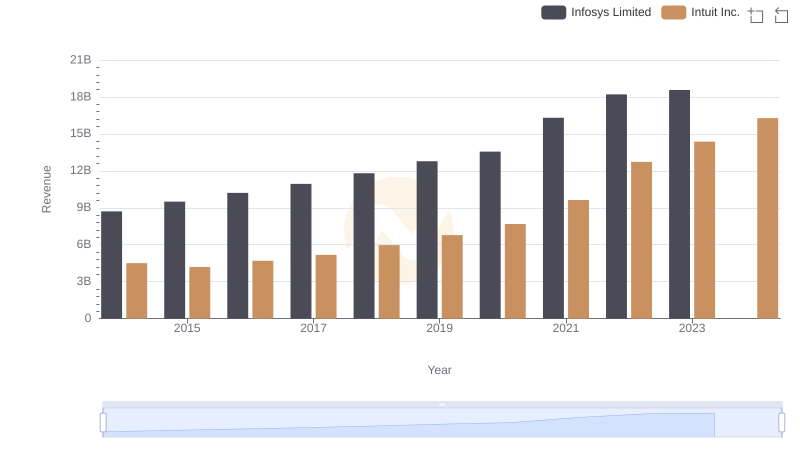

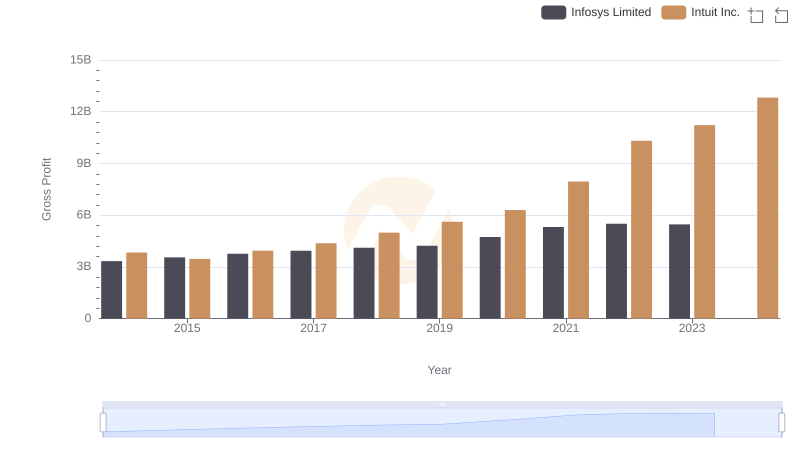

| __timestamp | Infosys Limited | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5374000000 | 668000000 |

| Thursday, January 1, 2015 | 5950000000 | 725000000 |

| Friday, January 1, 2016 | 6446000000 | 752000000 |

| Sunday, January 1, 2017 | 7001000000 | 809000000 |

| Monday, January 1, 2018 | 7687000000 | 977000000 |

| Tuesday, January 1, 2019 | 8552000000 | 1167000000 |

| Wednesday, January 1, 2020 | 8828000000 | 1378000000 |

| Friday, January 1, 2021 | 10996000000 | 1683000000 |

| Saturday, January 1, 2022 | 12709000000 | 2406000000 |

| Sunday, January 1, 2023 | 13096000000 | 3143000000 |

| Monday, January 1, 2024 | 3465000000 |

Unlocking the unknown

In the ever-evolving landscape of global technology, Intuit Inc. and Infosys Limited stand as titans, each with a unique approach to cost efficiency. From 2014 to 2023, Infosys consistently demonstrated a robust cost of revenue, peaking at approximately $13 billion in 2023, reflecting a 143% increase from 2014. In contrast, Intuit's cost of revenue grew by 370% over the same period, reaching around $3.1 billion in 2023. This stark difference highlights Intuit's aggressive expansion strategy, while Infosys maintains steady growth. The data for 2024 remains incomplete, leaving room for speculation on future trends. As these companies continue to innovate, their financial strategies will be pivotal in shaping their competitive edge. This analysis offers a glimpse into the financial dynamics that drive these industry leaders, providing valuable insights for investors and analysts alike.

