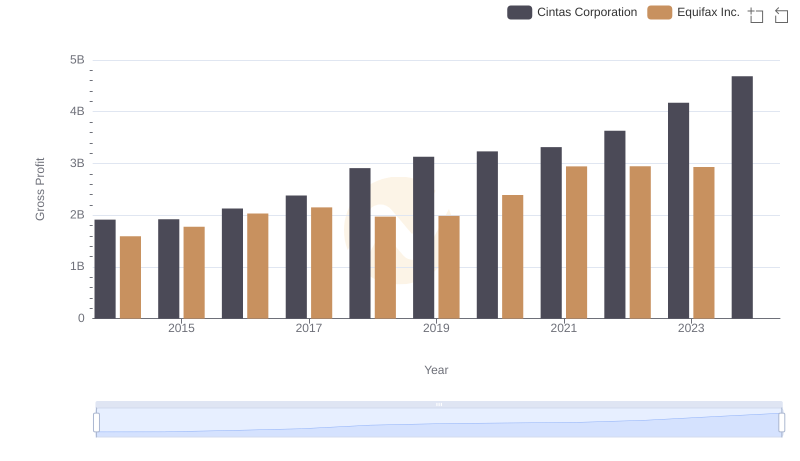

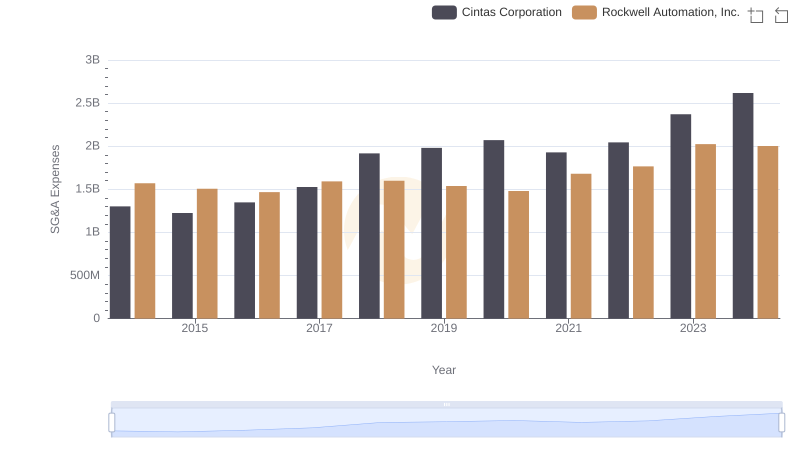

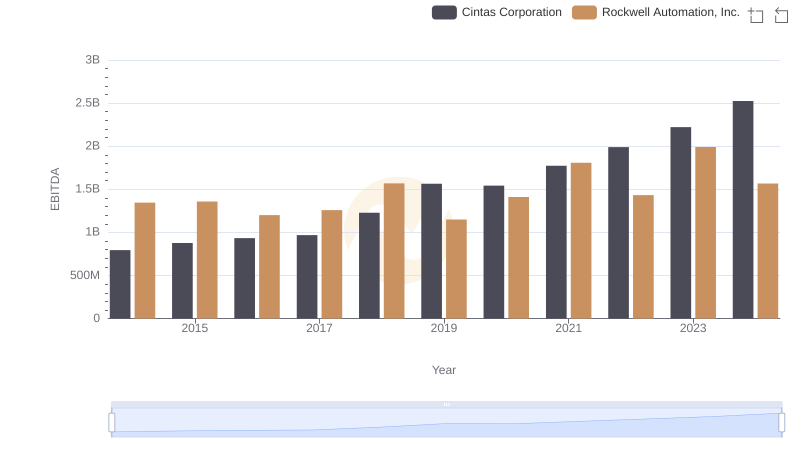

| __timestamp | Cintas Corporation | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 2753900000 |

