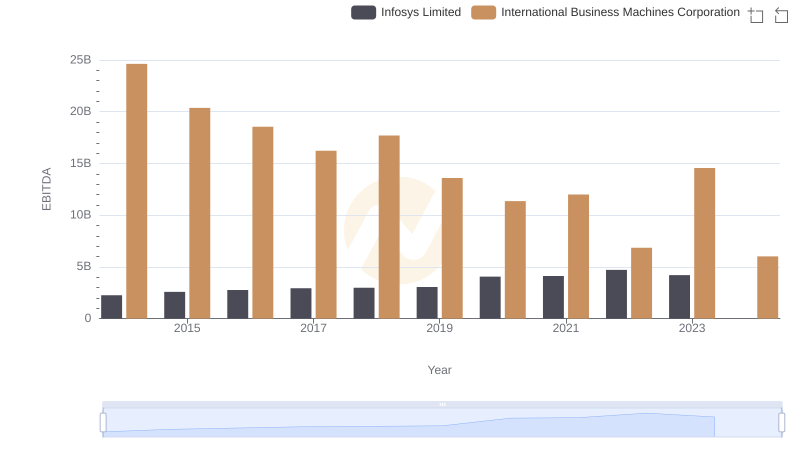

| __timestamp | Infosys Limited | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 22472000000 |

| Thursday, January 1, 2015 | 1176000000 | 19894000000 |

| Friday, January 1, 2016 | 1020000000 | 20279000000 |

| Sunday, January 1, 2017 | 1279000000 | 19680000000 |

| Monday, January 1, 2018 | 1220000000 | 19366000000 |

| Tuesday, January 1, 2019 | 1504000000 | 18724000000 |

| Wednesday, January 1, 2020 | 1223000000 | 20561000000 |

| Friday, January 1, 2021 | 1391000000 | 18745000000 |

| Saturday, January 1, 2022 | 1678000000 | 17483000000 |

| Sunday, January 1, 2023 | 1632000000 | 17997000000 |

| Monday, January 1, 2024 | 29536000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of global technology, the efficiency of Selling, General, and Administrative (SG&A) expenses is a critical metric for assessing corporate health. Over the past decade, International Business Machines Corporation (IBM) and Infosys Limited have showcased contrasting trends in their SG&A expenditures.

From 2014 to 2023, IBM's SG&A expenses have fluctuated, peaking in 2024 with a notable increase of approximately 30% from 2023. In contrast, Infosys has demonstrated a more stable trajectory, with a gradual increase of around 51% from 2014 to 2023. This divergence highlights IBM's strategic shifts and Infosys's consistent growth.

While IBM's expenses reflect its expansive operations, Infosys's efficiency underscores its agile business model. The absence of data for Infosys in 2024 suggests a potential shift or strategic realignment. As these tech titans navigate the future, their SG&A strategies will remain pivotal in shaping their competitive edge.

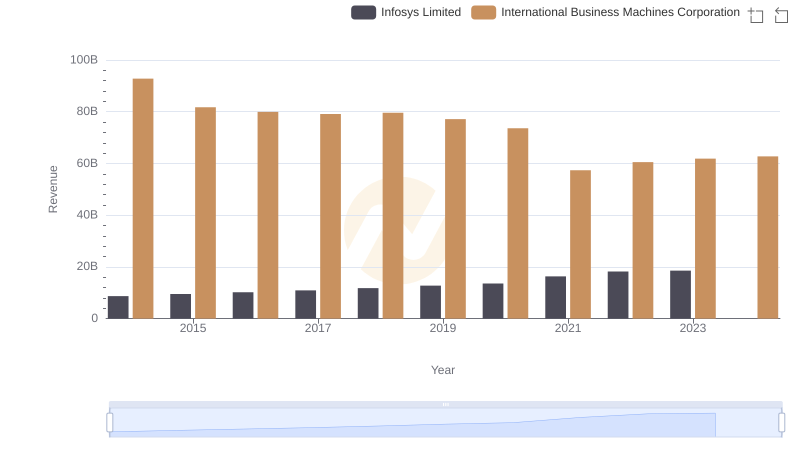

Revenue Insights: International Business Machines Corporation and Infosys Limited Performance Compared

