| __timestamp | Intuit Inc. | ON Semiconductor Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 1084900000 |

| Thursday, January 1, 2015 | 3467000000 | 1193200000 |

| Friday, January 1, 2016 | 3942000000 | 1296900000 |

| Sunday, January 1, 2017 | 4368000000 | 2033800000 |

| Monday, January 1, 2018 | 4987000000 | 2238700000 |

| Tuesday, January 1, 2019 | 5617000000 | 1973600000 |

| Wednesday, January 1, 2020 | 6301000000 | 1715800000 |

| Friday, January 1, 2021 | 7950000000 | 2714300000 |

| Saturday, January 1, 2022 | 10320000000 | 4077200000 |

| Sunday, January 1, 2023 | 11225000000 | 3883500000 |

| Monday, January 1, 2024 | 12820000000 | 3216100000 |

Infusing magic into the data realm

In the ever-evolving landscape of technology and semiconductor industries, Intuit Inc. and ON Semiconductor Corporation have showcased remarkable growth in gross profit over the past decade. From 2014 to 2023, Intuit Inc. has seen its gross profit soar by approximately 234%, reflecting its robust business model and strategic innovations. In contrast, ON Semiconductor Corporation has experienced a commendable 258% increase in gross profit from 2014 to 2022, highlighting its resilience and adaptability in the semiconductor market.

Intuit's gross profit reached its peak in 2024, while ON Semiconductor's data for 2024 remains unavailable, leaving room for speculation about its continued trajectory. This comparison not only underscores the dynamic nature of these industries but also provides valuable insights into the financial health and strategic direction of these two giants. As we look to the future, the question remains: how will these companies continue to adapt and thrive in an increasingly competitive market?

Revenue Showdown: Intuit Inc. vs ON Semiconductor Corporation

Comparing Cost of Revenue Efficiency: Intuit Inc. vs ON Semiconductor Corporation

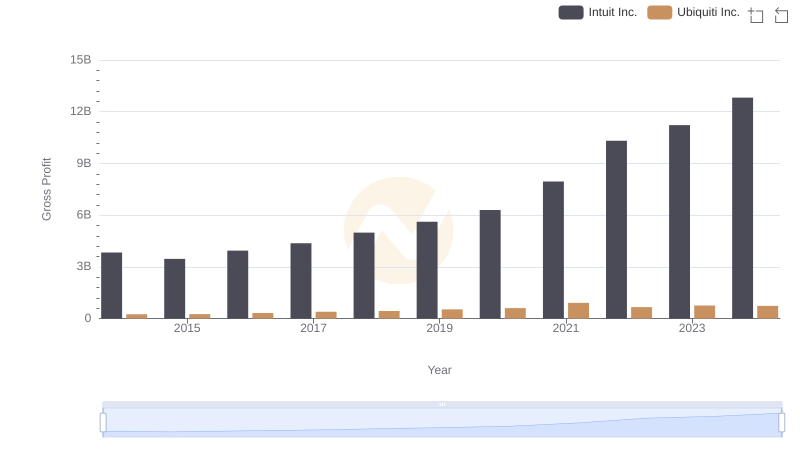

Intuit Inc. and Ubiquiti Inc.: A Detailed Gross Profit Analysis

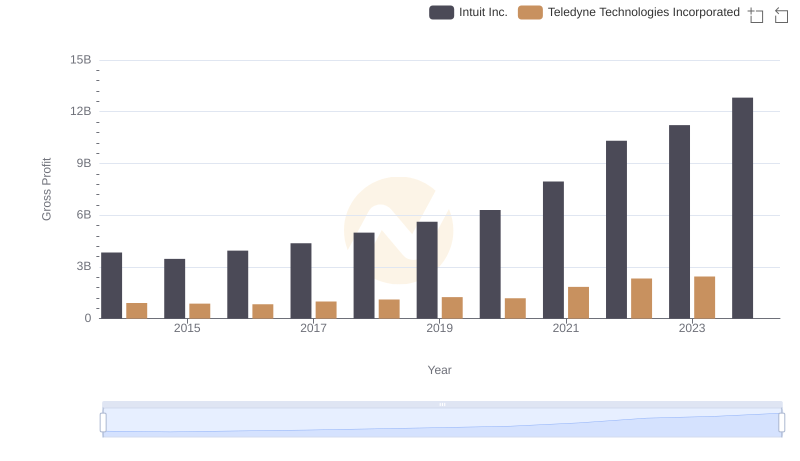

Intuit Inc. vs Teledyne Technologies Incorporated: A Gross Profit Performance Breakdown

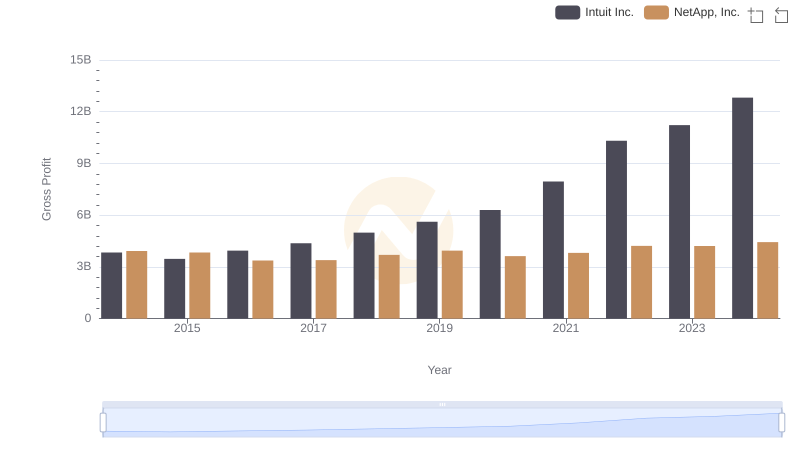

Gross Profit Trends Compared: Intuit Inc. vs NetApp, Inc.