| Thursday, January 1, 2015 | 1921337000 | 2703100000 |

| Friday, January 1, 2016 | 2129870000 | 2475500000 |

| Sunday, January 1, 2017 | 2380295000 | 2624200000 |

| Monday, January 1, 2018 | 2908523000 | 2872200000 |

| Tuesday, January 1, 2019 | 3128588000 | 2900100000 |

| Wednesday, January 1, 2020 | 3233748000 | 2595200000 |

| Friday, January 1, 2021 | 3314651000 | 2897700000 |

| Saturday, January 1, 2022 | 3632246000 | 3102000000 |

| Sunday, January 1, 2023 | 4173368000 | 3717000000 |

| Monday, January 1, 2024 | 4686416000 | 3193400000 |

Unlocking the unknown

In the competitive landscape of industrial services and automation, Cintas Corporation and Rockwell Automation, Inc. have been vying for supremacy in gross profit generation. Over the past decade, Cintas has consistently outperformed Rockwell, with a notable 50% increase in gross profit from 2014 to 2023. In 2023, Cintas reported a gross profit of approximately $4.17 billion, marking a significant lead over Rockwell's $3.72 billion.

Cintas's growth trajectory is impressive, with a steady upward trend, particularly from 2018 onwards, where it surpassed Rockwell by a margin of 15% to 20% annually. This growth can be attributed to strategic expansions and a robust service portfolio. Meanwhile, Rockwell Automation has shown resilience, maintaining a stable gross profit with a slight uptick in recent years.

As we look to the future, the question remains: Can Rockwell Automation close the gap, or will Cintas continue to dominate?

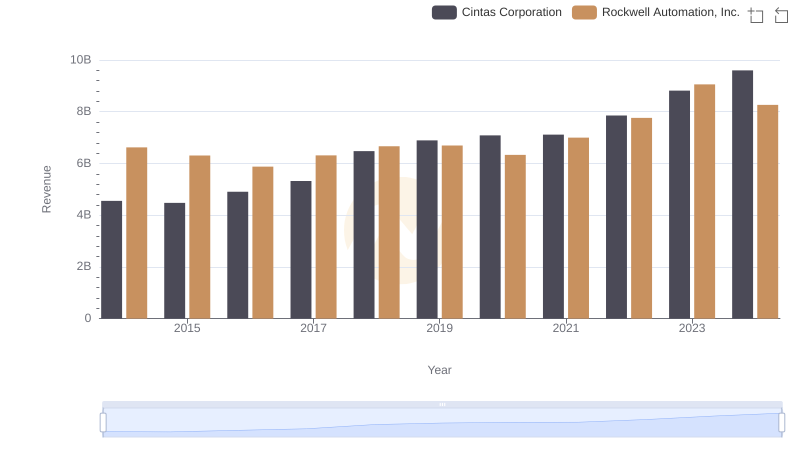

Who Generates More Revenue? Cintas Corporation or Rockwell Automation, Inc.

Gross Profit Comparison: Cintas Corporation and Equifax Inc. Trends

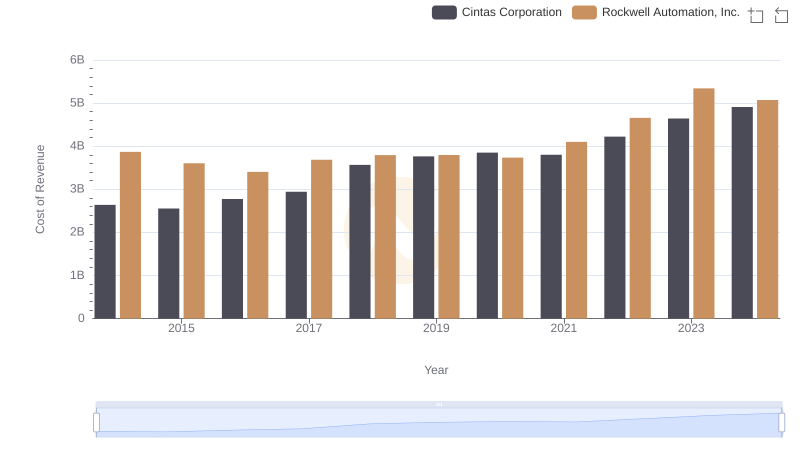

Cost of Revenue Comparison: Cintas Corporation vs Rockwell Automation, Inc.

