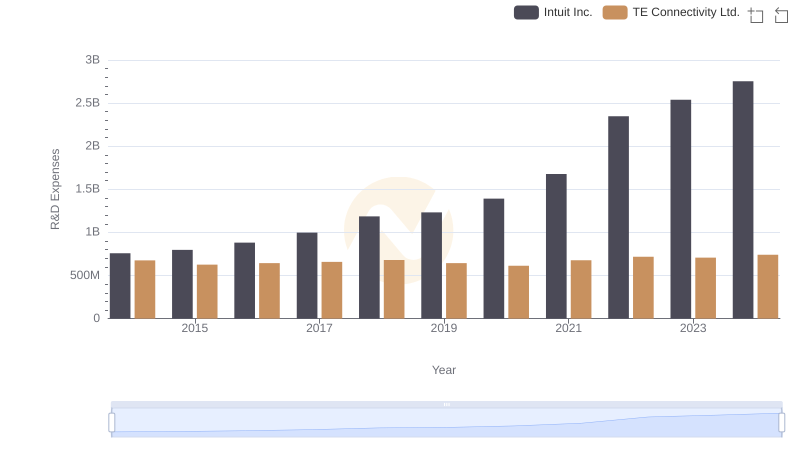

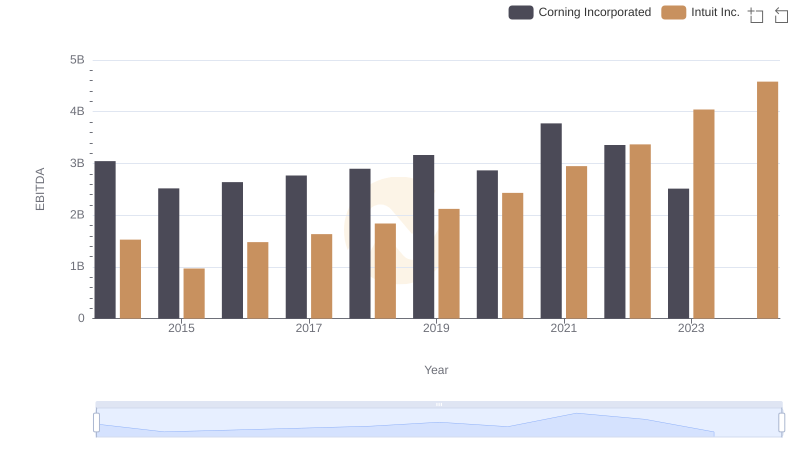

| __timestamp | Corning Incorporated | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 815000000 | 758000000 |

| Thursday, January 1, 2015 | 769000000 | 798000000 |

| Friday, January 1, 2016 | 742000000 | 881000000 |

| Sunday, January 1, 2017 | 860000000 | 998000000 |

| Monday, January 1, 2018 | 993000000 | 1186000000 |

| Tuesday, January 1, 2019 | 1031000000 | 1233000000 |

| Wednesday, January 1, 2020 | 1154000000 | 1392000000 |

| Friday, January 1, 2021 | 995000000 | 1678000000 |

| Saturday, January 1, 2022 | 1047000000 | 2347000000 |

| Sunday, January 1, 2023 | 1076000000 | 2539000000 |

| Monday, January 1, 2024 | 1089000000 | 2754000000 |

In pursuit of knowledge

In the ever-evolving landscape of technology and innovation, research and development (R&D) budgets are a critical indicator of a company's commitment to future growth. Over the past decade, Intuit Inc. and Corning Incorporated have demonstrated contrasting strategies in their R&D investments. From 2014 to 2024, Intuit Inc. has shown a remarkable increase in its R&D expenses, growing by approximately 263%, reflecting its aggressive pursuit of innovation in financial software solutions. In contrast, Corning Incorporated, a leader in materials science, has maintained a steady growth of around 34% in its R&D spending, emphasizing its focus on sustainable innovation in glass and ceramics. This divergence highlights the distinct paths these companies are taking to secure their positions in their respective industries. As we look to the future, these trends offer valuable insights into how each company is preparing to meet the challenges and opportunities of tomorrow.

