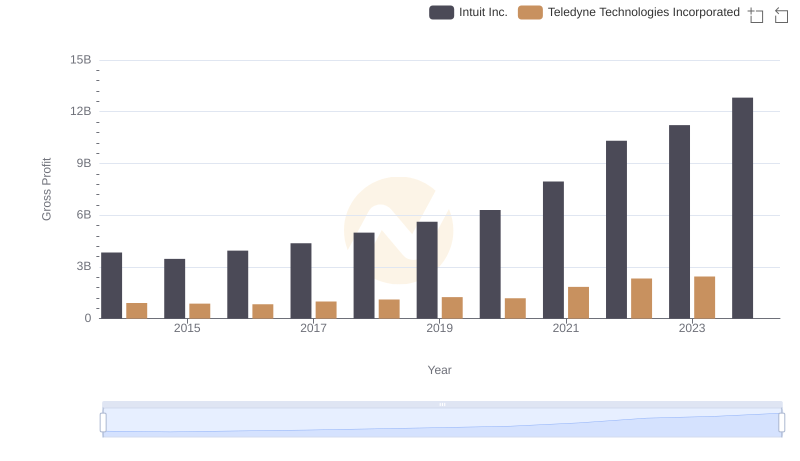

| __timestamp | Intuit Inc. | Western Digital Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 4360000000 |

| Thursday, January 1, 2015 | 3467000000 | 4221000000 |

| Friday, January 1, 2016 | 3942000000 | 3435000000 |

| Sunday, January 1, 2017 | 4368000000 | 6072000000 |

| Monday, January 1, 2018 | 4987000000 | 7705000000 |

| Tuesday, January 1, 2019 | 5617000000 | 3752000000 |

| Wednesday, January 1, 2020 | 6301000000 | 3781000000 |

| Friday, January 1, 2021 | 7950000000 | 4521000000 |

| Saturday, January 1, 2022 | 10320000000 | 5874000000 |

| Sunday, January 1, 2023 | 11225000000 | 1887000000 |

| Monday, January 1, 2024 | 12820000000 | 2945000000 |

Infusing magic into the data realm

In the ever-evolving landscape of technology, Intuit Inc. and Western Digital Corporation have carved distinct paths. From 2014 to 2024, Intuit's gross profit surged by an impressive 233%, reflecting its robust growth and strategic innovations. In contrast, Western Digital's journey was more volatile, with a peak in 2018 followed by a significant decline, ending 2024 with a gross profit 62% lower than its peak.

Intuit's consistent upward trajectory highlights its adaptability and market acumen. By 2024, its gross profit reached nearly 13 billion, a testament to its expanding influence in financial software.

Western Digital, a stalwart in data storage, faced fluctuating fortunes. Despite a strong performance in 2018, its gross profit plummeted by 76% by 2023, underscoring the challenges in the hardware sector.

This analysis offers a compelling glimpse into the contrasting fortunes of two tech titans.