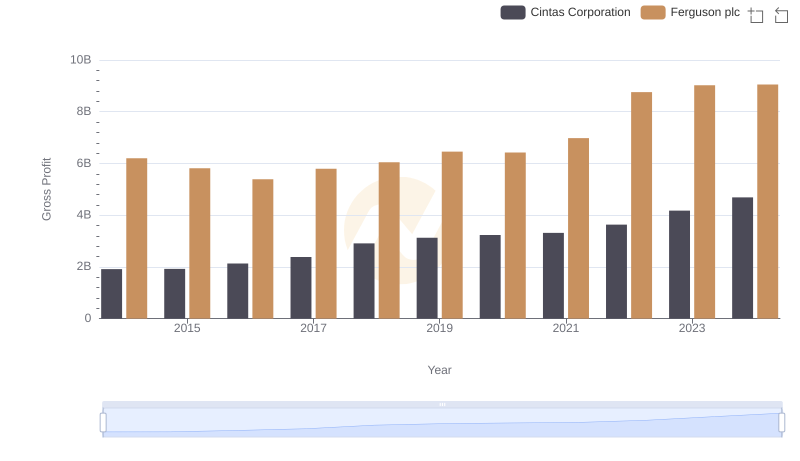

Gross Profit Trends Compared: Cintas Corporation vs Ferguson plc

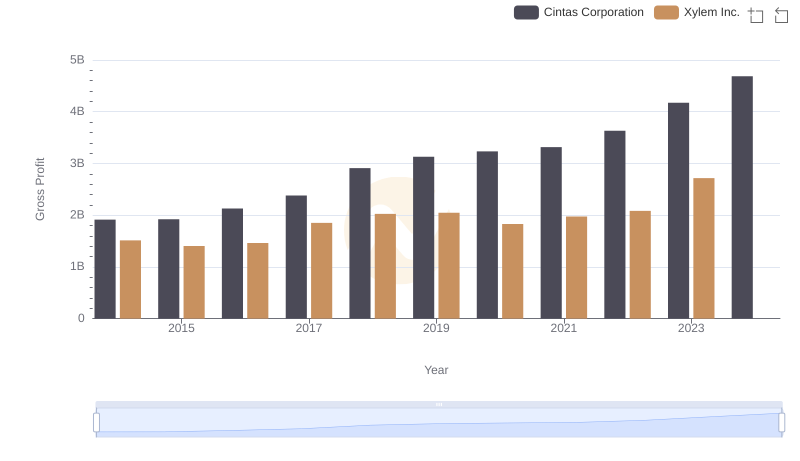

Gross Profit Analysis: Comparing Cintas Corporation and Xylem Inc.

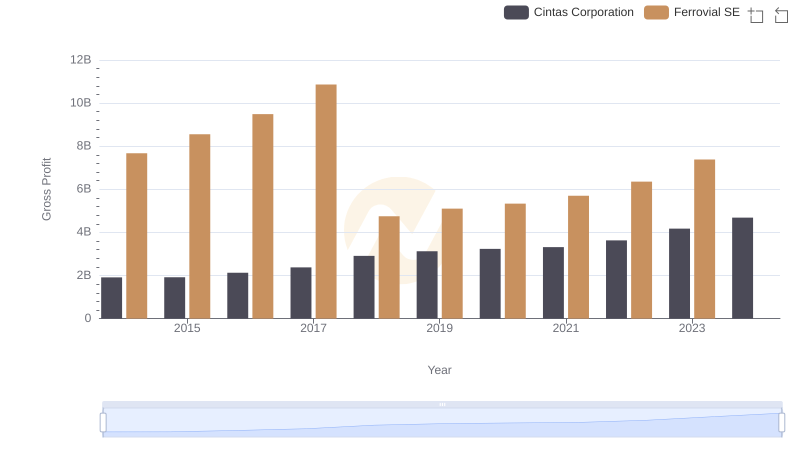

Key Insights on Gross Profit: Cintas Corporation vs Ferrovial SE

Comparing SG&A Expenses: Cintas Corporation vs Rockwell Automation, Inc. Trends and Insights