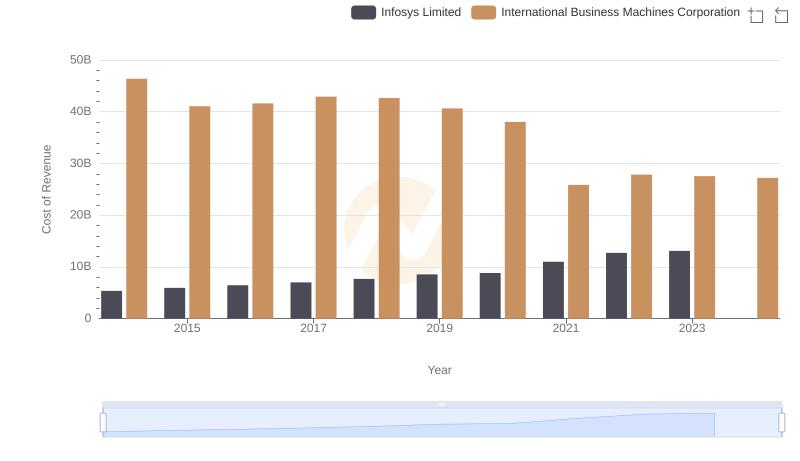

International Business Machines Corporation vs Infosys Limited: Efficiency in Cost of Revenue Explored

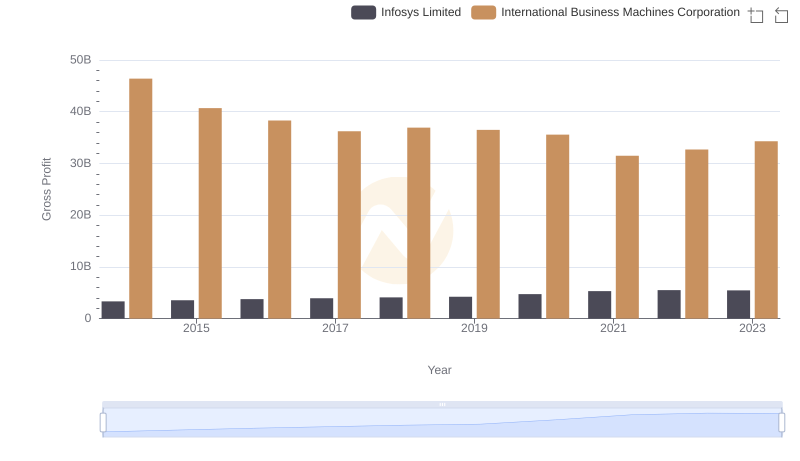

Key Insights on Gross Profit: International Business Machines Corporation vs Infosys Limited

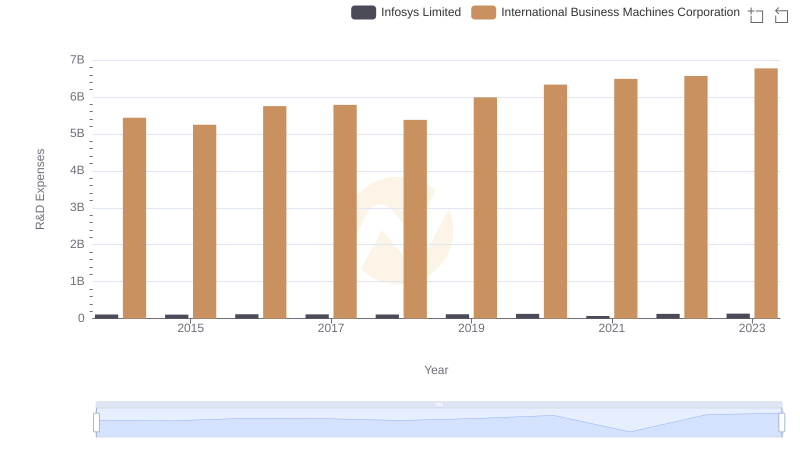

Analyzing R&D Budgets: International Business Machines Corporation vs Infosys Limited

