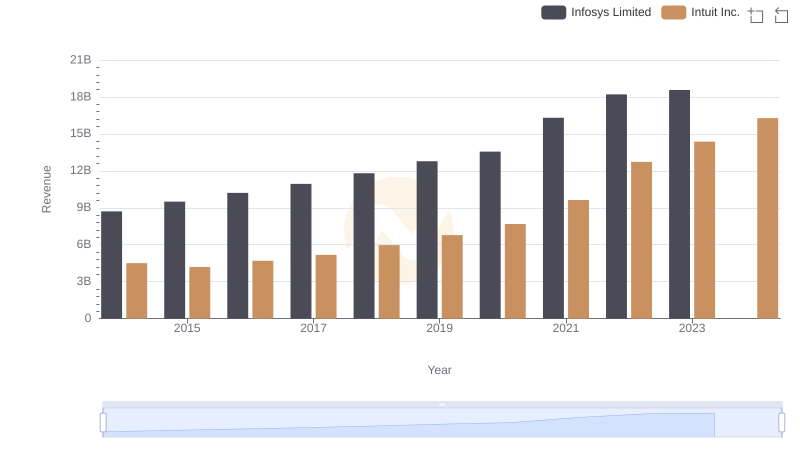

| __timestamp | Infosys Limited | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3337000000 | 3838000000 |

| Thursday, January 1, 2015 | 3551000000 | 3467000000 |

| Friday, January 1, 2016 | 3762000000 | 3942000000 |

| Sunday, January 1, 2017 | 3938000000 | 4368000000 |

| Monday, January 1, 2018 | 4112000000 | 4987000000 |

| Tuesday, January 1, 2019 | 4228000000 | 5617000000 |

| Wednesday, January 1, 2020 | 4733000000 | 6301000000 |

| Friday, January 1, 2021 | 5315000000 | 7950000000 |

| Saturday, January 1, 2022 | 5503000000 | 10320000000 |

| Sunday, January 1, 2023 | 5466000000 | 11225000000 |

| Monday, January 1, 2024 | 12820000000 |

Data in motion

In the ever-evolving landscape of global technology, the financial performance of industry giants like Intuit Inc. and Infosys Limited offers a fascinating glimpse into their growth trajectories. Over the past decade, Intuit has demonstrated a remarkable upward trend in gross profit, surging by approximately 192% from 2014 to 2023. This growth reflects Intuit's strategic expansion and innovation in financial software solutions. Meanwhile, Infosys Limited, a leader in IT services, has shown a steady increase of around 64% in the same period, underscoring its resilience and adaptability in a competitive market.

While Intuit's gross profit reached an impressive $11.225 billion in 2023, Infosys recorded $5.466 billion, highlighting a significant difference in scale. However, the data for 2024 is incomplete, leaving room for speculation on future trends. As these companies continue to navigate the complexities of the tech industry, their financial performance remains a key indicator of their strategic direction and market influence.