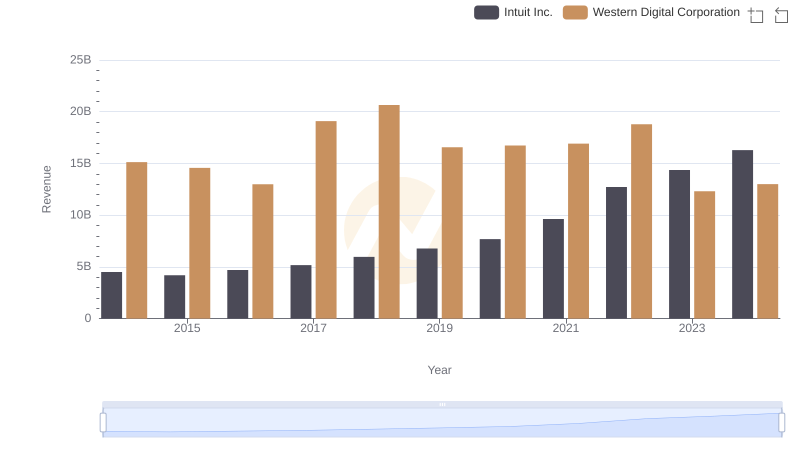

Intuit Inc. vs Western Digital Corporation: Annual Revenue Growth Compared

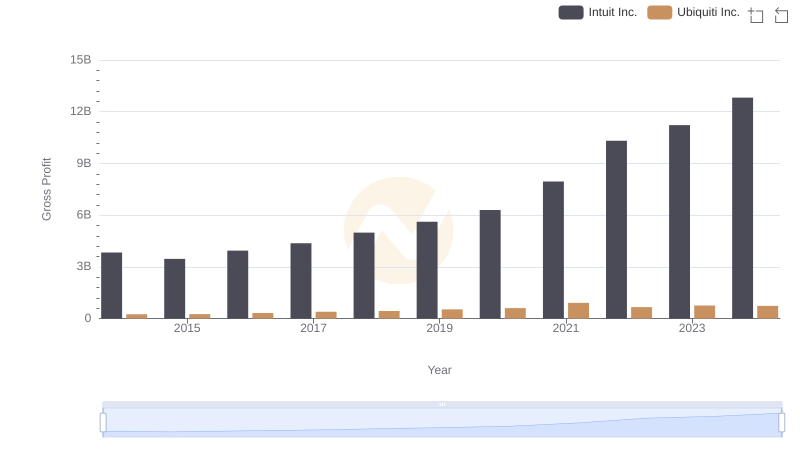

Intuit Inc. and Ubiquiti Inc.: A Detailed Gross Profit Analysis

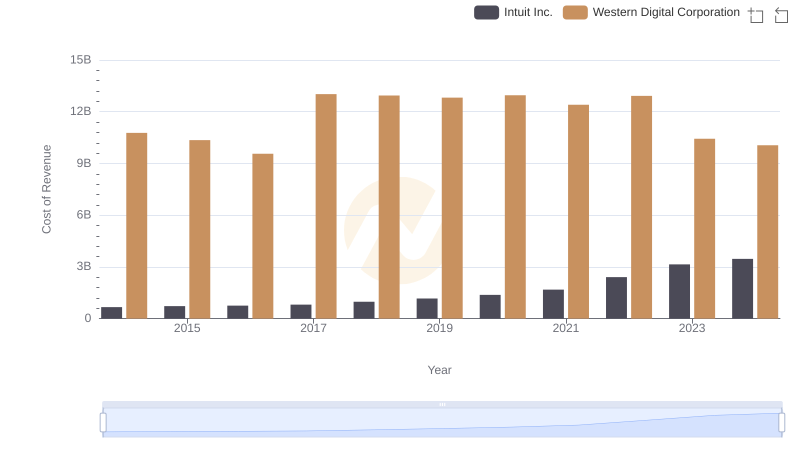

Cost of Revenue Trends: Intuit Inc. vs Western Digital Corporation

Intuit Inc. vs Teledyne Technologies Incorporated: A Gross Profit Performance Breakdown

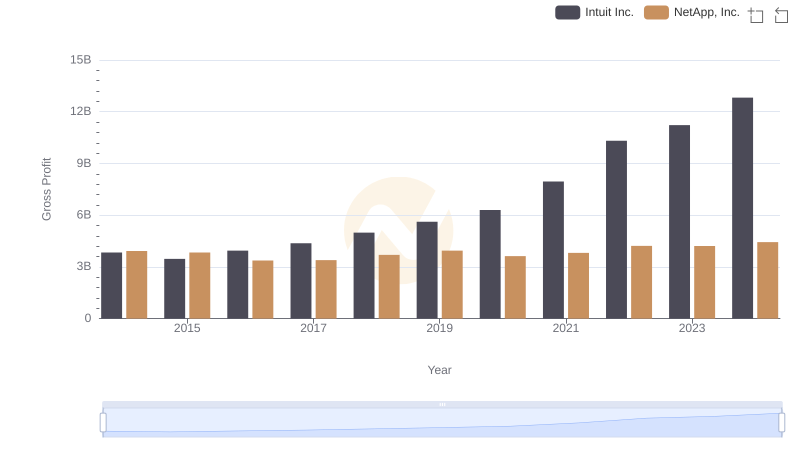

Gross Profit Trends Compared: Intuit Inc. vs NetApp, Inc.