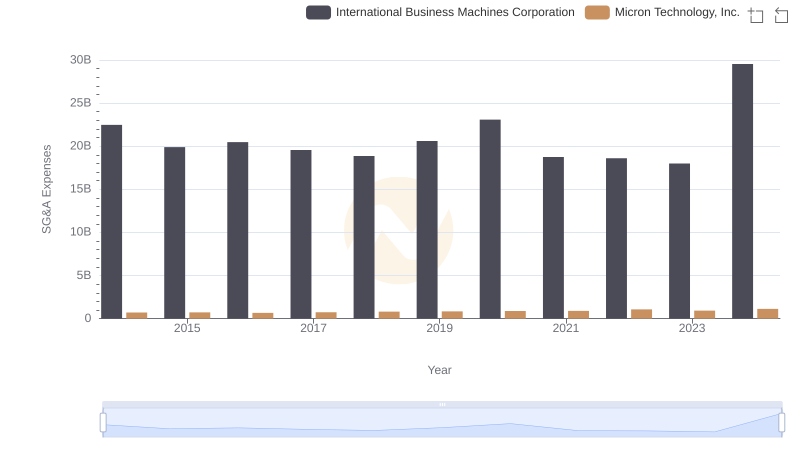

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Micron Technology, Inc.

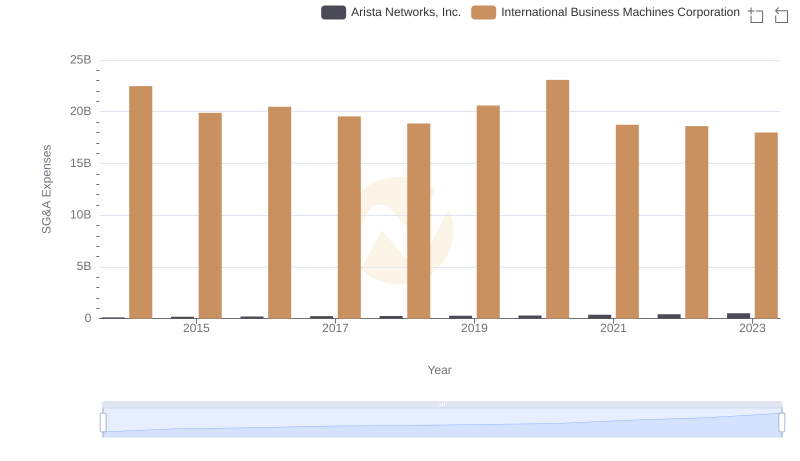

Comparing SG&A Expenses: International Business Machines Corporation vs Arista Networks, Inc. Trends and Insights

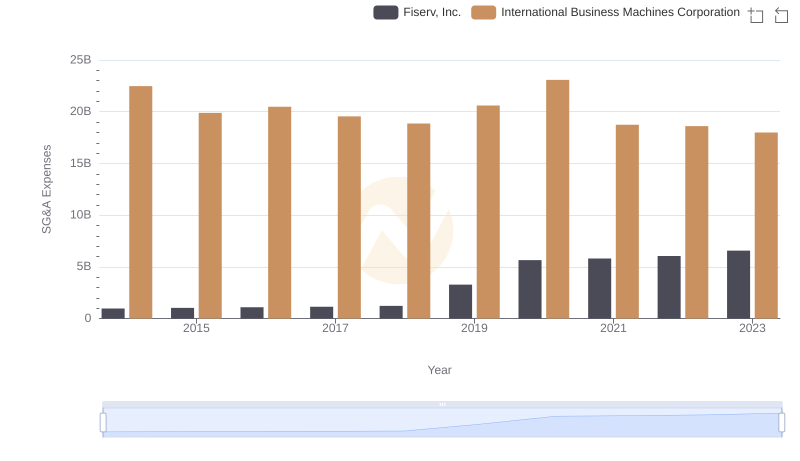

Comparing SG&A Expenses: International Business Machines Corporation vs Fiserv, Inc. Trends and Insights

