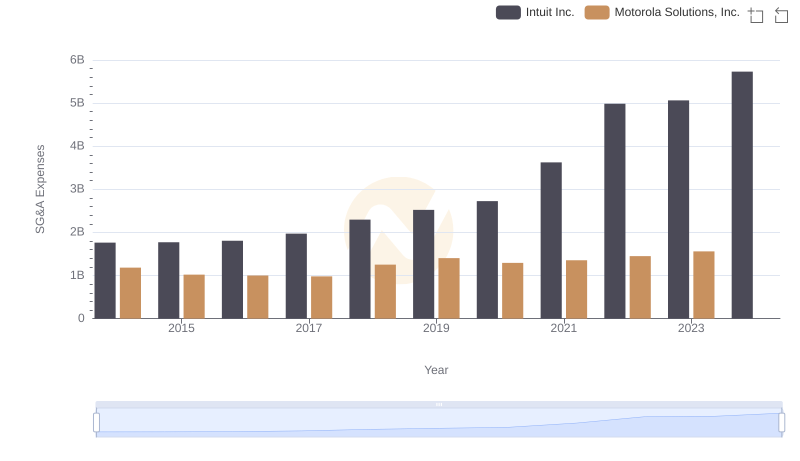

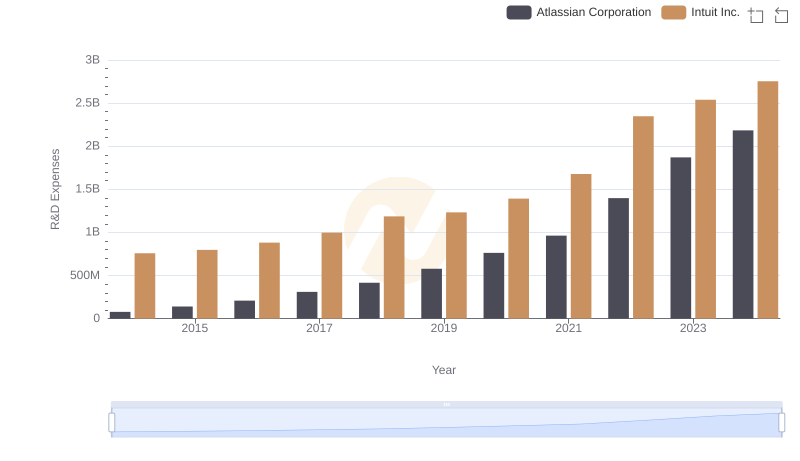

| __timestamp | Atlassian Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 75782000 | 1762000000 |

| Thursday, January 1, 2015 | 125319000 | 1771000000 |

| Friday, January 1, 2016 | 178849000 | 1807000000 |

| Sunday, January 1, 2017 | 253693000 | 1973000000 |

| Monday, January 1, 2018 | 339232000 | 2298000000 |

| Tuesday, January 1, 2019 | 484070000 | 2524000000 |

| Wednesday, January 1, 2020 | 568092000 | 2727000000 |

| Friday, January 1, 2021 | 688151000 | 3626000000 |

| Saturday, January 1, 2022 | 1046064000 | 4986000000 |

| Sunday, January 1, 2023 | 1376223000 | 5062000000 |

| Monday, January 1, 2024 | 1488074000 | 5730000000 |

Unleashing the power of data

In the competitive world of software, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Intuit Inc. and Atlassian Corporation have taken different paths in optimizing these costs. From 2014 to 2024, Intuit's SG&A expenses have surged by over 225%, reaching a peak in 2024. Meanwhile, Atlassian's expenses have grown by nearly 1,864%, reflecting its rapid expansion and investment in growth.

Despite Intuit's larger absolute expenses, its growth rate is more controlled compared to Atlassian's. This suggests a more mature approach to cost management, likely due to its established market presence. In contrast, Atlassian's aggressive increase in SG&A expenses indicates a focus on scaling and capturing market share. As these two tech titans continue to evolve, their strategies in managing SG&A costs will be pivotal in shaping their financial futures.