Revenue Showdown: Intuit Inc. vs Infosys Limited

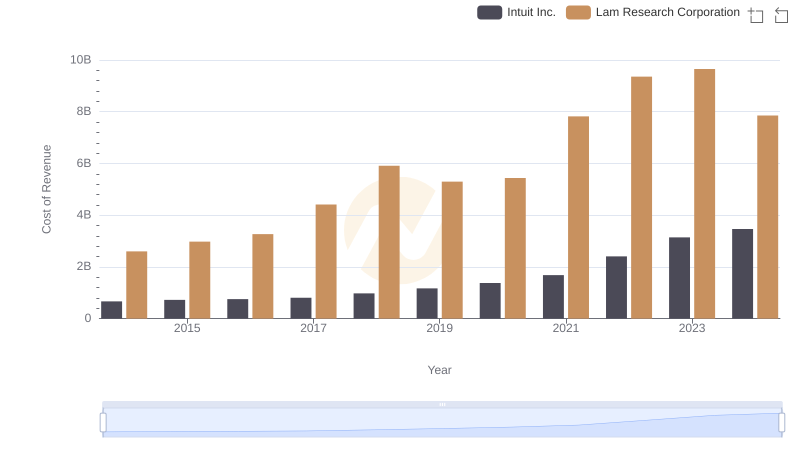

Analyzing Cost of Revenue: Intuit Inc. and Lam Research Corporation

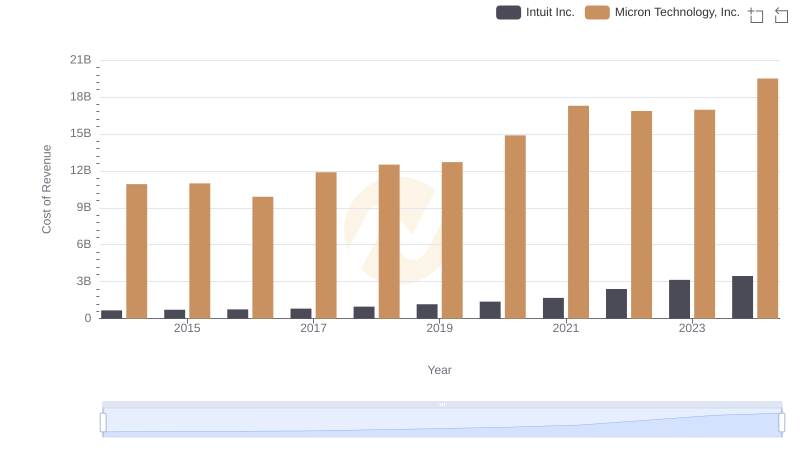

Cost of Revenue Trends: Intuit Inc. vs Micron Technology, Inc.