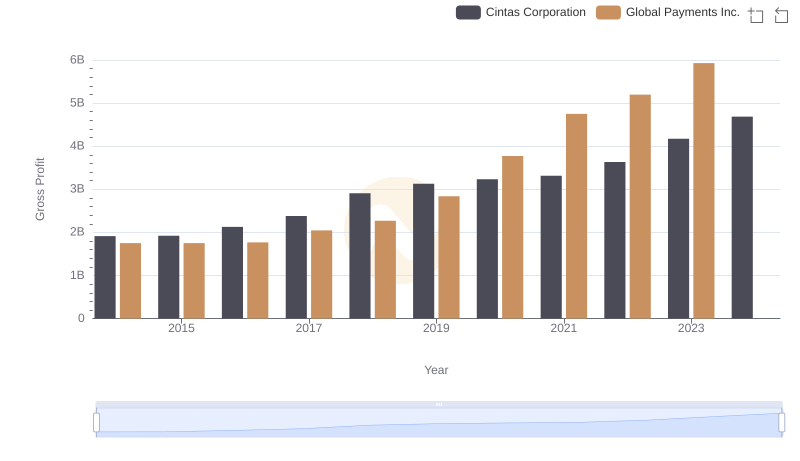

Who Generates Higher Gross Profit? Cintas Corporation or Global Payments Inc.

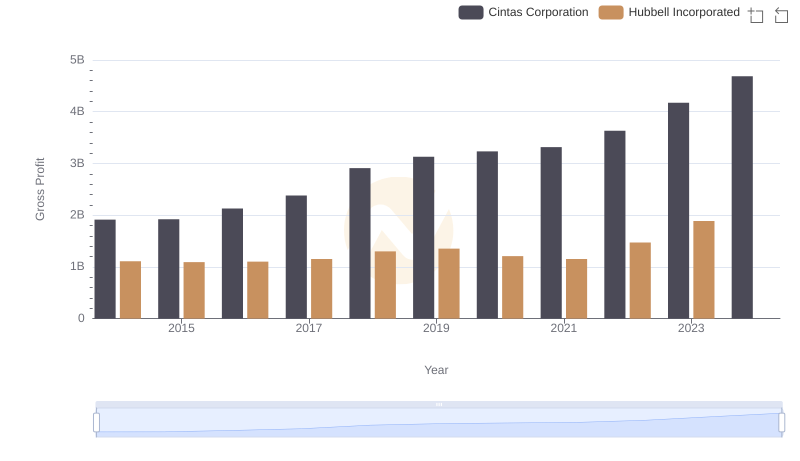

Gross Profit Comparison: Cintas Corporation and Hubbell Incorporated Trends

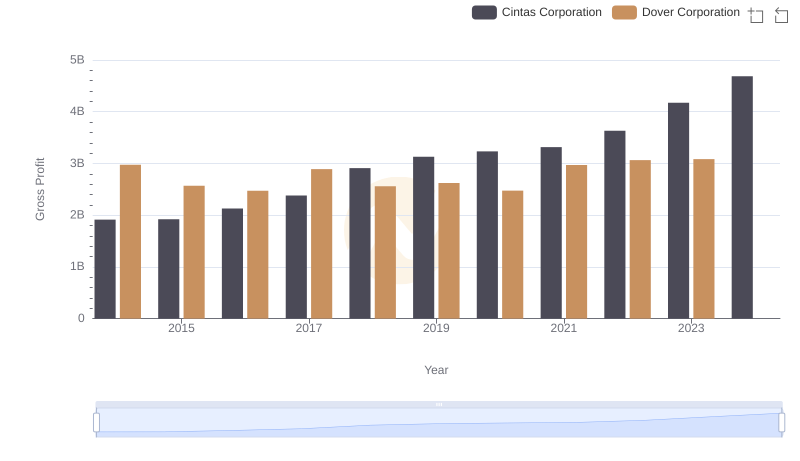

Gross Profit Analysis: Comparing Cintas Corporation and Dover Corporation

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Rockwell Automation, Inc.