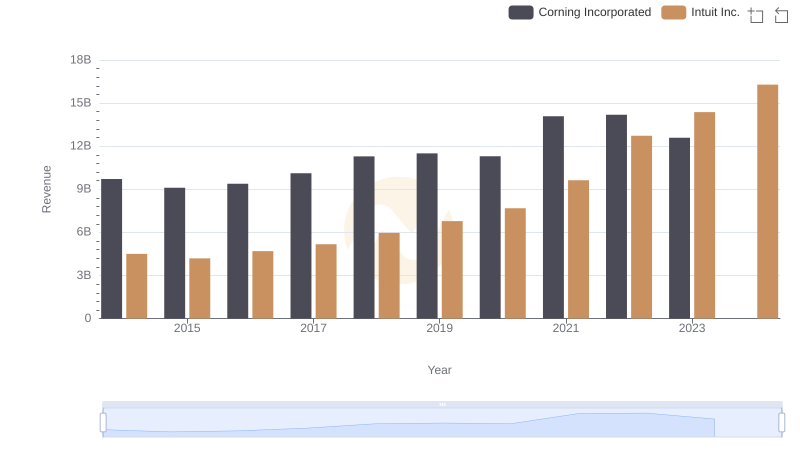

Intuit Inc. vs Corning Incorporated: Examining Key Revenue Metrics

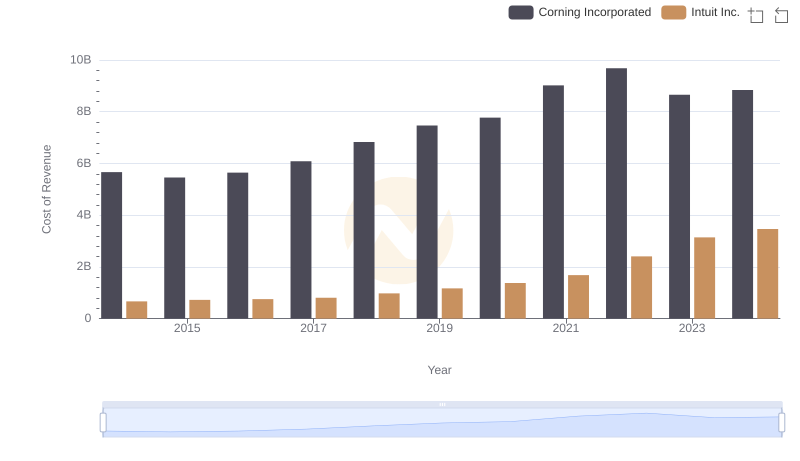

Cost of Revenue Trends: Intuit Inc. vs Corning Incorporated

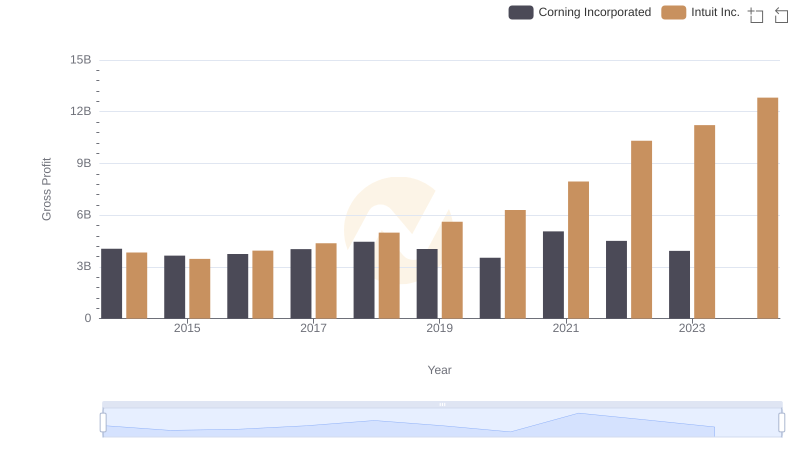

Gross Profit Trends Compared: Intuit Inc. vs Corning Incorporated

Intuit Inc. or TE Connectivity Ltd.: Who Invests More in Innovation?