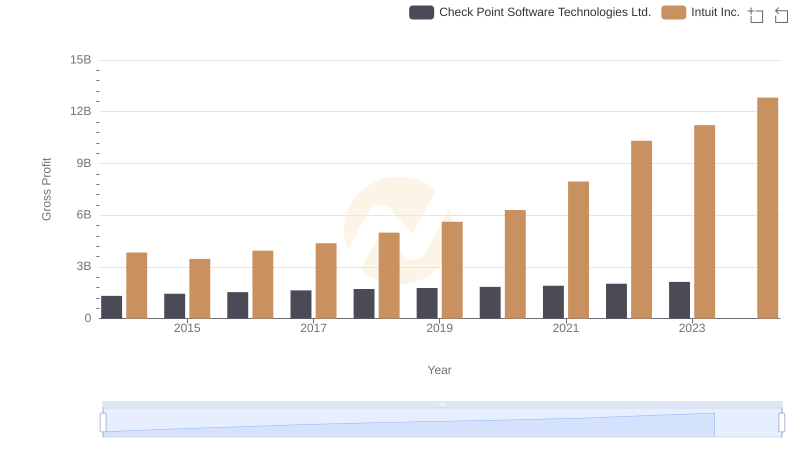

Who Generates Higher Gross Profit? Intuit Inc. or Check Point Software Technologies Ltd.

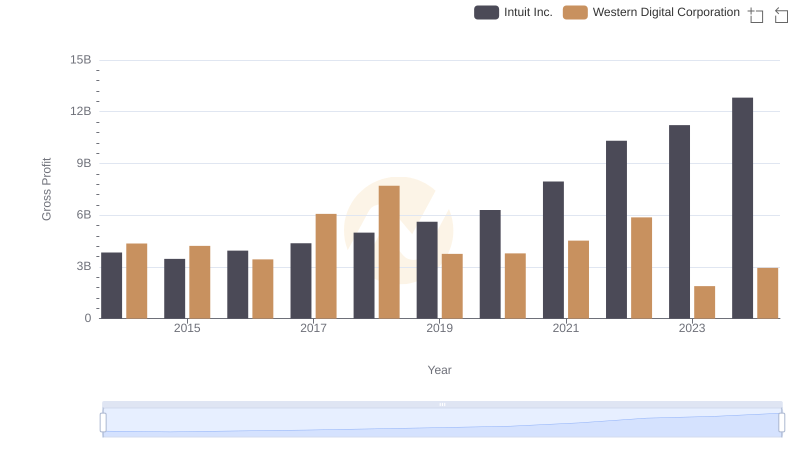

Intuit Inc. and Western Digital Corporation: A Detailed Gross Profit Analysis

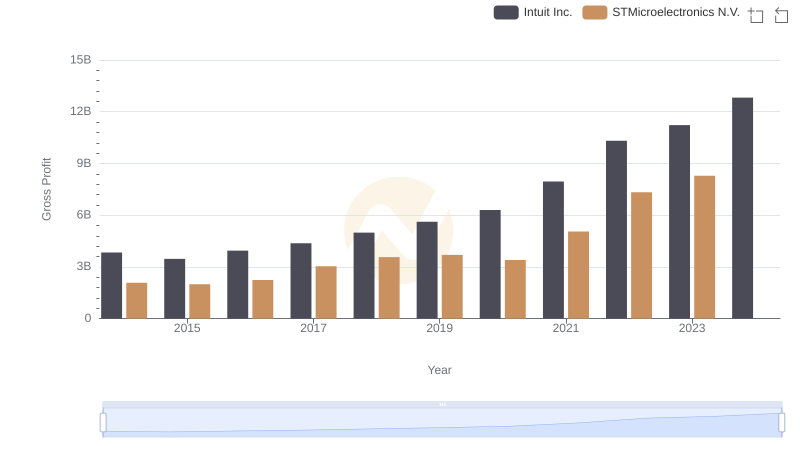

Gross Profit Analysis: Comparing Intuit Inc. and STMicroelectronics N.V.

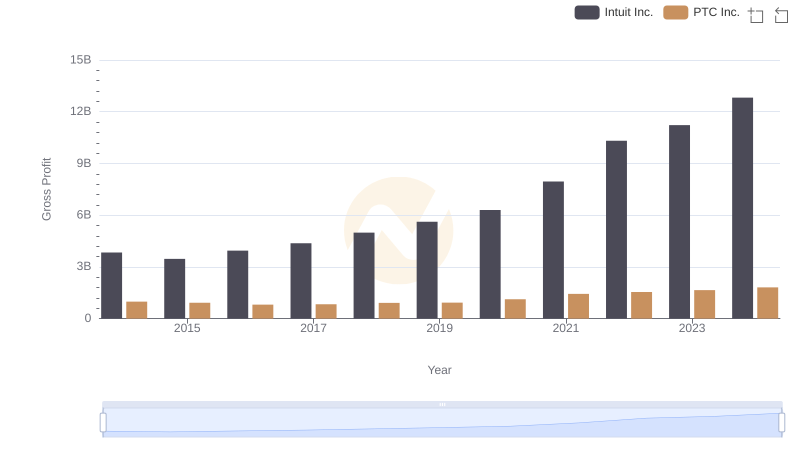

Gross Profit Analysis: Comparing Intuit Inc. and PTC Inc.

Research and Development Expenses Breakdown: Intuit Inc. vs ON Semiconductor Corporation

Intuit Inc. vs ON Semiconductor Corporation: SG&A Expense Trends

EBITDA Analysis: Evaluating Intuit Inc. Against ON Semiconductor Corporation