Intuit Inc. vs ON Semiconductor Corporation: A Gross Profit Performance Breakdown

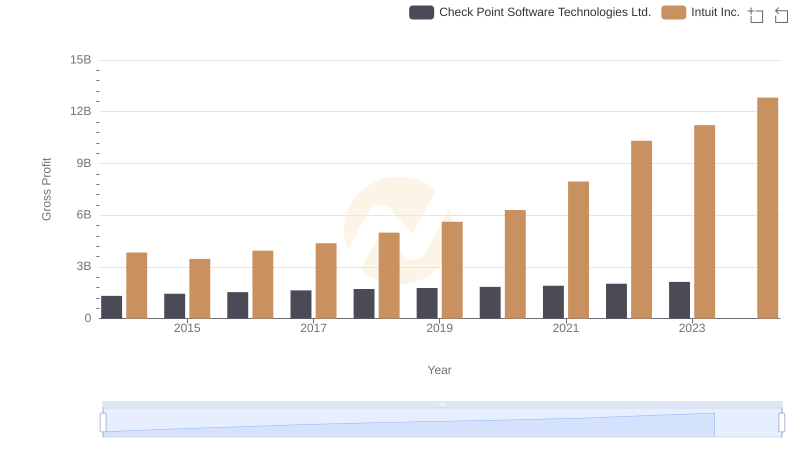

Who Generates Higher Gross Profit? Intuit Inc. or Check Point Software Technologies Ltd.

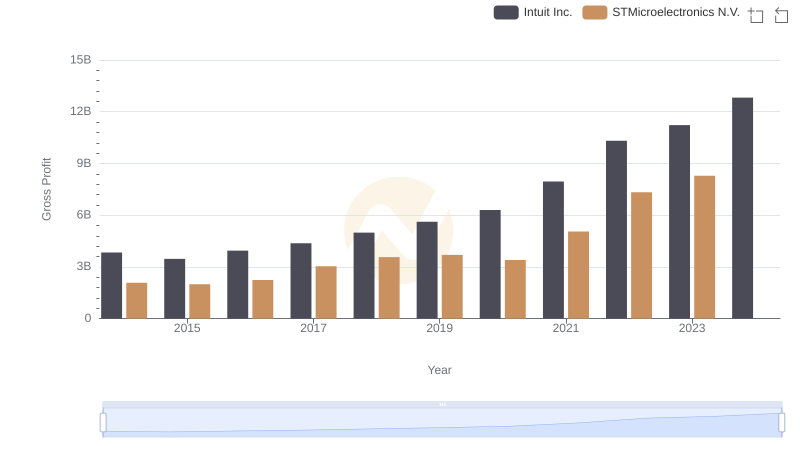

Gross Profit Analysis: Comparing Intuit Inc. and STMicroelectronics N.V.

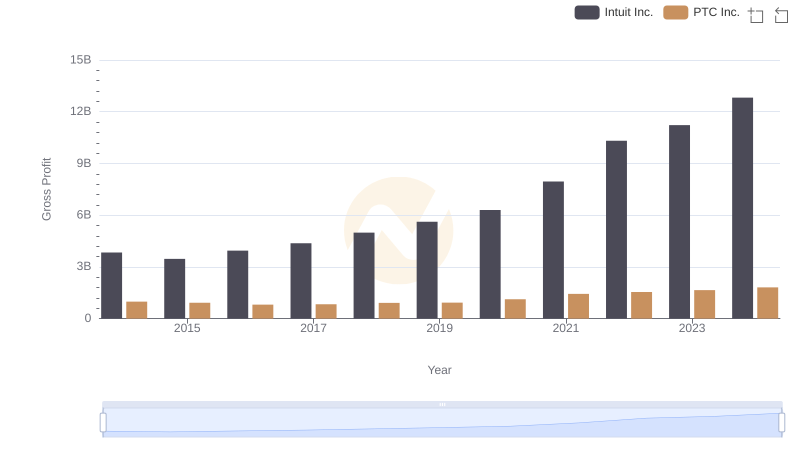

Gross Profit Analysis: Comparing Intuit Inc. and PTC Inc.