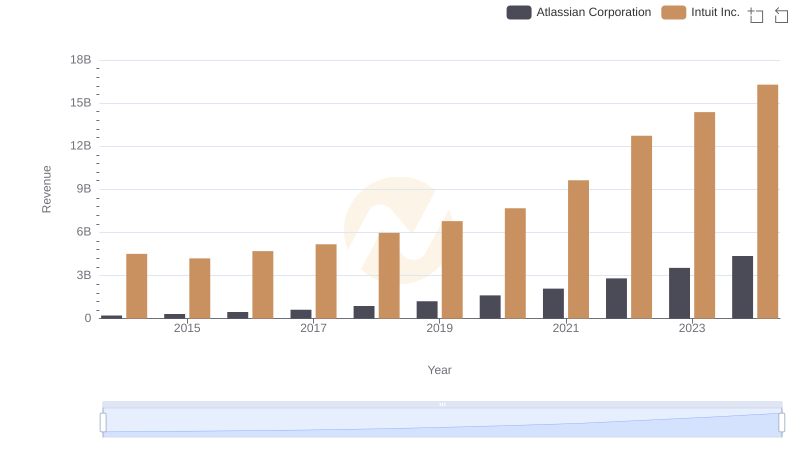

Who Generates More Revenue? Intuit Inc. or Atlassian Corporation

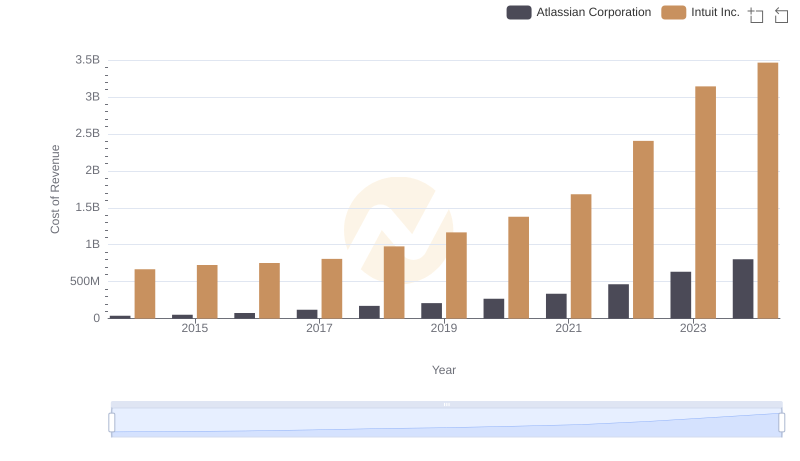

Analyzing Cost of Revenue: Intuit Inc. and Atlassian Corporation

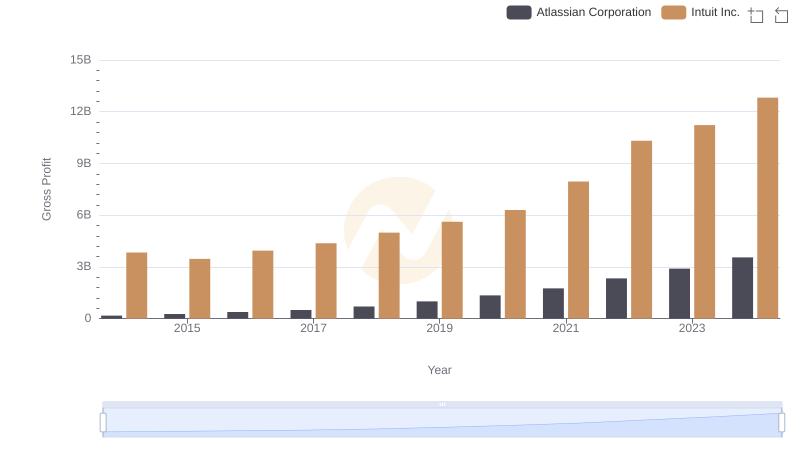

Gross Profit Analysis: Comparing Intuit Inc. and Atlassian Corporation

Selling, General, and Administrative Costs: Intuit Inc. vs Motorola Solutions, Inc.