Revenue Showdown: Intuit Inc. vs Infosys Limited

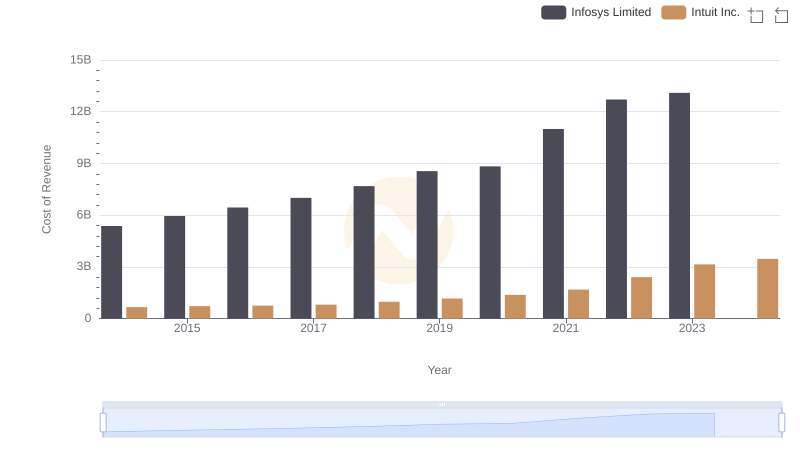

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Infosys Limited

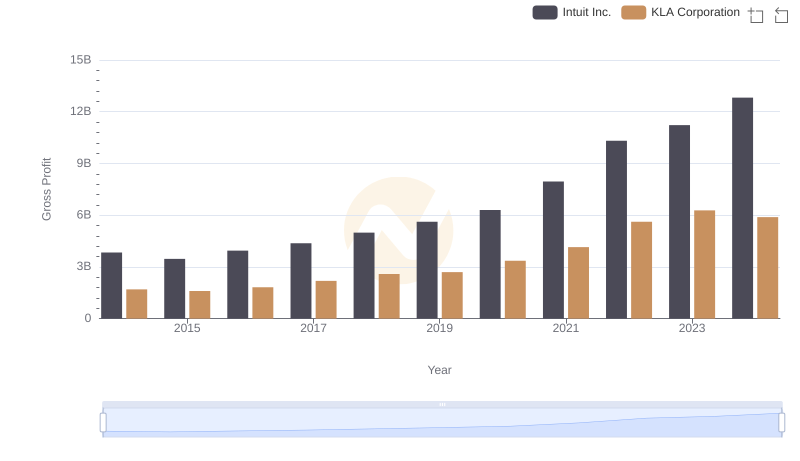

Intuit Inc. and KLA Corporation: A Detailed Gross Profit Analysis

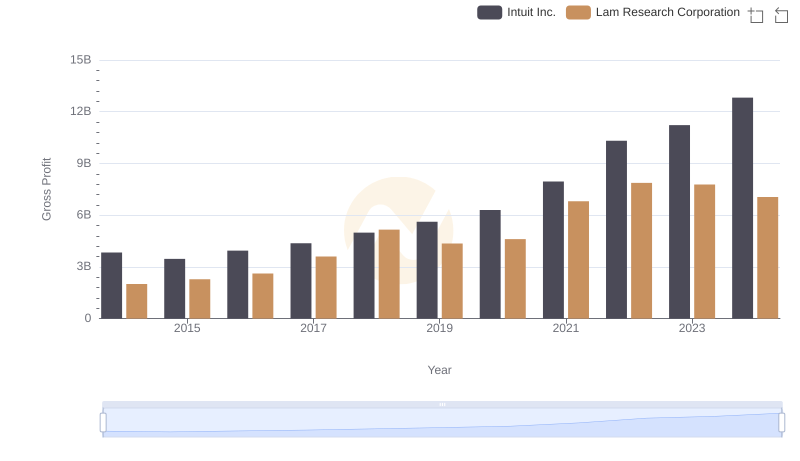

Gross Profit Comparison: Intuit Inc. and Lam Research Corporation Trends

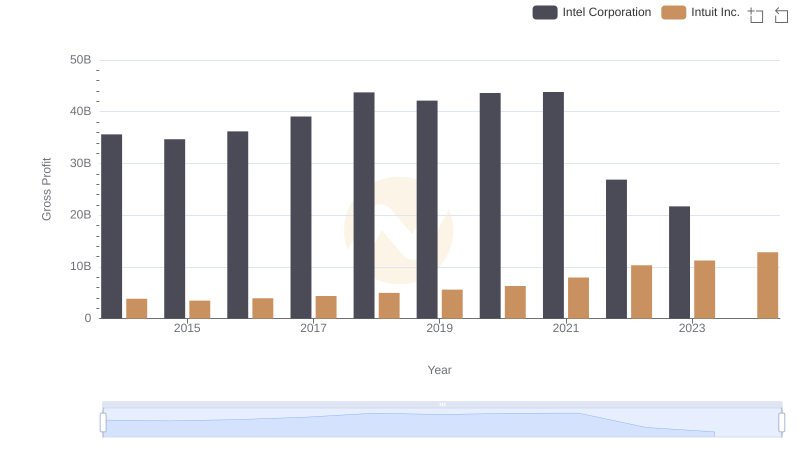

Intuit Inc. vs Intel Corporation: A Gross Profit Performance Breakdown