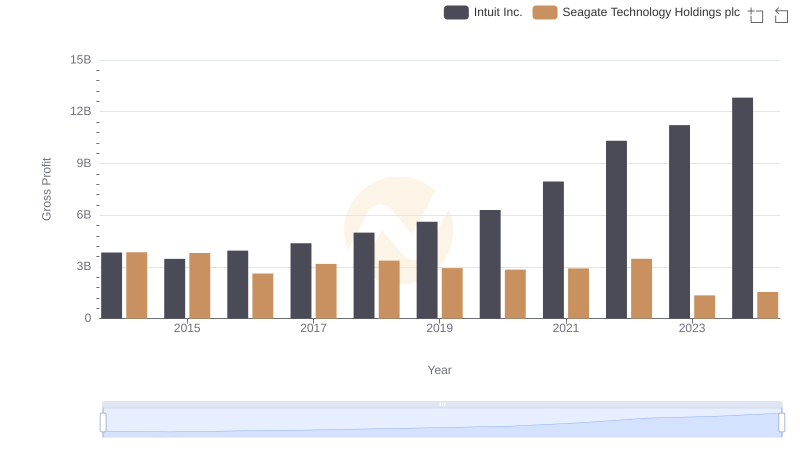

Gross Profit Analysis: Comparing Intuit Inc. and Seagate Technology Holdings plc

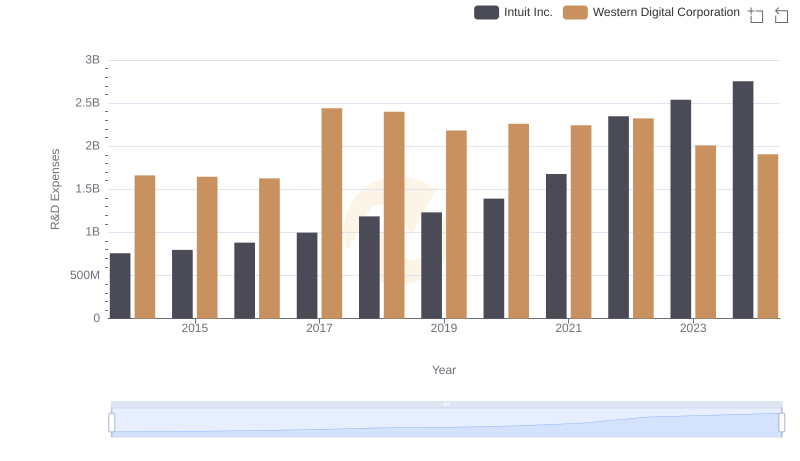

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and Western Digital Corporation

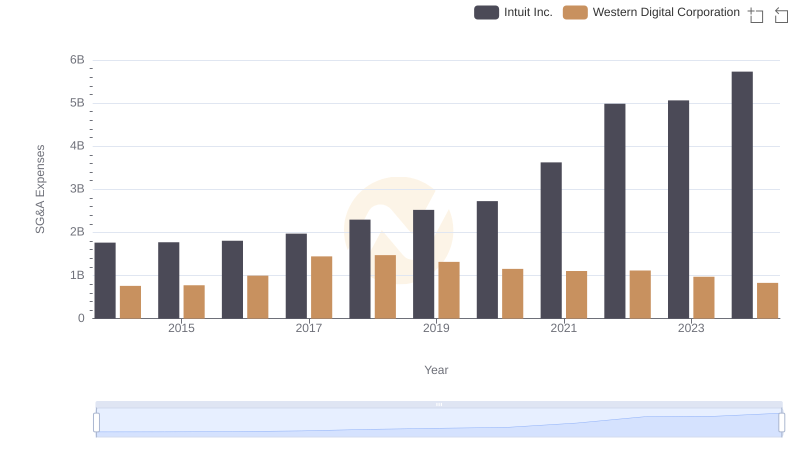

Intuit Inc. or Western Digital Corporation: Who Manages SG&A Costs Better?