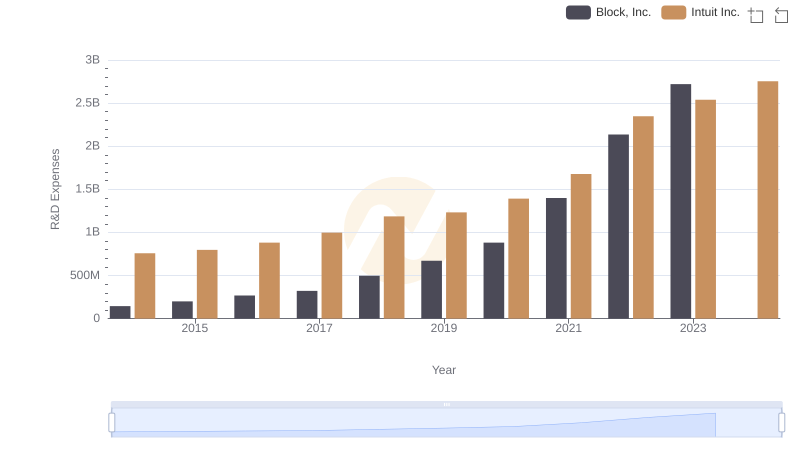

Comparing Innovation Spending: Intuit Inc. and Block, Inc.

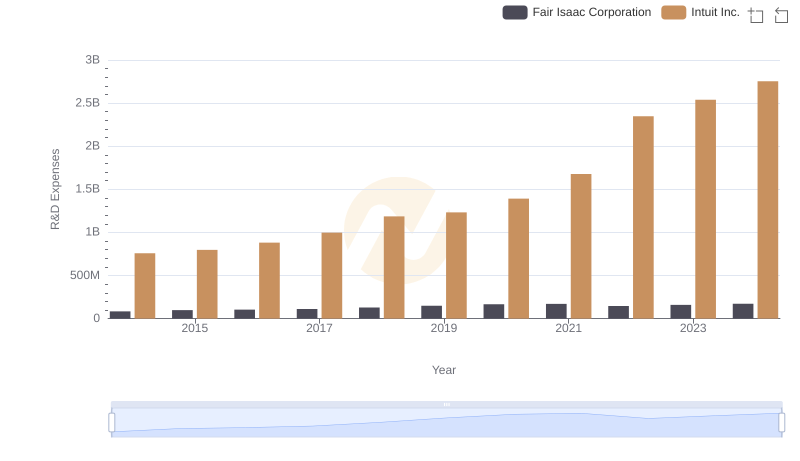

R&D Spending Showdown: Intuit Inc. vs Fair Isaac Corporation

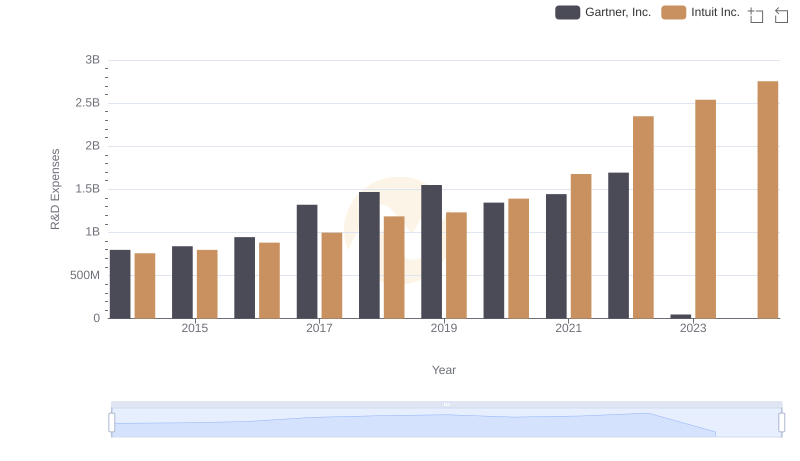

Intuit Inc. vs Gartner, Inc.: Strategic Focus on R&D Spending

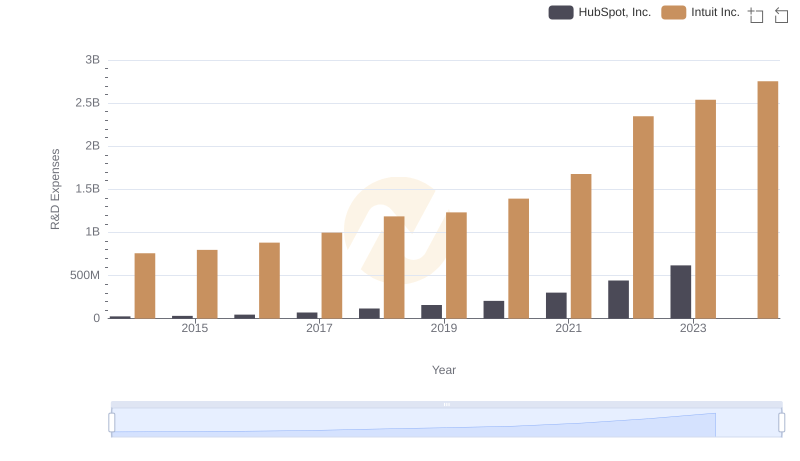

Research and Development Expenses Breakdown: Intuit Inc. vs HubSpot, Inc.

