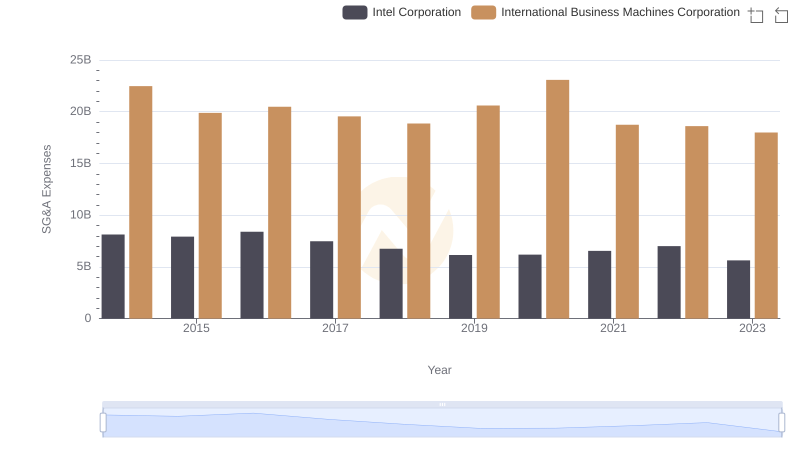

Selling, General, and Administrative Costs: International Business Machines Corporation vs Intel Corporation

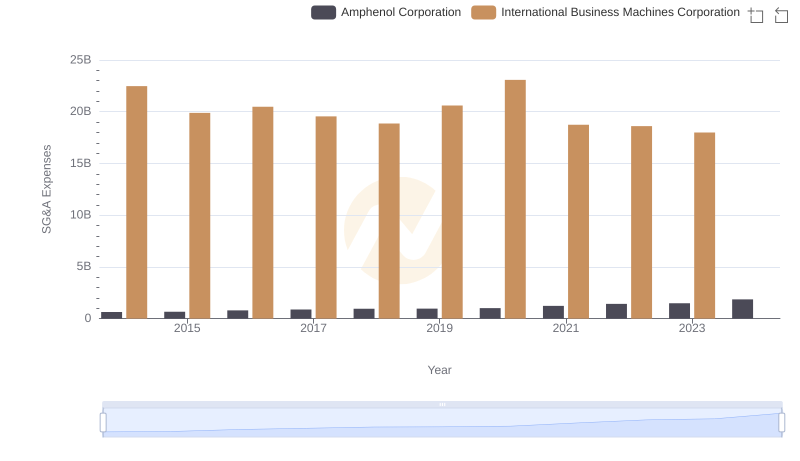

International Business Machines Corporation or Amphenol Corporation: Who Manages SG&A Costs Better?