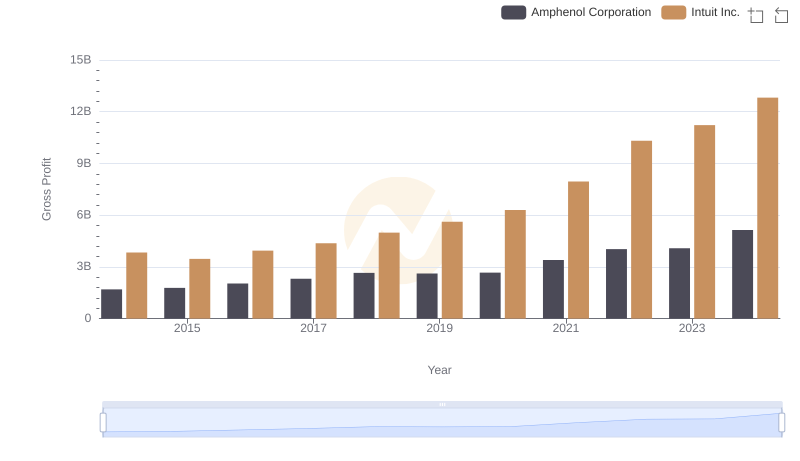

Gross Profit Analysis: Comparing Intuit Inc. and Amphenol Corporation

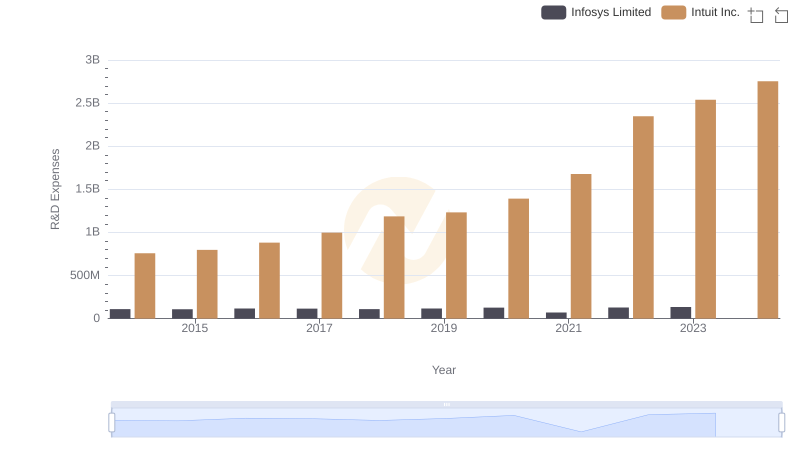

Research and Development Investment: Intuit Inc. vs Infosys Limited

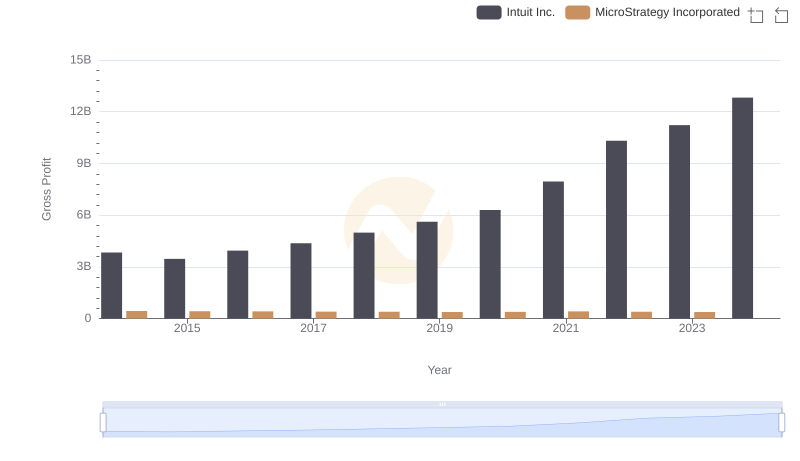

Gross Profit Comparison: Intuit Inc. and MicroStrategy Incorporated Trends

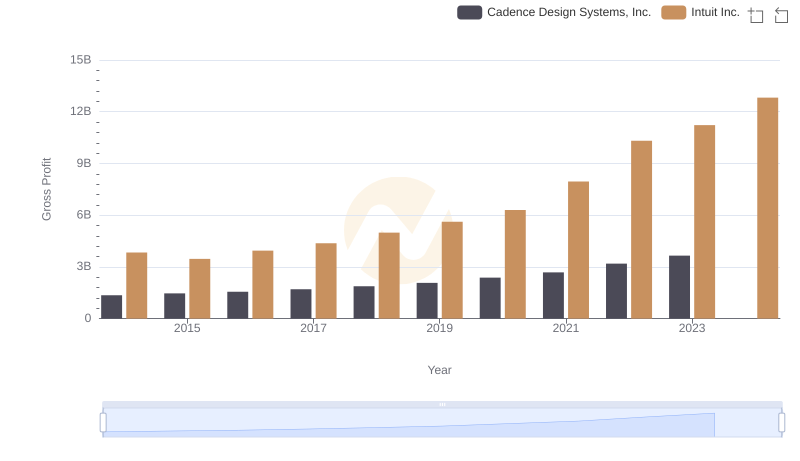

Key Insights on Gross Profit: Intuit Inc. vs Cadence Design Systems, Inc.