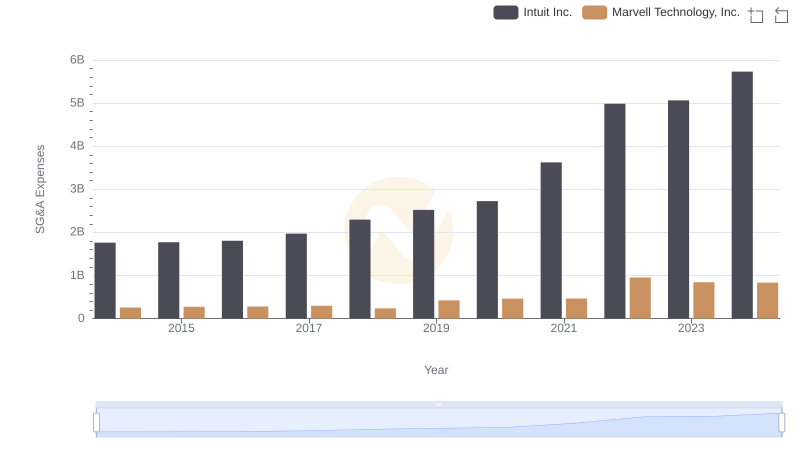

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Marvell Technology, Inc.

R&D Insights: How Intuit Inc. and Atlassian Corporation Allocate Funds

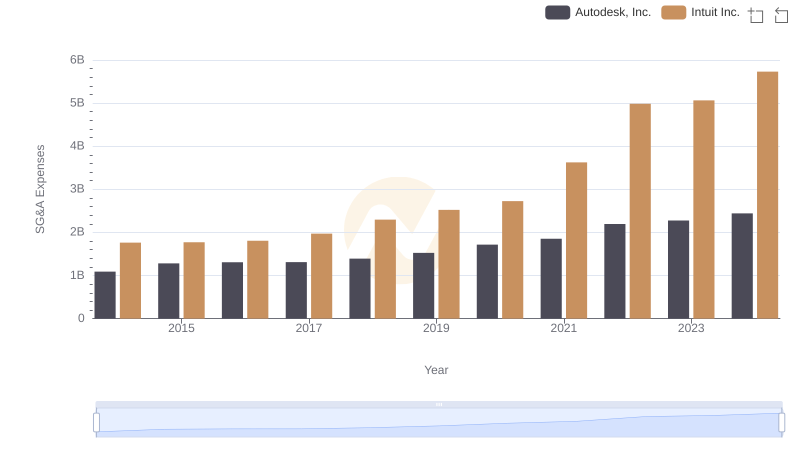

Intuit Inc. vs Autodesk, Inc.: SG&A Expense Trends

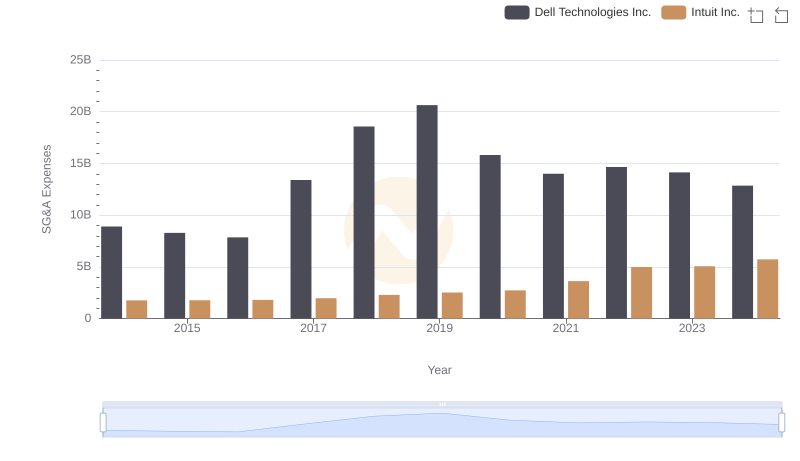

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Dell Technologies Inc.