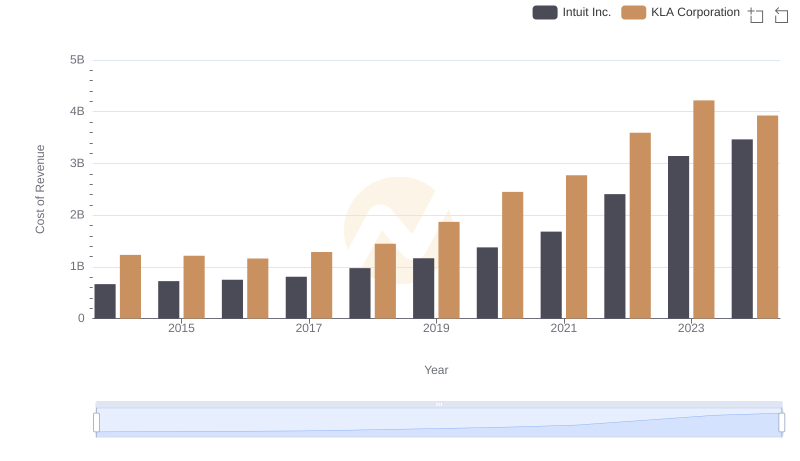

Cost of Revenue Trends: Intuit Inc. vs KLA Corporation

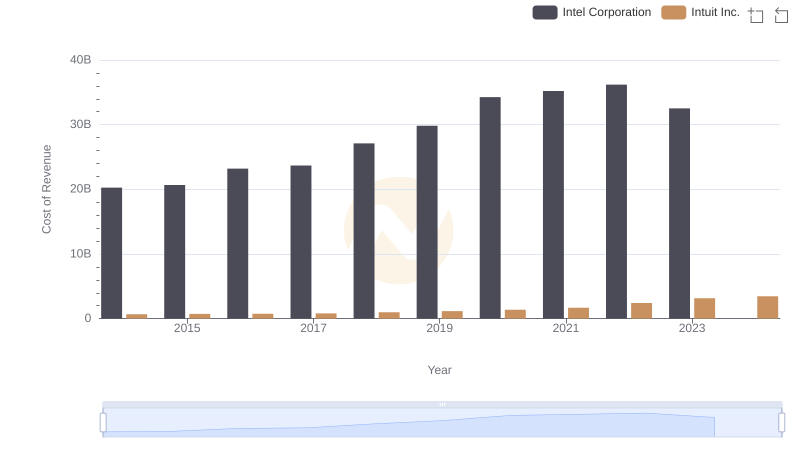

Intuit Inc. vs Intel Corporation: Efficiency in Cost of Revenue Explored

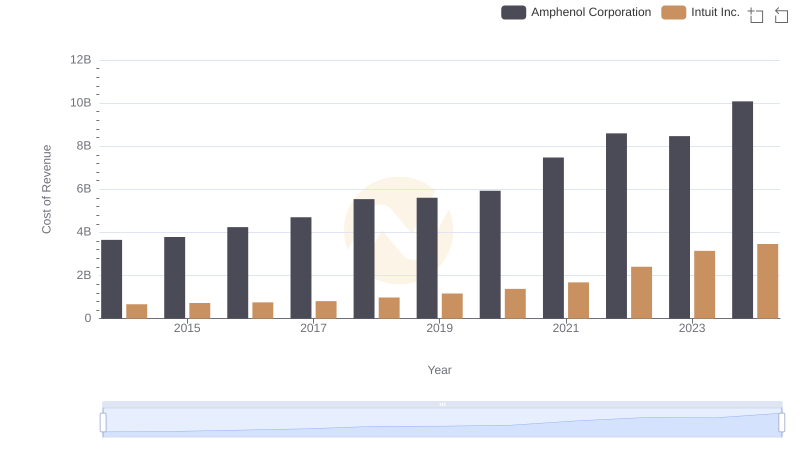

Analyzing Cost of Revenue: Intuit Inc. and Amphenol Corporation

Gross Profit Trends Compared: Intuit Inc. vs Infosys Limited

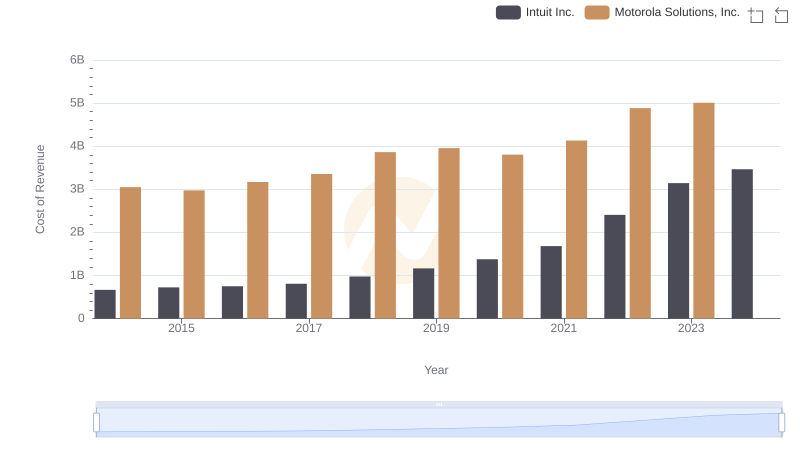

Cost Insights: Breaking Down Intuit Inc. and Motorola Solutions, Inc.'s Expenses

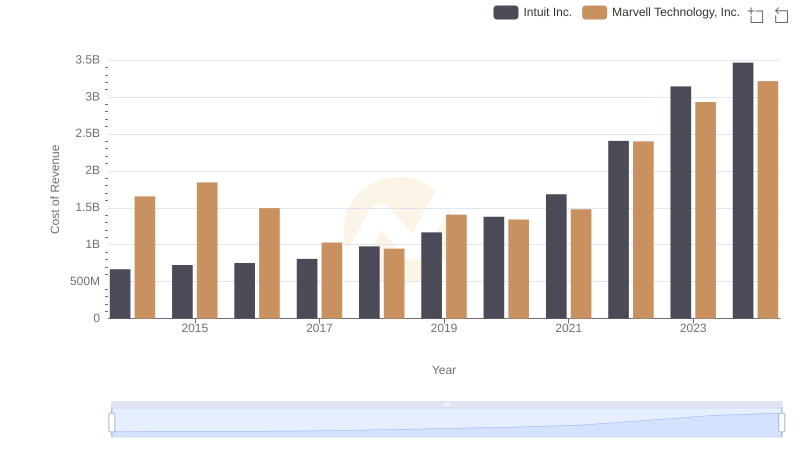

Cost of Revenue Comparison: Intuit Inc. vs Marvell Technology, Inc.