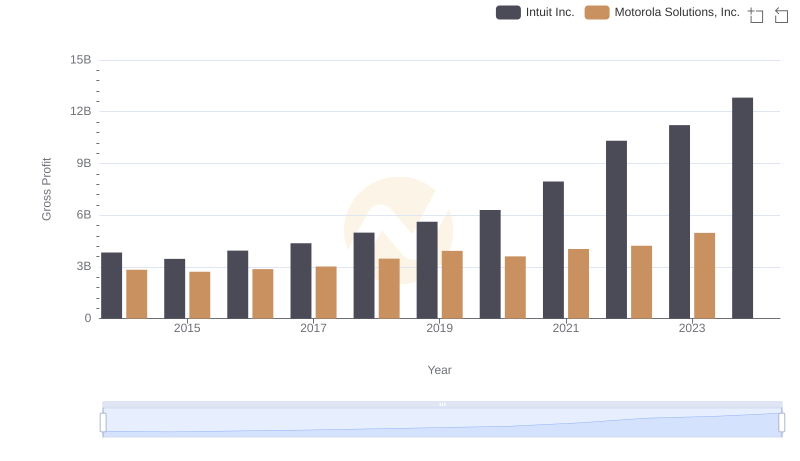

Intuit Inc. and Motorola Solutions, Inc.: A Detailed Gross Profit Analysis

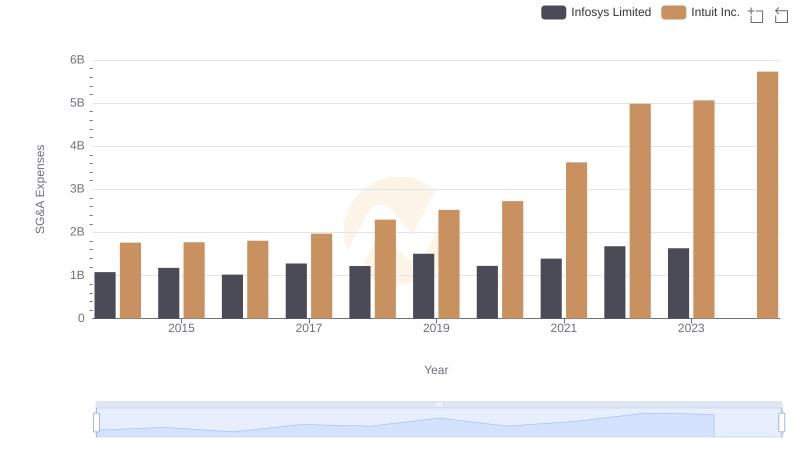

Intuit Inc. and Infosys Limited: SG&A Spending Patterns Compared

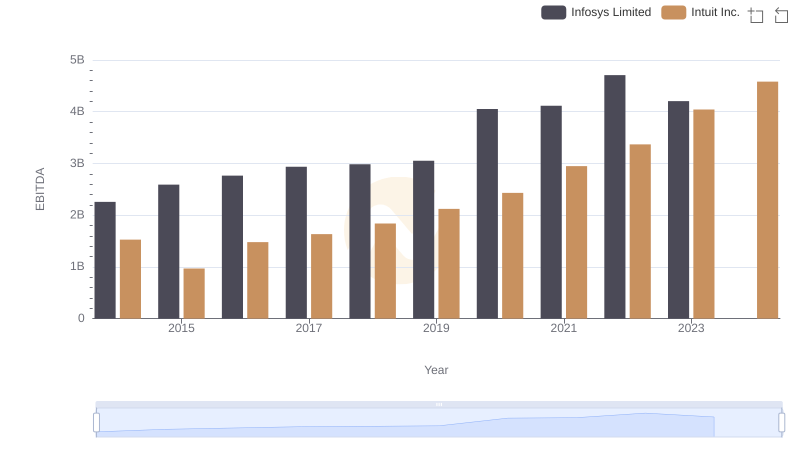

Intuit Inc. and Infosys Limited: A Detailed Examination of EBITDA Performance