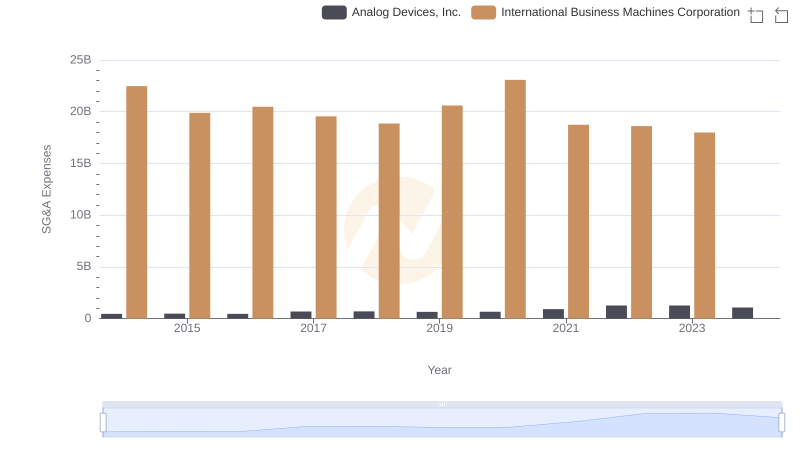

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Analog Devices, Inc.

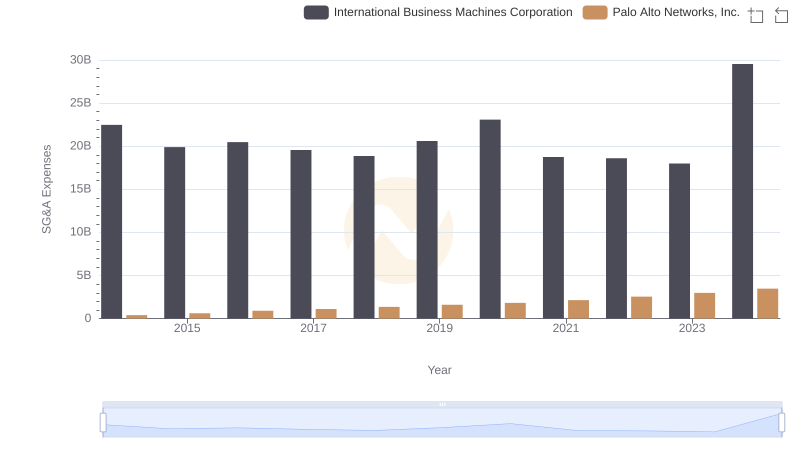

Breaking Down SG&A Expenses: International Business Machines Corporation vs Palo Alto Networks, Inc.

EBITDA Metrics Evaluated: International Business Machines Corporation vs Infosys Limited

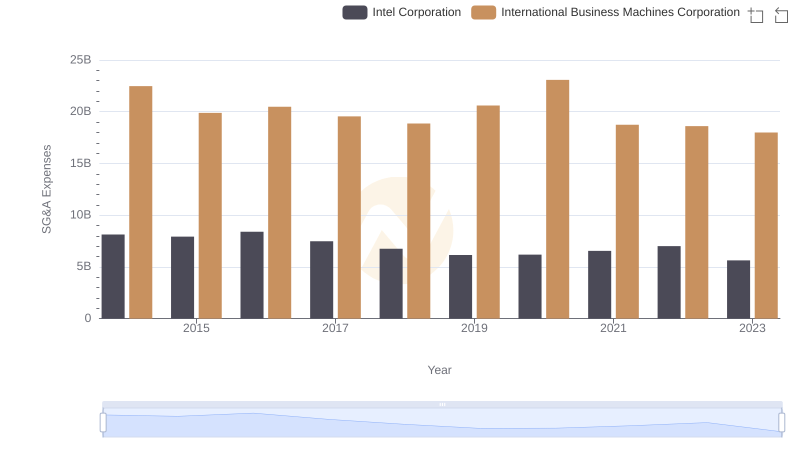

Selling, General, and Administrative Costs: International Business Machines Corporation vs Intel Corporation