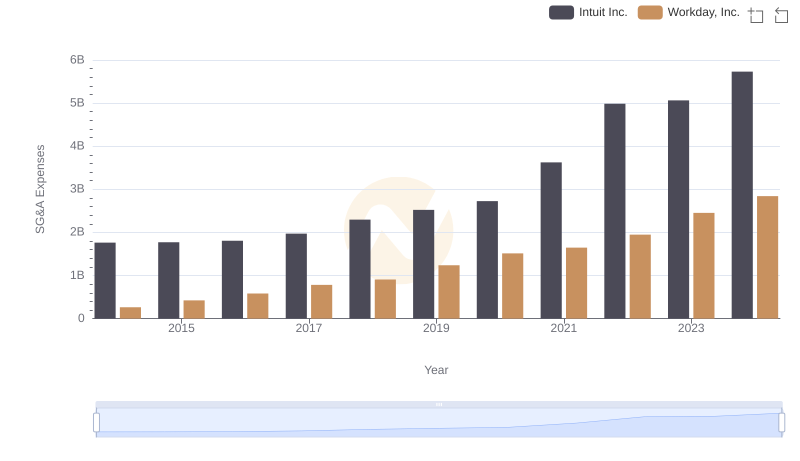

Intuit Inc. and Workday, Inc.: SG&A Spending Patterns Compared

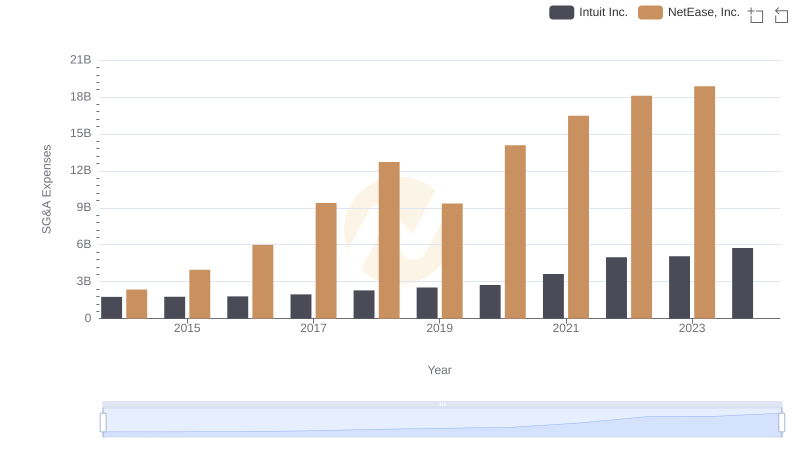

Breaking Down SG&A Expenses: Intuit Inc. vs NetEase, Inc.

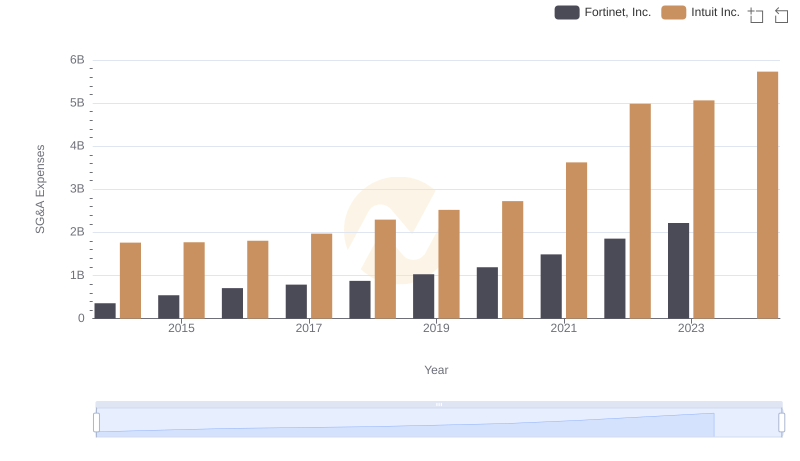

SG&A Efficiency Analysis: Comparing Intuit Inc. and Fortinet, Inc.

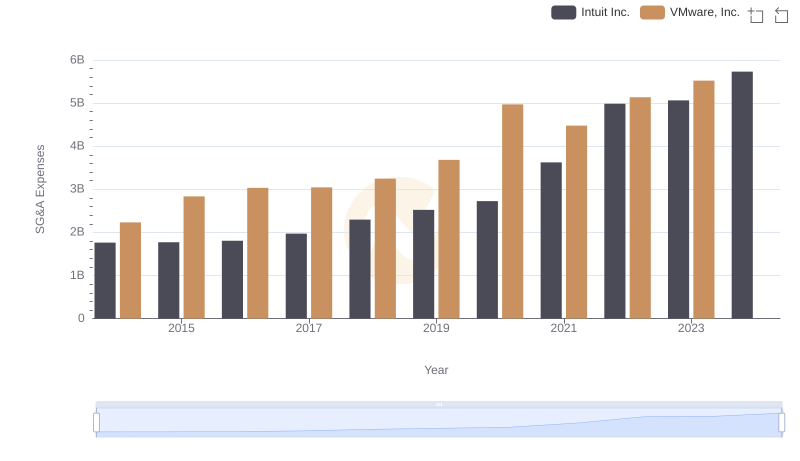

Cost Management Insights: SG&A Expenses for Intuit Inc. and VMware, Inc.