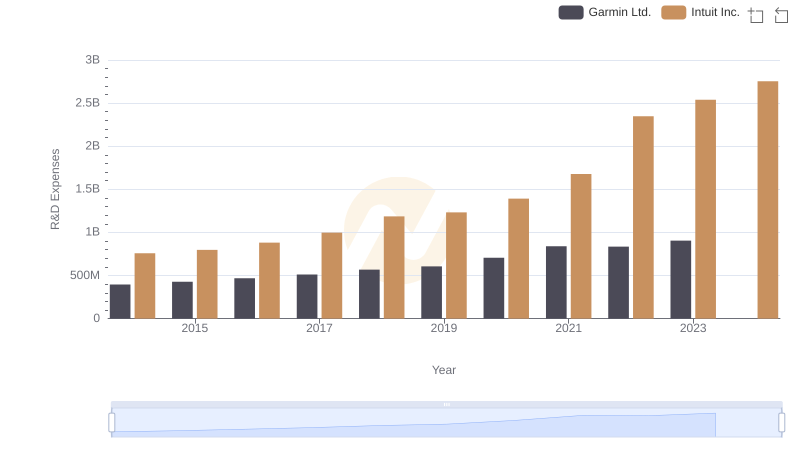

Intuit Inc. vs Garmin Ltd.: Strategic Focus on R&D Spending

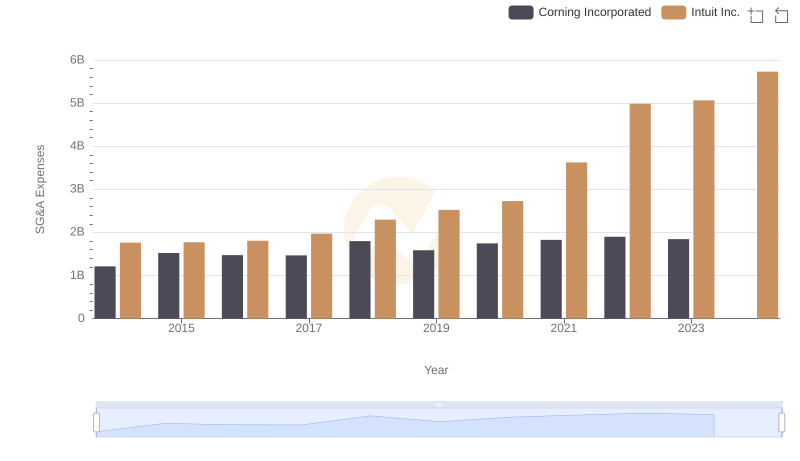

Selling, General, and Administrative Costs: Intuit Inc. vs Corning Incorporated

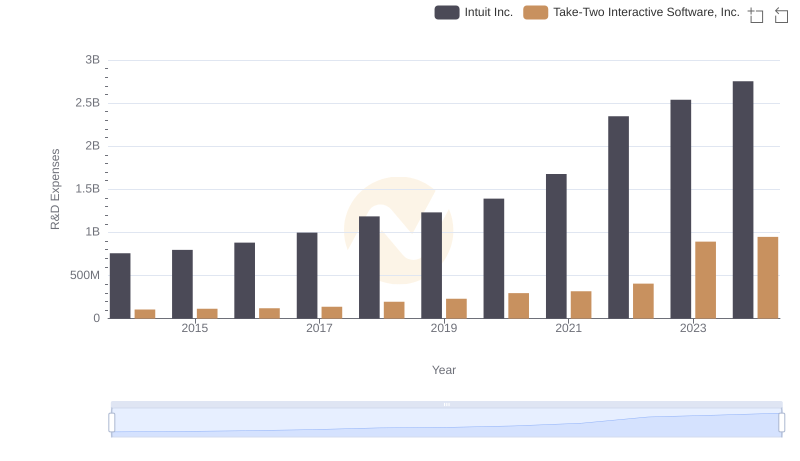

Analyzing R&D Budgets: Intuit Inc. vs Take-Two Interactive Software, Inc.

EBITDA Metrics Evaluated: Intuit Inc. vs Corning Incorporated