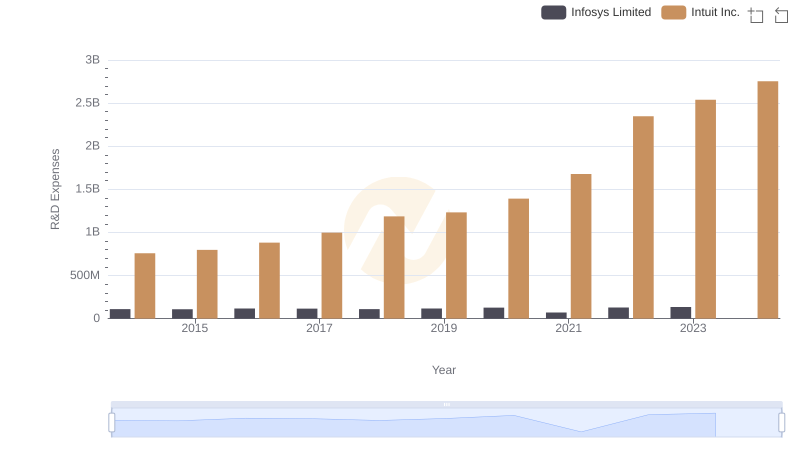

Research and Development Investment: Intuit Inc. vs Infosys Limited

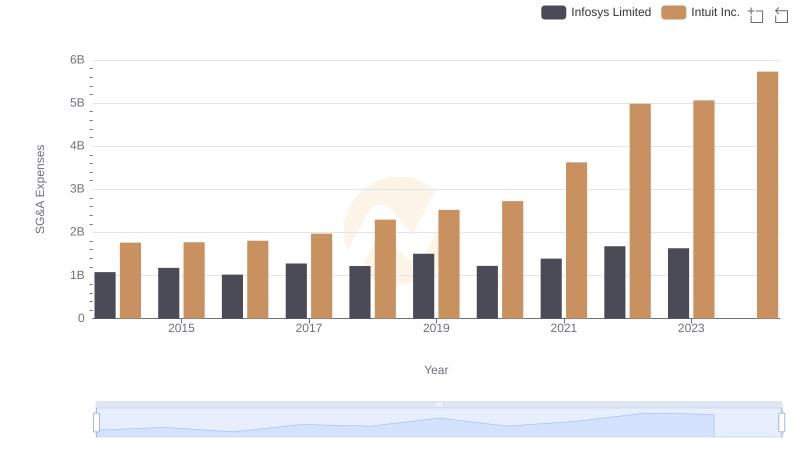

Intuit Inc. and Infosys Limited: SG&A Spending Patterns Compared

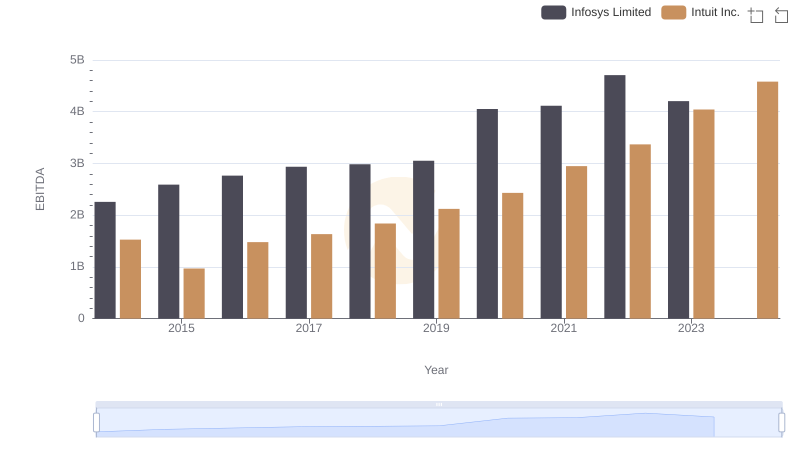

Intuit Inc. and Infosys Limited: A Detailed Examination of EBITDA Performance